Admiral Markets Review (2026)

Regulator

What is Admiral Markets?

With a quite long operation history since 2001, the Admiral Markets is a brand that operates in the field of investment financial services and continuously expands its offering worldwide while headquarters in the UK and operates offices in Cyprus, Estonia and Australia.

The general Admiral Market aim is to bring access to functional software and quality offering to the traders’ community throughout transparent pricing and execution.

The trading process indeed built for low latency and high trading frequency that aggregated by the system’s flow from different banks and venues into a single liquidity pool.

That allows providing competitive low spreads and deep liquidity with no restriction on trading styles or strategies, with low slippage and rejection rates and of course at high speeds.

Admiral Markets Pros and Cons

Admiral Markets is among well regarded large Brokers with sharp regulation and good standing, the account opening is easy and digital, Admiral Markets spreads are among lowest in industry based on our research, besides all trading strategies are available and there is a choice between Mt4 MT5 platfroms with great education, research and 24/7 support.

There is no much negative points for Admiral markets, conditions and proposal may vary according to the entity rules also some deposit methods will add on commission.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | ASIC, FCA, CySEC, EFSA, IIROC |

| 📉 Instruments | Metals and currencies, CFDs trading on indices, energies, bonds, stocks and CFDs on Cryptocurrencies |

| 🖥 Platforms | MT4 and MT5 |

| 💰 EUR/USD Spread | 0.6 pips |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 🎮 Demo Account | Offered |

| 📚 Education | Extensive educational and support materials |

| ☎ Customer Support | 24/7 |

Awards

In fact, various efforts Admiral markets placed to become leading proposals within the markets and various jurisdictions have been recognized timely by publications and awards, along with numerous positive clients’ reviews, which is always great for better reputation.

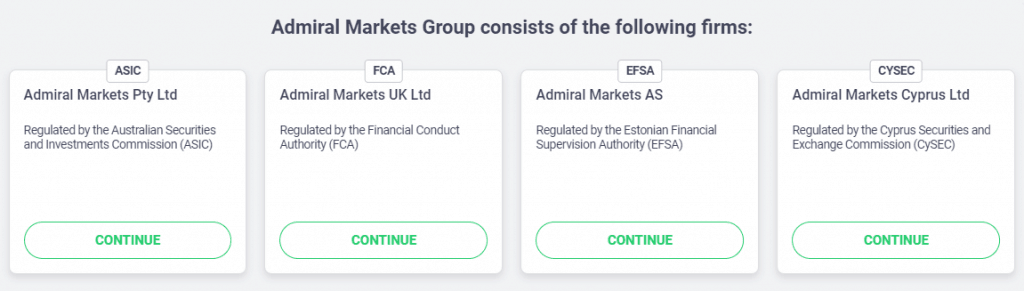

Is Admiral Markets safe or a scam

Admiral Markets, is heavily regulated by the multiple, world most reputable authorities that includes FCA in UK and CySEC in Cyprus, also EFSA in Estonia and ASIC in Australia, IIROC in Canada so is not a scam.

Is Admiral Markets legit?

Regulatory status and necessary license within the jurisdiction broker is operating meaning its legitimate status. In simple words regulation means that operation and the service they provide is regulated, authorized and sharply controlled on every step.

Therefore, traders and investors may trade with a confident state of mind knowing the broker is overseen, while various jurisdictions may apply slightly different requirements, yet concerned about the main issue of a safe trading environment.

Protective measures

In accordance with rules and restrictions, the company should follow certain operational model while providing a secure online trading service and a high level of financial confidence. Hence, all clients’ funds are segregated from the company owns, traders are covered by the compensation fund the FSCS (The Financial Services Compensation Scheme) along with encryption of the data and overall secure environment.

Leverage

Since Admiral Markets is an international brokerage that delivers its service through 4 worldwide offices to choose from, there are applicable differences according to which jurisdiction Admiral entity complies with. Admiral Markets does offer marginal trading, meaning you can trade through a multiplied amount of your initial deposit and operate larger positions. As this tool give a great advantage and may increase your potential gains, you should learn how to use leverage smartly and obtain good knowledge about it.

