ActivTrades Review (2026)

Regulator

What is ActivTrades?

ActivTrades is an independent brokerage firm founded in 2001 in Switzerland as a small brokerage house and now has developed into a global broker firm for retail and institutions.

In 2005 company had moved its headquarters to London while showed rapid growth through Europe and became a market leader in Italy, Germany and France, then followed across Australia, South America, Russia and South East Asia. Recently, ActivTrades serves also an office in Dubai to cover Middle East trading needs.

Is ActivTrades good broker

ActivTrades offer a wide range of benefits that make trading the financial markets smooth and pleasant while giving traders the opportunities they need to be successful in both short and long terms.

Proposed benefits including access to diverse financial instruments, awarded platforms, full trading solutions and exceptional trading tools. With ActivTrades client can trade more than 50 currency pairs, cryptocurrencies, metals, indices, commodities, shares and ETFs, also UK client can access spread betting.

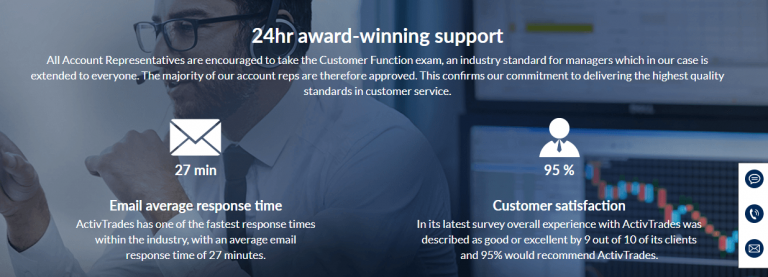

Actually, there are many regards and recognition that have been proved ActivTrades successful years, while official figures prove it even more than needed: 95 % – Customer satisfaction, in its latest survey overall experience with ActivTrades was described as good or excellent by 9 out of 10 of its clients.

ActivTrades Pros and Cons

ActivTrades is a reliable broker with great trading environemtns, powerful technology and one of the lowest spreads based on our test trades. There are MT4, MT5 and proprietary ActivTrades platforms

Low Forex fees and Excellent support, learning and research tools.

For the Cons, Conditions may vary according to regulation and entity and support isn’t 24/7.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, CBS |

| 📉 Instruments | 50 currency pairs, cryptocurrencies, metals, indices, commodities, shares and ETFs |

| 🖥 Platforms | ActivTrader, MT4, MT5 |

| 💰 EUR/USD Spread | 0.63 pips |

| 💰 Base currencies | USD, GBP, EUR |

| 💳 Minimum deposit | 250 US$ |

| 🎮 Demo Account | Available |

| 📚 Education | Education center and contests |

| ☎ Customer Support | 24/5 |

Awards

Actually, there are many regards and recognition that have been proved ActivTrades successful years, while official figures prove it even more than needed: 95 % – Customer satisfaction, in its latest survey overall experience with ActivTrades was described as good or excellent by 9 out of 10 of its clients.

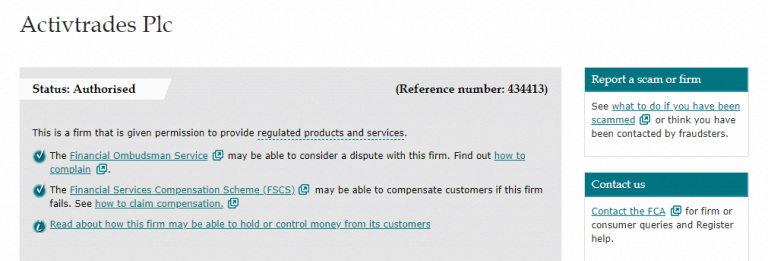

Is ActivTrades safe or a scam

ActivTrades broker has fully regulated status by the reputable FCA, so traders can be assured your investments are safe and considered low-risk Forex trading. The broker actively improving their services through the years and have been able to establish a reputation of a trusted and reliable company to cooperate with.

Is ActivTrades legit?

ActivTrades PLC is authorized and regulated under Financial Conduct Authority (UK) and is a member of the Financial Services Compensation Scheme. Moreover, the broker serves office in Dubai and is also regulated by the Dubai Financial Services Authority along with its offshore entity in the Bahamas.

In addition, to ensure advanced trading safety, ActivTrades provides protection from a negative account balance, storage of the funds in segregated accounts and additional insurance to up to 1,000,000$ (which is a quite rare state among the brokers).

