Eightcap Review (2026)

Who is Eightcap?

Eightcap is an Australian incorporated brokerage company, which brings a transparent pricing model since 2009 through low rates of variable spreads with quotes that are coming from numerous leading banks or institutions and performed via technological solutions through Equinix servers.

Eightcap performs a global operation through their reputable Australian HQ and other regional offices across the world, including the UK, Bulgaria and Cyprus. Apart from the offering to retail clients, this broker also brings technological advantages and partnership opportunities to affiliates, IBs and influencers.

Eightcap works towards building a home for MT4 and MT5 traders and aims to provide them with a personalized trading experience. This broker gives access to the most popular financial instruments, all with rapid execution and low spreads, via the award-winning MetaTrader platforms.

EightCap Pros and Cons

EighCap is a reliable broker, also provides good technological base for trading, costs are good and there is great research included in MT4 platform. Instruments are widely presented, you can withdraw fund using various methods.

From the negative points, there is no good learning materials essential for beginners, also no 24/7 support centers.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, SCB |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | Currencies, oil, gold, silver, global indices, shares and cryptocurrencies |

| 💰 EUR/USD Spread | 1.0 pips Standard Account |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | USD, AUD |

| 📚 Education | Analysis and research |

| ☎ Customer Support | 24/5 |

Is Eightcap safe to trade with?

No, EightCap is not a scam, it is a low-risk trading broker due to a strict regulatory or compliance culture done by a reputable license and follow of regulation set by the Australian Securities and Investments Commission (‘ASIC’), recognized world authority which regulated Forex and trading industry.

Therefore, as a regulated entity EightCap meets the highest standard of corporate governance, financial reporting, and disclosure. All retail client funds are kept separately from business funds in segregated bank accounts with AA-rated banking institution. Furthermore, EightCap undertakes additional protection by the professional indemnity insurance policy which all in all brings you a clear state of mind and trustable cooperation.

Also, Eightcap serves an additional entity that serves global clients from its offshore branch based in the Bahamas. Of course, we never recommend trading with offshore brokers, however, since Eightcap also follows reputable license from ASIC it means the broker is sharply regulated in terms of its operation.

Trading Instruments

The trader has access to over 1000+ financial instruments, including major and minor currency pairs, oil, gold, silver, shares and cryptocurrency CFDs.

The broker has recently expanded its Stock CFD Range by adding ASX Share CFDs, NASDAQ Share CFDs, NYSE Share CFDs, LSE Share CFDs, German Share CFDs.

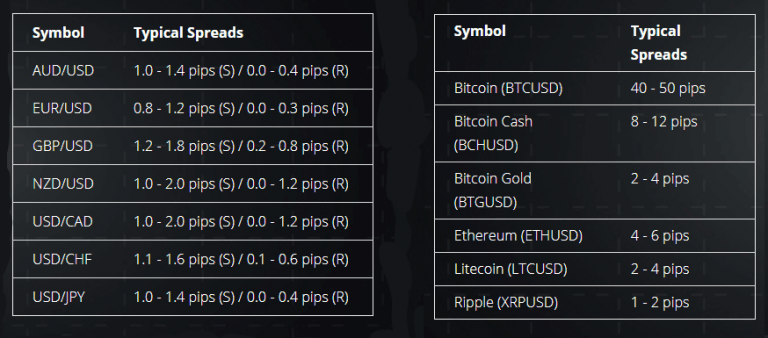

Going deeper into a promised competitive offering, the broker indeed brings excellent costs with the typical spread for EUR/USD at a standard 1.0 pips, as well as a raw spread of 0.0 pips. The spread for metals XAU/USD sits at 1.0 pips.

Leverage

One of the great features of Forex trading is an allowance to use leverage, which may increase your potential gains timely. However and in order to help traders in minimizing risks, which of course requires you to study well how to use leverage smartly, Eightcap also has specific leverage restrictions according to the trading size you operate.

Eightcap allows a leverage of 1:30, presenting its users with various market opportunities.

