FXGM Review (2026)

Regulator

What is FXGM?

FXGM is an online trading brokerage firm that serves multiple entities while headquarter based in Cyprus. This means that FXGM is a European broker that is of course regulated and overseen by the necessary authority CySEC in reverse providing its clients with integrated trading conditions and guaranteed transparency.

FXGM operates since 2011 while along the time shows its reliability and was quite regarded by the international traders and industry communities. Moreover, FXGM always strives to improve its trading technology and offering, therefore went beyond by establishment of the branch in South Africa.

| Pros | Cons |

|---|---|

| Regulated broker with good record | No 24/7 support |

| Good selection of instruments | No comprehensive education |

| Exclusive trading analysis and research tools | No MT4 or alternative platform |

| Low fees | |

| Proprietary platforms |

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC |

| 📉 Instruments | Forex and CFD products on shares, commodities and indices. |

| 🖥 Platforms | WebPROfit |

| 💰 EUR/USD Spread | 0.3 pips |

| 💳 Minimum deposit | 100 US$ |

| 🎮 Demo Account | Available |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Variety of trading tools and services |

| ☎ Customer Support | 24/5 |

Is FXGM safe or a scam?

| Pros | Cons |

|---|---|

| Globally regulated broker | None |

| Licenses from CySEC, CNMV and FSCA South Africa | |

| Negative balance protection |

Is FXGM legit?

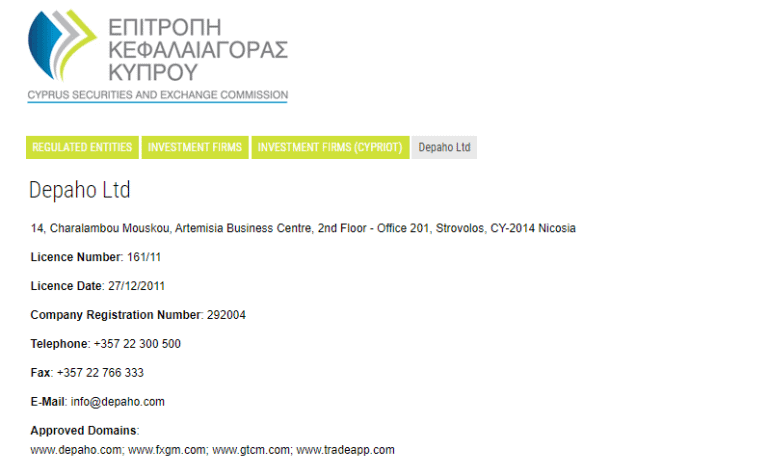

FXGM is a tradename used by a company Depaho Ltd registered in Cyprus and regulated by the local CySEC. Cyprus being a part of the EU therefore complies its regulation with European MiFID that establishes harmonized financial investment services to the public.

Also, FXGM serves a branch in Spain which is also registered with a local CNMV so the trading and brokerage service is compliant to the necessary laws, protecting clients and bringing you a trustable environment.

Additionally, FXGM took an expand approach and established entity Depaho Ltd or FXGM authorized by the South Africa FSCA so the broker gains effective exposure and presence in additional markets together with a strict follow of customer protection, due to regulations.

How are you protected?

Overall, the broker being regulated by several authorities worldwide meaning broker working closely with best concepts of trading operation ensuring its clients with safety procedures. As such, numerous regulatory rules covers all aspect on how the trading environment is established, money operated, client treated, as well as covered by the compensations in case of insolvency.

Which is in reverse bringing to you as trader confidence in brokers offering an opportunity to trade with a reliable firm, which is never a case of offshore entities besides its super attractive opportunities where you never know what to expect.

Leverage

The first thing to check while you need to know the maximum leverage ratio is under which entity you will be trading. As we mention within FXGM Review, the broker operates through various jurisdictions and complies with its particular regulatory restrictions.

- Therefore, European clients may access the maximum leverage of 1:30 for forex instruments, available for retail traders.

