Capital Index Review (2026)

Regulator

What is Capital Index?

Founded in 2014, Capital Index is an international online brokerage service firm with established operations in UK, Europe, Australia and worldwide sharp regulation and specialization on CFDs, Financial Spread Betting and Spread Trading on a range of financial instruments including Foreign Exchange (FX), Commodities, Indices and Metals.

The Capital Index team, with a wealth of industry experience, recognizes that providing customer service and support together with state of the art technology are central to the success in the industry. Hence, the broker invested heavily into an advanced technical infrastructure to provide an efficient trading environment and ensure continuous growth.

Capital Index’s uses no dealing desk execution (NDD) that allows transparent, fast and secure trading. That means the best possible prices in the market along with utmost security making your trading opportunities wider and more efficient.

Capital Index Pros and Cons

Capital Index is a broker with FCA license and transparent conditions. The NDD execution is perfect for platform Capital Index provides with low spreads.

The negative side, there is no professional education section compared to other brokers, and instruments are limited to Forex and CFDs.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, SCB |

| 🖥 Platforms | MT4 |

| 📉 Instruments | CFDs, Financial Spread Betting and Spread Trading, FX, Commodities, Indices and Metals |

| 💰 EUR/USD Spread | 1.4 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100 US$ |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Webinars, Seminars, Daily Outlooks |

| ☎ Customer Support | 24/5 |

Is Capital Index safe or a scam

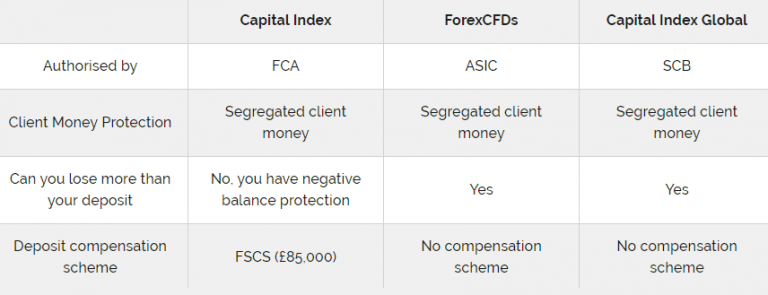

No, Capital Index is not a scam Capital Index with its headquarter in London is authorized and regulated in the UK by the Financial Conduct Authority whish is registered as Capital Index UK Limited, as well as through its Bahamas office registered by SCB is known as Capital Index Global Limited.

Moreover, broker serves another popular brokerage entity in Australia under the Cardiff Global markets Pty Ltd with a trading name ForexCFDs’, which is respectively regulated by the Australian ASIC.

In simple words, heavy regulation means – follow and operation under safety measures, which as per regulations apply numerous restrictions and overseeing how brokerage is operated. Therefore, all client funds are fully segregated and kept in separate bank accounts, ensuring client funds are not used for the company purpose.

Capital Index applies also an operational model set by a world-recognized authorities that provide a harmonized environment with financial transparency, competition, and offer greater consumer protection in investment services across the EEA and worldwide.

Leverage

Leverage levels offered by Capital Index does depend on the entity you trading with. This happens due to various regulatory requirements that diverse from the authority to another. Therefore, Australian client trading with Capital Index AU can enjoy high leverage levels up to 1:500 for Forex instruments, while European and UK clients eligible to use as low as 1:30 for Forex instruments.

Account types

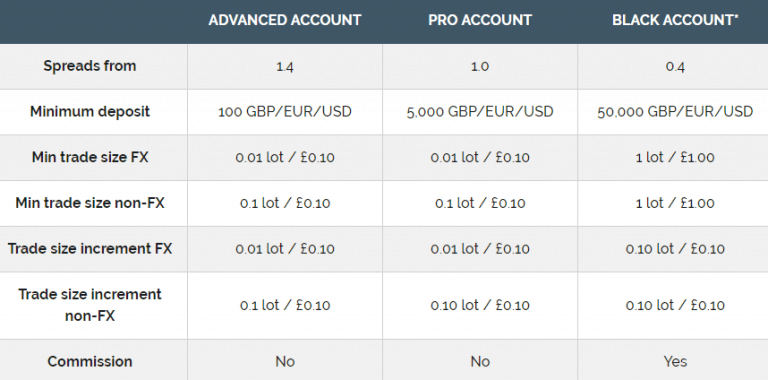

You are able to choose from three account types at Capital Index, plus to that the Islamic Account offering available to the traders who follows Sharia rules. All accounts supported by VPS service, various leverage levels, see the next paragraph, and the STP execution model.

Of course, in the beginning, any trader can open a risk free demo account with Capital Index.

Fees

While various account types designed to differences between trading needs, each of them lists lower spread offering as soon as trading size increases. Particularly, see Capital Index spreads comparison below, as well compare fees to another popular broker Pepperstone.

