Fineco Bank Review (2026)

Regulator

What is Fineco Bank?

Fineco Bank brings access to online trading since 2004, and is an Italian market leader with over 250,000 trading client base and more than 1.1 million customers. As per Global Finance Award, financial magazine – 2016, The Fineco Bank is the Best Digital Bank of Italy.

So apart from its trading offering, Fineco was established as a bank which gained top-ranking position in Italian and European markets.

Further on Fineco spread it’s offering to trade opportunity on 26 worldwide markets CFDs, Indexes and the US shares with no fees, as well Forex through 50 currency exchange, Futures and Options with three multifunctional platforms at the fixed commission for global traders.

Fineco Bank Pros and Cons

Fineco Bank is a highly reliable broker since operate with European Banking license with high trust and reliability. Trading conditions and proposal is good, there are large instrument range including Indices and Stocks, the platform is well developed with good research.

On the other hand, there is no proper education or popular MT4 offered.

10 Points Summary

🏢 Headquarters

Italy

🗺️ Regulation

CONSOB, ESB

🖥 Platforms

Powerdesk, Stock Screener

📉 Instruments

26 CFDs, Indeces and the US shares, Forex, Futures and Options

💰 EUR/USD Spread

commission of 10$

🎮 Demo Account

Provided

💳 Minimum deposit

100$

💰 Base currencies

Several currencies offered

📚 Education

Provided on free basis

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | Italy |

| 🗺️ Regulation | CONSOB, ESB |

| 🖥 Platforms | Powerdesk, Stock Screener |

| 📉 Instruments | 26 CFDs, Indeces and the US shares, Forex, Futures and Options |

| 💰 EUR/USD Spread | commission of 10$ |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Provided on free basis |

| ☎ Customer Support | 24/5 |

Is Fineco Bank safe or a scam

No, Fineco is a not a scam it is a reliable brker with Banking license and low risk Forex trading.

Is Fineco bank legit?

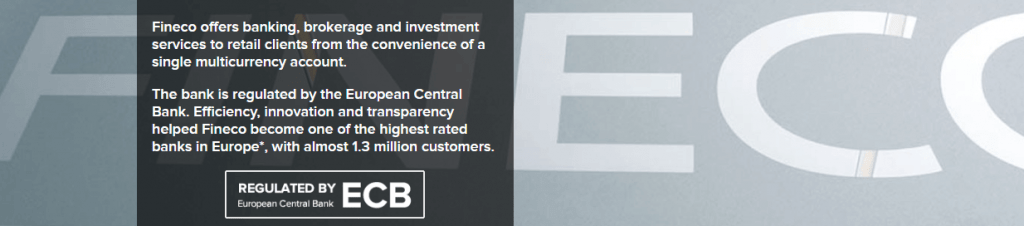

FinecoBank S.p.A. is a part of the UniCredit Banking Group enrolled in the Register of Banking Groups, with headquarters in Milan, Italy. Actually, UniCredit Bank is one of the largest groups worldwide, which is also the Member of the National Compensation Fund and the National Interbank Deposit Guarantee Fund. Therefore, Fineco Bank is regulated not only as a brokerage or trading firm but as a banking institution, which follows much more sharp authorization for its service delivery by the European Central Bank, Bank of Italy and cross-regulation within Europe and UK (Also read our review on UK headquartered Exness).

What are the safety measures?

In simple words that means you can trade with a trust, knowing Fineco Bank is constantly overseen and definitely not a scam. In order to protect their clients the company uses multiple levels of security, starting from the data encryption ending by numerous security rules in regards to personal data, funds transaction and storage, as well as execution policies.

All clients’ funds, of course, are kept in the segregated accounts, which is supervised internally and externally, which ensures maximum protection of account holders.

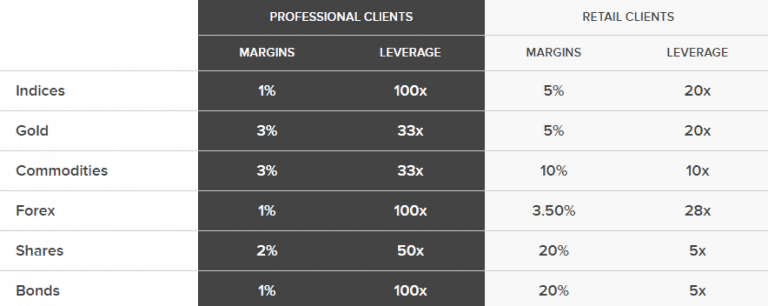

Leverage

Being a European Bank and broker, Fineco Bank falls under the ESMA regulatory requirements and regulations which recently restricted maximum allowed leverage. Therefore, retails traders may use maximum leverage of 1:30 for Forex instruments, 1:20 for minor currencies and even 1:110 for commodities.

