CornerTrader Review (2026)

Regulator

What is CornerTrader?

The confidence of services along with the attractive offerings comes through the fact that CornerTrader is a division of Corner Bank Group, which is one of the most solid bank in Switzerland. Cornèr Bank Ltd is an independent Swiss private bank, and the #1 bank in Switzerland in terms of capital soundness founded in 1952, as confirmed by The Banker’s Top 1000 World Banks ranking.

With the launch of CornèrTrader in 2012, the bank has extended the power of solutions and service into the growing market towards online trading.

Since then, CornèrTrader gives access to the world’s financial markets, backed by a robust suite of flexible functionality, tools and resources packed with a solid background and high operational standards recognizing Swiss Finance.

10 Points Summary

| 🏢 Headquarters | Switzerland |

| 🗺️ Regulation | FINMA |

| 🖥 Platforms | CornerTrader Platform |

| 📉 Instruments | Forex, FX Options, CFDs, ETFs and Stocks, aContract Options and Futures. |

| 💰 EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 $ |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Provided with insights and webinars |

| ☎ Customer Support | 24/5 |

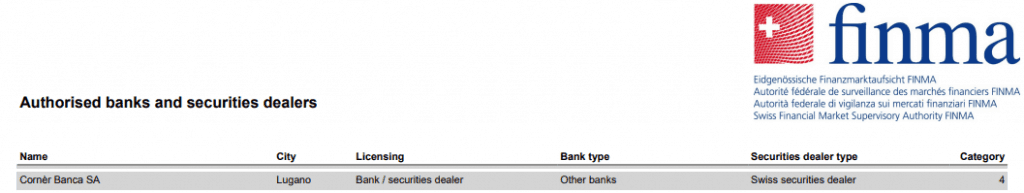

Is CornerTrader safe or a scam?

CornerTrader as a part of a Cornèr Bank which is regulated by one of the sharpest regulators Switzerland FINMA means that its fully complying operations according to the requirements and necessary measures. In fact, to operate as a brokerage any firm in Switzerland should obtain a banking license, which is quite hard to get due to very high requirements and numerous rules that apply to a general model of operation up to a ruling directors.

Therefore, CornerTrader is a trusted broker, which should not left you questions about its reliability and trust, and that goes together with more than 60 year of its operation within the finance. Moreover, CornerTrader and Corner Bank is the member of Esisuisse depositor protection scheme, which ensures that clients’ deposits at Swiss banks are protected.

In accordance with the scheme, Esisuisse members ensure the transfer of required amounts up to CHF 6 billion in the case of the company insolvency that client receives fund protection of up to 100,000 CHF.

Trading Instruments

A trading offering of CornerTrader presents its proprietary platform with a world of thousands of assets that includes more than 160 Forex classes along with FX Options, thousands of CFDs, ETFs and Stocks from 22 global exchanges, as well with Contract Options and Futures.

Leverage

As for the Leverage, known as a fantastic tool that allows you to trade bigger size compared to your trading account, in fact, it is a sort of loan given by the broker to the trader. Leverage enables you to multiply volume that may raise your potential gains, yet it works in reverse too.

As such, FINMA and various regulatory standards restrict allowed levels of leverage in order to protect clients. Therefore, as a retail trader, you can use maximum leverage level 1:30 for Forex instruments, while professional traders confirming their status and may apply for higher levels.

Account types

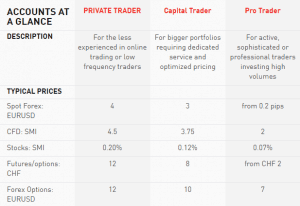

CornerTrader offers three account types, each of which can be supplemented with a range of additional services and available in EUR, USD, CHF and more.

Fees

The strategy can be as nuanced as the client wants, as CornèrTrader offers a comprehensive range of trading products including stocks, CFDs, futures and contract options allowing to trade Forex spot, Forex options – both Vanilla and Binary – and Forex futures.

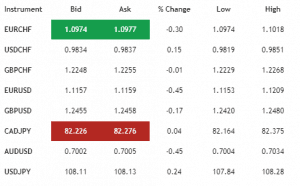

Also offering includes Cryptocurrencies with Bitcoin and Ethereum trading through commission starting from 0.07% for Pro Traders. Forex trade packed by global reach, intuitive orders tickets and a fluid combination of liquidity and pricing without re-quotes and a selection of competitive spreads 0.2 pips for EURCHF and 0.4 for GBPUSD pairs. As well through low margin requirements of FX tiered margin as 1% on majors and dedicated liquidity.