Account types

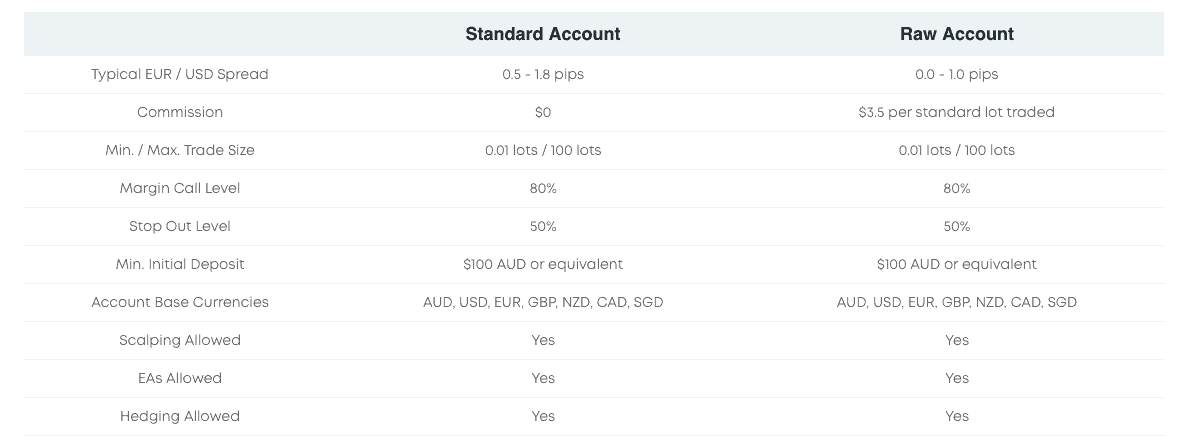

EighCap 2 account types offer of a simple choice between two accounts, either trade with Standard conditions with no complications all built into a spread or through Raw Account with spreads from 0.0 pips and commission for professional traders.

What is more, all trading styles are accepted, with no restrictions to use EAs or other strategies, also with flexible lot sizing and high leverage options. Regardless the account type all traders will have the same professional conditions to trade, as well as a support from the company for any requirement.

Fees

EighCap fees mainly built into a spread if you use Standard account or into a commission basis for Raw accounts. However, for full fee structure refer to the comparison table below and see all applicable fees for EighCap.

Also, always consider overnight fee as a cost, also referred to as Rollover rate, an interest for holding positions open overnight in foreign exchange trading. It is determined by the overnight interest rate and is a differential between two involved currencies and affected whether the position is a buy ‘long’ or sell ‘short’.

| Fees | Eightcap Fees | FXTM Fees | Fortrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

EightCap spreads designed at the account you use, while Standard account offers slightly higher spreads with no commissions and Raw account allows to enjoy interbank spread but with commission per trade. For instance see below a comparison of the spread offering, as well you may compare EightCap fees to another popular broker FBS.

| Asset | Eightcap Spread | FXTM Spread | Fortrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.8 pips | 1.5 pips | 2 pips |

| Crude Oil WTI Spread | 4 pips | 9 pips | 4 pips |

| Gold Spread | 4 pips | 9 | 45 |

Trading Platforms

With Eightcap, the trader will have access to MetaTrader 4 and the newer MT5 platform, which has numerous advanced features and tools. The proprietary developed platform is available for desktop and mobile apps with the same capabilities to view prices in real-time, monitor or access an account, and enable chat and push notifications.

MT4 provides all the necessary tools and resources that are essential for successful trading, with a range of indicators, and strategies to use.

Furthermore, Eightcap users will also have the ability to automate their trades without any coding knowledge. With the use of capitalise.ai Eightcap users will have access to automation and analytic tools, including backtesting, loop strategies, smart notifications, and much more.