Leverage

As for the trading conditions, ActivTrades chooses the optimal path to maximize the offer with tight spreads, leverage up to 1:400 with no hidden fees and no-requotes or rejections policy, enhanced by fast direct execution.

- However, the mentioned leverage of 1:400, available for the residents who trade with Dubai or the Bahamas entity of ActivTrades.

- The main offering of ActivTrades complies to FCA regulation, which strictly restricts leverage to a maximum of 1:30 for major currency pairs.

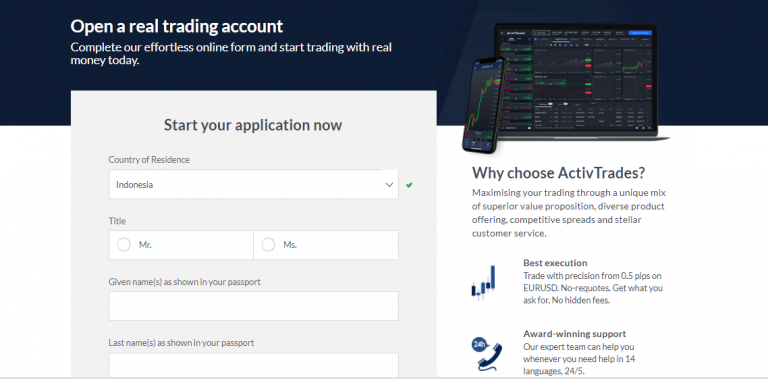

Account types

The ActivTrades accounts diverse only according to the trader type, means broker offering either Individual Account (allows to trade mini and micro lots) or Professional Account (which involves some rules for opening, alike significantly large transactions, the size of the financial portfolio must exceed 500,000$).

Of course, for the beginning traders convenience, there is an opportunity to try the platform and generally see the brokers operation throughout Free Demo Account. Respectively, Islamic Account or Swap-Free Accounts are also available for those who comply with Sharia laws.

Instruments

Among widely offered Trading instruments with a choice to trade Forex, Cryptocurrencies, Indices, Shares, Commodities and SpreadBetting for UK residents, you may also access to the most important Fixed Income contracts such as the US T-Note and the German Bund.

Fees

ActivTrades are depending on the account type you use but mainly built into a spread. See fee table below with funding fees and non trading fees to be considered.

| Fees | ActivTrades Fees | Swissquote fees | CMC Markets Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

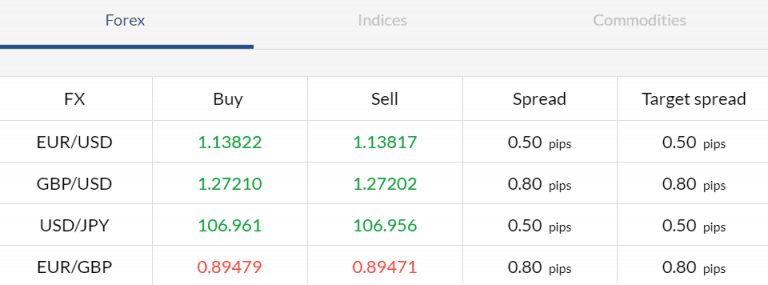

Spreads

ActivTrades spread for currencies starting from 0.5 pips, on indices and financial CFDs the spreads are set to 0.5 pips too, eventually that are low compare to other brokers.

What is more, there is no overnight adjustment (the underlying Futures price already accounts for the adjustment). On CFDs shares commissions are starting from €1 per side, while spread betting on shares are commission free, with 0.10% of the transaction value.

As it becomes obvious, ActivTrades spread indeed is a very attractive opportunity for various types of traders. See below typical trading fees for popular instruments, also compare ActivTrades trading fees to another popular broker BDSwiss.

| Asset/ Pair | ActivTrades Spread | Swissquote Spread | CMC Markets Spread |

|---|---|---|---|

| EUR USD Spread | 0.63 pips | 1.7 pips | 0.7 pips |

| Crude Oil WTI Spread | 3 | 5 | 3 |

| Gold Spread | 35.75 | 28.6 | 3 |

| BTC/USD Spread | 1% | 1% | 0.75% |

Snapshot of Forex spread

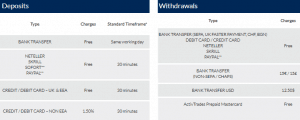

Methods of Payment

Deposits or withdrawal requests can be done from an online Personal Area, which makes the process seamless and easy.