- Recently, Admiral Markets offer lower levels of leverage for retail traders due to the European updates in regulatory requirements,

- Australian regulation still allows a high level of leverage of 1:500 for Forex instruments.

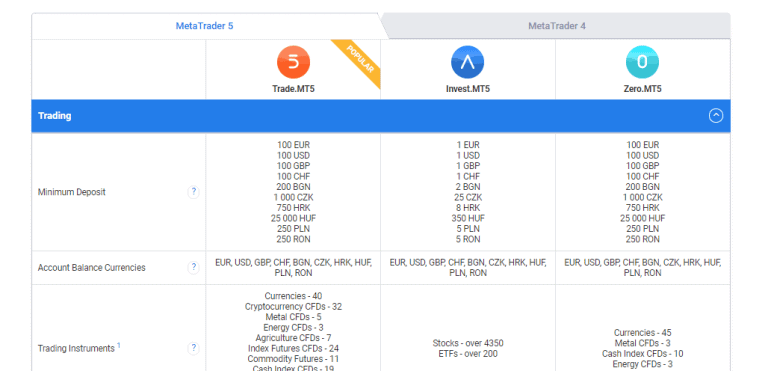

Account types

There are few flexible accounts offered by Admiral Markets that allows match of particular trading needs by the choice between two types of platforms divided into Admiral Markets Account and Admiral MT5 Account.

The most demanding traders, as well as beginning traders ones, can check the Admiral Markets account that is featured through the MT4 platform and costs built into the spreads. MT4 accounts defined as Trade.MT4 and Zero.MT4 accounts depending on fee structure either with all costs in the spread or sith interbank quotes and commission per lot as a broker fee.

MT5 accounts are also defined like Trade.MT5 and Zero.MT5 with similar structure, plus there is a separate account type for investors – Invest.MT5 allowing t invests in Stocks and ETFs and a minimum deposit requirement of only 1$.

Instruments

The Admiral Markets also diverse their offering by opportunities to trade metals and currencies, as well CFDs trading on indices, energies, bonds, stocks and CFDs on Cryptocurrencies – Bitcoin, Litecoin, Ethereum as well freshly introduced Monero, Dash and Zcash.

Fees

Typically Admiral Markets costs built into a spread defined by the instrument you trade, also conditions are different according to the account type and platform you would use. Moreover, see fee table below including funding fees and inactivity fees to consider full fee structure.

| Asset | Admiral Markets Fees | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | Yes |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

Admiral spread varies according To account offering and Commission charge also applicable to Forex & Metals – from 1.8 to 3.0 USD per 1.0 lots, Cash Indices – from 0.05 to 3.0 USD per 1.0 lots and Energies – 1 USD per 1.0 lots for Zero MT4 account.

Overall, Admiral Markets spread and costs are quite low and competitive among the market, see samples of the typical spread below for the MT4 account, yet you can check and compare fees to another popular brokerage FP Markets.

| Asset/ Pair | Admiral Markets Spread | AvaTrade Spread | eToro Spread |

|---|---|---|---|

| EURUSD Spread | 0.6 pips | 1.3 pips | 3 pips |

| Crude Oil WTI Spread | 3 pips | 3 pips | 5 pips |

| Gold Spread | 17 cents | 40 | 45 |

| BTC/USD | 50 | 0.75% | 0.75% |

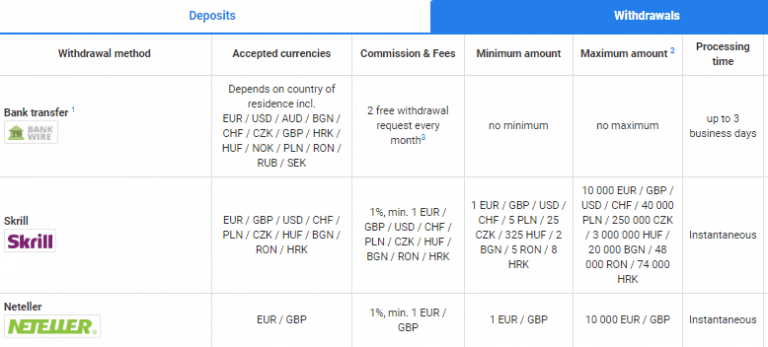

Deposits and Withdrawals

Deposit methods

To fund the account you will be having choice of the most convenient funding ways that includes major bank transfers, Visa and MasterCard payments, Klarna (that is available in European countries Germany, Austria, Belgium, France, the Netherlands, the UK, Italy, Spain, Hungary, Slovakia, Czech Republic).

