AxiTrader Review (2026)

Regulator

What is AxiTrader?

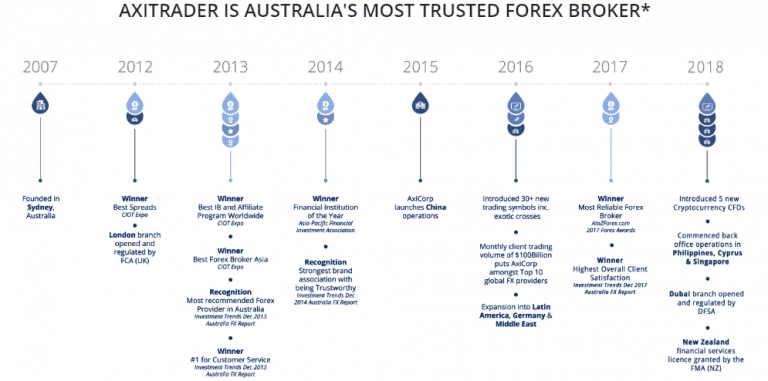

AxiCorp Financial Services Pty Ltd or its trading name AxiTrader based in Australia and founded in 2007. After the successful operation during the first years, the broker been ranked among the most trusted Australia’s Forex brokers with the strongest brand association.

In 2012 as a part of the company global enlargement campaign, London branch AxiCorp Ltd was opened, as a wholly owned subsidiary of its Australian company.

As an established international group of companies, AxiTrader provides financial products focused on foreign exchange, primarily for retail investors. Tight spreads and fast execution come as standard on all accounts. The AxiTrader’s clients as well enjoying direct access to various liquidity providers from over than 14 world’s largest banks.

AxiTrader Pros and Cons

AxiTrader is a reliable broker with good regulation from top-tier FCA and ASIC. AxiTrader provides range of trading platforms, various funding methods, with average spreads and excellent customer support.

For the negative points, instruments range is limited to Forex and CFDs and there is no propose for beginners education with courses.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | FCA, ASIC |

| 📉 Instruments | Forex, Commodities as well CFDs and Indices, Bitcoin or Cryptocurrencies |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 1.24 pips |

| 💳 Minimum deposit | 0$ |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | AUD, GBP, USD, EUR |

| 📚 Education | Education center with analysis |

| ☎ Customer Support | 24/5 |

Is AxiTrader safe or a scam

Axitrader is not a scam but voted timelessly for its trustworthiness, with low-risk Forex trading.

AxiTrader is licensed and regulated by the two main authorization institutions Financial Conduct Authority (UK) and by the Australian Securities & Investments Commission. Since over-the-counter derivatives carry significant risks traders should be assured they’re dealing with a transparent provider, which can be provided only by the regulated broker.

| AxiTrader entity | Regulation and License |

| AxiCorp Financial Services Pty Ltd | Is authorized by ASIC (Australia) registration no. ACN 127 606 348 AFSL 318232 |

| AxiCorp Limited | Is authorized by FCA (UK) registration no. 509746 |

In this case, client’s funds are safely kept in segregated accounts with top-tier banks and secured by the compensation schemes. As well as all online transactions, executions or traders manipulations are fully encrypted and following operational guidelines.

Instruments

From one MT4 terminal client can access the full range of widely presented by the company trading options, including Forex, Commodities as well CFDs and Indices, Bitcoin or Cryptocurrencies also can be traded the same way as major currencies. Overall, the broker covers the most demanding markets to trade, also UK residents can benefit from the Spread Bet option.

Account types

AxiTrader are divided into two accounts – MT4 Standard Account and MT4 Pro Account.

At the first stage and as a new to the trading, you also can open free 30-day trial Demo account with a virtual cash balance of £50,000 to practice skills and touch a trading process in a “real”. The traders that follow Muslim Sharia rules are entitled to open a Swap Free Account that is not subject to Swap Fees on FX Major, FX Minor and Precious Metals Symbols.

Fees

The difference between AxiTrader pricing features particular needs of a trader, while Standard account fees are built into the spreads, which starting at from 1 pips, and 0 pips at Pro Account along with committeemen to 7$ commission per round.

Another cost you should consider while trading is Swap Fee or an adjustment reflecting the relative difference in interest rates or yield on the underlying instruments. Typically, AxiTrader will charge Swap Fees on a Long Position and pay Swap Fees on Short Positions.

| Fees | AxiTrader Fees | FM markets Fees | ICM Capital Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

Spreads

AxiTraders spreads are average and low. With AxiTrader you’ll be able to keep your trading costs quite low, as the broker shows market-competitive spreads across a wide range of currencies, commodities and indices (see a table with average spreads for standard account). During liquid times the spreads may go as low as 0.0 pips, and broker truly adheres to ensure costs at the most competitive available.

| Fees | AxiTrader Fees | FM markets Fees | ICM Capital Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

Leverage

Leverage is a quite known instrument, which obviously multiplies the initial capital you trading with and can be a very useful tool to magnify your potential gains, but in case you use it smartly. However, always note that high leverage can work in reverse too.

AxiTrader as a regulated broker in various jurisdictions complies to provide different trading conditions according to what regulatory obligations set. The Australian clients of international traders that holding with ASIC regulated AxiTrader account are entitled to enjoy high leverage up to 1:400.

