CPT Markets UK Review (2026)

What is CPT Markets UK?

CPT Markets UK is a brokerage company established in the UK with the goal to offer the best of possibilities for a various size or level international traders that seek comprehensive trading options. Also, one of the important notes of CPT Markets UK is to enable secure and transparent environments for trading which also is confirmed by CPT Markets UK specialization in CFDs and FX trading under respected FCA regulation.

As we found, throughout over 10 years’ experience in Forex trading, CPT Markets UK defines its success though the core professionalism of the investment opportunity, as it covers a simple way to trade CFDs with no complications on conditions or confusing management.

Together with that, CPT Markets designed tailored solutions for both personal retail trading and specialized conditions for institutional trading based on values of respect, reliability and high performance.

CPT Markets UK Pros and Cons

CPT Markets UK is a good standing broker with STP execution and spread basis fee, there are various trading instruments and platforms, good research and support.

For negative side, spreads are slightly higher than average, education is basic.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | 50 Markets including Forex, Precious Metals, Cash Indices and Energy Futures |

| 🖥 Platforms | MT4 |

| 💰 Costs | 1.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, GBP, USD |

| 💳 Minimum deposit | 100$ |

| 📚 Education | Research tools, analysis |

| ☎ Customer Support | 24/5 |

Is CPT Markets UK safe or a scam

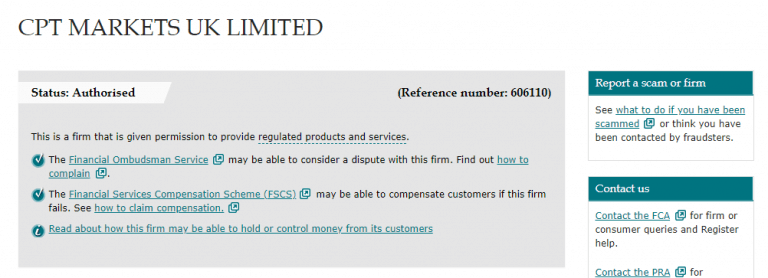

CPT Markets UK is a business and trading name used by the Citypoint Trading Limited company registered in England and Wales, also respectfully registered under UK’s FCA considered low-risk trading broker and not a scam. You may read more Why trade with FCA brokers, which in simple words means that broker operates under a high level of reliability ensured by FCA constant overseeing of its regulatory standards. In fact, FCA is one of the most respected world authorities to the end maintaining a great financial standing and auditing of finance firms.

CPT Markets is also operating an additional company that is doing international business under the name of CPT Markets and is registered in Belize, being a licensed IFSC investment firm.

Despite the fact that Belize is an offshore zone under which on its own we do not recommend trading with, together with FCA applied guidelines of investment operation it is considered a safe choice.

Therefore, being a UK firm CPT Markets’ each customer is covered by the Financial Services Compensation Scheme (FSCS) that guarantees clients’ funds up to 50,000 GBP in the unlikely event. Also, funds are always kept separately from the company’s actives, means cannot be used for operational purposes, making money management a transparent system.

Trading Instruments

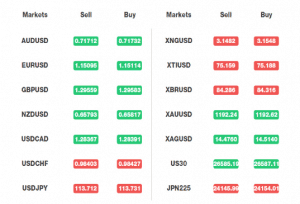

For those interested, CPT Markets UK offers bespoke solutions to build and manage portfolios through access to over 50 Markets including Forex, Precious Metals, Cash Indices and Energy Futures. Together with a quite diverse portfolio, CPT Markets built low spreads and margins strategy with the possibility also to leverage positions, therefore giving a chance to magnify your profit.

As well as enhance your knowledge by the Research materials CPT Markets provides keeping you updated on market news and changes.

Leverage

As for the trading leverage conditions, CPT Markets UK as a UK regulated firm obliges and complies with FCA regulation, therefore, chooses an optimal path to maximize the offering through the leverage.

- In fact, European authorities strictly restrict leverage to a maximum of 1:30 for major currency pairs, 1:20 for minor currencies and 1:10 for commodities.

However, in case you are not a resident of Europe, there is a possibility to trade Forex through CPY Markets international entity with an opportunity to speculate with higher leverage ratios which you may check with customer service directly.

