GMG Markets Review (2026)

What is GMG Markets?

Global Markets Global or GMG Markets offers a multitude of globally traded financial products, through its enabled STP model while all spreads and commission are the competitive cost involved in trading across multiple asset classes. Currently, GMG is one of the fastest growing brokers worldwide with the range of clients based in Europe, Asia, South America, Africa and Australia, with headquarters in London, UK.

Trading Instruments

So apart from its technological solution, GMG markets offer wide trading instruments range including FX, Indices, Gold, Silver, Energies, Treasuries while all can be accessed via one platform available on multi-devices.

However, one of the important in trading issues is support of traders thus the company delivers unparalleled customer support service with its over 20 year’s industry experience as well as supports a company’s growing reputation. So you are supported by the phones or Live Chats at your convenience along with the free educational resources available to everyone enhanced by one on one trading capability.

Is GMG Markets safe or a scam?

Being a UK based broker, the GMG Markets is a fully authorized and licensed by the FCA (Financial Conduct Authority) broker that enables a company to deliver a transparent and secure trading environment. As one of the most respected industry authorities, the obtaining of the license involves vast or rules and standards to be followed with an aim to protect clients and investors at any possible mean. Combining strict security with technological solutions that provides what is important to the trader – trading.

Fund protection delivered with segregated accounts held at Tier One banks, commitment to keep the money safe and operate under the European regulations along with the capital adequacy requirements. In the unlikely event of default, client funds are protected by FSCS while the GMG is solely an intermediary between the client, liquidity providers and exchanges.

Trading Platforms

The industry proven technology MetaTrader4 represents a GMG Markets company mainstay, which brings a possibility to various trading strategies to be performed. In addition, there is an option to trade through its newer version MetaTrader5, while the STP execution model performs access to the liquidity providers through low latency servers and no requotes policy.

Moreover, you will get access to trade at any suitable device either by using a desktop, web, smartphone or tablet versions with the multiple cutting-edge platforms cater to the needs and lifestyle of each individual trader.

In addition, there are numerous possibilities to enhance your trading, alike in order not to never miss a market move again you may use the GMG MetaTrader 4 app on Apple iOS, Android, Blackberry or Windows mobile phones.

Furthermore, the company offers Fund Managers and Corporate investors to diversify their portfolio by PAMM and MAM Software system. As well FIX API is plugging the price feed into a third party GUI that utilizes special order types or accessing up-to-date rates.

Accounts

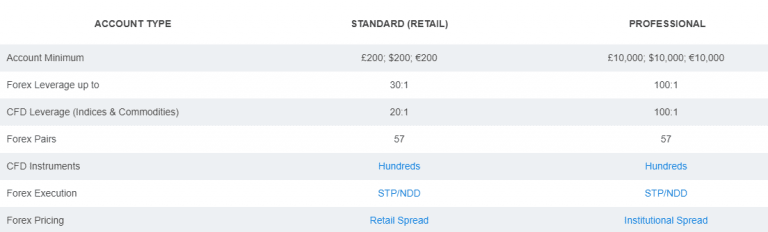

GMG Markets due to their diversified trading offering, designed also different account types catering to all types of traders, novices or the experienced ones. The standard account is ideal for a smaller account offering all trading costs within the spread. Or the Pro Account that offers ECN style trading low commission forex pricing with interbank wholesale rates but with commission per trade.

Fees

The trading costs represent flexible tiered commission rates based on volume with the price competition from liquidity providers at the Top of Book. Yet, while the trading costs vary from the trade to another due to its variable spread nature, the typical Standard Account features spread for EUR/USD of 1.1 pips, and Pro Account delivers spreads for EUR/USD 0.1 pips.

For more Standards GMG Markets spread see table below, as well compare its fees to another popular broker FP Markets.

Leverage

As for the leverage levels, GMG Markets offers leverage according to the regulatory restriction it complies with, as well as defined by your personal professional level. Therefore, retail traders may use a maximum of 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities. While the professional ones, may apply for leverage up to 1:400.

Payment Methods

The payment options include the most common, as well the safest ways to transfer the money, which is the Credit and Debit Cards or the Bank Wire transfer.

minimum deposit

The Standard account requires only 200$ as an initial deposit at the beginning, while the Pro Account maintenance should be at least 10,000$.

withdrawal fee

Typically, there are no charges from the company towards deposits or withdrawals, however, you should double check with the payment provider in case any applicable fees for the transactions will be added on.

Conclusion

Overall, the GMG Markets Review is about a highly secured, regulated UK company that delivers vast investment opportunities to all types of investors retail, corporate, novice or experienced traders with its enabled STP model of execution.

The broker offers advanced trading options through its diversified trading instruments portfolio, a choice between the platforms MT4 or MT5 and the trading account along with the dedicated support from the company. Therefore, there is a possibility to the trader of any strategy and size to engage in trading while developing its trading skills with the provided support.

Even though, we would be glad to hear your personal opinion about GMG Markets, as you may add your comment below or ask for additional info.

Update on GMG Markets

Currently the website is not available and there is no clear evidence whether broker provides its trading service or no. Therefore, we strongly recommend readers double check any proposals appearing under the name GMG Markets or similar.