Hirose Financial Review (2026)

Regulator

What is Hirose Financial?

Hirose Financial UK is a trading company established as an enhancement of FX services of Hirose Tusyo Japan incorporated in 2004 the company considered as one of the biggest, and multiple awarded OTC brokers in Japan. The UK operations started back in 2010, while additionally, the Global group serves service offices in Hong Kong and Malaysia to cover the customers’ demand.

The Hirose group serving over 200,000 clients worldwide while mainstays on trading stability enhanced by technology with NDD execution and leading industry platforms MT4 and LION Trader (ActTrader) to trade Forex instruments, mainly currencies.

The broker executes orders through 15 liquidity providers that are fed into an aggregator, while the charge is incorporated into the variable spread without any commission charges making it a convenient option.

10 Points Summary

| 🏢 Headquarters | Japan, UK |

| 🗺️ Regulation and License | FCA, IBFC, JFSA |

| 📉 Instruments | Currencies, Commodities |

| 🖥 Platforms | MT4, LION Trader |

| 💰 Costs | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, EUR, USD etc |

| 💳 Minimum deposit | 20 $ |

| 📚 Education | Trading manuals, essential trading components, technical analysis overviews, economic indicators |

| ☎ Customer Support | 24/7 |

Is Hirose Financial safe or a scam?

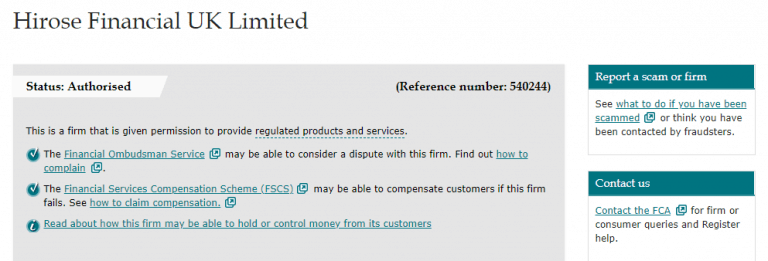

Hirose Financial is a multi-regulated broker, which holding licenses from each jurisdiction it serves office and offers its trading services making it a reliable company following strict guidelines.

These licenses include respective regulation from the Ministry of Finance in Japan, its Malaysia entity Hirose Financial MY Ltd authorized by Labuan FSA, while the UK branch is regulated by the UK’s reputable authority FCA.

Thus, Hirose considered a safe broker, as among the top priorities of any authorized companies is the safety of client’s funds along with the protected operational standards.

Along with the operational standards and requirements to operate trading service, Hirose maintains safety measures towards client funds, while money are always kept at bank trust segregated accounts. Together with that, each regulation support traders by slightly different means and either involving regulatory procedures on how to treat the client or which measures to follow.

Thus, trading with the UK branch every client is covered by the Financial Services Compensation Scheme (FSCS), which secures the client in case of the company insolvency up to £50,000.

Leverage

While trading with Hirose Financial you are offered to use the leverage that may magnify your profits, due to its possibility on the increase of trading size you operate. However, together with its unique opportunities, leverage increases risks too that’s why it is very important to use it smartly. With this regard, regulatory obligations and restrictions, as of Hirose Financial is the UK regulated broker, mandates lower leverage levels towards retail traders.

Therefore, the maximum leverage for retail traders is set to a maximum of 1:30 for Major Currency pairs and 1:10 for Commodities. However, professional traders may apply for higher leverage up to 1:100 for Forex instruments, as well as leverage levels may be higher while trading with another Hirose entity since regulatory restriction depends from the jurisdiction to another.

Account Types

The account types respectively also ranged between the provided platforms only, while the corporate client may discuss tailored trading conditions. Hirose Financial didn’t place a minimum deposit requirement on any of the accounts, thus the beginning traders or professional ones can join trading with ease and convenience. Furthermore, there is availability to trade in micro lots, which is another great feature for novices.