However, the professional trader may apply for higher leverage levels once confirm status, see example below.

Account types

Fineco Bank has single account with Shares, CFDs, CFDs FX, Futures & Options, Bonds, ETFs, CWs and Certificates, all the thousands of markets available for trading. Apart from the trading capabilities, the multicurrency account offers banking, brokerage and investment services to all retail clients that maximized your capabilities.

In addition, reaching a total of 500,000 euros or more client obtains the status of Private that brings more advanced conditions of exclusive account, dedicated rates for Credit Lombard and Mortgages, Advisory services, reduced pricing on securities trading and the credit card reserved for Private customers.

Fees

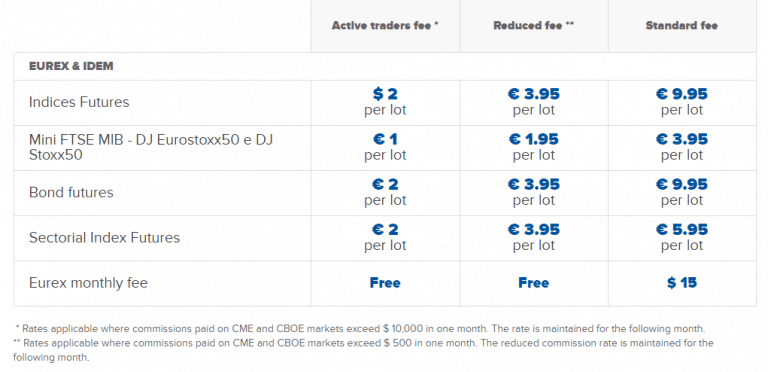

What is interesting is how Fineco bank or broker built its cost strategy, while with 1o orders per month you’ll pay less than 10€ per order that even can go to just 2.95€ as the trading size increases. Meaning there is a great opportunity for both beginning and advanced traders while all tools are developed for professional trading in addition to long and short intraday and multiday margin-settings.

Options and futures are offered with 1.95€ per batch and CFDs, FX CFDs and Super CFDs with zero commissions but only with a spread.

| Fees | Fineco Fees | Dukascopy Fees | FXTM Fes |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Average |

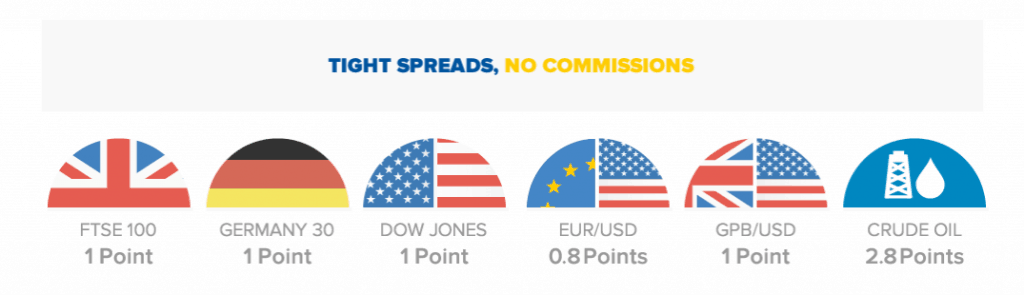

Spreads

Fineco trading costs upon your choice from the thousands of international stocks, shares, currencies, futures, ETFs or options you will find unique and simple pricing designed for most dedicated traders. The costs of spreads or commissions at Fineco are fair.

Generally there are three pricing models that start from the Standards fees, Reduced fees and Active fees.

