Equiti Review (2026)

Regulator

What is Equiti?

Equiti Group Ltd is the parent company of some of the most progressive FX and CFD brands and prime brokerage providers in the industry. With over 150 global staff and 24×6 customer service, Equiti provides clients with access to individual, corporate and institutional brokerage services across various affiliates and subsidiaries.

Equiti is a global brand that used by the group of companies that serve corporate and institutional services globally through decentralized international offices. The company maintains offices in Amman operates under the brand Equiti Jordan, Dubai (Read about forex trading in UAE), Nairobi, London, Auckland, Miami and Yerevan.

What type of broker is Equity?

The company goal is to provide an easy, safe and productive trading experience that is achieved by innovative technologies through NDD and bridged ECN execution technology, professional educators, transparency and excellent service.

Equity Pros and Cons

Equity is a reliable broker with good regulation and proposal with NDD execution, various account types and competitive spreads and commissions.

For the negative side, Trading conditions may vary according to entity rules, there is No 24/7 support and First deposit requirement is rather high.

10 Points Summary

| 🏢 Headquarters | Jordan |

| 🗺️ Regulation | JSC, FCA, DMCC, SCA |

| 📉 Instruments | Forex and CFD, Precious Metals, and various Partnerships |

| 🖥 Platforms | MT4, WebTrader |

| 💰 EUR/USD Spread | 1.4 pips |

| 💰 Base currencies | Several currencies available |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 500$ |

| 📚 Education | via Equiti project – Academy |

| Customer Support | 24/6 |

Is Equiti safe or a scam

Equiti is a reliable broker with CySEC regulation considered low-risk Broker for Forex and CFDs.

Is Equity legit?

Equiti Group operates through the range of established offices, which are regulated and compiled according to various regulations and holding necessary licenses. It means the broker fully complied its operation with best practice and safety measures.

Equity operates mainly in the Middle East market through the Equity limited Jordan – a registered trade name in Jordan. Additional entities are registered in the United Arab Emirates, and in the UK authorized by the Financial Conduct Authority.

| Equiti entity | Regulation and License |

| Equiti Group limited Jordan | Authorized by JSC (Jordan) registration no. 18/00240/1/3 |

| Divisa UK Limited | Authorized by FCA (UK) registration no. 528328 |

| EGM Futures | Authorized by DMCC (Dubai) registration no. 31573 |

| EGM Futures | Authorized by SCA (Dubai) registration no. 607136 |

Customer protection

Overall, various regulations and authorities require the number of rules that set a reliable environment for investors or traders. All individual clients of Equiti Group will have their money fully segregated, in accordance with client money rules, which protects your funds and guarantees its safe kept along with participation into compensations in case of insolvency.

Leverage

Equiti offering leverage up to 1:500 that opens the way to use bigger trading size comparing to your initial balance and maximizes capabilities. Yet, the maximum leverage is also depending on the Equiti entity you trading with.

Means, that if your trading account is opened under the UK FCA regulation, the maximum leverage is allowed set to a 1:30 for Forex instruments, while regulations in MENA regions still allow floating higher levels of leverage.

Besides, you should always choose leverage accurately and always consider necessary risks since high leverage can significantly play against you too.

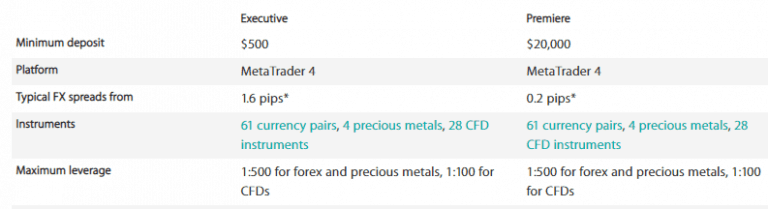

Account types

Equiti offers two account types whether the trader is a new one or a professional one. At the very beginning you can sign in within minutes for Demo account, known as practice account where you can check trading conditions and see Equiti trading environment.

Executive Account built for intermediate traders offers a mix of investment choices through market execution and average spread from 1.6 pips. The account enables trading with no commission charges, all costs are included in a spread and the minimum deposit is 500$.

Equal opportunities along with the flexibility to trade on a professional-level enabled through Premiere Account. While the account features more competitive trading terms and a variety of services, yet requires a balance of 20,000$ and shows with average FX spreads 0.4 pips and commission of 70USD per 1 million traded.

Swap-free accounts

As the company locates in the Arabic world, the traders that require specific terms are welcomed also. Alike swap-free or Islamic accounts are available to those who follow Sharia rules.

How to start trading

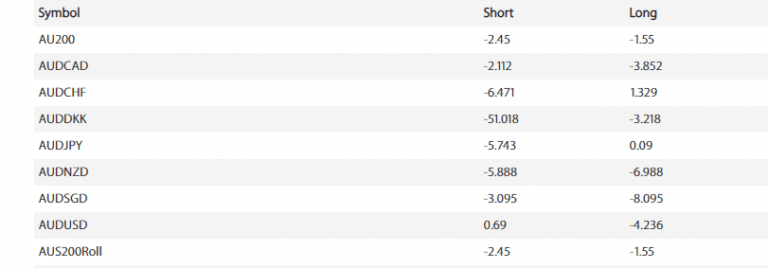

Fees

At Equiti there two different fee conditions according to the account type and trader you are. So the first Executive account will offer a spread only basis and the Premiere account is built in commission charges.

