Advanced Markets Review (2026)

Regulator

What is Advanced Markets?

Advanced Markets is incorporated in the Cayman Islands-registered foreign company which is highly-capitalized and jointly owned by Macquarie Americas Corp Inc., a wholly-owned subsidiary of Macquarie Bank.

The company was established with the goal to facilitate a transparent and secure trading environment that brings true Direct Market Access (DMA) liquidity, credit and technology solutions to the foreign exchange, energy, precious metals and CFD markets.

The firm offers its wholesale services to institutional clients globally, providing also trade execution and prime brokerage solutions directly to banks, hedge funds, commodity trading advisors, corporations and other institutional market participants.

Advanced Markets Pros and Cons

Advanced Markets the broker offers a solution to wholesale and corporate clients, as well acts as a technology, liquidity provider. Being a retail trader, you may benefit through Advanced Markets unparalleled reliability, Prime of Prime credit solutions and full direct access to a bank, non-bank and ECN multi-asset class liquidity on tight, competitive spreads. Advanced Market delivers guarantee on all client positions that are instantly passed straight through the liquidity providers while the broker does not take any Market risk.

For Cons, the proposal might be more suitable for advanced and professional traers, there is no proper education.

10 Points Summary

| 🏢 Headquarters | Cayman Islands |

| 🗺️ Regulation | ASIC, FCA |

| 📉 Instruments | Foreign exchange, energy, precious metals and CFD markets |

| 🖥 Platforms | MT4, DMAhub, Fortex 5 & 6 |

| 💰 EUR/USD Spread | Spread + comission $20.00 per USD Million |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, AUD |

| 💳 Minimum deposit | 2,500 US$ |

| 📚 Education | Research tools |

| ☎ Customer Support | 24/5 |

Is Advanced Markets safe or a scam

No, Advanced Markets is not a scam, but a regulated broker with low risk trading.

The Advanced Markets Group has formed Advanced Markets LTD (“AMLTD”), as a Cayman Islands corporation in order to be able to provide the services under governance that enables offer a broader range of products to the clients.

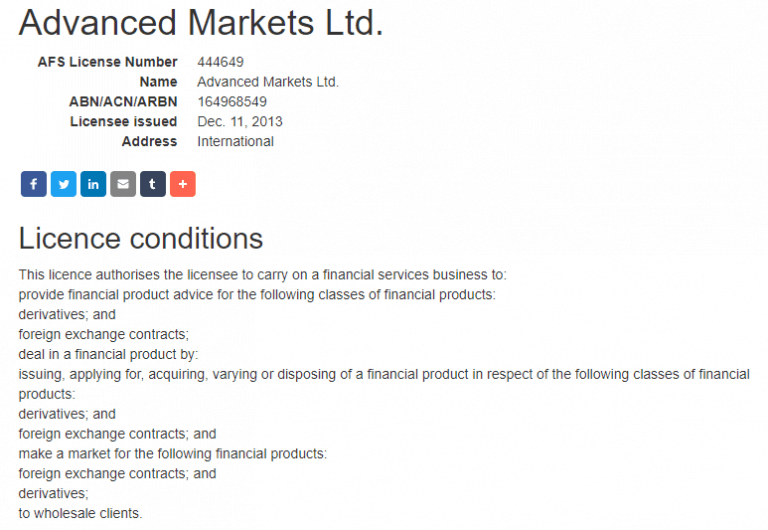

Yet, being located on an offshore zone, the broker trusty Registration of Advanced Markets Limited performed via a hold of an Australian financial services license (AFSL) No. 444649 and is a registered foreign entity by the Australian Securities & Investments Commission (ASIC).

While ASIC is a robust regulator, its regulation to the Advanced Markets applies in respect to the Australian financial services activities only. As a regulated company, the license ensures financial markets are complying with their legal responsibilities to operate fair and transparent markets.

And surely, client funds are held in accordance with the requirements in segregated client trust accounts separate from the firm capital. All clients and firm funds are kept at internationally rated banks, including Bank of America, Citi, Macquarie Bank and Deutsche Bank.

Leverage

Advanced Markets leverage levels typically set to a standard level of 1:100 for currencies. However, trading another instrument or depending on the volumes traded offered levels may diverse. Also, each type of clients receives tailored solutions designed specifically according to the needs, thus Advanced Markets is indeed quite flexible in these regards too.

Account types

The account offering defined only by the type of the clients and features either individual or corporate account type. Due to the company registration and license the Advanced Market can only accept a Wholesale client as defined by Section 761G(7) and 761G(A) of the Australian Corporations Act.

