City Index Review (2026)

Regulator

What is City Index?

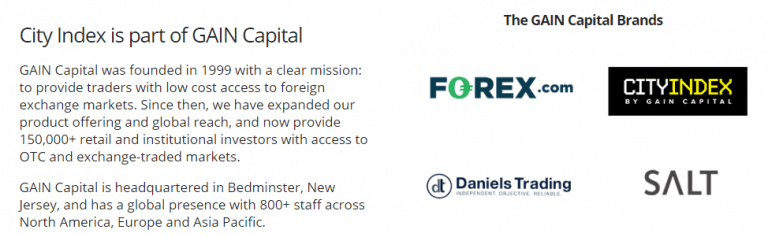

City Index is a trusted provider, located in the heart of London with over than 30 years of experience and heavy background of well-trusted parent company – GAIN Capital, which is listed on the New York Stock Exchange, serves numerous trading names around the world and is one of the largest retail and institutional trading providers.

Among the numerous benefits and transparent operation that Gain Capital shows constantly within the industry, its global presence with 800+ staff across Europe, Asia Pacific and North America are letting you trade assured of a clear manner broker operates.

Is City Index a good broker?

Investors that chose City Index as their broker comes to a number of over 150,000 traders worldwide, and this is not a surprising fact. The broker’s quality execution, competitive pricing, low margins, tight spreads from 0.5 points of FX and truly supportive relationship management makes a well-valued choice.

Along with the wide range of markets, the broker is famous for its platform features, as well as the progressive, some of the leading trading solutions and technologies which we will see in detail further n City Index Review.

City Index Pros and Cons

City Index is respected and reliable broker is a part of the large strong established group listed in stock. City Index based on our research is one of the Best UK broker with a large instrument range, low spreads and professional education section. City Index is good choice for both beginners or advanced traders.

On the negative hand, there customer support is not available 24/7 also there is no multi-currency accounts, so conversion fees for funding might be applicable

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA, IIROC, ASIC, CFTC, JFSA |

| 🖥 Platforms | Advantage Web, AT Pro, MT4 |

| 📉 Instruments | Currency pairs, Shares, Cryptocurrencies Bitcoin and Ethereum, Indices and commodities |

| 💰 EUR/USD Spread | 0.5 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100 GBP |

| 💰 Base currencies | Several currencies |

| 📚 Education | Learning Academy and technical analysis |

| ☎ Customer Support | 24/5 |

Awards

As we will go further we find the City Index offering in a detail, you would truly understand why the broker gained during thirty years of their activity such a trustful position along to many awards and international recognition. Also, GAIN capital is among one of the ranked successful institutions and holding, so the awards are truly mean.

Voted Best Spread Betting Platform | ADVFN & Best Spread Betting Provider at the Shares Awards

Voted Best CFD Provider, Best Mobile application, Best Cryptocurrency Trading Platform | Online Personal Wealth Awards

Best MT4 Broker | UK Forex Awards

Is City Index safe or a scam?

No, City Index is not a scam but a well-respected and established firm with FCA authorization (Read about FCA regulated broker Fortrade Pros and Cons) and listed on Stock company for extra transparency.

Is City Index legit?

City Index and City Trading is a trading name of GAIN Capital UK Ltd authorized and regulated trading provider by the UK Financial Conduct Authority and holds additional 8 worldwide jurisdictions registrations as a part of GAIN Capital Holdings Inc, founded in 1999.

However, particularly City Index serves offices in Dubai, Singapore and Australia, while surely holding respected local authorizations by UAE Central Bank (Find Best Brokers in UAE), MAS and ASIC accordingly.

Since GAIN Capital Inc is one of the largest and heavily regulated providers from almost every jurisdiction, with its strong records and the highest standards of governance, the financial strength and the transparency it delivers considered to be on the highest possible level.

| City Index entity | Regulation and License |

| GAIN Capital UK Ltd | FCA (UK) registration no. 113942 |

| GAIN Capital UK Ltd in the UAE | Authorized by UAE Central Bank |

| GAIN Capital Singapore Pte Ltd | Authorized by MAS (Singapore) |

| GAIN Capital Australia Pty Ltd | ASIC (Australia) registration no. ACN 141 774 727, AFSL 345646 |

How are you protected?

As a retail client’s money is fully segregated from the broker funds and are kept separately safely with world-leading banks. Along with the rest, necessary protection procedures that are carefully followed by the company the trading accounts and overall management of the traders from A to Z adheres to provide you with a clear state of mind.

In addition, the broker applied for negative balance protection and in case of insolvency FSCS controlling clients’ compensation to recover accounts up to £85,000.

