CommSec Review (2026)

What is CommSec?

CommSec is an Australian brokerage firm that operates for over 20 years confirming its successful position in the industry and always striving for professionalism in everything they do. Originally, CommSec is an investment firm that offers vast opportunities to either invest through 7 simplified options or trade yourself.

Is CommSec any good?

Eventually, CommSec is one of the leading online trading providers within Australia, which actively maintains the financial growth of the industry, educating traders and even supporting regional communities through various programs.

Is CommSec expensive?

No, we consider CommSec a good value broker also there are options for beginning traders and low deposit requirements at the start.

CommSec Pros and Cons

CommSec is one of the leading online trading providers within Australia with an excellent reputation and is well-regulated broker. There are Great investment opportunities and unique access to trade Shares and Options on the choice between CommSec, CommSecIRESS platforms with Quality customer support.

For the Cons, Broker might be more suitable for professional traders, there is No Forex and CFD trading and No Demo Account.

1o Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | Australian ASIC |

| 🖥 Platforms | CommSec, CommSecIRESS |

| 📉 Instruments | Shares, ETFs, Options, Cash, Fixed Income Securities, Equities and International Funds |

| 💰 EUR/USD Spread | Commission charge |

| 🎮 Demo Account | No |

| 💳 Minimum deposit | 50$ |

| 💰 Base currencies | Various currencies supported |

| 📚 Education | Professional Education with Webinars and advanced research |

| ☎ Customer Support | 24/5 |

Is CommSec safe or a scam

No, CommSec is not a scam it is a reputable firm with low-risk Investment due to regulations.

CommSec is a trading name used by Commonwealth Securities Limited a wholly-owned subsidiary of Commonwealth Bank of Australia, a market participant of the ASX and Chi-X Australia. As a result, being a subsidiary of a strong established financial company and a bank, its trading service and all settlements are respectively authorized by the Australian Securities and Investment Commission (ASIC) and oblige to necessary laws.

Is CommSec a regulated broker?

As we timely say, the regulatory overseeing and reputation within the finance world always act in your favor as a regulated company means the broker is constantly audited and maintaining transparent conditions.

Ever since CommSec is a regulated broker, also a part of a very reputable Bank within Australia that gives you a better understanding and a trustable exposure to the market along with competitive trading conditions.

Investors Protection

Apart from the provided security as per regulation requirements, CommSec also protects client funds, also by its Banking regulated service, and harmonizes experience within and beyond the market. In addition, treading with a regulated broker you may always count on the support in case there are any misunderstandings or questions appearing throughout your cooperation, which is never a case with unregulated firms.

Leverage

Trading always walks in parallel with the risk of capital loss, despite the normal winning losing process of trading there are risks increasing if you use leverage. The leverage tool indeed is a powerful feature, which is designed to magnify your potential gains and trade a bigger size, yet you should learn carefully how to use it smartly.

Leverage depends on several factors, including your proficiency level, as well as defined by each instrument individually so the full details may be always checked through a trading platform.

- Trading throughout the CommSec environment allows you also to access flexibility through leverage ranging from 1:20 and up to 1:500, which is considered high leverage.

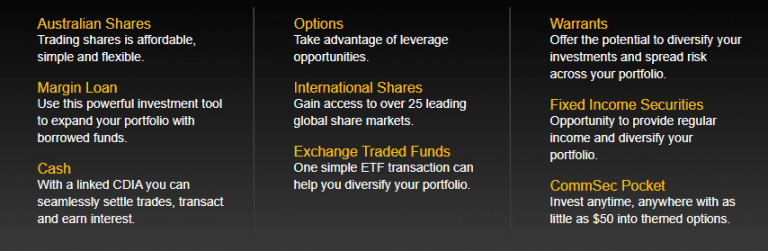

Trading Instruments

Apart from numerous trading instruments including Shares, Options, Cash, Fixed Income Securities, Equities, ETFs and International Funds, CommSec also allows enhancing your portfolio with unique offerings.

