BlackBull Markets Review (2026)

What is BlackBull Markets?

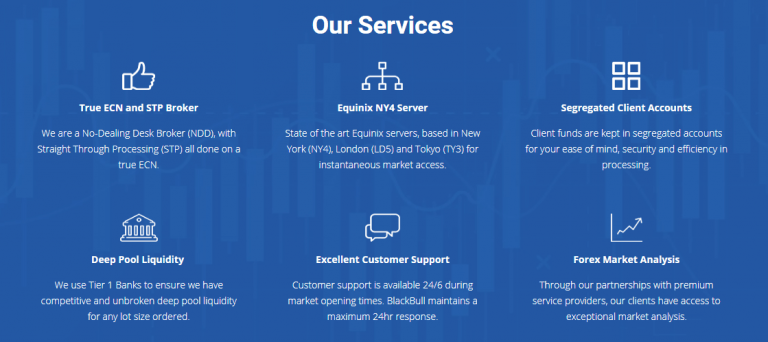

BlackBull Markets began its operation back in 2014 through Auckland New Zealand and combines years of Institutional Forex experience with the focus on resource offering to retail traders. Ever since the broker enables multiple trading solutions as a financial services provider with proprietary software to aggregate powerful trading performance along with competitive pricing.

Also, BlackBull Markets was founded as a prime broker also offering retail trading solutions and maintaining its traducing facilitates within world trading centers including London, UK, and Malaysia in reverse bringing global exposure. Numerous possibilities include diverse conditions, and assets to trade, supported by the learning materials and programs for active traders.

Apart from the various solutions for retail traders, there are also professional services for an institutional account, money managers along with MAM and PAMM accounts.

BlackBull Markets Pros and Cons

BlackBull Markets provides quality trading conditions and is a fully regulated broker. It is one of the few brokers with high leverage, a good trading environment, lowest spreads based on our research and professional trading overall, plus education and research

For the Negative points, there is no 24/7 support, and tools might be slightly limited.

10 Points Summary

| 🏢 Headquarters | New Zealand |

| 🗺️ Regulation and License | FMA, FSA |

| 🖥 Platforms | MT4, MT5, Social trading Myfxbook and ZuluTrade |

| 📉 Instruments | Forex, Index and Single Stock CFDs, Commodities, Precious Metals, and Energy |

| 💰 Costs | 0.9 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | Various base currencies offered |

| 📚 Education | Forex Education and tools on free basis |

| ☎ Customer Support | 24/5 |

Awards

Actually, BlackBull markets is a highly regarded broker, as the clients they serve are mostly happy with the trading conditions and the service they receive. As well as numerous awards confirming BlackBull Market’s success within the industry and placing them among regarded trading providers for its great technology and innovation.

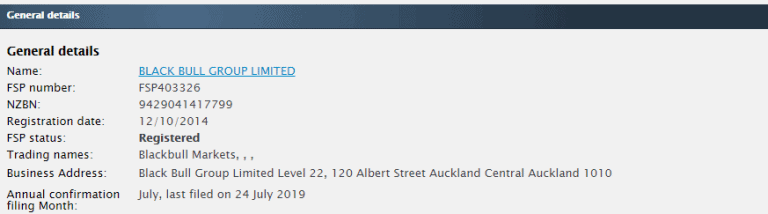

Is BlackBull Markets safe or a scam

No, BlackBull is not a scam. It provides low-risk Forex and CFD trading since Black Bull Group Limited known under the trading name BlackBull Markets is a New Zealand registered and incorporated company that is also respectively regulated by the local authority FMA. In fact, being a regulated broker is somehow a crucial factor, since obligations towards authorities guarantee the company was checked before it was established, complies with necessary laws and model of operation, therefore considered a safe investment firm.

Is BlackBull markets legit?

Registration with the NZ legislation regime announces BlackBull Markets good standing and reliability to its provided services also meaning BlackBull Markets is a fully legit broker that obliges to the regulatory regime. The broker applies money protection rules and policies, as well as provides qualified service and trading environment, which also compensates clients in case of the company insolvency, as defined by FMA rules.