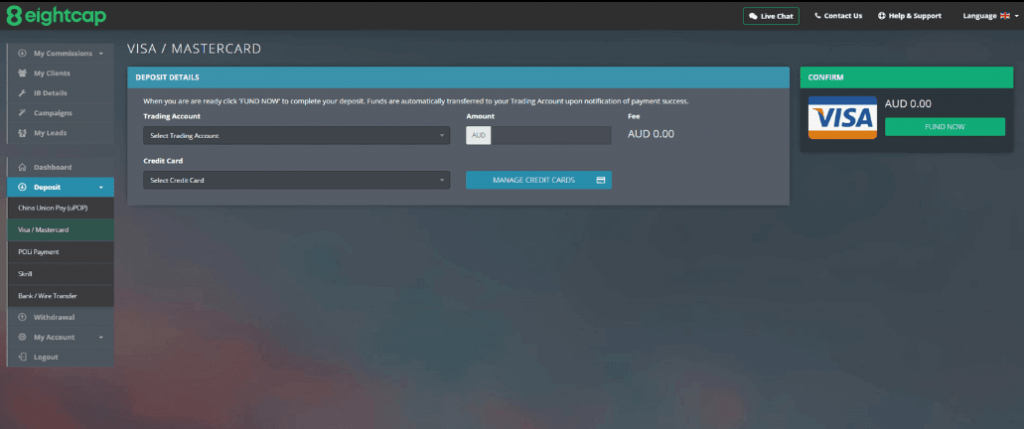

Payment Methods

The number of payment methods to fund the trading account which allows you to transfer from Demo trading to Live one including instant deposits through Visa/MasterCard, Skrill, POLi Payment, Neteller, China UnionPay and Bank Wire Transfers.

Eightcap clients can now deposit via BTC and USDT on USD accounts only.

While you may choose at your convenience a base account currency either AUD, USD, GBP, EUR, NZD, CAD and SGD, the deposits and withdrawals will be respectively made in the same currency as the base of trading account.

EightCap Minimum deposit

Minimum deposit is 100$ at EightCap for both account types offered. Also, EightCap does not charge any internal fees for deposits or withdrawals, yet you should note that payments from non-Australia banks may be subject to bank fees and is solely your responsibility.

EightCap minimum deposit vs other brokers

| EightCap | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

EightCap withdrawal options including bank transfer, debit cards and ewallets. There is no fee for deposits and withdrawals, meaning you can easily manage fundings, yet make sure to deposit in your account base currency to avoid conversion.

Customer Support

What is more, all trading styles are accepted, with no restrictions to use EAs or other strategies, also with flexible lot sizing and high leverage options. Regardless of the account type all traders will have the same professional conditions to trade, as well as support from the company for any requirement.

Conclusion

EighCap stands as a trusted and regulated trading service provider with good business model built on simple trading without making choices complicated or confusing, yet providing exceptional conditions. Their main offering is the technological solution of execution trough powerful servers with centralized integration, competitive pricing provided by leading institutions and access through the powerful features of popular platform MT4 along with accounts suited for various strategies. The only gap is deep learning materials which company does not provide, however, their support centers are showing great performance and solely considered as a con.

Reviews

I have opened an account with eightcap global and deposited to trade with mt4 account 400721. I got trading normal and have withdrawn my profit until the last 2 weeks. I had made a withdrawal request from my MT4 account and have been waiting for 2 weeks and received nonsense answers about the investigation of my account with any satisfactory explanation.

Until yesterday I got my money back. I have received my withdrawal. But the amount is not correct. My withdrawal is $8154USD but I only received 169,945,668VND. It is 10% less than my withdrawal. Please help to check with the payment and pay the remaining 10% for me.

Dear San,

Please, contact your manager and try to find out the reason they do not release your money. Also, try withdrawing smaller amounts, maybe it will work. Since the broker is regulated by ASIC, you can also contact the regulated regarding your issue.

I’ve been in trading business long enough to say that the choice of the brokerage really matters.

I would have said that Eightcap suits me perfectly but I only see one single disappointing detail in the features of this brokerage. The point is that they only provide MT4 and Mt5 access with no alternative solutions for professional market analysis and trading.

Recently I’ve got fascinated with Ctrader. Maybe this is not the only alternative to MTs, yet if you need my opinion, the broker that suggests Ctrader immediately gets some competitive advantage. It gives trader a complete infomration on his orders’ execustions, removes the barrier between a broker and its client so to speak. it’s easier to trust your brokerage if you know there is a FULL transparency there in your work relationships (which MT fails to provide unfortunately). Secondly, its just convenient to use. So just in case broker’s representatives will read this review – please take into consideration the opportunity to partner with Ctrader.

Everything else I’m completely pleased with. Tading fees, regulations, executions, support team – all is up to the highest standards!

Do you know of any broker that uses ctrader

I have been investing with a company called Eightcap optional trade on a telegram site, is this company associated with yours or not, Mark Thompson is the broker? I have had no success receiving any kind of profit!

Thank you and waiting for response

Joe Kozak

I invested with Mark Thompson on telegram and he uses the same name eightcap. I invested money and lost a lot of money but never received any profit. He continued asking for more deposit and more money and fake promises but I never got any money back in the end. I lost over $4000USD. He’s fake and his group is a scan. Do not invest with him. He needs to be reported.

He’s fake and the group on telegram is a scam.