DF Markets Review (2026)

What is DF Markets?

DF Markets is a CFD and Spread Betting provider company and is a UK Broker established in London in 2011. The broker idea at its beginning was to enable any type of the trader to engage with DF Markets, while experienced traders can take advantage of tight spreads, fast execution and competitive conditions along with the range of trading resources.

New traders having the opportunity to develop their skills by exploring the learning platform with a Trading course and Demo Account with a virtual 10,000$. At every stage of the trading, DF Markets supporting their customers by the dedicated management team in multiple languages making it a truly trader-friendly broker with vast of possibilities.

DF Markets Pros and Cons

DF Markets provides quality trading conditions with fixed or variable spreads, education and range of trading platforms.

From the Cons, the education is rather basic and instruments might be limited to Forex and CFDs.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | 50 popular markets across FX, Indices, Shares, ETFs, Commodities, and Cryptocurrencies |

| 🖥 Platforms | DFTrader |

| 💰 Costs | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, GBP |

| 💳 Minimum deposit | 10 $ |

| 📚 Education | Education for various level traders, research |

| ☎ Customer Support | 24/5 |

Is DF Markets safe or a scam

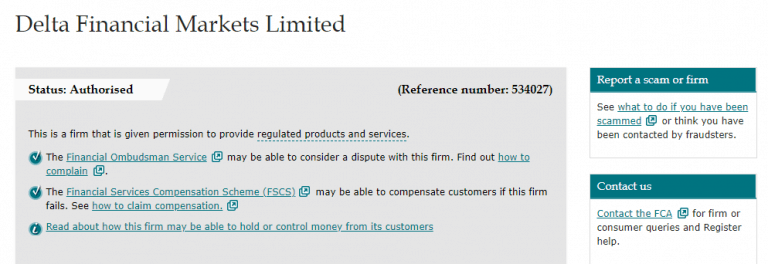

No, DF Markets is not a scam.

DF Markets is a trading name of Delta Financial Markets Limited, which is established according to the guidelines and authorization by the Financial Conduct Authority (UK). In simple words that means that company complies with strict FCA rules including a commitment to treat customers fairly with the transparent operational standards.

Also, compliance to regulations means funds received from the clients are transferred and kept in top-tier banks segregated accounts that ensure safety. Along with secured substantial liquidity and capital reserves provided by the company.

In addition, one of the most advanced features of FCA regulation requirement is participation to FSCS scheme that protects retail client funds up to 50,000£ in the unlikely event. DF Markets is also required to file a monthly Client Money and an Assets Return to the FCA that constantly monitors the compliance with the regulations and necessary requirements, protecting clients even more.

Instruments

DF Markets provides access to trade thousands of CFDs on 50 popular markets across FX, Indices, Shares, ETFs, Commodities, and Cryptocurrencies. The competitive trading conditions offering no minimum deposits, no re-quotes policy with instant order execution and spreads from 0.8 pips for EUR/USD or 1.2 pips in USD/JPY.

Leverage

As the majority of Forex brokers, DF Markets also offers to use leverage, which may increase potential gains through its possibility to multiple initial accounts balance.

- Leverage levels always depending on the instrument you trade, as well defined by the regulatory restrictions and your personal level of proficiency. Since FCA significantly lowered possibility for leverage levels, the maximum leverage you may use as a retail trader is 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

And of course, always learn how to use leverage correctly, as leverage may increase your potential loses as well and is a different feature in various instruments.

Account types

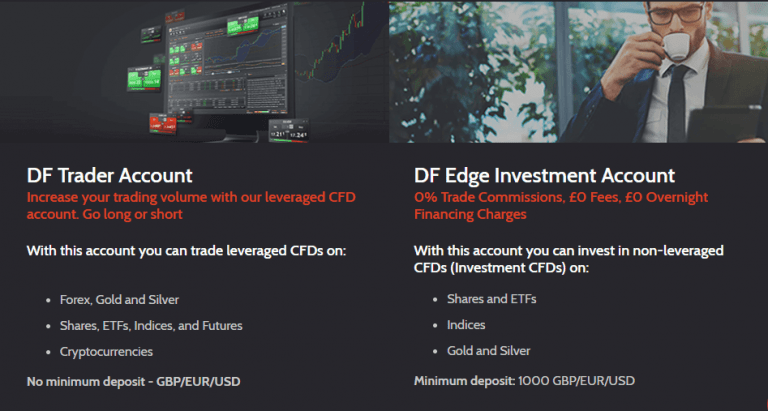

DF Markets does not charge a commission per trade while all costs are concluded into a tight spread. Upon activation of the trading account, the spreads may be set either at the variable or fixed spread basis, giving you opportunity to choose the best.

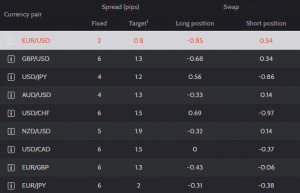

DF Markets rollover

Also, always consider DF Markets rollover or overnight fee as a cost, which is charged on the positions held longer than a day. Each instrument charges different quote for overnight positions, which may work in your favor as a refund or be deducted as a fee.

Fees

DF Markets does not charge a commission per trade while all costs are concluded into a tight spread. Upon activation of the trading account, the spreads may be set either at the variable or fixed spread basis, giving you opportunity to choose the best.