The beginners may be advised to join various investment programs, while active traders may sign for specified conditions. Professionals that met specified criteria over a 12 month period are also offered by the rewarding active traders’ program known as CommSec One that gives numerous trading benefits and dedicated support.

Account types

CommSec offers a pretty unique way of investment, while there is no typical account opening but a tailored solution to your investment, so be sure to learn it well, as well with support of our CommSec Review followed.

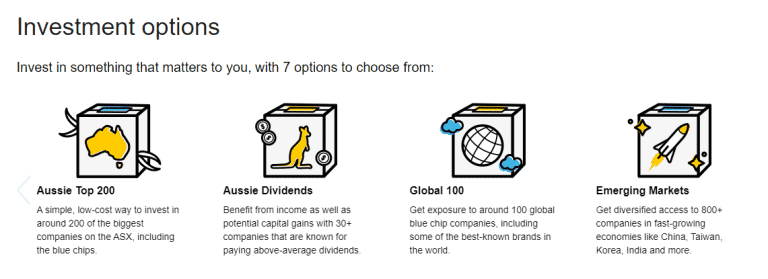

Investment Options

CommSec developed its proposal through a choice between 7 Investment Options so you can choose a suitable portfolio to trade along with the competitive condition CommSec provides. Also, important to note that CommSec developed its offering with a trough of a client so all accounts are tailored solutions which you will discuss with customer support.

Is CommSec good for beginners?

The very beginners are also offered simplified investment options called CommSec Pocket where with only 50$ you can build your portfolio over time.

What are CommSec Share Packs

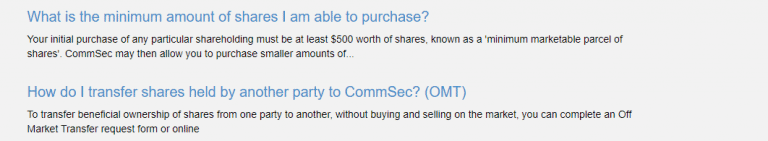

Also one of the greatest CommSec opportunities is real-time access to shares and market prices, regardless of the amount you trade so that you may find a fast and steady process to deploy your strategy. It means you may open a CommSec International Securities Trading Account with exposure to over 25 leading global share markets including London and New York Stocks.

How to open an Account?

As for the Trading account itself, CommSec allows the opening of account based on an existing bank account or open a Cash account using CommSec Share Trading account for the seamless settle of trades.

So the options are:

- Firstly go to CommSec Sign In page – ‘Join Now’. You may also sign with an existing account on Facebook or Google.

- Enter your personal data (name, email, phone number, etc)

- As for the Trading account itself, CommSec allows the opening of account based on an existing bank account or open a Cash account using the CommSec Share Trading account

- Complete questioner about your trading experience and expectations

- Once your account is activated and approved by customer service you can start trading

Fees

CommSec Review’s important point is its fees, so the broker developed quite comprehensive conditions that may suit traders of any size, portfolio or need mainly built into a commission charge.

| Fees | CommSec Fees | Interactive Brokers Fees | Dukascope Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

Spread

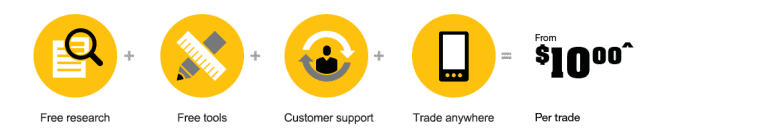

CommSec developed an interesting pricing strategy considered as low brokerage rates that starts from 10$ per trade for trades under 1,000$ giving you a better value for money.

CommSec trading fees are actually based on a commission basis, that are depending on the instrument you trade, as well as getting lower as long as your trading size increases. Also additional benefits and better conditions applicable either through CommSec One program or other tailored conditions according to one’s own investor needs.

Share Packs

Therefore, fees will vary according to the Share or Asset you trade where also trades are divided either if you trade them over the Phone or are charged by Packs, alike $66 per pack of 6 Australian stocks, see more example on the snapshot below.