Also, there is an additional entity based in SVG for the following countries that don’t have the option to register with FMA: Albania, Azerbaijan, Bosnia-Herzegovina, Barbados, Brazil, Bahamas, China, Ecuador, Egypt, Western Sahara, Ghana, Jamaica, Cambodia, Lao People’s Democratic Republic, Liberia, Morocco, Nigeria, Philippines, Bolivia, St Maarten, Tunisia, and Uganda. These countries are accepted under FSA only. All other countries can have an account with either of the broker’s regulatory licenses.

The only difference between FMA and FSA licenses is the document requirements when an account is being approved, because the FMA has a much higher standard, as would be expected. As to the trading conditions, they are always the same no matter which regulatory licence trader’s account is under.

There are some Restricted countries BlackBull Markets does not accept clients from, under any circumstances as it is both an AML and CTF risk, not deemed acceptable by either the FSA or FMA. Here is the full list of those Restricted regions: Afghanistan, Burundi, Belarus, Congo, the Democratic Republic, Central African Rep, Cuba, Spain, Guinea Bissau, Haiti, Iraq, Iran, Islamic Republic of, North Korea, Lebanon, Libya, Mali, Myanmar, Nicaragua, Panama, Pakistan, Gaza Strip, West Bank (Palestinian Territory), Russian Federation, Sudan, Somalia, South Sudan, Syria, Ukraine, United States, Venezuela, Yemen, and Zimbabwe.

Leverage

Another important point within Blackbull Markets Review is offered leverage levels. Usually, maximum leverage defined by the instrument you trade, also the type of trader you are either professional or retail trader, and lastly is restricted according to the regulatory requirements broker obliges to.

- With BlackBull Markets you are able to use high leverage levels up to 1:500 available for retail or professional traders.

- International traders entitled for 1:500 likewise through the Seychelles entity

These are the great news indeed, as despite the fact that the majority of world authorities already significantly lower allowed leverage levels, NZ and Australian authorities still offer high maximum leverage ratios, which also require you to learn how to use it smartly without making trading too risky for you.

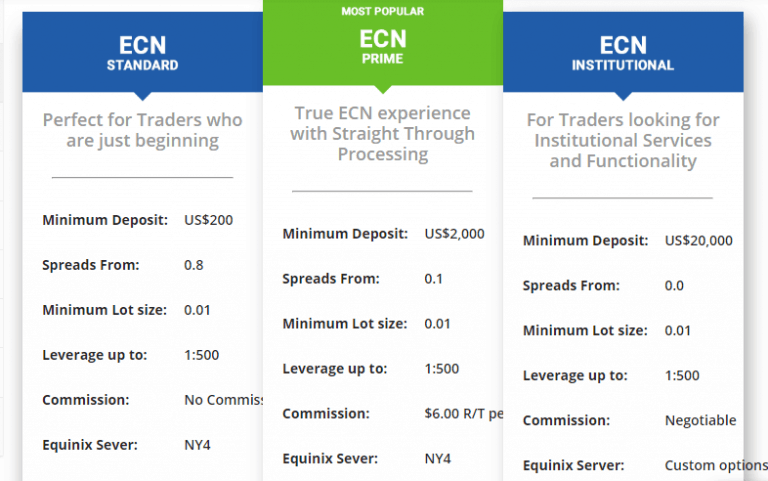

Account Types

BlackBull Markets designed three account types all based on ECN execution and offering quite competitive trading conditions through no dealing desk model of operation. BlackBull made indeed made a great job with its proposal possibility to the traders of different size, portfolio and needs to access its trading rooms.

Additionally, there is specified and defined access for institutional trading and professionals where all conditions are tailored and sustained as per request. Active traders may also find tailored solutions and additional services to enhance capabilities, alike VPS hosting, advanced reporting and so.