DF Markets rollover

Also, always consider DF Markets rollover or overnight fee as a cost, which is charged on the positions held longer than a day. Each instrument charges different quote for overnight positions, which may work in your favor as a refund or be deducted as a fee.

| Fees | DF Markets | Fondex Spread | City Credit Capital Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

DF Markets spread

The target or variable spread is the minimum spread DF Markets quotes and is typically 0.8 for the EUR/USD pair. Those who prefer a fixed spread, the company offers a bigger spread of 2 pips for the EUR/USD pair, yet it brings you a stable trading cost with no matter what is the current condition in the markets.

| Asset | DF Markets | Fondex Spread | City Credit Capital Spread |

|---|---|---|---|

| EUR USD Spread | 1.2 pips | 0.28 pips | 1.2 pips |

| Crude Oil WTI Spread | 3 | 3 | 3 |

| Gold Spread | 35 | 30 | 35 |

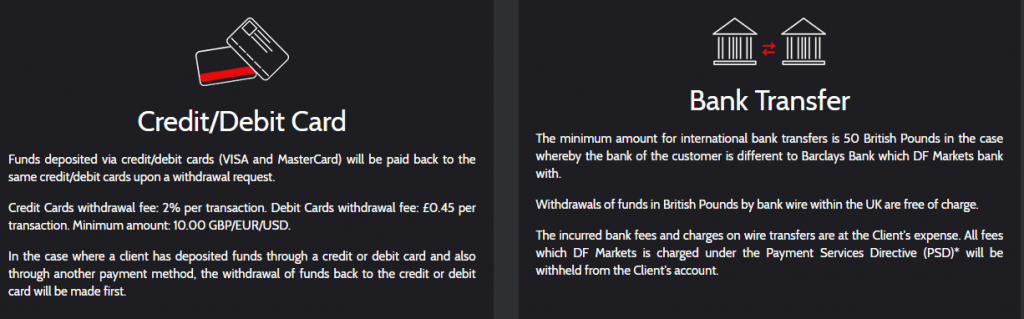

Deposit Options

DF Markets offer an easy and secure ways to fund the live trading account, that includes options by Credit/ Debit Card or Bank Wire transfer. Even though it seems not too many options, actually these are the most used and the most convenient ones.

DF Markets minimum deposit

The minimum deposit is 10$, while the broker does not charge any transaction fees making you a great opportunity to engage in trading. However, check on conditions for the instrument you planning to trade, as various instruments require different margins.

DF Markets minimum deposit vs other brokers

| DF Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

DF Markets withdrawal

DF markets withdrawal options are processed with the same payment methods due to regulatory restrictions, yet there are some withdrawal fee waived for credit card transaction – 2% and 0.45$ for Debit Cards. The Bank transfers within the UK are free of charge, while the incurred bank fees and charges on wire transfers are at the Client’s expense.

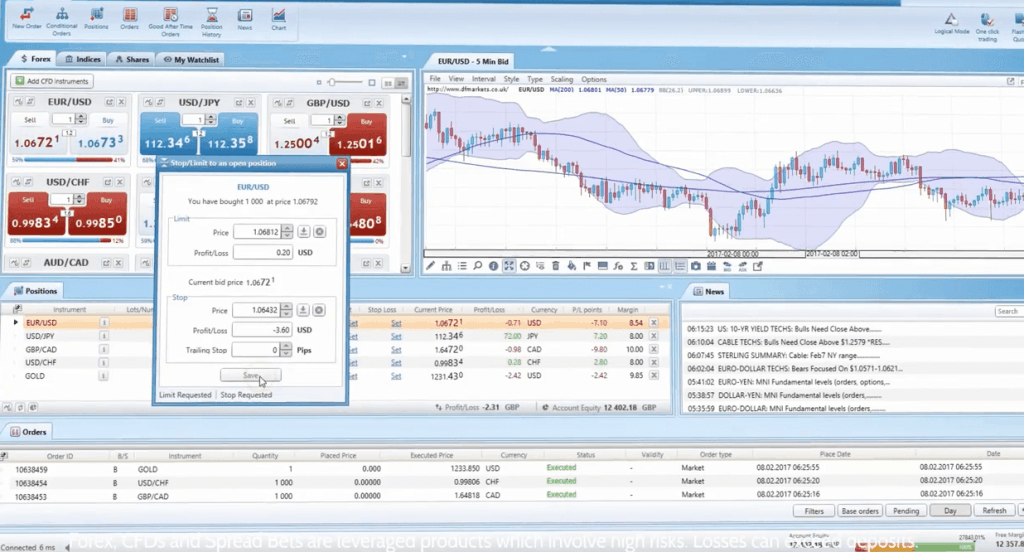

Trading Platforms

DF Markets created a proprietary trading platform that is constantly updated with new features and advanced trading tools. Additionally, there are various versions to suit your demand and you can choose between software for any device DFTrader, DF WebTrader and DFMobile, while all of them offering a user-friendly interface and advanced features designed to maximize the trading experience.

The trading platform brings a higher potential through its comprehensive features, including Sentiments to see the traders’ behavior, risk management strategy like Trailing Stops, limit price improvements, and conditional order options.

In addition, platform enhanced by daily analysis and major event notifications, secure encrypted access to the account and many more progressive tools.

As novice traders will find great flexibility of the platform, the advanced traders will appreciate rich functionality of the platform, which grants full control over the trading with simultaneously synchronized features.

Also, you may count on historical data that present charts viewed in a range of time frames enabling to identify the price trends while it is also allowed to open positions and display them directly from the charts.

Conclusion

Overall, DF Markets review the company-trading provider located and regulated in the UK. Along with the wide range of markets and spread betting possibility, the broker offers an option to stick either to a variable or fixed spread allowing any strategy to fit. There is no any commission charges and spreads are among the average within the industry offerings. Thereby, you can choose which strategy to use, there is no minimum deposit requirement and range of proprietary platforms to choose from.