Also, due to its trading professional environment, there are additional fees that may occur, depending on the services you may use require, so you better check Fees through the official website by the link.

See, some of the CommSec Fee examples below, also well you may compare fees to another popular broker FP Markets.

What Deposit and Withdrawal is available at CommSec?

Deposit Options

Since CommSec offers professional trading of Shares your account is automatically connected to your nominated settlement bank account, so all the transactions are connected to it directly. Practically, it means that once you settle an order the amount on which you bought Shares will be automatically debited from the bank account, and the same goes on with the sale of Shares as well.

What is the minimum trade on CommSec?

If you sign for beginners CommSec Pocket minimum deposit is $50 for the parcel. Since the CommSec Share Account connected to the initial bank account, there is no specification on how much money should be there. However, the initial purchase of any particular shareholding must be at least $500 worth of shares, known as a ‘minimum marketable parcel of shares’.

CommSec minimum deposit vs other brokers

| CommSec | Most Other Brokers | |

| Minimum Deposit | $50 | $500 |

Withdrawals

CommSec Withdrawal Options are automatically returned to you connected Bank account, similarly to deposits while trading or investment transaction directly taken and refunded to you account.

Trading Platform

CommSec mainstays on its own powerful trading software with the same name, which is aggregated by the front-end technology and powerful feature, all packed with the utmost level of security. All Shares trades go directly from the software while charges for trades are taken directly from your bank account and connected card.

In addition, for live-stream quotes and data CommSecIRESS serves your need as response instantly to market movements. Even though CommSecIRESS is a paying service, in case you execute 8 or more trades you will get complimentary access to it. IRESS in general is a quite comprehensive platform, a quite known software famous for its powerful and sophisticated charting and analysis features.

| Pros | Cons |

|---|---|

| Proprietary Web trading platform | None |

| User friendly design and login | |

| Rewarded investment software | |

| Powerful technology and direct connection to banks | |

| Mobile Trading | |

| CommSecIRESS |

How to place order?

So in order to initiate trading with CommSec, as a powerful Shares trading, you firstly need to set up a trading account which is either connecting CommSec to your existing bank account or setting a new one.

Then you may place orders through your CommSec Account online by navigating through an online account to Trading-> Shares Place Order.

Mobile Trading

Also, you may use CommSec mobile app that also gives you full capacity of control over your orders or an account. In addition, CommSec offers you placement through access via phone or internet so the broker will place the order on your behalf, which may also incur additional charges.

Selling Shares

The selling process goes a similar simplified way, even though it is sometimes complicated or impossible with other brokers.

Selling also is determined either you Chess sponsored with CommSec or held share registry, since in other way broker may need your shareholder reference number SRN to proceed with orders. However, all the processes may be completed with full support of CommSec so the procedures are seamless and essential at a time you need it.

Customer Support

One of the other great points we should admit is Customer Support CommSec provide, being truly a supportive partner for its investors you can find answers or understanding for your concerns.

CommSec support available with service the trader requires daily, also operating Shared trading via phones, which is also on a very sustainable and professional level. Even though you can access them via Live Chat, Phone or Email them within working hours 24/5.

Education

Free education resources available in any location you are, CommSec stands here at the strong foot as well, as broker developed not only great learning materials which making Shares trading understandable process. But also support with insights, Webinars and everything you need to get started or follow the success trading path.

In addition to its powerful and diversified trading opportunity CommSec also offers research materials you can trust, including Goldman Sachs stock and Morningstar ratings together with the latest tools like CommSecIRESS.

Conclusion

Overall, CommSec is a company with a strong background based on the efficiency and reliability of Commonwealth Bank. The trading environment is also a comprehensive feature mainly suitable for active and professional traders due to its sophisticated technology and access to professional instruments, mainly offering to trade Shares. However, beginning traders are welcomed also, as the broker provides leading educational materials, as well as offers investment programs suitable for the investor of any size or need.