Cresco FX Review (2026)

What is Cresco FX?

Cresco FX is a UK established boutique brokerage firm that offers forex and CFD trading as a fully regulated and respectively authorized firm.

At its beginning and the idea itself, Cresco FX designed tailored service together with trading innovation in order to deliver seamless trading solutions to global traders and allow easy management of complex trades.

Cresco FX Pros and Cons

Cresco FX account is easy opening, there is god range of trading instruments, research, platform and flexible fees based on commission.

For negative points, the education is rather basic, and commission is average for first grade account.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 📉 Instruments | Equities, Commodities, Bonds, FX, Indexes, Cryptocurrencies and Metals |

| 🖥 Platforms | Cresco Trader, MT4 |

| 💰 EUR/USD Spread | 0.7 pips |

| 💳 Minimum deposit | 1,000 US$ |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, USD, EUR |

| 📚 Education | Educational or research materials |

| ☎ Customer Support | 24/5 |

Is Cresco FX safe or a scam

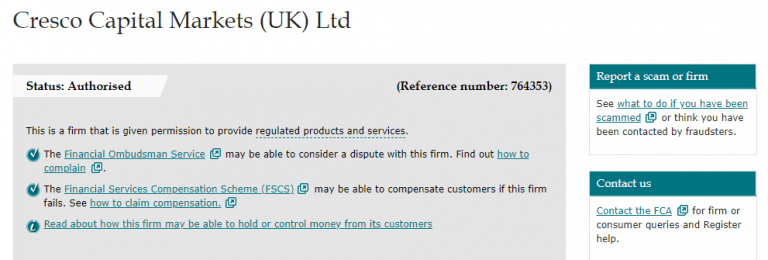

No, Cresco FX is not a scam is provides low risk trading due to to-tier FCA regulations.

Cresco FX is a UK based brokerage firm that is a fully authorized and regulated company registered as Cresco Capital Markets UK Ltd.

As almost any true financial service firm operating through London, Cresco FX is also authorized by the local respected authority Financial Conduct Authority (FCA). While FCA is a world known and one of the most respected authorities, FCA regulated brokers adhere to strict regulations and legislation in reverse providing great protection for clients and demanding high operational standards.

As per the regulation, clients funds are held in accordance with the FCA’s Client Money Rules and segregated in Tier 1 bank accounts. All accounts are also monitored and reconciled on a daily basis to the protection and integrity of clients’ funds. In addition, deposits up to £85,000 are also protected under the Financial Services Compensation Scheme (FSCS) in case of the company insolvency.

Leverage

And of course trading with Cresco FX you also offered to use powerful tool leverage, which may increase potential gains through its possibility to multiple initial accounts balance. Particularly leverage levels depending on various instances, including prof level in trading, the instrument you trade, as well defined by the regulatory restrictions.

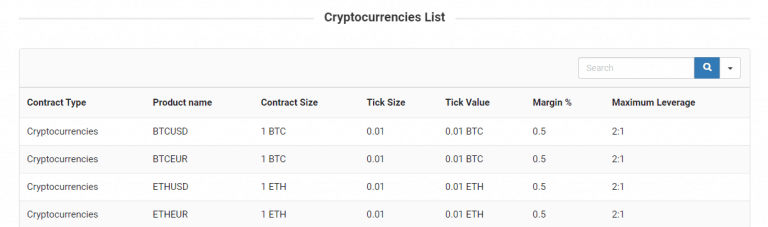

Cresco FX as an FCA authorized firm that also falls under ESMA restrictions demands a lower leverage level for a retail trader with a maximum of 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities. Yet, Professionals may access a higher level upon compliance procedure.

Instruments

Cresco offers extensive product range together with great technical performance also available either through its proprietary platform or industry peer MT4. Being a mainly CFD broker, Cresco FX market range includes Equities, Commodities, Bonds, FX, Indexes, Cryptocurrencies and Metals.

Account types

At Cresco there are four account types Standard, Gold, Platinum and VIP where higher grate offers better commissions. Of course, all trading accounts feature dedicated service and also offering MAM accounts for money managers.