In addition, you should also consider an overnight policy which applies in case the trading order is held longer than a day, or unless you trade through swap-free account. In this case rollover fee, swap or overnight fee will be applicable to the position. See an example below.

| Fees | Equiti Fees | RoboForex Fees | FxPro Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | Yes | No | No |

| Inactivity fee | Yes | Yes | Yes |

Spreads

The trading costs are offered with variable spread offering through the market execution, a straightforward pricing model that is devoid of unnecessary mark-ups, incentives or fees. See a comparison table below, you can also see also fees of another popular broker FP Markets.

Various currency pairs or instruments defining specified fee terms or conditions which are available via trading platform. Here for our reference we compare Equiti fees and spreads, also considering other market proposals.

| Asset/ Pair | Equiti Spread | RoboForex Spread | FxPro Spread |

|---|---|---|---|

| EUR USD Spread | 1.4 pips | 1.4 pips | 1.2 pips |

| Crude Oil WTI Spread | 3 | 4.2 | 5 |

| Gold Spread | 20 cents | 1 point | 27 |

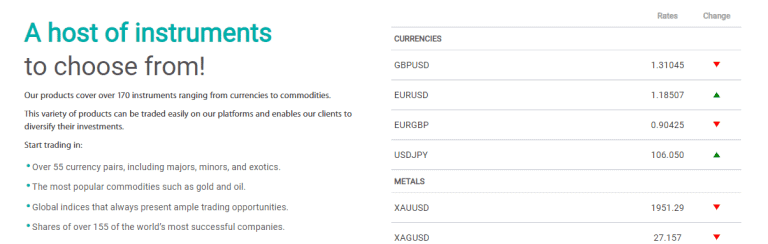

Instruments

So operating NDD execution the range of liquidity providers includes the world’s largest banks with the comprehensive product and service offerings across asset classes. Which includes Forex and CFD, Precious Metals, and various Partnerships.

Most popular commutations and global indices with shares for over 155 successful companies are traded on a CFD basis so be sure to learn about trading risks and how to trade the instruments.

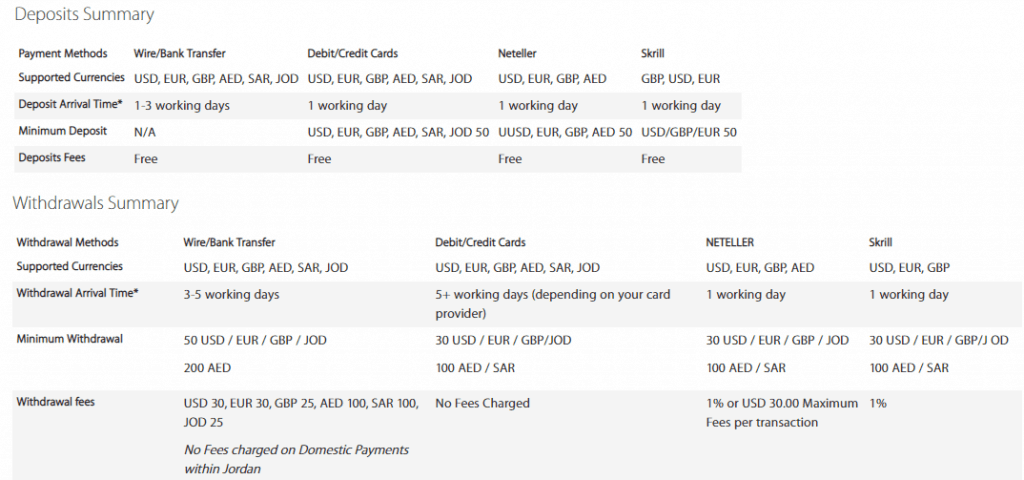

Deposits and Withdrawals

Another important note in our Equiti review is deposits and withdrawals methods or simply how you can send and receive money from the trading account. Obviously conditions and laws are different in each country, while all transactions and requests are seen and done via you online account field.

Deposit Options

Payment options that allow you to fund an account including the range of the convenient payment methods alike Cards payments, Bank Wire transfers or e-payments through Neteller or Skrill.

What is the minimum deposit for Equiti?

Equiti minimum deposit is 500$ for first grade account.Professional accounts require even more, 20,000$ which is quite a big amount compared to other CFD brokers.

Also, there are minimums set to e-payment providers like Neteller and Skrill which demand a minimum of 50$ for you to transfer at any time.