However, those traders that are operated under the European FCA regulation can use limited Leverage to a maximum of 1:30 on Forex instruments. These updated took place quite recently and are obligatory for the authorized broker, yet you as a trader may choose under which entity to open an account and therefore, have an option which leverage level to use.

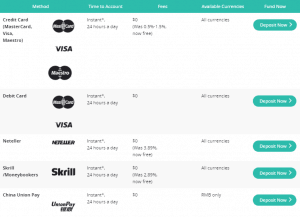

Methods of Payment

AxiTrader account can be funded by several options including Moneybookers/Skrill, Neteller, Wire Transfer, Credit Card, and BPAY. Also, there are selected companies with whom company allows broker-to-broker transfers, so you can either transfer your account from another brokerage to AxiTrader.

As a client, you may also enjoy the possibility to have account base currency in GBP, USD, EUR, CHF or PLN and deposit funds in those major currencies as well.

AxiTrader’s has no minimum deposit requirements, you are free to deposit any amount.

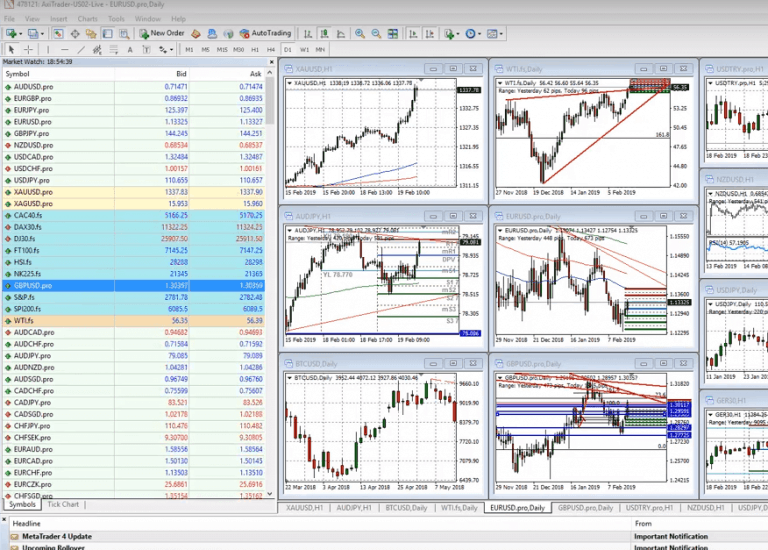

Trading Platforms

AxiTrader mainstays at the technical solution through a platform – MetaTrader 4, presented in a Web, Android, iPhone and iPad versions. Good to note, that not all MT4 platforms created equal, as the broker may invest into a co-located server and fiber optics, in order to process more accurate trading or not.

Since MT4 is a well-known and powerful enough platform with a broad array of available tools, AxiTrader’s users enjoy access to automated trading performed via EAs, enhanced connectivity with a range of extensions, trading signals with allowance to share your strategies too.

As well, you can strengthen your strategies by Authochartist, as an AxiTrader client getting free access to flexible charts by the sophisticated tool – PsyQuotation.

For professional traders, the company offers to use Next Generation of MT4 – MT4NexGen. The platform filled up with better and proved features, which makes trading even better and including sentiment indicators, correlation trader, alarm manager, automated trade journals and many more. This platform is available free of charge for the clients who open a live account with the minimum deposit of 1,000$.

The ones who hold multiple accounts the integrated software tool Multi Account Manager (MAM) is the great and available solution, which lets placing of large orders in bulk with speed and no limitation.

Customer Support

Furthermore, since the broker faced a significant increase in its volumes, AxiTrader launched operation and multilingual customer support in numerous locations and now covering China, Latin America, Middle East, Germany and more. Actually, and this is true that AxiTrader is known in the trading industry for its award-winning customer support.

Conclusion

Overall we found the main Axi offering that adheres to access online trading world with ease for the fresh graduates, as well sophisticated enough solution for experienced ones. A truly comprehensive range of tools, at the AxiTrader’s mainstay MetaTrader 4 brings a very competitive technical solution to trade through market making execution. As for the important question about margins, Axi offers access to flexible leverage options. In addition, the broker is a popular choice among Australian traders and worldwide investors that were convinced about the Australian service providing.

Reviews

withdrawalls refused its a scam

I have tried to withdraw my money from Live Account 441658 but they have refused the request

I have sent updated details by pdf of my account

i have tried to update my credit card details but can’t do so by the new client portal it wont let you update your details all it does is ask you for more funds for your account if you refuse to give them more money they block access to the portal

If you call them they refuse to talk to you and tell you to do all transactions by the portal

You can’t get any assistance from them

Axi name Change

I have done further research on this company and what is interesting is AXI Trader. has been investigated by asic and the company has been refused permission to trade as a cfd broker because fraud

they have changed their name to AXI and still say that they are regulated by ASIC

I guess that this means that I wont get any money back by Who, AXI or AXI trader

what will be the next name they choose

Good day

Did you come right with them , I just joined I’m concerned

I would like to join im from the phillipines

Any update from your withdrawal status? About to open an account, now hesitant… Thanks.