FxNet Review (2026)

Regulator

What is FxNet?

FxNet is a brokerage firm established as a Cyprus Broker acquired over a decade in the financial investment industry, as well as based on the knowledge and professionalism approach.

Being an STP broker you will trade through a Market Execution also provided with competitive pricing, with no restrictions on strategies while broker keeping a high level of customer service and supporting its clients.

10 Points Summary

🏢 Headquarters

Cyprus

🗺️ Regulation

CySEC

📉 Instruments

Currencies, Metals, Shares, Bonds, Commodities and Indices.

🖥 Platforms

MT4

💰 EUR/USD Spread

2.3 pips

💳 Minimum deposit

50 US$

🎮 Demo Account

Available

💰 Base currencies

USD, EUR, GBP

📚 Education

No comprehensive education, just trading information

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC |

| 📉 Instruments | Currencies, Metals, Shares, Bonds, Commodities and Indices. |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 2.3 pips |

| 💳 Minimum deposit | 50 US$ |

| 🎮 Demo Account | Available |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | No comprehensive education, just trading information |

| ☎ Customer Support | 24/5 |

Trading Instruments

Along with an offered powerful execution and connection to the market through liquidity providers, there is an exposure to various markets including Currencies, Metals, Shares, Bonds, Commodities and Indices.

However, there are no comprehensive educational materials, just trading information with economic calendars, news feed and other essential data. So beginning traders better to find another source of learning, yet there are good conditions for starting with FxNet, so it might be an option too.

Is FxNet safe or a scam?

FxNet as a Cyprus investment firm therefore, operates under CySEC license which is being a part of European Union legislation that complies fully with MiFID regulatory directive active within the EEA zone. Also, FxNet serves additional entities through offshore zone Belize, so the company getting global exposure as well.

Nevertheless, we would recommend trading with the Cyprus entity only due to its regulatory obligations and coverage of the client complains in any unlikely scenario or experience with FxNet.

So due to its regulated nature, it is considered safe to trade with FxNet as its operational standards are set according to the requirements along with the client protection with money segregation and participation in investor compensation schemes.

Leverage

The maximum leverage FxNet offers is a maximum of 1:500, which is available only while trading with an offshore entity of FxNet.

- Otherwise and in case you are EU resident automatically you will fall under regulatory restriction where lowered ratios may be used for retail traders, alike 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

It will also depend on your trading knowledge, since professionals by confirming its status may access higher ratios for speculative products.

And of course, always learn how to use leverage correctly, as leverage may increase your potential loses as well and is a different feature in various instruments.

What are FxNet Costs and Fees?

There are three account types offered by the FxNet so either you are a beginner or professional trader there is a suitable account for you. Also, there is Islamic Account offering suitable for those who follow Sharia laws and available for day trading and specified conditions.

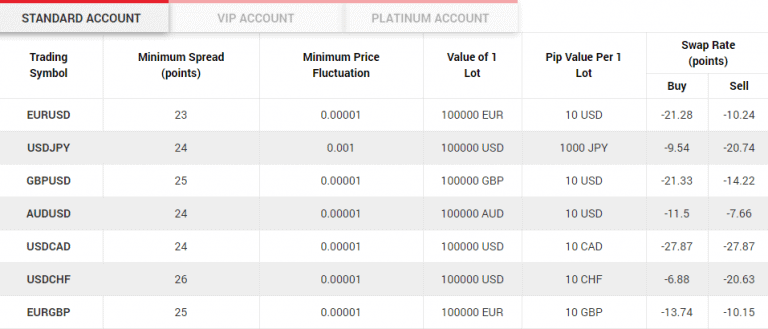

Fees

FxNet spread is based on tight variable spreads, which is defined by the account type as well. Standard account has slightly higher ratios, where spreads starting from 2.3 pips, and VIP Account has lower charges of spreads from 1.9 pips.

Premium account features 0 spread plus the commission charge of 1.2 pips per each closed lot, which is an option for professional traders.

See some of the examples you may see below for a better understanding of costs, which is considered as average rate compared to industry offerings, as well you may see fees of another broker Pepperstone.

Also, always consider FxNet rollover or overnight fee as a cost, which is charged on the positions held longer than a day. Each instrument charges different quote for overnight positions, you also may see some swap examples above.

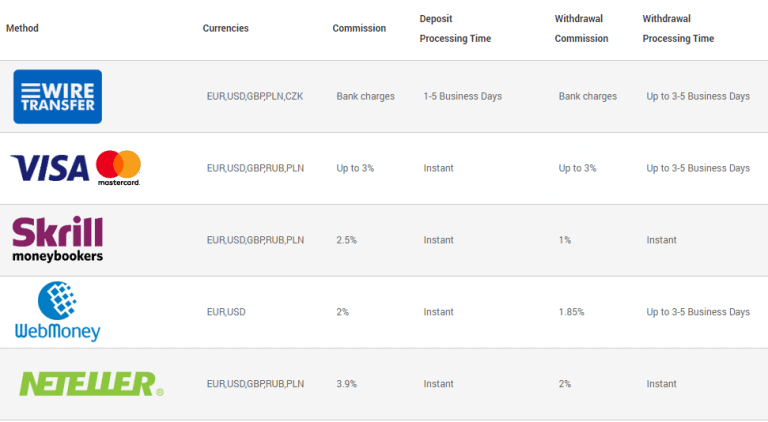

What Payment Methods FxNet offers?

The last point of FxNet Review is payment methods or how exactly you may transfer funds to or from the account. Actually, FxNet offers a truly diverse range of payment options so you will definitely find the one suitable for you. These methods including Card Payments, Bank Wire, e-wallets, WebMoney, Turstly, iDeal, Przelewy24 and more.

FxNet Minimum deposit

FXNet minimum 50$ for Standard Account. VIP account and Platinum will need much higher deposits 10k$ and 25k$ respectively in reverse giving extra benefits to its holders.

FxNet minimum deposit vs other brokers

| FxNet | Most Other Brokers | |

| Minimum Deposit | $50 | $500 |

FxNet withdrawal

FxNet withdrawal methods has own defined charges considered as payment provider fees. So while depositing or withdrawing money make sure to check on necessary fees, some examples of fees you may see above and for other methods consult customer service or see brokers’ website.

Trading Platforms

As for the trading platforms, FxNet made a decision to mainstay on MetaTrader4 an industry-leading software that is actually the most regarded and used platform. MT4 provided through a variety of applications that gives access to trading through any device so you will stay in control at any time.

Also, FxNet does not restrict the use of some specific strategies, so there is an option to deploy trading style as you wish either manual or automatic through EAs. MetaTrader is known for its powerful charting features, as well as numerous add-ons that enhance trading analysis and execution of orders.

In addition, FxNet added extra benefit though its truly well-managed access to markets by the use of numerous liquidity providers along with competitive pricing which we will cover further.

Conclusion

Concluding FxNet Review we admit flexibility over the trading process, covering leverage, a choice between accounts, guarantees based on regulations, as well as various assets to trade. The trading costs considered among regular compared to other brokers, while professionals may maximize strategy with raw spread and commission per charge. So overall, the trader of any size or portfolio may find its way with FxNet.

FxNet Updates

FxNet is no longer active, however its registered in Cyprus mother company operates new brand www.nessfx.com

We reccomend doing your own research about the offering in detail.