Capprofx Review (2026)

Is Capprofx a scam or a legit broker?

CapproFX is not a secure Forex broker since it does not hold a license from any worldwide serious Forex authority. Meaning the broker is suspected of being a fraud company since it was not checked for its compliance before establishment, never monitored in terms of its safety and simply may operate the business in any way it wishes. This results in a very high risk trading opportunity, despite its alluring proposal.

About Capprofx

| 🗺️ Registered in | No Registration |

| 🗺️ Type of License | No License |

| 🛡️ Is Capprofx safe to trade | No |

| 🗺️ Recommended Licenses | FCA in UK 🇬🇧 & ASIC in Australia 🇦🇺 |

| 🖥 Alternative Broker | FP Markets - licensed by ASIC in Australia |

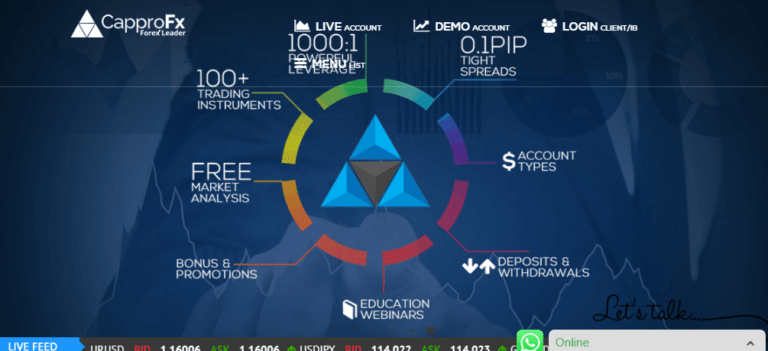

CapproFX is an Online trading provider, a broker with its registered office in the UK, London and maintained support office in Hong Kong. Being located in a world financial hubs, the company, however, did not obtain any license from the local respected authorities, notwithstanding even the fact that the FCA license is mandatory for all UK based financial service firms. The CapproFX claims its prime services for trading in Forex, Commodities and CFDs while performing trading through liquidity providers and services of sophisticated trading solutions with competitive conditions. Moreover, it seems like the address in UK is a virtual one, while the company office is located in India, according to their use of IP’s and other details.

Overall, with its unregulated operation, CapproFX received also numerous negative reviews from the traders, which faced complications with withdrawals, misunderstanding about the closing of positions, as well as removal of profits. Therefore, it comes to the evidence that the company delivers a tricky business while pretending to be a reliable broker.

Conclusion

As a promising and a highly competitive industry, Forex and Online trading requires high safety measures especially for the novice traders or those who would like to invest large amounts into the trading. Therefore, we advise choosing only regulated brokers that comply with necessary laws and follow operational standards that are set by the industry authorities in order to protect clients. Alike, reputable FCA (Financial Conduct Authority, UK) requires a company to follow set of rules that include capital adequacy, as well as participation in the compensation scheme with FSCS that recovers clients in the case of the company insolvency and other. For that reason, choose among the FCA regulated brokers that prove their reliability and obligations towards clients.