Spreads

CornerTrader fee structure or spread and commission is based on the service level denoted by your choice of account type, and actually Cornèrtrader is widely accepted as the most competitive provider in Switzerland. See a sample of spread offering below, as well compare fees to another Swiss broker BlackBull Markets.

Deposits and Withdrawals

Being a client of CornerTrader, you automatically can enjoy service of Swiss banking services, while transactions of funds performed via the Corner Bank IBAN. CornèrTrade exclusively offers a TradersCard that is linked to the trading account and making the client option to withdraw money instantly from any ATM counter.

Withdrawal

CornerTrader does not charge a commission for money withdrawals while the funds are sent to CornerTrader Card making withdrawal easy process.

Minimum deposit

CornerTrader CornerTrader minimum standards in terms of first funding, however, you should check account type you choose since some may require minimums to access designed features and cover necessary margins.

CornerTrader minimum deposit vs other brokers

| CornerTrader | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Trading Platforms

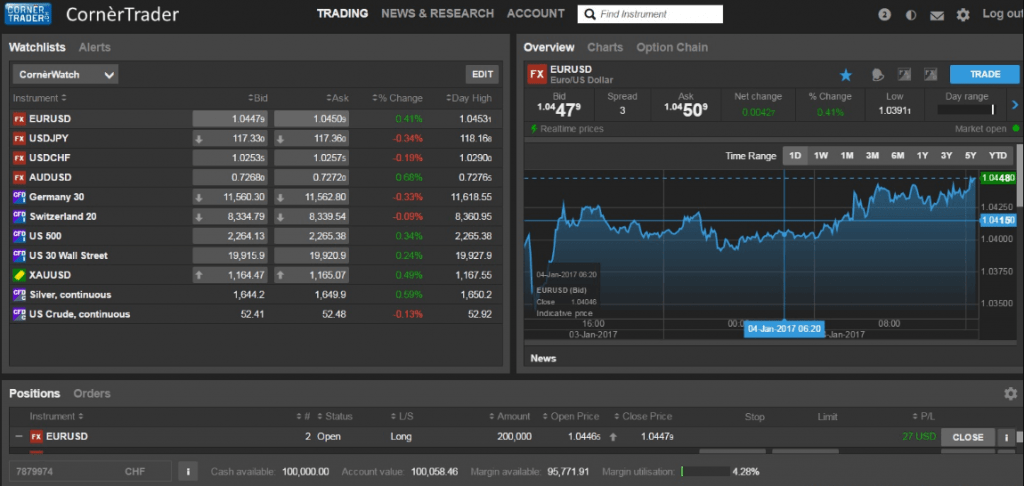

The broker’s award-winning platform features powerful capabilities designed to maximize impact along with sophisticated tools, access to the world’s markets and smart thinking to inform your trading strategy. The platform packed through an intuitive interface with a strategy building capabilities that are reachable from any devices, desktop, phone or tablet.

Trading with CornerTrader you can benefit from aggregated liquidity from Tier-1 banks along with access to over 80 trading venues around the globe through real-time prices, execution and competitive commissions and fees.

Research

All necessary information needed for successful trading is available through insights with Forex news, charting and analyses, along with oversights to monitor and control margin requirements and access to account overview with fees report.

You’ll get streaming liquidity, leverage and global access along with the added flexibility that Forex Options provide for trading any market movement for both retail, institutional, professional traders, as well as investment opportunities through PAMM. However, note CornerTrader charges market data fees, as actually majority of futures brokers, according to the market you choose to trade.

Education

Equipped to follow any number of trading strategies, clients are backed by personalized service and assistance provided by Account Executives specialized in trading global markets. As well as, you will be supported by educational materials, insights, equipped with meetings and webinars designed by CornerTrader.

Conclusion

CornerTrader review presents a well-regulated Swiss multiasset Bank along with its competitive brokerage services, which established a very large portfolio of trading instruments. At CornèrTrader you’ll find an attentive value to each client with prized assets, proven by more than 60 years of operation in the financial sector. The trading costs might be also very competitive among the market offering, which brings a range of the trader’s sizes hence could be a convenient option to choose from. Nevertheless, the company does not require a minimum deposit, which can be a good start for the new traders or even a solution for active traders.