Ayondo Review (2026)

Regulator

What is Ayondo?

Ayondo was established in 2008 as a FinTech group with the main aim to develop and democratize the financial industry to retail and institutional clients. The clients across Ayondo offerings have an option to choose trading experience either via Social Trading that allows to follow proved top traders automatically or to discover Market trading through their award winning trading platform for CFDs and spread betting.

Indeed, Social Trading is a fast-growing innovation, with a high growth rate which allows retail investors and traders to monitor and copy trading strategies in real time, proportionate and fully automated. The broker already covers a broad array of services in the financial field, while serving over 210,000 users from around 200 countries in their back.

10 Points Summary

🏢 Headquarters

Germany

🗺️ Regulation

BaFin, FCA

🖥 Platforms

TradeHub

📉 Instruments

Indices, currencies, shares, ETFs, commodities and interest rates with bonds

💰 EUR/USD Spread

o.8 pips

🎮 Demo Account

Provided

💳 Minimum deposit

100$

💰 Base currencies

Several currencies offered

📚 Education

Included with social trading options and research tools

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | Germany |

| 🗺️ Regulation | BaFin, FCA |

| 🖥 Platforms | TradeHub |

| 📉 Instruments | Indices, currencies, shares, ETFs, commodities and interest rates with bonds |

| 💰 EUR/USD Spread | o.8 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Included with social trading options and research tools |

| ☎ Customer Support | 24/5 |

Awards

Nevertheless, the main specialty of Ayondo is the financial trading technologies and tools development that drives more people into the trading and brought until now numerous recognitions of the company.

In 2013, Ayondo was listed among the world’s top 50 financial technology companies and further achieved to become first FinTech company to list on Singapore’s Stock Exchange (SGX).

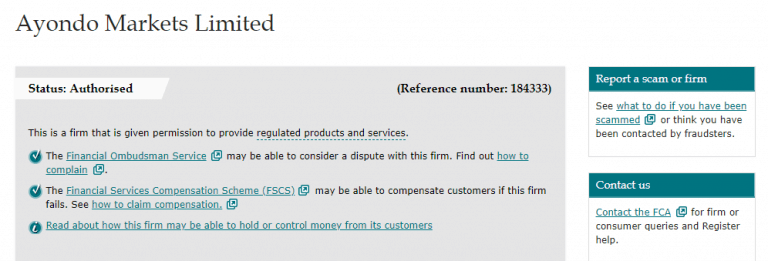

Is Ayondo safe or a scam?

At the core of the Ayondo group portfolio and establishment stands the Technology and Service provider Ayondo GmbH and Social Trading services that are exclusively provided by Ayondo Portfolio Management GmbH. Both companies based in Frankfurt, Germany while Ayondo portfolio management GmbH is authorized and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin.

However, the investment firm Ayondo Markets Ltd itself is based in London and respectively regulated by FCA. Moreover, additional offices that cover the clients’ need locating in Singapore, Switzerland and Spain are fully authorized to deliver its service.

Along with numerous restrictions and regulation, the broker complies due to its licenses, Ayondo‘s customers trade without debit balance obligation or negative balance. This means that traders cannot lose more money than they invest. And the last but not the least, the supplementary insurance covers every client up to £1,000,000 in excess of the standard FSCS cover.

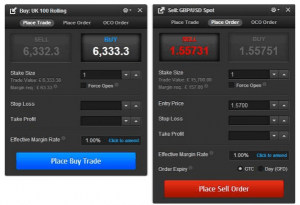

Trading Platforms

The company mainstays on a proprietary platform TradeHub that performs fast and accurate execution combined with intuitive design and simple filters for easy research. Chart and tools have been developed for both beginning traders, which are able to get into trading easily, as well as extensive capacities for developed traders.

It is true, the TradeHub charting package is an extremely comprehensive one that uses javascript and SVG based chart, fully customized and features amended technical indicators. The platform available on either PC or mobile devices and featured with tight spreads and low funding or rollover costs.