Leverage

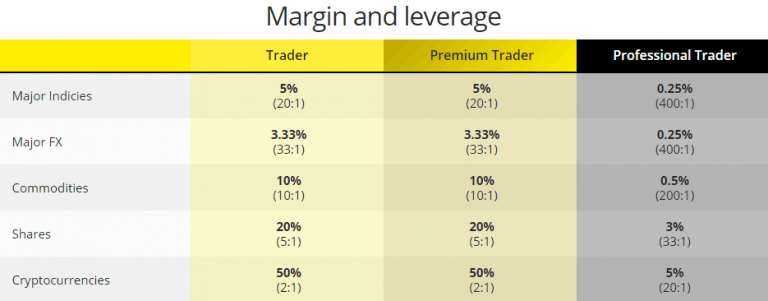

Leverage known as a loan given by the broker to the trader that allows you to trade larger capital than the initial capital is a very useful tool, yet you should use it carefully. Recent regulatory updates from European ESMA set a maximum level to only 1:30, as the authority recognized the potential not only to magnify gains but losses as well.

Therefore, the European entity is eligible to offer a 1:30 leverage only, while the Australian branch (Forex Trading Platforms Australia) and clients still might use leverage up to 1:400 (see the top forex brokers with high leverage). In addition, the leverage levels are depending on the account offering, while you may face a difference in margins too.

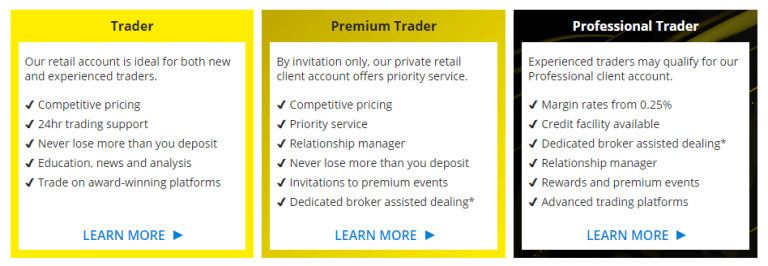

Account types

In terms of an account management it has been done in a simple, not confusing way, meaning you can apply either for a financial spread betting or CFD trading account. Furthermore, there are options between three account types: Trader, Premium Trader and Professional Trader respectively, while all of them are featuring the same efficiency, utmost support and technology used, but vary by the level of the trader itself.

Another interesting additional feature from the broker is Private Client Service – is a tailor-made exclusive program for active traders who fund and maintain an account balance of £10,000 or more, and it comes with highly competitive pricing, expert trading support and some interesting perks.

Demo trading

Certainly, it is important to understand the risks involved in trading before account opening, hence the broker strongly encourages new traders to practice and educate themselves by using a demo account, also how to minimize risk using the educational tools available from the broker learning programs.

City Index offers two demo accounts joint CFD, spread bet and MT4 accounts. Demo account gives 12 weeks unlimited access with a balance of £10,000, also the client will be able to access Advantage Trader or MT4 mobile, tablet and downloadable platforms according to account type.

Trading Instruments

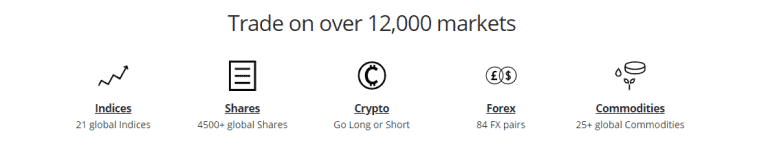

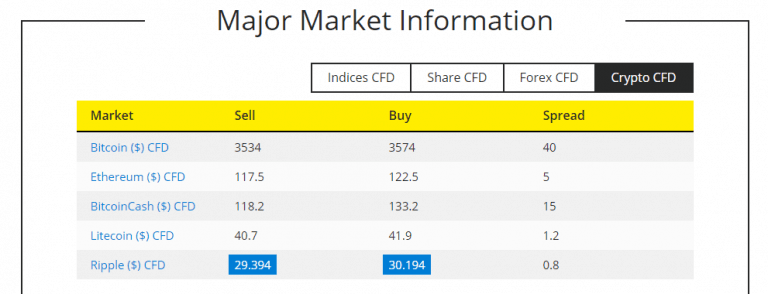

City Index enables trading on over 12,000 global markets consisting of Spread Betting, CFD and Forex Trading for 21 global Indices, 4,500+ Shares, 84 FX pairs, Crypto and 25+ Commodities. Crypto market at City Index is also widely presented and including Bitcoin, Etherum, Bitcoin Cash, Litecoin and Ripple, with an opportunity to adjust trading strategy and start to trade as a spread bet from 10p a point or as CFD Minis.

Fees

City Index markets and trading conditions delivers transparent pricing model and actually offers quite competitive fixed and variable spreads starting from 0.5 pips for FX or from 1 point for Indices, with margins from 3.33%.

Additional charges

In regards to additional charges, you should consider that City Index charge commission when you Spread Bet or trading Shares on CFD Trading. E.g. UK Shares are eligible to 0.08% CFD Commission with a minimum of £10.

Also bear in mind the overnight fee, which is charged if you hold a position open longer than a day, financing rates are set at benchmark regional interest rate of +/- 2.5%.

| Fees | City Index Fees | Axiory Fees | ETFinance Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Low |

Spread

City Index spread depending on the market you wish to trade, as well as giving you an option to choose between the fixed or variable spreads according to the strategy you prefer to use. Below you can see the comparison based on minimum spread quotes, yet for a most recent price check an official website or platform.