Equiti minimum deposit vs other brokers

| Equiti | Most Other Brokers | |

| Minimum Deposit | $500 | $500 |

Withdrawal

While the overall process to make a deposit or withdraw fund from or to an account is a straightforward process that takes a little of time, Equiti covers all payments fees means there are no any charges on deposits or withdrawals waived to you, yet e-payment withdrawals may cost 1% per transaction.

However, the traders of different residence should check the availability of the particular payment or another, in terms of availability as well as regards to the applicable fees.

Trading Platforms

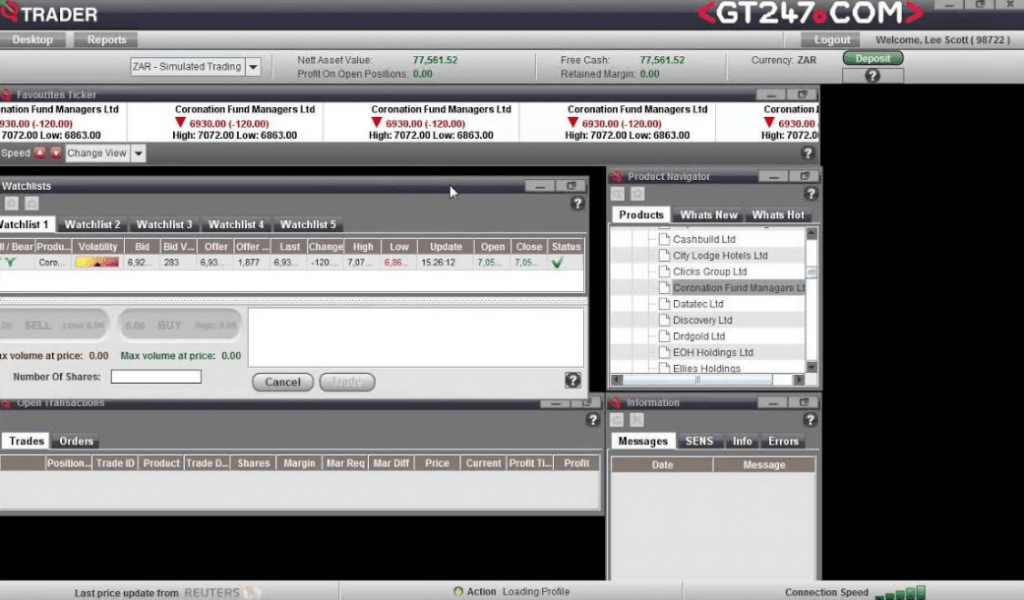

Equity supports the MetaTrader4, the most used choice between the traders along with a Web version WebTrader – EQTrader that provides instant online access to trading.

| Pros | Cons |

|---|---|

| Mainstay on friendly MT4 and WebTrader | No proprietary platform |

| Good Copy Trade, Social Trading and Technical Indicators | |

| No restrictions on strategies | |

| Fast execution | |

| Platform supporting various languages |

Desktop Platform

The main version is of course the desktop platform with full capabilities and available tools. MetaTrader4 is also not a surprise choice from the broker, as it offers multi-asset trading flexibility with advanced charting package and enhancement of 30+ technical indicators, along with truly powerful trading features.

In order to optimize and apply various strategies or to automate trading, you have an option to choose from the powerful MT4 EAs. In order to do so, the trader only selects from the range of tools in a marketplace and customize its own MT4 interface, which is a truly efficient way to trade.

Research

Moreover, the Equity broker provides free research tools with insightful technical analysis reports and sophisticated pattern recognition tools that bringing trading even further, the tools are available in all accounts to all clients.

Web Trading

However, if you prefer easy accessible platform right from your browser and simple capabilities Web Platform is available at your choice as well.

Mobile Platform

Mobile trading of course supported too, actually Equiti mobile app is quite well designed and easy to use from any device allowing to stay updated on the go.

Customer Support

Customer Support of Equiti available in various international languages and operating 24 hours a day, 6 days a week. You may either Live chat with the support or call them via phone lines, while we found customer service quite responsive and helpful.

Education

The educational sources combined into the Equiti project – Academy, which combines various learning materials through video, webinars, guides, seminars and many other analytical necessary data.

Besides, there is an online Newsroom where you can get all the latest updates and News, which are very useful for everyday trading and your updates.

Conclusion

Overall, Equity review is about a broker, which establishes an international offering to trade a range of instruments through the market execution, transparent pricing model and multiple customer support. The broker mainstays at the market-leading MT4 platform, which is a plus to all kinds of traders, from the beginners to veterans. Also, with its focus on MENA region, there are some good opportunities with swap-free accounts and tailored solutions.

Reviews

Worst Broker I have come across, I lost $10,000 in just 2-3days. Thanks to Equiti Accounts Manager Mr. Hammad and Mr. Fahad in specific. No any responsibility taken by Equiti as expected and experienced careless handling of account by account managers. I will not recommend it to any one. First they started investing in Forex trading and then assure me that if I invest more they will invest in company shares as well. But they invested full $10,000 in Forex trading which is very uncertain and ended up losing all my money.

Actually I like Equiti. Three years with no problem.