Fees

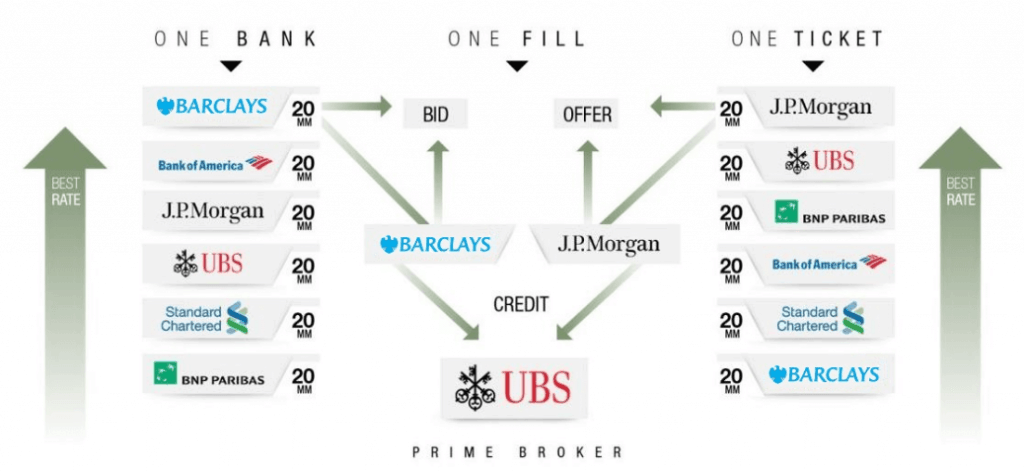

Advanced Marekets fees and pricing are based on the commission since broker delivering anonymous, low-latency access to multi-bank, multi-asset liquidity, so presents a compelling alternative to the single and multi-bank RFQ and ECN models currently available to institutional traders. Recent refinements, such as the FOX – Full Order execution block order trading mechanism, are gaining the attention of hedge funds, asset managers, commodity trading advisors (CTAs) and corporate treasuries which may offer a comprehensive solution.

| Fees | Advanced Markets Fees | AAATrade Fee | CommSec Fee |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Commission fee basis | Yes | Yes | Yes |

| Fee ranking | Average | Low | Low |

Spreads

Advanced Markets spread is tailored solutions suited the clients need and requirements while the trading cost will be set on a interbank spread basis along with the standard commission is set at $20.00 per USD Million. However, this standard may be negotiable based on the volumes traded and the solution provided.

As well you may compare Advanced Markets fees to another popular broker BDSwiss.

Payment Methods

The Advanced Market for the payment methods offering only the option to send and receive withdrawals through Bank Wire Transfer.

Wiring money is typically the fastest way of funding the Advanced Markets trading account, thus the broker defined this option as the major one. To ensure the integrity of the information sent via the Internet, electronic funding utilizes a multilevel server system with the latest encryption software that performs secure transactions.

Minimum deposit

The minimum required for Advanced Markets is 2,500$ at the very first type to set up an account and depending on what type of client you are.

Advanced Markets minimum deposit vs other brokers

| Advanced Markets | Most Other Brokers | |

| Minimum Deposit | $2,500 | $500 |

Trading Platforms

Advanced Markets as a technology-driven company recognizes the importance of having a robust and non-latent technology infrastructure, one that caters to the needs of all institutional FX market participants, from banks and fund managers to retail brokers and aggregators.

The platform offerings and the underlying supporting technology have been developed, to facilitate Direct Market Access (DMA) via GUI, Bridge and/or FIX API.

Desktop trading

The range of the trading platform includes the proprietary developed options, as well as the market leader – MetaTrader4 and MetaTrader5. Along with the powerful trading software you will get access to configure liquidity and choose from a menu of pricing that includes banks, non-banks and ECNs with defined layers, Top of Book, VWAP and more.

Advanced Markets also partnered with First Derivatives to create the fully customizable DMAhub trading venue that can be seamlessly accessed by both FIX API and GUI. DMAhub allows traders the ability to configure their own trading environment with a degree of granularity that is totally unique in today’s markets.

DMA trading

Another option, the robust Fortex 5 and its newer version Fortex 6 offers the ability to instantaneously access DMA liquidity via multiple routes all with a fully-functional, real-time, reporting suite. Alternatively, should the business use the Metatrader4 software, the direct connectivity using Fortex’s MT4 bridge technology offers so.

All of these options come with credentials to access Advanced Markets’ back-end reporting, providing full transparency on all transactions, P&L and end-of-day roll pricing amongst other things.

Conclusion

Overall, Advanced Markets is a model of a broker that takes the competitive, multi-bank elements of RFQ platforms and combines them with the low latency, transparency and anonymity of ECNs servicing for traders seeking consistent and interbank liquidity. Together with its advanced options for traders or the institutions, range with powerful effectiveness and an impressive choice of the cutting-edge platforms males Advanced Markets definitely a company of advance.

Reviews

Its like their method of deposit looks weird if they don’t receive via skrill and their likes.

What’s weird about wire transfer? It’s the best method anyway.