For instance, check out and compare City Index trading fees with its UK based peer BlackBull Markets. Beyond Indices, FX, Shares and Commodities City Index offers an additional choice of markets to trade, including Metals, Bonds, Interest Rates and Options.

| Asset/ Pair | City Index Spread | Axiory Spread | ETFinance Spread |

|---|---|---|---|

| EUR USD Spread | 0.5 | 1.2 | 0.7 |

| Crude Oil WTI Spread | 4 | 5 | 3 |

| Gold Spread | 0.3 | 0.3 | 0.37 |

Deposits and Withdrawals

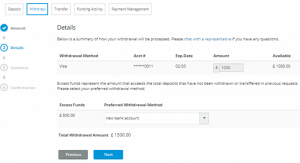

City Index offers the most common payment methods that will assist you to find the best suitable choice to transfer money to or from the trading account. Even though the payment methods are quite limited, they are in fact most reliable, as well as do not incur additional charges from you to transfer funds, which is definitely a big advantage.

Deposit Options

The set of methods includes Debit card: Visa, MasterCard, Maestro and Electron, Credit card: Visa and MasterCard, or a Bank transfer.

What is the minimum deposit for City Index?

There is no minimum deposit requirement for account opening, even so the company advising to do a deposit from £100 in order to cover margins.

Withdrawals

There is no minimum deposit requirement for account opening, even so the company advising to do deposit from £100 in order to cover margins.

City Index minimum deposit vs other brokers

| City Index | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawals

Transactions involving card deposits and transfers for both deposits and withdrawals do not incur any charges from the company and traders can use various methods from most convenient like Bank transfers to e-wallets. However, if you wish to receive same day payment using a CHAPS bank transfer, there will be a £25 charge.

Trading Platforms

A variety of platforms at City Index covers web-based platform – Advantage Web platform or downloadable AT Pro platform, as well mobile or tablet apps or still remains the choice to use known MT4.

| Pros | Cons |

|---|---|

| User friendly trading software | None |

| Variety of MT4 and proprietary Platform, AT Pro platform | |

| Web, Mobile and Desktop platforms | |

| Fee Report | |

| Technical analysis and no limitation on strategies | |

| Suitable for beginners and professional traders | |

| Supporting various languages |

Web Platform

In fact, and what is obvious the broker’s developed a platform designed as a powerful technology for whatever level of trading you are willing to perform, as it offers customizable 16 types of charts, 80 indicators and actionable trade ideas by research portal highlights.

It is web based platform allowing you to trade from any browser with no installations as a highly customizable web-based platform will be a perfect choice for those who prefer easy access and powerful fundamental analysis mixed in one tool. Eventually, for its great performance, the platform has gained several awards for excellence and has been chosen by many traders among others specifically for its outstanding capabilities.

Voted Best Spread Betting Platform | ADVFN Awards

Desktop platform

Of course, City Index mainstay platform features various versions so you can choose either to use or access the platform via various methods by the device of your choice.

Furthermore, the broker indeed pays great attention to the execution policy. If the price moves in traders favor while an order is being processed, City Index executes orders at a better price by their developed technology.

Mobile trading

Advantage trading apps are available for iOS and Android devices allowing you to live stream prices and charts also powered with Reuters news fees and economic calendar for your comfortable use.

Customer Support

As for the customer support services, we would note it’s a good level and regarded support from the traders. Customer Service available for traders via phone lines, chat and emails also covering clients worldwide due to brokers’ presence and coverage of major destinations and including.

Education

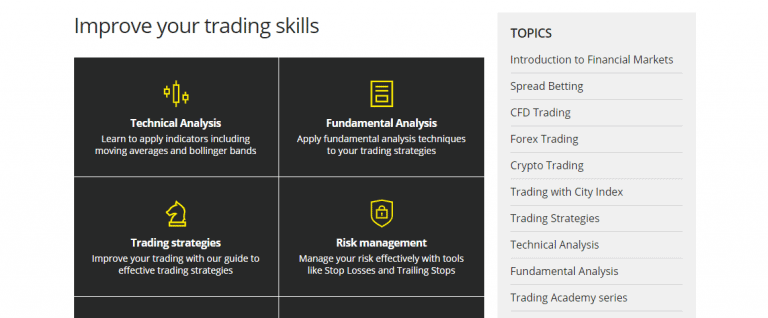

With City Index focuses on essential proposals, there is well-organized learning center designed for both beginning traders and professionals.

Education Center provides trading concepts, technical analysis and fundamental analysis, trading strategies, also trading courses defined by the trading level you are. Along with that, City Index runs regularly Webinars, and updates with Trading News and research materials covering popular and unique points.

Conclusion

As we conclude, City Index as a part of the global leading financial company GAIN Holding is not just the reliable and stable company to cooperate or trade with, due to heavy regulation and client protection rules. A wide range of technical optimization tools, alike highly developed choice of platforms and various instruments for analysis, strategy improvements and functions bringing excellent proposal mixture to suit your particular skill level and expectations, making City Index as one of the Best UK Brokers.