Core Spreads Review (2026)

What is Core Spreads?

The Core Spreads as a brokerage company has been established in the UK with the goal to offer the best of possibilities for active traders.

The strategy defined by Core Spreads is built to bring the best value in the industry while minimizing costs by reducing not the “first need” extensions. Their developed proprietary platform brings an honest low pricing as a standard to all clients.

Getting closer to the offering itself, Core Spreads combined years of experience in the market while offering spread betting and CFD trading through the essentials done by tight and fixed spreads, that helping to maximize returns.

Core Spreads Pros and Cons

Core Spreads trusted broker since regulated by high secure FCA in the UK. There is an easy account opening process, spreads are among lowest in industry with fixed or floating proposal.

From the Cons side Core Spreads instrument range is rather limited, and there is no 24/7 support.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 🖥 Platforms | CoreTrader2, MT4 |

| 📉 Instruments | Forex (including Spread Betting for UK residents), Shares, Indices, Commodities and Cryptocurrencies |

| 💰 EUR/USD Spread | 0.7 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 US$ |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Provided |

| ☎ Customer Support | 24/5 |

Awards

Another core side of the company is their service team that is dedicated to giving a personal service traders deserve, what we like is that Core Spreads continuously receives positive feedback from their traders, as well got a valuable award: Best Value Broker 2017 | UK Forex Awards 2017

Is Core Spreads safe or a scam

No, Core Spreads is not a scam, it is a trading name of Finsa Europe Ltd, a registered company in the UK considered low risk trading company due to regulation (Also read the UK headquartered Exness Review here).

The broker is subject to the Financial Conduct Authority (FCA) regulation in the UK, which performs some of the strictest rules in the financial market respected worldwide. Under the rules of the Financial Conduct Authority, Finsa Europe Ltd. has a duty to conduct all business with an honest, fair and professional manner and to act in the client’s best interests.

How are you protected?

What is more, each customer covered by the Financial Services Compensation Scheme (FSCS) under FCA rules of operation that guarantees clients’ funds up to 50,000 GBP in the unlikely event. Also, funds are always kept separately from the company’s actives, means cannot be used for operational purposes, and are kept in segregated bank accounts at Barclays that secures your account.

Trading Instruments

The market offerings covers the most important instruments bringing availability to trade 30 popular currency pairs at Forex (including Spread Betting for UK residents), vast of Shares, Indices, Commodities and Cryptocurrencies

Leverage

As for the trading leverage conditions, Core Spreads chooses the optimal path to maximize the offering through the leverage which also complies to FCA regulation. In fact, European authorities strictly restrict leverage to a maximum of

- 1:30 for major currency pairs,

- 1:20 for minor currencies

- 1:10 for commodities.

As well, newly presented by Core Spreads possibility to trade cryptocurrencies brings an opportunity to speculate cryptos with leverage 2.5:1, yet available to only professional traders.

Account types

Core Spreads has one account type. The company sticks not to divide their clients and to offer every client excellent conditions, while the only slight different may occur on various platforms Core Spreads operate.

Fees

Core Spreads pricing and MT4 offers variable spreads and low commission charges. All clients at Core Spreads are treated as retail clients, however, there is an option to obtain a professional status, which requires experience and significant size of transactions. In reverse you will get a special status with numerous attractive conditions, lower costs and participation into programs.

| Fees | Core Spreads Fees | AvaTrade Fees | Plus500 Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Low |

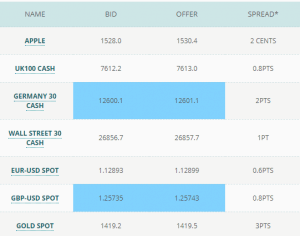

Spreads

CoreTrader spreads offer tight, some of the lowest spreads (Brokers with the Lowest Spread) which are fixed. Therefore, it is a great option that you may choose between the offerings and define what fee strategy will work the best for you.

See below typical Core Spreads trading spreads for popular instruments, also compare Core Spreads trading fees to another popular broker FP Markets.

| Spread | Core Spreads Spread | AvaTrade Spread | Plus500 Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 1.3 pips | 0.6 pips |

| Crude Oil WTI Spread | 3 pips | 3 pips | 2 pips |

| Gold Spread | 4 | 4 | 2.9 |

| BTC/USD Spread | 0.70% | 0.75% | 0.35% |

Deposits and Withdrawals

Core Spreads offer for your convenience the most common payment methods while supporting options to fund and withdraw money through Cards payments, wire bank transfers and through e-wallet Skrill.

Minimum deposit

There is no minimum deposit requirement for Core Spreads account opening. To make a trade, you just need to deposit ‘margin’, which is effectively money cover in case you lost money on the trade instead of gain. The margin needed on the account is a percentage of the notional value of the trade, sometimes this can be less than 1%.

Core Spreads minimum deposit vs other brokers

| Core Spreads | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

WIthdrawals

Core Spreads withdrawal similar to deposits are Bank Wire and Card payments, the transaction fees involving card deposits and transfers do not incur any charges from the company for both deposits and withdrawals. Yet, you should always check with your payment provider in case any fees are waived from your side.

Trading Platforms

As for the trading software Core Spreads offering, there is a choice between the proprietary platform CoreTrader2 or to choose known industry platform MetaTrader4. Along with this choice, the pricing strategy has been built between variable or fixed spreads which are diversified by platforms.

The CoreTrader presenting some of the lowest fixed spreads in the market with no commission while performing trading through web or application. The platform features the most important trading needs, without making confusion of numerous expensive tools, hence is fast and reliable software with rapid execution as well a great tool for spread betting clients.

The MT4 itself does not need much wording, yet at Core Spreads offering a powerful combination of some of the tightest variable spreads and a low commissions of just 1.5$ per lot for all clients, and of course a comprehensive technical solution through the platform. EAs for automated trading is allowed too, while MT4 is available through the desktop and mobile applications.

Conclusion

Our final thoughts about Core Spreads, one of the main attractive features of Core Spreads is their spreads offering, which they have managed to provide on a competitive basis along with an option to choose either fixed or floating spreads. The company does not offer learning materials or didn’t include sophisticated tools, but brings clear and transparent trade processing. So, the conclusion is the same as company positioning – no noise, just tight spreads on thousands of markets.