Fees

Cresco mentions on its website that it does offer lower transaction cost through commissions, fees are mainly built into commission charge and considered average pricing.

| Fees | Cresco FX Fees | GlobalPrime Fee | City Index Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Commission based fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Low |

Cresco FX Spread

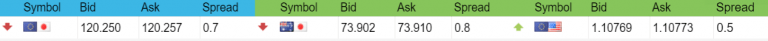

Cresco does not add extra charge for spreads, but provides raw spread below 1 pip for major currency pairs for all account types. Indeed, the typical raw spread is below 1 pip and floating around 0.7 for EUR/USD pair, yet maybe slightly different either on a proprietary platform Cresco Trader and MT4 accordingly.

Further on, the commission charges per lot depending on the account type you holding at Cresco FX. Thus, VIP accounts charged $2, Platinum – $1.5, Gold – $4 and Standard $6 per lot accordingly.

For instance see typical Cresco spreads for Forex instruments below, as well you may check TMGM spreads to know better pricing of the company.

Cresco FX rollover

Besides while holding a position longer than a day you may either benefit from the interest rate or be charged an extra fee in case you going long. This interest rate is also known as rollover or overnight fee is different for every instrument and calculated based on a base rate and some up mark from the broker.

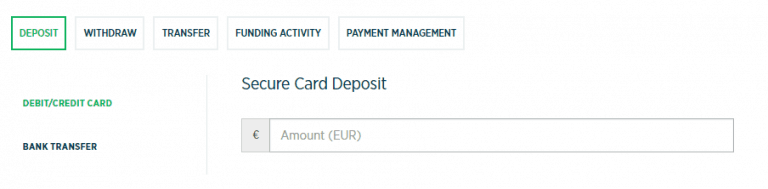

Payment Methods

Depositing funds To Cresco FX is a safe and simple process, due to its obligation to regulatory restriction and sharp oversee over the money safety measure. The fastest way to fund a trading account at Cresco FX is to use Credit, Debit card or Bank Wire Transfer.

Minimum deposit

The minimum deposit for Cresco is 1,000$ for Standard Account and is $50,000 for Platinum one. Even though the deposit requirement is quite high and reachable mainly for professional or high-volume traders, Cresco FX target stands mainly on those customers.

Cresco FX minimum deposit vs other brokers

| Cresco FX | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

Withdrawal

Cresco FX withdrawal options are Bank wire and Cards, there are no fees to withdraw funds from the trading account or for deposits, however, you better verify with the payment provider and customer service of Cresco in case any fees are waived due to the transaction rules set by the provider or country.

Trading Platforms

As for the platforms and trading software itself, Cresco FX offers you a choice between its own developed platform Cresco Trader or to use industry-standard MetaTrader4.

A choice is indeed a good option, since you may either learn Cresco Trader platform with the support of educational material and use its powerful automated execution accompanied by the chart trading, customizable layouts, advanced numerous tools and more.

Or still, if MetaTrder4 with its amazing analyzing features and possibility to run automated trading though numerous EAs with no restriction is better for you, the choice is here.

The trading technology brings access from anywhere and at any time across multiple devices supported by the platforms available from a single account. What is also important while choosing a broker is to check on its execution, and here at Cresco FX this is another advantage.

The broker uses institutional liquidity that selecting the best quotes on a light-fast speed which is definitely great for high-performance traders and institutions.

Education

Together with sophisticated technology, reliable execution through institutional liquidity Cresco FX also offers great pricing by bringing some of the competitive quotes for its numerous instruments.

Besides, Cresco FX also supports beginning traders and always focus on long-term relationship with its client by offering traders educational or research materials making you a better trader.

Conclusion

Overall concluding Cresco FX offering we should admit its regulated environment ensuring the safety of your investment, great technology they use, a choice between the platforms including industry-leader MT4 all accompanied with great pricing. Even though quite high deposit and general conditions may be better suitable for professional traders, beginners are also welcomed as Cresco FX provides all the necessary data and education.