GKFX Review (2026)

What is GKFX?

The international company GKFX, which was recently rebranded to GKPro providing global traders with access to the world financial markets since 2010. Today, GKPro headquarters in London, UK with strives to serve clients better, ensure their traders are properly supported through its various locations around the world Germany (Frankfurt), Spain (Madrid), Malta, Dubai, Indonesia, BVI and more.

The main company goal is to become a leading brand for financial market services with its huge investments and the exceptional personnel of the company, while many of them are senior specialists of more than 20 years’ experience in financial transactions.

All in all the technology they use and their exceptional service providing intermediary strengthens broker position in the market and expands its influence.

GKFX Pros and Cons

GKFX is a reputable well-regulated broker authorized by FCA. It provides comprehensive trading solution for investors, with easy, average trading costs and powerful trading software.

On the negative points proposal is different in each entity, there is no 24/7 support, spreads might be higher for some instruments.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 🖥 Platforms | MT4. GKFX Sirix Trader |

| 📉 Instruments | FX, CFDs or Spread betting, indices, equities, commodities and cryptocurrencies |

| 💰 EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 20 $ |

| 💰 Base currencies | Several currencies available |

| 📚 Education | Support materials available |

| ☎ Customer Support | 24/5 |

Awards

The broker is relatively young, but with its rapid development strategy its already been recognized by various international awards.

Is GKPro safe or a scam

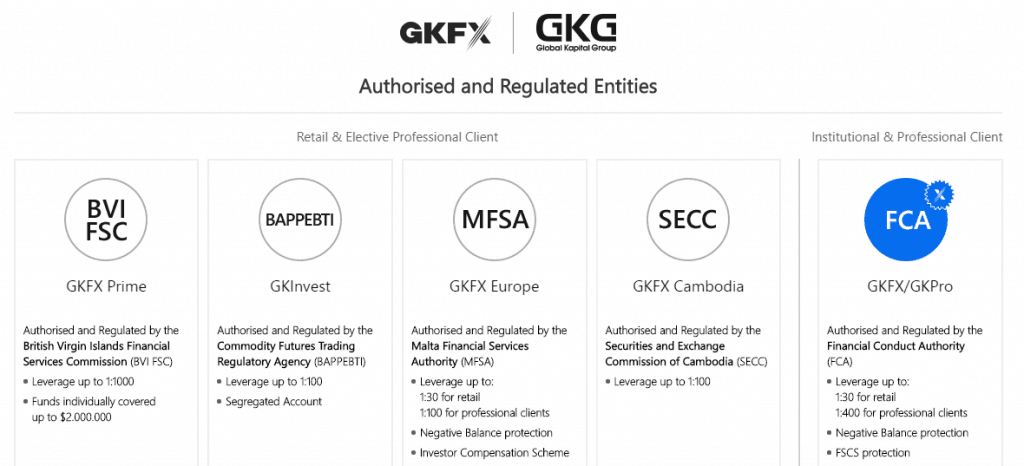

No, GKFX is not a scam you can make low risk investments with high confidence since the security of overall processes are guaranteed under legal terms and full regulation by major world regulators. GKFX Financial Services Ltd. is authorized by FCA (The Financial Conduct Authority) an independent non-governmental body, given statutory powers by the Financial Services and Markets, with registration number 501320.

In addition, there are few other company co-regulators BaFIN (Germany), CNB (Czech Republic), Národná Banka Slovenska (Slovakia) and CNMV (Spain), as well as MFSA in Malta which serves GKFX Europe branch.

Moreover, the additional entity GKFX serves is registered with an offshore authority on BVI, and other entities in Cambodia and Indonesia through BAPPEBTI regulation. While the requirement on offshore is definitely much lower than the reputable FCA regulation since GKFX complies to both there are no worries about their compliance with best practices.

Naturally, GKFX pays attention to provide high financial security and transparency to the clients’ funds. Hence, there are strict regulations in this regards, all retail client funds are separately held in segregated accounts, authorization involves security for traders under the Financial Services Compensation Scheme (FSCS).

Instruments

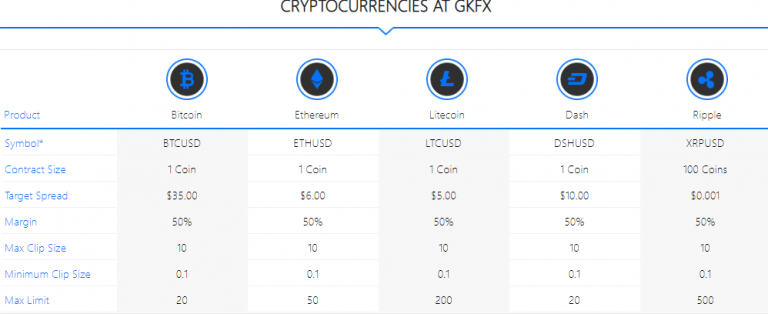

Traders and investors of different size and professional level are able to choose from FX, CFDs or Spread betting to trade on a variety of instruments including indices, equities, commodities and cryptocurrencies.