You may also enjoy a variable margin while choosing from low levels up to 100% need to pay only for the leverage you use. In addition, you always trade multiple markets with constant support from the company, since client services based in London, Singapore and Frankfurt and remains on hand at all times.

Accounts

Ayondo markets offering trading through CFDs, a derivative financial instrument that enables to gain exposure to markets, and includes exchange the difference in value between the indices, currencies, shares, ETFs, commodities and interest rates with bonds.

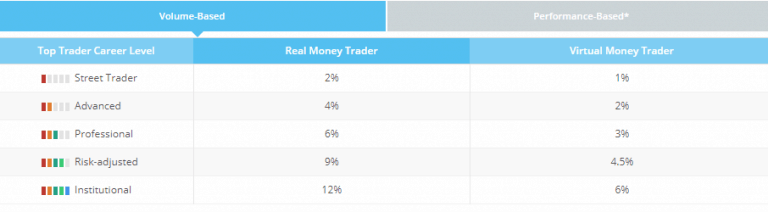

The broker brings access to online trading through three various accounts, as the offer varies to Social Trading Follower, Social Trading Top Trader and CFD or Spread Betting.

Social Trading is now a very progressive possibility that allows follower account to automate trading signals according to the chosen Top Trader and track performance through your own account.

– The CFD, Spread Betting account available through TradeHub platform along with powerful charts and tools. However, spread betting accounts are only available to customers from Great Britain and The Republic of Ireland.

Fees

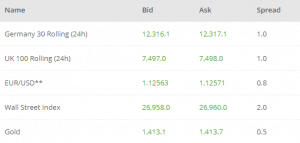

For the trading conditions, the broker offers variable margins or spreads with no volatility impact on the value of the instrument, limited risks through guaranteed stop loss, no commissions but only spread (typically EUR/USD o.8 pips)

Yet, See below typical trading fees for popular instruments, also compare Core Spreads trading fees to another popular broker BlackBull Markets.

| Asset/ Pair | Ayondo spread |

| EUR/USD | 0.8 |

| Crude Oil WTI | 5 |

| Gold | 6 |

However, you should also consider additional costs which are built into the overnight funding or swap rates that are normally charged at the rate of 2.5% p.a. plus relevant interbank rate in case you holding open position longer than a day.

Leverage

As for the trading leverage conditions, Ayondo mainstays at the optimal path to maximize the offering through the leverage which also complies with FCA and BaFIN regulation. In fact, European authorities strictly restrict leverage to a maximum of 1:30 for major currency pairs, 1:20 for minor currencies and 1:10 for commodities.

Deposits and Withdrawals

To fund the live account you ate having a choice from a few payment methods including bank wire or credit / debit cards.

Deposit

The minimum deposit amount is set to a competitive 100$, which allows even beginning traders to enjoy with no issues. Nevertheless, check your account preferences for a minimum necessary amount, as example accounts for social trading requires at least 2,000$.

Withdrawal fee

Cards deposits are free of charge with 0$ fee, however, the cards that are issued outside of the EEA will be charged 1.75% to process the transaction. In addition, to provide secure transaction the payments accepted only by 3-D secure cards that are developed by Visa for more safe internet payment process. To withdraw the money from account you simply should proceed with an easy request, while the funds will be back to the original source.

Conclusion

As a licensed and regulated by two major authorities broker Ayondo provide an option to trade safely while bringing innovative ideas into the trading world.

With the best possible service, unique tools, and a diverse product range, Ayondo delivers more equal opportunities and helps to ensure traders become satisfied and successful investors. Their social trading network is among the biggest available that is fulfilled by numerous Top Traders and their followers.

What is also good, trader with not significant account size can start, which is a valuable benefit for beginners. Overall, the broker brings to the table a quite valuable offering to global traders that broaden trading possibilities through various options and that’s, for sure, worth consideration.

Nevertheless, always good to know your personal opinion about Ayondo which you’re welcome to share below.

Ayondo Updates

Ayondo disclosed activity in December 20202, the broker is no longer operational and suspend all trading activity.