GMI Review (2026)

Regulator

What is GMI?

Global Market Index or GMI is one of the known online leveraged Forex trading providers, that was established in Shanghai and then due to expansion opened several representative offices within China, also in Auckland and enabled office in the financial hub – London.

The company profile is determined as a technology driven brokerage solution along with transparent pricing, cutting-edge systems, multiple customer support and numerous proposals of software. The product offering states a pure ECN, STP connection that brings direct, light-fast connectivity to multiple top-tier liquidity providers with deep liquidity and tailor-made trading solutions.

GMI Pros and Cons

GMI is a reliable broker with good quality trading proposal including Institutions and Money managers. There is great selection between trading platform, MT5 bridges, technology and tool available at GMI. There are various options to deposit or withdraw funds.

On the negative side there is no 24/7 support, and education is rather basic.

10 Points Summary

| 🏢 Headquarters | Shanghai |

| 🗺️ Regulation and License | FCA, SFC |

| 📉 Instruments | FX, Indices, Cryptocurrencies, CFDs for Crude Oils, Metals and Indices |

| 🖥 Platforms | MT4, Alpine Trader, ClearPro, MTF, Currenex |

| 💰 EUR/USD Spread | 1 pip |

| 💰 Base currencies | USD, EUR, GBP, AUD |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 2,000$ |

| 📚 Education | Education, Analysis, research |

| ☎ Customer Support | 24/5 |

Awards

Apart from the retail traders offering, the GMI brings an advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional Trader, Money Managers, White Label and APIs via FIX connectivity network.

Indeed, it is obvious that the main pro of GMI is a technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

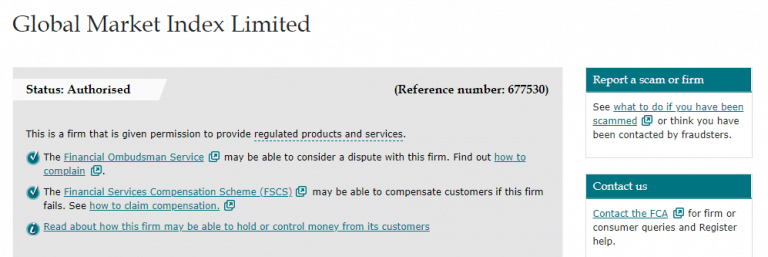

Is GMI safe or a scam

GMI is not a scam, but a regulated broker with top-tier authorization from FCA.

GMI Group of companies includes the firms and entities that are registered in several jurisdictions while using the shortcut-trading name of Global Market Index Limited. GMIUK is a trading name of the Global Market Index that is based in London and authorized by the Financial Conduct Authority.

Other brands including GMINZ a trading name of the company registered in New Zealand, the GMIVN is a company registered in Vanuatu, and the GMI Limited is registered in Hong Kong.

While the broker is regulated by one of the most reputable world authority UK’s FCA, the traders can keep peace in mind, knowing the broker is fully compliant in regards to the operations and how it manages traders. Furthermore, the client’s funds are secured at all times, kept in leading Banks segregated accounts and protected by the compensation schemes in case of insolvency.

Trading Instruments

Moreover, the GMI’s multi-platforms performing ultra low latency and FIX API connectivity, while the range of trading instruments including FX, Indices, Cryptocurrencies, CFDs for Crude Oils, Metals and Indices. Forex trading including vast of currency pairs that also contain some specials as FX Minors, which gives an opportunity to gain flexibility by matching strategy for both long and short positions with high investments potential.

Leverage

Leverage levels offered by GMI of course depending on the regulatory requirements and the entity of GMI you are trading with. This happens due to various safety measures each authority applies in order to eliminate the risks, specifically for retail traders.

- Therefore, trading with a UK brokerage the set of rules established by the European ESMA and allows only lower leverage levels of up to 1:30 for Forex instruments, 1:20 for minor currency pairs and even 1:10 for Commodities.

However, if you open an account with Hong Kong or Vanuatu entities levels are jumping to the high leverage up to 1:200 or even 1:300, yet check carefully with customer support under which regulation you particularly will fall.