- While trading with South Africa branch traders will get higher ratios, as jurisdictions allow bigger leverage levels up to 1:200

- Nevertheless, the maximum leverage for professionals goes up to 1:200 respectively once the status is confirmed.

Accounts

FXGM defined various accounts either for retail traders or professionals, while professional traders solely getting tailored solutions according to the need.

| Pros | Cons |

|---|---|

| Fast account opening | Account conditions may vary according to regulation |

| Individual and Professional accounts | |

| Demo Account and Live Accounts | |

| 6 account types defined by account equity |

Account types

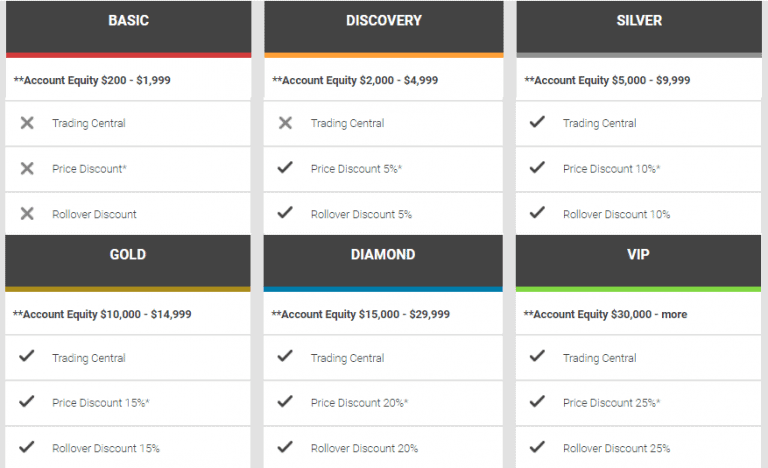

If you are a retail trader there are six account types where the first 10 trades are protected from loses, as a reward to get familiar with the software, so also the accounts are defined by the size and its offered package with higher discounts on prices, see sample below.

Likewise, professionals may access specified conditions along with higher leverage ratios and tailored solutions according to particular needs.

Instruments

In its offering you will find a wide variety of trading tools and services, with a great array of services suitable either for beginning investors or professionals. The instrument range includes most popular Forex and CFD products on shares, commodities and indices.

Fees

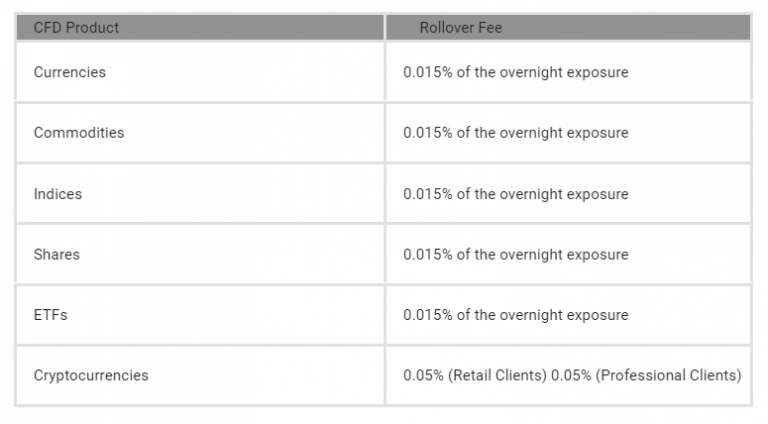

FXGM as an STP broker provides tight variable spreads according to the market conditions, while actual cost is defined by the account type you are using.

Each account type, as mentioned, features Price Discount up to 25% for both spread and rollover fees, so you may benefit from better costs as long as your trading size increases.

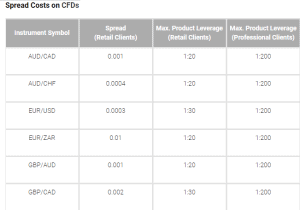

You may see some of FXGM spreads below, as well some standard rollover rates above, also may compare FXCC spread to another popular broker Pepperstone.