Deposit fees

Also, you may use Przelewy in Poland and iBank&BankLink, while all above will not include any additional transfer fees for you to pay. Moreover, the additional methods of e-wallet payments like Skrill and Neteller are available also, however, will add on a 0.9% fee for the deposit transaction or 1% for withdrawal respectively.

Withdrawals

Admiral Markets rewards traders by two bank wire withdrawals per month free of charge, while further requests may incur fees for your transfers. Withdrawal methods offered the same options like deposits including most used Bank Wire and Card payments.

What is the Minimum deposit for Admiral Markets

Admiral Markets account requires only 100$ as a start capital or other currency that you choose as a denominated base currency, it does depend on the account you choose amount is the same.

Admiral Markets minimum deposit vs other brokers

| Admiral Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

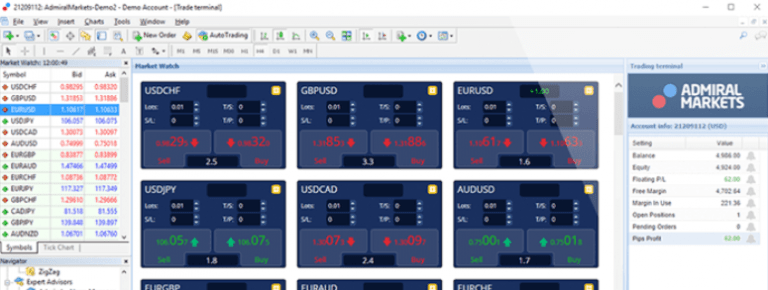

Trading Platforms

For the Admiral Market software and technical performance, let us start from the servers, which are physically located next to all major liquidity providers that in reverse ensures the best execution and lowest latency.

The software Admiral Markets use are reliable, convenient and popular trading platforms MetaTrader4 and MetaTrader5 that was developed by a global leader in trading software the MetaQuotes Software Corp. Both platforms delivering powerful STP execution, with eligible to use EAs with no restrictions, enhanced by various useful tools.

| Pros | Cons |

|---|---|

| Great platform suitable for all size traders and professionals | None |

| Mainstay on multiply awarded proprietary MT4 and MT5 | |

| Superior version for advanced traders offered | |

| Powerful trading capabilities with free range of tools | |

| Clean view and good charting |

Desktop Trading

MT4 is the most powerful and customer friendly platform for Forex and CFDs trading that recognized the biggest number of traders worldwide. You can install a platform at a desktop, as well reach through the browser as a WebTrader, or mobile devices along to enhance features by the MetaTrader Supreme Edition offering.

This plugin is an intuitive software that brings innovative features while making MT4 even more powerful and includes trading widgets, mini terminal with management options, tick chart trader, indicator package and more.

Web Platform

The next option is MT5 is an improved version of the previous powerful platform, also available to almost any device and even features Supreme Edition offering free of charge for any holder of the live account with Admiral Markets. MT5 also supporting various versions including web platform and mobile application for any device.

Mobile platform

Customer Support

Admiral Markets traders also will get easy access to phone support, Live chat room, send email or talk to representatives quite easily. Also, its teams are quite responsive and professionals so you can count on good support from the broker side.

Education

Furthermore, Admiral Markets provides truly extensive educational and support materials as we found through Admiral Markets review, throughout various seminars, analytical data research and daily support to their clients, so the very beginner would feel comfortable with Admiral Markets as well.

Also, there is free market news and analysis provided by Dow Jones along with the trading tools and extensions inbuilt into the platforms, all in all allowing you to make better trading decisions with the latest information and analytics.

Conclusion

Throughout the Admiral Markets review, we found broker is a highly regulated company and a respected online trading service provider. Admiral Markets brings an opportunity to trade with deep liquidity conditions from top-tier providers through the high speed of order executions and a quite low deposit to start along with its attractive pricing strategy. Technical solutions and optimizations are done in a very smart way while using the industry-proven platforms MT4 and MT5.