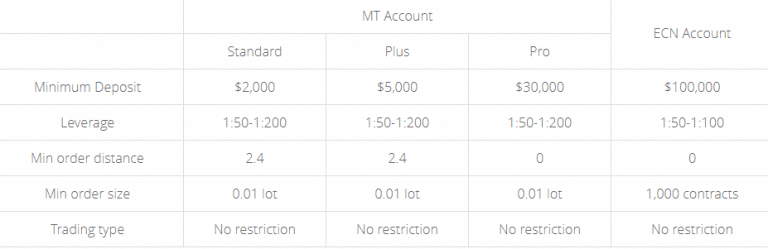

Account types

There are 4 account types designed by GMI, while three of them are MT4 Accounts with STP connection, and the last one is offering ECN bridging technology. The trading accounts were designed through ultra customizable mode, while you may choose between flexible leverage and trading size along with ultra-tight floating spreads and rapid connectivity to the market.

Each of the accounts diverse by the initial deposit, and trading size accordingly allowing to choose the best suitable version along with more competitive pricing built into the spread only or with interbank spread and commission per order.

Fees

GMI apply different costs applied according to the trading account and the volumes you operate. There are option for spread only or commission basis in addition to tailored solutions for traders of bigger size. Also, consider additional fees like funding fees or inactivity.

| Fees | GMI Fees | XM Fees | BCR Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

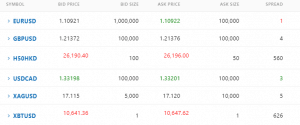

Spread

GMI spread considered to be the lowest spread offering among the market based on our research, see below comparison on some popular instruments, as well compare fees to another popular broker TMGM. And the last, always consider rollover or overnight fee as a cost, which is about -2% for short positions held longer than a day.

| Asset | GMI Spread | XM Spread | BCR Spread |

|---|---|---|---|

| EUR USD Spread | 1 pips | 1.6 pips | 1.6 pips |

| Crude Oil WTI Spread | 5 | 5 | 4 |

| BTC Spread | 626 pips | 60 | 45 |

Deposits and Withdrawals

In order to start Live trading, of course, you should deposit an initial balance requirement, which is set at different levels according to the account type you chose. Transfer options including various payment methods alike Credit and Debit Cards, Bank Transfers and e-payment Skrill.

Minimum deposit

The GMI minimum deposit amount starts at 2,000$, which is quite high for beginning traders, but a reasonable amount for professional ones. Actually, due to super developed technology of GMI this broker is considered a choice for professionals or active traders.

GMI minimum deposit vs other brokers

| GMI | Most Other Brokers | |

| Minimum Deposit | $2,000 | $500 |

Withdrawal

GMI does not charge any additional fees for deposits or withdrawals, however the payment provider may treat the deposits as a cash advance hence will add extra fees, which require your check on the issue.

Trading Platforms

As the technology driven executions require a sophisticated tool, the GMI provides traders with a choice of 5 platforms. They are divided by connection type while STP supports GMI MT4 and GMI Alpine Trader platforms, and ECN connection performed via GMI ClearPro, GMI MTF, GMI Currenex.

Desktop platform

– GMI MT4 allowing great stability and is the most popular retail world platform. In addition to its powerful chart features and enabled EA trading, the GMI enhanced it by VPS hosting and collocation configuration for smart order routing.

– GMI Alpine Trader is an intuitive interface platform with the ability to trade in fixed dollar amounts with OCO orders and server based trailing stops pip-by-pip. However, this platform is no available for GMIUK clients.

– GMI ClearPro is an institutional platform with VWAP (Value Weighted Average Pricing) that allows choosing order size, with the interbank daily settlement and one-click order reversal.

– GMI MTF is designed for the ECN venue for multiple asset classes and flexible connectivity, also enhanced by ultra-high order acceptance rate and low latency with no rejections.

– GMI Currenex is an automatic matchmaking system with a wide selection of order types, ESP quote system and deep liquidity pool. Yet, the platform is not available for GMIUK clients.

Conclusion

Overall the Global Market Index or GMI Review concludes well regulated firm, which serves offices in the world leading financial centers and offering transparent conditions through the technological connectivity. Yet, there are some Cons which are first of all lack of information on the website, no educational support along with a quite high deposit to start, which is 2,000$. However, what is pleasant at GMI very widely diverse platforms offering, which brings numerous solution to almost any demanding trader, beginner or the experienced one, institutional or retail.