Leverage

Since the broker delivers its service through various jurisdictions and registered entities respectively, the leverage levels will depend under which regulation your account is opened with. This means that the main entity of GKPro that follows UK’s FCA regulatory guidelines may offer maximum leverage up to 1:30 for Forex instruments, 1:20 for non-major currency pairs, 1:5 for Stocks etc.

Nevertheless, the accounts which are opened under the BVI registration may sigh for a very high leverage level of 1:1000. Yet, always remember to learn how to use leverage smartly, as the correct usage will allow you to profit better, instead of just fall under the risk of rapid loss.

Account types

GKFX offering various types of accounts for both retail and corporate clients to suit trading needs and accomplishments, along with the slight differences according to the regulatory entity of the broker. A successful choice of the appropriate account is depended by many factors, risks, size of the investment and your personal time availability to trade Forex.

Fees

GKFX fees and costs are mainly built into a spread, however for full fee structure important to consider funding fees, swap fees and inactivity fee (Read about forex brokers swap-free). See below comparison for Trading Fees.

| Fees | GKFX Fees | Price Markets Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

Spreads

GKFX accounts featuring the possibility to trade with micro and standard lots, through same execution quality, high level of leverage and available tools. Another nice bonus for traders is a quite attractive cost strategy, while you are able to choose either variable spread or fixed spread (Check the fixed spreads forex brokers), however we found some spreads are higher than average, see the typical spreads below. For instance, you can also compare fees to another popular broker FP Markets.

| Spread | GKFX Spread | Price Markets Spread | AvaTrade Fees |

|---|---|---|---|

| EUR USD Spread | 1.2 pips | 0.3 pips | 1.3 pips |

| Crude Oil WTI Spread | 5 pips | 1 pips | 3 pips |

| Gold Spread | 3 | 1 | 4 |

| BTC/USD Spread | 35 | - | 0.75% |

Deposits and Withdrawals

The quickest and easiest way to deposit funds to GKPro or GKFX account is to use a credit/debit card or E-wallet card, or a Bank transfer if you can wait up to 5 Business days.

Minimum deposit

For card payments there is a minimum deposit of 20 GBP/EUR/USD, while Bank Transfer is set to a minimum of 50$.

GKFX minimum deposit vs other brokers

| GKFX | Most Other Brokers | |

| Minimum Deposit | $20 | $500 |

WIthdrawals

GkPro withdrawal options are Bank Wire and Cards, GKFX does not charge any withdrawal or deposit fees for any of the payment methods and accepting multiple currencies – USD, EUR, GBP. When you want to withdraw funds, the minimum amount for a withdrawal request is 50 GBP/EUR/USD, unless you are requesting your full balance.

Trading Platforms

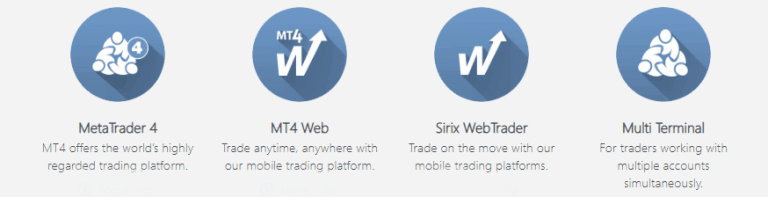

The main platform of the company through which customers can make transactions in the Forex market, is the popular full-featured trading platform MetaTrader4. MT4 indeed is the leading global trading platform among the clients of different experience level, however exciting part from GKFX GKPro is that they are the only broker that provided MT4 platform for spread betting.

With the modern way of living and for the traders benefit, the mobile apps and WebTrader online platform offer great flexibility to the clients’ on-move. Another great advantage is GKFX Multi Terminal, which is an additional component with the feature to manage up to 100 MT4 accounts and is a solution for traders working with many accounts simultaneously.

Web Platform

There is also Sirix WebTrader, based on MT4 desktop platform solution, but with the added flexibility of platform access from any web-enabled PC. When using the Sirix WebTrader, you have the option to trade using one-click trading, seamless social trading, black and white in HTML 5, and advanced Charting.

Numerous useful tools will also make your trading life with analyses and every day monitoring easier through MarketInsights (ensuring latest forex news up to date), Economical Calendar, Tradeworks (trade automation), Autochartist, Trading Central, VPS, MT4 Booster (toolkit with new way viewing trades), Recognia (expert analyst views and insights) and much more.

Conclusion

Overall GKFX or GKPro has a strong technological background, while all platforms demonstrate great trade execution and allow all trading styles. Micro Lots, low spreads, and 0$ minimum deposit are very attractive to the new traders too, in turn, experienced traders can find an array of useful tools and reliability.