How to open Account

Account opening is a fully digital process, which is easy guided step by step on how to obtain access and activate your trading specified conditions.

- Access BlackBull Markets Sign In page

- Enter your personal data First and Last Name, Country of residence, email, phone, etc. Also, you may use Facebook or Google existing account.

- Choose the account type of your preference and specify your trading experience

- Verify your account through email, upload proof of ID, address and other documents

- Get access to your trading and account area with active logit to Demo account

- Follow with first deposit

Fees

BlackBull trading costs consistent of a regular spread or commission charges, also you should consider rollover or swaps, also non-trading fees, like deposit fee or additional charges that might be applicable.

| Fees | BlackBull Fees | FXTM Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | Yes | Yes | No |

| Inactivity fee | No | Yes | Yes |

| Fee ranking | Average | Average | Low |

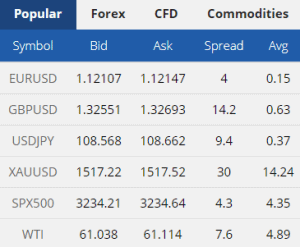

BlackBull Markets Spread

AT BalckBull Markets you can choose the most suitable option according to your trading style either with all costs included into spread, more suitable for beginning or regular size traders through ECN Standard account with spreads from 0.8 pips. Active or professionals traders will better use ECN Prime account with raw spreads from 0.1 pips and a commission charge $6 per trade.

As well you may see more spread examples below and compare fees to another popular broker Pepperstone or other competition shown on the table below.

| Asset/ Pair | BlackBull Spread | FXTM Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.9 pips | 1.5 pips | 1.3 pips |

| Crude Oil WTI Spread | 6 pips | 9 pips | 3 pips |

| Gold Spread | 25 | 9 | 40 |

ECN spread

Trading Rollover

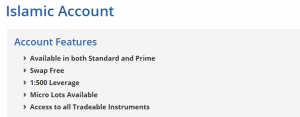

Also, always count on swap or rollover fees charged for positions held longer than a day. Besides, BlackBull Markets maintains offering suitable for traders following Sharia rules known as Islamic Swap-free accounts, so that global investors may find suitable conditions.

Trading Instruments

BlackBull Markets bringing exposure to various markets available around the globe and including over 64 currency pairs, Forex, indices, metals, commodities, energies, etc. This range is a quite good one, as it includes popular trading instruments to diversify your portfolio especially considering good cost strategy and inbuilt proposal, which we will see further in our BlackBull Markets Review.

What Deposits and Withdrawals BlackBull Markets use?

BlackBull Markets being a regulate broker offers a great range of secure funding solutions and keeping money according to trust, safety and confidence with Top tier segregated Bank accounts. However, always make sure to verify according to your residence what conditions and methods are applicable to you, or some rules that may vary.

Deposit Methods

BlackBull Markets allows fund deposits and withdrawals through various methods including following, while also you may choose a base currency for your account for easy transfers and no conversion fees.

- Credit Card,

- Bank wires

- e-wallets like Skrill, Neteller and FasaPay

Minimum deposit

BlackBull minimum deposit is $200 for the ECN Standard account, and the next grade ECN Prime will require 2,000$ as a first deposit.

BlackBull Markets minimum deposit vs other brokers

| BlackBull Markets | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawal

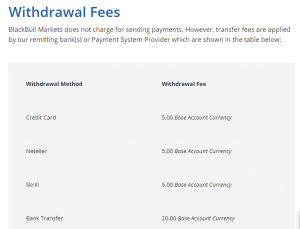

BlackBull Markets does not charge any fees for deposits, withdrawal options widely available including most used Bank Transfers and credit cards, yet there are some charges for withdrawals. Withdrawing of money will cost you 5 base currency, 5$ if your base account currency is in US$.

How do I withdraw money from BlackBull Markets?