Deposits and Withdrawals

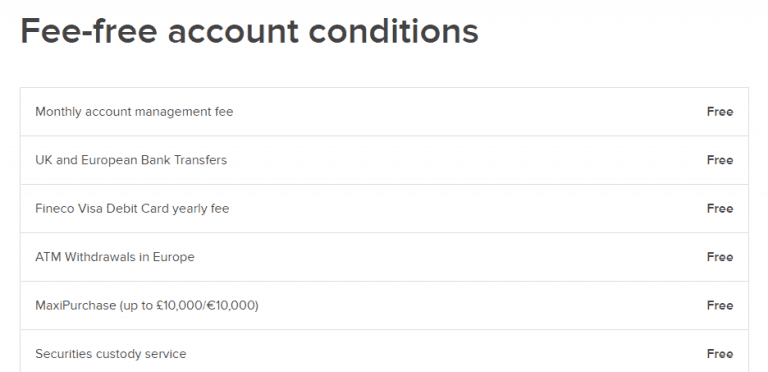

For the money transfers you will definitely find one of the most convenient and good options to transfer money with ease, as the Bank allows automatic deposits available through UniCredit or Fineco Bank ATMs. Smart withdrawal is a free service available via the Fineco app for smartphones that allows withdrawing cash without a payment card.

Withdrawal

What is more deposits and withdrawals are free of charge, while the UK, Italy and European Banks transfer along with Fineco Visa Debit Cards are free of charge. Other regions and jurisdictions may apply international transfer fees, which you should check with customer service.

Minimum deposit

There is no minimum requirements for Fineco thus you can transfer any amount suitable for your needs, just check desired instrument trading conditions in order to be able to cover all necessary margins.

Fineco minimum deposit vs other brokers

| Fineco | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Trading Platforms

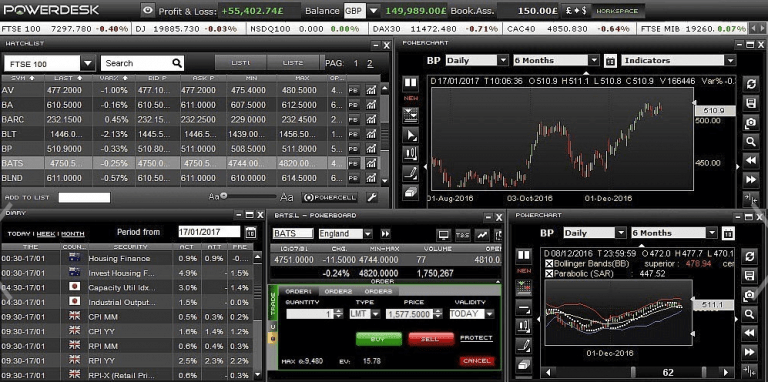

Fineco is one of Europe’s most popular online trading platforms which is an outcome for a robust order execution with tight spreads and direct access to liquidity and of course, fantastic constant innovation Fineco applies.

It only takes a click to access account and start trading, as the broker’s service offering advanced technical solutions for trading including Powerdesk platform and unique intuitive tool to explore markets Stock Scnreener, as well as mobile applications.

So let us have a closer look on each of the offering, the Powerdesk is actually the revolutionary software for trading, with its easy interface to push markets, margin setting, CFDs and automatic orders that features advanced charts, spread views, news and more. Its total personalization configures listings and tools while enabling friendly access that does not require installation.

With the Stock Screener you’ll be able to invest in bonds through filters divided into 5 main categories and search ideas that allow exploring of the market from predefined searches. Thus you’ll immediately identify the securities of interest, select technical, fundamental, performance or sectorial data to run a trade.

The last is a Fineco App that keeps necessary tools reachable at any time with availability to transfer, top-up, stock market orders and more while available in real-time with no extra costs.

Customer Support

As for the Fineco bank customer service it brings highly qualified support with the portfolio of over 96% satisfied customers and more than 200 operators are at the disposal with the additional over 2,600 personal financial advisors that are able to analyze and fulfill investment expectations.

Also, you can count for Fineco Learning that provides education about accounts, markets, trading and investments that clearly explained by professionals.

Conclusion

Our conclusion is very positive, Fineco is the top-ranked Italian bank that brings a trustable trading and financial solutions without any doubts on its sharp regulatory obligations. The increasingly functional platform brings tons of solutions and offers to trade more effectively. However, PowerDesk will require a monthly fee if the client does not reach the necessary trading volume therefore may be a better option for active and professional traders along with competitive pricing and commission free offers. Also, Fineco Bank offers trustworthy trading proposal along with banking services that are worth consideration.