EVFX Review (2026)

What is EVFX?

EVE or EVFX provides Electronic and Voice access to the Foreign Exchange Spot, Forwards and Options markets. EVE actively trades in all major, minor and exotic currency pairs, including Non-Deliverable Forwards (NDFs) as well as Precious Metals.

Therefore, being a professional brokerage firm EVFX throughout its development enlarged offering and since 2011 EVFX offering solutions to access the FX market, as well as many of the major electronic venues.

And of course, EVFX still continues to offer its unrivaled direct access to the best market liquidity through established agency voice desks, and the selection of spot and option platforms.

EVFX Pros and Cons

EVFX is a reliable broker with good regulation. The offering is solely tailored solution with great range of platforms, instruments, and various liquidity providers.

For the negative side, EVFX is not for beginning traders or smaller size traders, there is no education.

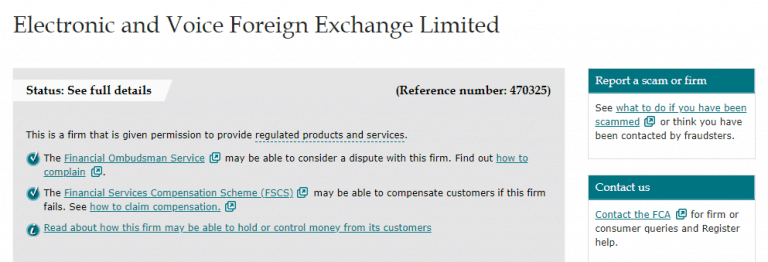

Is EVFX safe or a scam

No, EVFX is not a scam. Being a UK based company, the EVFX performs and delivers its services in a full compliance with the necessary laws and regulations. Electronic and Voice Exchange Limited (EVE) is registered in England with Company and is authorized as well regulated by the Financial Conduct Authority (FCA).

In fact, FCA is one of the strictest world respected authorities that oversee the financial companies conducted within the UK. According to the FCA set of rules, the broker should maintain and establish significant adequacy capital along with the necessary operational standards and the highest level of the investors’ protection.

The regulatory status also means that the company fully segregates client’s money from the company funds at all times, participate into the Scheme that covers clients in case of the company insolvency which covered by the FSCS (UK).

Trading Instruments

Getting more detailed to the offering, EVFX provides access to the trading markets that include trading on spot FX, Precious Metals, forwards, NDFs and options, as well as Futures and Equity exchanges, CFDs.

Along with the range of markets and numerous solutions to execute orders and perform trading itself, the broker delivers truly impressive advanced software offering. Of course, necessary support is also one of the jet features from the EVFX, while you can rest assured about the company reliability and constant support by every mean, which stands at your back for the best from the trading experience.

Leverage

Leverage known as a loan given by the broker to the trader indeed allows you to trade larger capital than the initial balance and is a very useful tool, yet you should use it carefully. Recent regulatory updates from European ESMA set a maximum level to only 1:30, as the authority recognized the potential of leverage not only magnify gains but loses as well.

- Therefore, the EVFX is eligible to offer a maximum of a 1:30 leverage only, while professional trader by confirming its status may apply for higher levels. In addition, the leverage levels are depending on the account offering, while you may face a difference in margins too.

Accounts

The account types offering an investment opportunity for retail, professionals and institutional clients, while all can find suitable conditions with the correct technology or services. Thus, the account types are varied by the investors’ portfolio, type and the trading instruments you wish to trade, of course, along with the platform options.

Fees

Similar to account types, EVFX trading costs are divided by the trader’s expertise, volume traded and the trading methodology along with its NDD or ECN execution model that delivers competitive spreads. Overall, the Account types are tailored to the client solution with all options to be settled and defined as per your particular need and the best match in terms of the investment trading.

| Fees | EVFX Fees | Interactive Brokers Fees | Goldwell Fees |

|---|---|---|---|

| Deposit Fees | No | No | No |

| Withdrawal Fees | No | No | No |

| Commission based fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Average |

Spreads

EVFX spread or the trading costs are built into the tight spread offering along with the applicable commission as defined per trading instrument. It is hard to define exact example about EVFX spread with its tailor to client measures, yet typical spread in EUR/USD pair is starting from 0.1 pips. For instance, you can check out and compare EVFX trading fees with Pepperstone broker.

Also note, that depending on the market you wish to trade you may choose between the fixed or variable spreads according to the strategy you prefer to use.

Payment Methods

For the payment options and the methods themselves, which represents a trader’s possibility to transfer the money to and from the account, the EVFX do not offer a wide range of possibilities. However, the most used Bank Wire Transfer and the Cards payments are always available and actually are the most secured, as well as convenient payment solutions to the transfer of any size.

Minimum deposit

The minimum deposit at EVFX is 500$ and depending by the account type you open, along with the trading conditions which will be suited together with the broker customer service.

EVFX minimum deposit vs other brokers

| EVFX | Most Other Brokers | |

| Minimum Deposit | $500 | $500 |

Withdrawals

Withdrawal EVFX are smooth process, request via your trading account and offering Bank Wire and Card payments. As for the transaction fees, Broker does not wave additional charges for both deposits and withdrawals, yet you payment provider may include some fees for your transactions.

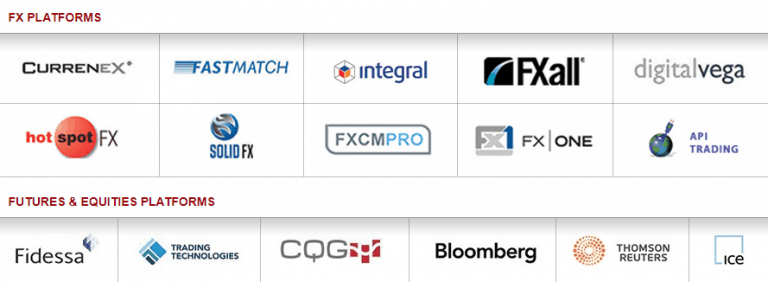

Trading Platforms

As for the trading software, EVFX truly stands at the forth front with its comprehensive and wide range of the platforms that are centralized with one back office, while all transactions regardless of the platform are reported to the office system giving clients a One Stop Shop solution. EVE provides a choice of electronic trading platforms for all traders and covering Spot, Forwards, Options and Ndfs with APIs available on all of them.

More specifically, FX Platforms available at EVForex include Currenex, FastMatch, Integral, FXall, digitalvega, hotspotFX, solidFX, FXCMPRO, FXONE, API Trading which gives almost endless trading opportunities to every trader of any level or experience.

In case you prefer to trade Futures and Equities platforms covering the most used platforms as well, while the performance powered by the electronic transaction model. Therefore, it is a fact trader of any size and strategy can engage in the trading as the variety of platforms is very impressive and features options designed to everyone own need.

Moreover, you still have another opportunity through a Voice Trading, while EVE’s voice desk allows clients the ability to execute transactions of significant size and sensitivity.

EVE offers both traditional Agency and Margin facilities, Exotic currencies, including NDF’s (Non-Deliverable Forwards) and options strategies that are not liquid or supported electronically but also available for potential benefit.

Conclusion

The EVForex review shows the broker based and respectively regulated in the UK which offers an array of platforms for the best suit particular trader may needs. The company performs its operation on a pure agency model, while acting only as a broker, so the interests are always aligned with their clients, which is definitely a huge advantage. Even though there is no too many information presented by the broker about trading costs and conditions, it is obvious that professional trader will suit its trading needs with EVFX super extensive choice between platforms and costs that will be satisfied by the EVFX tailored solution.