Account types

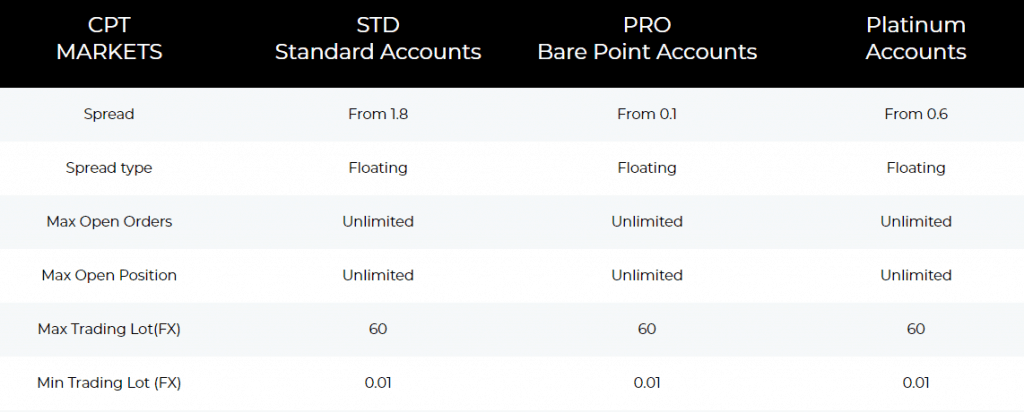

There is no diversification between account types unless defined by the type of trader himself. Meaning there is a Standard Account for retail traders and a Professional one for professionals respectively, lastly there is a Platinum account designed as a solely tailored solution mainly for institutions.

As for the important topic about trading costs, CPT Markets UK builds quite competitive conditions for both retail and professional traders. However, always make sure to check under which entity of CPT Markets you trade, as various jurisdiction obligations may offer slightly different conditions.

Fees

CPT Markets fees are mainly built into a spread with no commission, for full pricing check other fees like deposit and withdrawal fees too.

| Fees | CPT Markets UK Fees | City Index Spread | BDSwiss Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

CPT Markets UK Spread

CPT Markets UK costs mainstay on a variable or floating spread that is starting from 1.8 pips for Standard Accounts.

See below typical trading fees for popular instruments, also compare Core Spreads trading fees to another popular broker FBS.

| Asset | CPT Markets UK Spread | City Index Spread | BDSwiss Spread |

|---|---|---|---|

| EUR USD Spread | 1.8 pips | 0.5 pip | 1.5 pips |

| Crude Oil WTI Spread | 5 | 4 | 6 |

| Gold Spread | 40 | 0.3 | 25 |

Deposits and Withdrawals

CPT Markets UK and its global entity, as a majority of brokers offer the most common payment methods and support funding and withdrawals through Cards payments, wire bank transfers and e-wallet Skrill, Neteller.

Minimum deposit

CPT Markets small minimum deposit requirement of 100$ for Standard account opening. Professional accounts and institutional of course require a bigger amount which you may check directly with customer service. Nevertheless, always check on the margin needed to trade specific instruments and according to this define the amount you want to invest.

CPT Markets minimum deposit vs other brokers

| CPT Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal fee

CPT Markets commission and transaction fees for withdrawal, involving card deposits and transfers do not incur any charges from the company for both deposits and withdrawals. Yet, you should always check with your payment provider in case any fees are waived from your side.

Trading Platforms

As for the trading software CPT Markets supports a market leading and industry known platform MetaTrader4. Indeed, MT4 does not require an introduction, as together with its comprehensive and professional approach for trading you’ll get vast possibilities to learn, automate or even copy positions.

The platform features the most important trading needs, without making confusion of numerous expensive tools as very known for its customer-friendly design. Also, the MT4 platform is accessible through either PC or Mobile Phone thanks to its Applications suitable for all devices.

Overall, CPT Markets UK offering a powerful combination of some of the best executions, powerful technology and low commissions for all types of clients, and of course a comprehensive technical solution through the platform. A variety of EAs for automated trading is allowed too, so you may choose your best strategy towards trading, as well as the possibility for managers through MAM.

Conclusion

Overall, CPT Markets UK is an interesting opportunity for traders of different size and portfolio. You will find exactly what is necessary for trading, good platform, competitive spreads as well as follow of strict regulation by the broker himself. Seamless account opening and money transfer to or from the account also worth a good word about CPT Markets UK, which all in all makes a broker choice to consider.