Deposit options

ActivTrades supports various payment options to fund the account including bank transfer, credit/debit card, Neteller, Skrill and Sofort. In addition, the firm offering ActivTrades Prepaid Card, which is provided for free to the clients with no monthly administrative fee, which gives the same benefits of usage as Mastercard.

What is the minimum deposit?

ActivTrades minimum deposit requirement is 250$, which allows you to start live trading immediately.

ActivTrades minimum deposit vs other brokers

| ActivTrades | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

Withdrawals

ActivTrades doesn’t charge clients for the deposits made via bank transfers or e-wallets, however, the investor should calculate above 0.75% for deposits via credit card in UK& EEA or 1.5% of non UK&EEA cards.

For withdrawal fees, transfer to the ActivTrades Prepaid Mastercard or e-wallets are free, bank transfers USD will be charged by 12.50$.

Trading Platforms

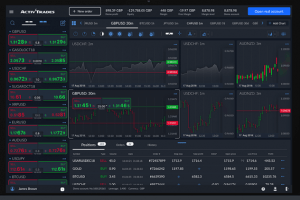

Another strong offering from ActivTrades is their choice of platforms, which including proprietary ActivTrades platform and well-known MT4 and MT5 Platforms with an exclusive offering of Add-Ons.

| Pros | Cons |

|---|---|

| Proprietary trading platform | None |

| Exclusive trading tools | |

| ActivTrades, MT4, MT5 offered too | |

| Supporting many languages | |

| Technical analysis | |

| Mobile trading apps |

Web Trading

The ActiveTrades trading platform is a web-based platform that allows trade straight from the browser, also possess a loyal application for iPhone or iPad. The platform features an intuitive interface, yet provides cutting-edge functionalities for experienced traders of all trading styles with access to more than 90 technical analysis indicators.

Desktop platform

However, the traders who feel more comfortable and convenient with a user-friendly platform MT4 are also welcomed by ActivTrades, that are available through desktop trading. Moreover, technology has been enhanced with the company standards of security and advanced charts also enables automation of the strategies with EAs.

With MetaTrader5 you will find updated, extended characteristics, bringing online trading to the deepest level. The platform enables to trade more markets like shares and ETFs, more than 450 CFDs on stocks with wide characteristics and availability to auto trade, with integrated trading statements.

Trading tools

In addition to the powerful platform, numerous utility extensions are offered to enlarge trade functionalities and automation features, while bringing tools designed for both decision making and indicating purpose. These including trading tools, decision-making tools and numerous indicators.

Customer Support

Another good word should go to the ActivTrades support and education center. Since client service won numerous awards and the main aim of the offered education system is to keep traders up to date with new features, technology developments and market trends.

24h support center available through Live chat and email with average of amazing 27 min response, which is definitely good for you as a trader.

Education

With ActivTrades you can access detailed education materials with key elements, analysis, courses, webinars and e-books defined by the topic. In addition, Demo account is at your offering, together with powerful analytical, technical analysis inbuilt into the platforms and exclusive add-ons allowing you better learning and trading as well.

Conclusion

In conclusion, the ActivTrades as an international broker with 10 years of successful operation and experience with mainly long-term professionals, the offering is good quality, well-maintained and reliable option to choose. We fund a quite satisfying trading coditions within our ActivTrades Review including lowest spreads, no dealing desk intervention in the trading process and quite competitive conditions are an advantage to various level traders too.

Reviews

What are the advantages of ActivTrades proprietary platform?

First of all, ActivTrades proprietary platform is intuitive. I managed to cope with the functionality at the very first sight. The workspace is organized very well here.

Secondly, I like the charting tools of the software. They contain everything that I need for technical analysis. At the same time, there’s no overcomplication. I mean sometimes it happens that software developers try to add as many functions as possible. As a result, a jumble of features creates a mixed impression. That is not related to the ActivTrades platform as everything is clear and placed in order.

Next, the watchlist of assets contains market sentiment indicators built into the window of symbols. This is very handy for quick trading decisions.

What’s your minimum deposit?

Minimum deposit here is 500$. I believe it’s a great solution for those traders whose intentions are serious.

A perect broker for those who only start their journey in trading. First of all, it is a really reliable broker with long and rich history and huge traders community. The clients of activetrades can be calm about their deposits as the broker works for nearly 20 years and it managed to preserve its good reputation. Secondly, there is also an educational center which may come in handy for the beginners. It is very convenient to learn and practise in one place.