Fees

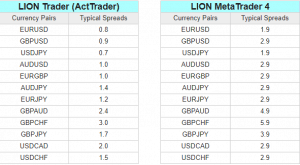

Hirose Financial costs are built into a competitive spread that varies according to the account type or platform, while broker consistently stays at a tight and low spreads strategy with no hidden costs.

The typical spread for EUR/USD pair is 0.3 pips and commodities trade presented with low margins of 0.5%. The Standard Account and Pro Account costs are all built into a variable spread, while Prime Account offers lower spread but with commission per trade.

Spreads

Hirose Financial spread are indeed very smartly built, you may see a comparison of typical spreads below, as well check out another broker BDSwiss.

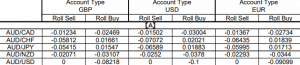

Trading Swaps

In addition, you should always consider rollover, swap or overnight fee as a trading cost. Rollover Financing is the interest paid or earned for holding opened position overnight. Every currency pair or instrument has its own rates, which also vary by the trading platform you use. The rollover rates may be checked in the platform, as well as online through Hirose Financial website, yet see a sample of Hirose rollover below.

Payment Methods

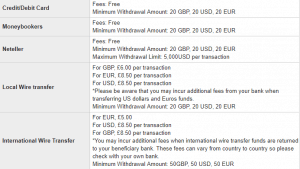

Hirose Financial offers a number of simple ways to fund your trading account and withdraw funds with convenience and relative ease. Payments can be made in GBP, EUR, and USD, while funding methods including Credit/Debit Cards, Skrill or Neteller transfers, as well as Bank Wire Transfers.

Minimum deposit

Hirose Financial minimum deposit ranges from 20-50$ with no strict requirement while all fees are covered by Hirose. Credit/debit card payment may not be available in some countries, and card type availability will change from country to country.

Hirose Financial minimum deposit vs other brokers

| Hirose Financial | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawals

Hirose Withdrawals are processed via online form request and eligible to be returned to the source from which the initial deposit was done. Typically there are no fee charges for the transaction of withdrawal, yet local or international wire transfer may require an additional processing fee, around 10$.

However, always not that in some circumstances other organizations charge the company for facilitating payments and withdrawals, so then this charge will pass on as an administration fee to the client.

Trading Platforms

Hirose offers the choice between two market-leading platforms MetaTrader4 and based on ActTrader LION Trader that in addition were enhanced with unique specification including trading hours, order types, margin call info and PC tools.

And of course, being a t2chnological broker, Hirose trading execution stands at the highest level, while orders processed through Japan cluster Technology that expands nodes.

Getting to more details, LION Trader offers the selection of download, web and mobile versions with allowance to use any trading strategy and a range of risk management orders Stop, Limit, OCO, trailing stop, etc.

The platform is simple and good for traders from beginners to veterans allows trading with 1 click and provides the most powerful indicators. This platform is good for scalpers and hedging too, with access to 50 currency pairs with the most convenient and good cost conditions and in addition, there is the potential to use Expert Advisors through Actfx language.

Desktop platform

While MT4 does not require too much introduction, apart from its advanced charting features and indicators that are fully customized, MT4 support most progressive area for automatic trading through MQL4 language and thousands of EAs to choose from.

Trading instruments including 46 currency pairs through margin from 0.33% and typical spread from 1.9 pips. There are also few versions of MT4 accessible by PC or Mobile, which allows to trade on the go and to manage Forex position easily.

Customer Support

The traders of any level can find their benefits and necessary tools at Hirose Financial. Educational Materials presenting the range of tools to choose from and including trading manuals, essential trading components, technical analysis overviews along with economic indicators and Demo accounts to improve skills. And of course, there is a multilingual customer service support working 24 hours.

Conclusion

Hirose Financial Review presents a subsidiary company established on Japan expertise and success, which offers financial investment services with market execution and a range of leading competitive offerings. The pleasant conditions are featured for the beginning traders since there is no minimum deposit requirement, along with a great choice between platforms, education and a simple costs system with all charges included in the spread. Yet, the professional traders will find their benefits also, due to the transparent operational policy and comprehensive tech proposals, with one of the most competitive trading costs.