Comparison between FXGM fees and similar brokers

| Asset/ Pair | FXGM Fees | ActivTrades Fees | CMC Markets Fees |

|---|---|---|---|

| EUR USD | 0.3 pips | 0.63 pips | 0.7 pips |

| Crude Oil WTI | 0.06 | 3 | 3 |

| Gold | 1 point | 28.6 pips | 3 point |

| BTC/USD | 300 | 1% | 0.75% |

| Inactivity Fee | Yes | Yes | Yes |

| Deposit fee | No | No | No |

| Fee ranking | Low | Average | Average |

Snapshot of FXGM spreads

What Payment Methods FXGM offers?

The variety of methods to deposit or withdraw funds including most used options, so you will always find a way to transfer money conveniently.

Deposit Options

This includes Credit/ Debit Cards, Wire Bank transfers, e-wallets and even PayPal. Nevertheless, always make sure to check with a particular entity for the payment providers’ applicable fees and conditions, as they may vary.

FXGM minimum deposit

The minimum deposit for FXGM is 200$ for the first grade retail account type, while the next grade account will require bigger amounts.

It is considered a good amount for beginning traders, while with a slightly bigger amount you will get some extra discount on trading costs which is also something we like at FXGM offering.

FXGM minimum deposit vs other brokers

| FXGM | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

FXGM withdrawl options are wide and does not charge any fees for making the deposit, as well as withdrawals which is of course great. However, depending on your country of residency and international policies some fees might be applicable and will be solely your responsibility, so you better check for them with a provider or with customer service of FXGM.

Trading Platforms

FXGM gives you an opportunity to access the trading environment through an easy to use trading platform WebPROfit, which is an online-based platform that does not require installation. Also, there is a developed Mobile PROfit allowing to stay connected and updated on the go, just through your mobile.

| Pros | Cons |

|---|---|

| Proprietary trading platform WebPROfit and MobilePROfit | No MT4 or alternative platform |

| Exclusive trading tools and analysis | No copy or social trading |

| Supporting many languages | |

| Technical analysis | |

| Suitable for beginners and advanced traders |

Web Trading

WebPROfit provides vast trading tools accompanied with the latest news, real time charts and additional analysis tools suitable for beginners and advanced traders as well.

Overall, the FXGM Review of a platform concludes its software as a harmonized system to use for your trading strategy either you are a beginning or professional trader.

You will find all what is necessary for good performance without complications, even though this is the only option of the platform available at FXGM. In case you require industry known MetaTrader4 you better check other brokers by the link.

Analysis

What is actually great at FXGM, the broker supports you with comprehensive analysis, access to Trading Insider that brings you sentiment data, as well as Trading Central with its certified financial research materials.

So all in all, the FXGM toolbar and software bring you all what is needed for a good deployment of the strategy, whatever style it is.

Mobile Platform

MobilePROfit provides a great range of real time charts and analysis likewise, all available via a mobile device which is super essential and useful nowadays. We enjoyed the look and design of the mobile app, so you probably would like it too.

Customer Support

Besides, FXGM developed customer service at a high level, so you may always count for its support. Support teams are reachable either via Live chat or emails, phone lines also through the contact form available during working hours Monday to Friday 07:00 – 19:00 GMT.

Education

Even though there is no comprehensive education courses or webinars organized by FXGM, there are research and analysis available for every trade. These include Economic Calendar, Market Review and News, along with SMS service.

Conclusion

Out though about are positive. FXGM expanded offering through the South Africa branch and is regulated in each region it operates, making its conditions transparent and reliable to you as an investor. As for FXGM trading conditions, we rather consider them competitive and pleasant either for beginning traders or professionals. Its truly diverse range of account types will give you extra benefits with bigger discounts as long as your trading account keeps growing, which promises you fruitful cooperation.

FXGM Updates

Depaho Ltd is currently undergoing regulatory review adopting a set of improvements as required by our authority, its license for now is suspended.We reccomed stay allerted and doing your own research about FXGM.