I totally agree with you. The only thing I would add is that the ActivTrades broker has a proprietary trading platform which is much more informative and convenient compared to other trading software solutions, in my opinion.

The broker is very pleased with its conditions. I was surprised by the rich access to trading instruments. For example, on crosses the spread is much lower, despite the small liquidity. I had no idea, but now I want to learn how to trade on the stock market as the broker gives me access to the stock markets.

The analytics and training section from the company helps me a lot in this. In the beginning I got used to their proprietary trading platform, and now I trade to my own pleasure.

Yes, this broker has a really good deal. I love that it has a good selection of trading platforms and low spreads. Plus a 0.5 pips spread on popular currency pairs is a very generous offer.

I trade major currency pairs with this broker. It’s quite beneficial to trade intensively these assets here because the broker offers good spreads on these instruments and I can trade them without commission.

It’s hard to say anything against it. I also do appreciate their trading conditions. With this broker I trade major as well as minor currency pairs on a regular basis and sometimes I enter the market on gold and silver.

Don’t come any close to them my trades reach to and not close then they allow you to open trades on expired contracts this is ain’t normal thinking of reporting to fca !!

MT charts reflect bid price by default so that’s often an issue with inexperienced traders not knowing why thier buy orders don’t get executed while the price seems to have reached the order value. Ask price must be reached. 99% of complains of this type refer to this issue with charts refelcting the bid price.

As for expiration, I’m lost in guesses as for which contracts you could have traded. Most CFDs don’t have an expiration date.

Some brokers really offer trading CFDs based on futures with a certain expiration date and these assets are not very popular among CFD traders. The issue is that trading these assets really requires little more attention than typical forex or crypto trading. Such CFDs contracts terminate on a certain date and liquidity can really get very low when coming close to the expiration which results in slippages and price gaps. Traders need to be careful and rollover when the volume decreases compared to the next contract.

I have a very positive impression of trading with this broker and I should note that my impression has even improved recently because they recently added cryptos. Earlier they had no cryptos but I nevertheless joined them because I like their trading conditions on majors.

A couple of days ago I suddenly noticed that they added cryptos, not so many coins but it’s still a very good news for me because I do appreciate cryptos and I would like to trade them here too.

Yes, it’s cool that ActivTrades is adding new money making opportunities.

In addition, I think that it would be strange if this broker did not have cryptocurrency, becouse this is very popular now.

Negative balance protection was something that I looked for. Not just it of course. I mean I wanted a respected and well -regulated broker with neg balance protection. Sorry, its just some kind of a nightmare that chases me – that I can lose more than I deposited. I’ve never met a person yet though who would have owed money to the broker. Have you?

Certainly there are brokers that don’t offer negative balance protection. Activtrades does have it. You don’t wanna be in a situation when you owe broker a mony, trust me. I know the cases and this is not the kind of experience I would want to go through.

I have already reviewed the trading conditions and found them acceptable. I wanna trade here but there’s one thing that needs to be made clear. It’s deposit and withdrawals. I wanna know about bank transfer. Can I use it for depositing and withdrawals?

Sure, you can use wire transfer in case of withdrawals and depositing. I believe it’s even better than using services such as paypal. At least, it’s much more convenient for me to transfer money via the banking system.

I’m currently testing this broker on a demo platform. I got a positive impression about its user-friendly platform. I think it’s much better than Metatrader. I have nearly decided to open a real account but want to make one thing clear. How long does it take to withdraw money here?

withdraw is fast but of course it depend from working day and your bank account. usually its about a day for me

anyone knows is there something like negative balance protection for rookies?

It’s all there.

BUT

Learn not to count on it.

Better pay attention to their education: articles, webinars, seminars.

IT MEANS SO MUCH MORE

As for the reputation of ActivTrades, I don’t think there’s anything to discuss. It is perfect. Nothing should be added. For newcomers who don’t know, feel free to open an account with ActivTrades and don’t be afraid.

Yap, agreed. Still 500USD min depo is quioate a big for newcomers 😉

activtrades is optimal broker for many reasons. one of the most important is how long it in a game, where it registered and how regulated.

in these case i would like to know why is the minimum deposit is quite a sum here?

activtrade is a stable broker for many reasons. i trade here for many years and glad that i found this company.

minimum deposit for swap free account is 500$ and for individual account 500$.