To withdraw funds from your BlackBull account you simply should login to your account area or a Client Portal and submit a request. Under the section ‘Funding’ click tab Withdraw Funds, submit all the required data, allow BlackBull to process the request within 1-2 business days and then your payment provider will ad funds to the chosen method.

Trading Platforms

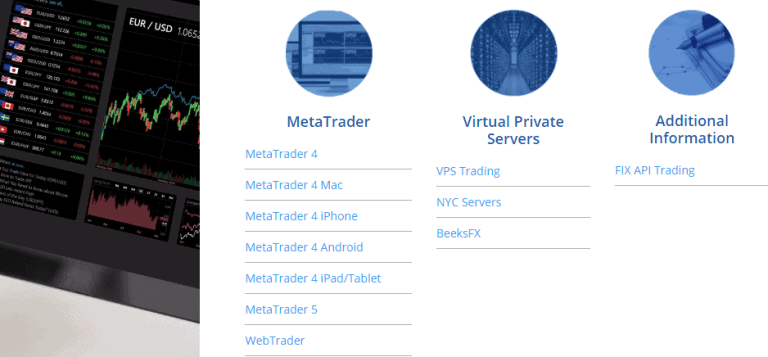

The platform offering as a part of the BlackBull Markets Review shows us a choice between industry leader MetaTrader4 and its next version MetaTrader5. Both offer a super convenient option between powerful conditions and user-friendly interface, both are suitable either for beginners or professionals making software a pleasant partner in your trading journey.

| Pros | Cons |

|---|---|

| Customer friendly design | No proprietary platform |

| Popular MT4 platform and MT5 | Relatively limited analysis |

| Good range of tools | |

| WebTrader Does not require installation | |

| Clear look | |

| Automated Trading and Social Trading |

Web Trading

Both platforms feature versions suitable for ay device either PC, MAC or tablet, mobile devices together with web-version accessible right from the browser. While Web Trading is a little limited in its tools compared to desktop version it still offers the most important point which are needed in every day trading.

The look is clear and good to analyze, which MT4 and 5 technology is famous for, also together with unparalleled BlackBull markets trading solutions and heavy investment in innovation you can make the most out of the trading performance.

Mobile Trading Platform

Definitely nowadays it is almost impossible to imagine trading without a mobile trading platform, as it allows you to monitor and stay updated with the situation whenever you are. BlackBull Markets Mobile platform also please you with a range of technical analysis and chart option features it offers.

Also, BlackBull made it possible to use extra benefits from VPS servers and additional FIX API Trading capability so you always having the option to deploy your strategy at the best.

AutoTrading

While there is no need to go deep into the specification of each platform, generally we must say a BlackBull platform is a great software for manual either automatic trading. There is no restrictions for use of EAs, neither scalping nor hedging strategies so with BlackBull technology of execution and comprehensive education you may get the maximum, all depending on you.

Moreover, you may access social trading through leading software including ZuluTrade and Myfxbook.

Customer Support

In terms of the Customer Support BlackBull made it as comfortable as possible so that its traders will be supported and satisfied at any step.

You may refer to the support with any concern or question you may have and also count on a quality service while the support team accessible via Live Chat, International Phone Lines and email also supporting world centers.

Education

Along with its advanced and competitive offering as we discover in our review, BlackBull also supports educational resources suitable for traders of different levels. There are trading videos, guides and trading glossary where you can find good quality information. Also, to support your ongoing trading process BlackBull Markets runs its Trading Blog with market overview, analysis and research materials.

Packed Research tools provided by both advanced MetaTrader capabilities also with technical analysis, trading ideas and other capabilities, all available at BlackBull.

Conclusion

Overall, BlackBull Markets offers a comprehensive offering to traders around the globe. Together with its regulated environment, broker also provides advanced capabilities with competitive conditions among market offerings and is one of the brokers allowing high leverage ratios. There are different trading styles supported including the technology to use, platform or a program trading, so with our opinion, BlackBull Markets is definitely a broker to consider.

Reviews

Do you accept clients from the United States?

Yes I do accept