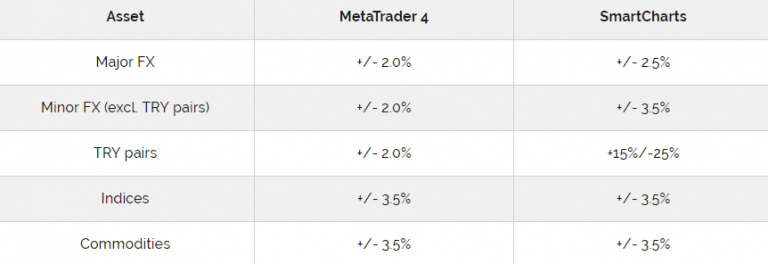

Also, always consider overnight fee or swap as a trading cost(Check out swap-free forex accounts), as in case you hold an open position longer than a day various fees are applicable, see below. In addition to funding fees and other fees that may arise.

| Fees | Capital Index Fees | Trading 212 Fees | Infinox Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

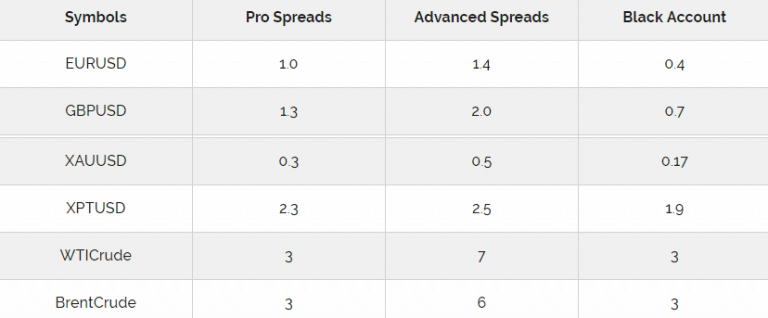

Spreads

Capital Index Spreads are different depending on the account type you choose, see comparison below.

| Asset | Capital Index Spread | Trading 212 Spread | Infinox Spread |

|---|---|---|---|

| EUR USD Spread | 1.4 pips | 0.9 pips | 1.3 pips |

| Crude Oil WTI Spread | 7 | 4.8 pips | 4.7 |

| Gold Spread | 0.5 | 0.35 | 0.27 |

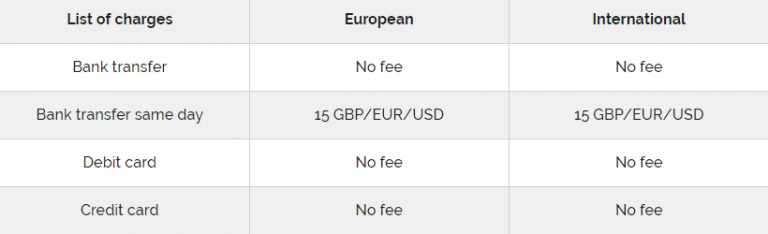

Deposits and Withdrawals

Capital Index accepts the most common payment methods, which includes Debit card and Credit card payments, and Bank transfer.

Withdrawal

Capital Index introduces a new withdrawal option – the Capital Index Prepaid MasterCard. It means when the client withdraws from the account, the funds are added to the card instantly as they are deducted from the trading account and allows to enjoy the same features as the MasterCard offer worldwide. The card issue costs 10$, as well monthly operational fee will be applied actual of 1.95$.

What is also great, there are no charges for deposits or withdrawals, except if you would like to perform withdrawal the same day.

Minimum deposit

The minimum deposit is 100 units of your base currency, depending on your account type and the currency you choose to be as the main one.

Capital Index minimum deposit vs other brokers

| Capital Index | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

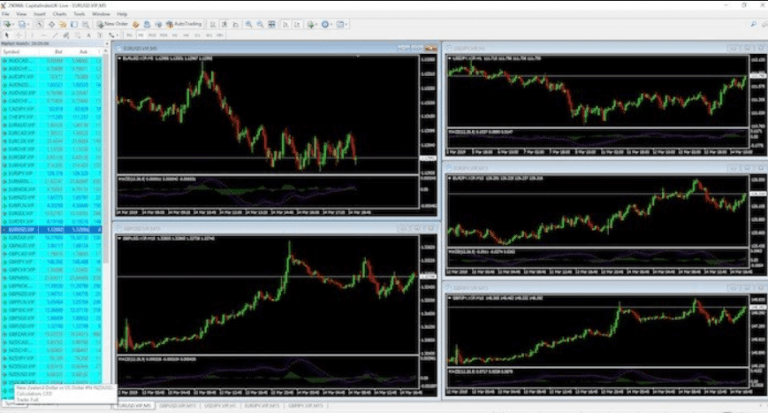

Trading Platforms

As for the trading software, Capital Index offers the ability to place financial spread bets, spread trades and CFDs on Foreign Exchange (FX), Indices and Commodities. These market areas can be traded on the world’s most popular downloadable trading platform MetaTrader 4, with the option to trade on mobile devices.

The platform enables the use of EAs that are monitoring markets for you and according to the settled rules trading on your behalf.

The MT4 is actually known for its wealth information, a simple yet, powerful information, charts and custom indicators. Furthermore, MT4 brings the possibility to trade directly from the chart in manual or even automatic way through EAs.

Education

Capital Index customer support throughout multiple convenient to the client ways offers comprehensive educational materials that cater to all levels of trading experience with regular seminar and webinars, as well through daily video updates of key economic data.

Conclusion

Final thought upon Capital Index review is clear that the broker is a reliable choice while regulated by two major industry authorities. Generally, Capital Index satisfies the most convenient and common traders need into their offering. While bringing a reliable platform with comprehensive trading solutions, various instruments for analysis, strategy improvements and functions through STP execution model along with competitive pricing that excludes any conflicts between the client and the company. All that enhanced by the broker’s learning materials, convenient support and stable cooperation make it a good option to choose from.