House of Borse Review (2026)

What is House of Borse?

House of Borse is the UK established brokerage firm that operates since 2001 and became a known company for its excellent service they offer together with high goals it preserves towards client interest.

House of Borse proposal was specifically designed and suited for Professional and Corporate clients needs, as the company gives an opportunity to access Tier 1 Banks and institutional liquidity through ECN connectivity.

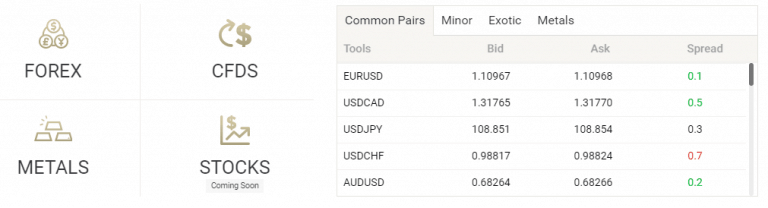

With the possibility to trade a wide range of instruments alike Forex, CFDs and metal commodities, House of Borse accompanies all with tight spreads and highest regulatory standards so than the trading becoming a reliable option.

House of Borse Pros and Cons

House of Borse account opening is fully digital, there are various deposit methods, ECN trading environment, commission based fees considered low, good research and platform selection.

For negative side, House of Borse might suit advanced traders better, there is no proper education and 24/7 support.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | Forex, Metals, CFDs, Stocks |

| 🖥 Platforms | MT4, MT5 |

| 💰 Costs | 0.1 pip + 4$ per 100k$ traded |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 5,000 US$ |

| 💰 Base currencies | EUR, USD, GBP |

| 📚 Education | Education and research |

| ☎ Customer Support | 24/5 |

In addition, House of Borse gives a clear advantage over the competition as they develop a presence in the UK and the Middle East by growing innovations and control over the Professional trading account they serve. House of Borse indeed passed through a hard time of deleverages, crises and so, yet managed to hold strong positions in industry which proves again its viable trading way.

Is House of Borse safe or a scam

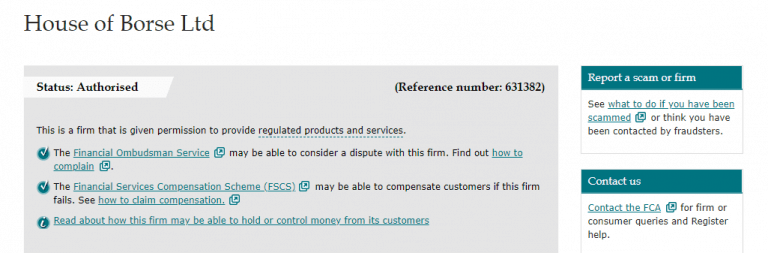

No, House of Borse is not a scam it a reliabile broker with top-tier regulation and low-risk ECN trading environment.

Yet, in case of House of Borse you can rest assured broker is fully legit and licensed brokerage house operating under reputable FCA license. Read more Why Trade with FCA Brokers.

Being an FCA regulated firm eventually means a lot, as the broker complies to strict standards of operation with high capitalization and sharp safety measures.

In addition, FCA constantly oversees and audit each position House of Borse made in reverse ensuring your safety. Clients’ funds are always segregated or separated from the company money and held in top Tier Banks. Lastly, in the case of company insolvency FSCS, which is a compensation fund will cover clients’ claims.

Leverage

As for the leverage levels, House of Borse allows this opportunity as well, which makes your operating position multiplied by a defined number of times in reverse bringing bigger exposure to the markets.

- House of Borse being however, a regulated UK broker obliges to necessary risk measures and allows a maximum of 1:30 for retail traders and up to 1:100 for professionals once the status it proved.

Account types

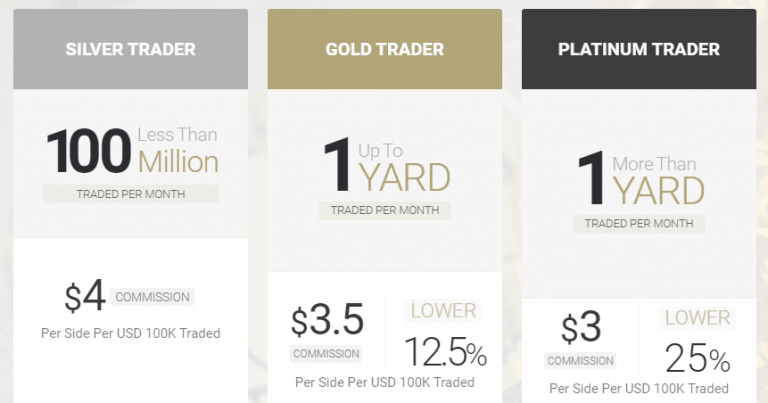

The account types at House of Borse depending on the volumes traded, as likely each of them rewards better trading costs that are built into commission charges.

Fees

House of Borse fees are built into a commission charge, there is no spread basis accounts, in addition check full fees like applicable platform fee or funding fees.

| Fees | House of Borse Fee | Interactive Brokers Fee | Dukascopy Fee |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Comission based fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

House of Borse spread

By providing an ECN connectivity to markets and quotes House of Borse offers variable interbank spread from 0 pips plus the commission charges as per account you trading through. The commission is charged per $100k traded, you may see table above with applicable charges as per account, which is $4 for a Silver Trader type.

You may see also examples of the spread below, besides compare House of Borse fees for your better knowledge to another broker Eightcap.

House of Borse rollover

Lastly, always consider rollover or overnight fee as a cost, which is charged daily in case the position is held longer than a day. Each instrument defines different ratio and may act either in your favor as a refund or will be deducted as a fee.

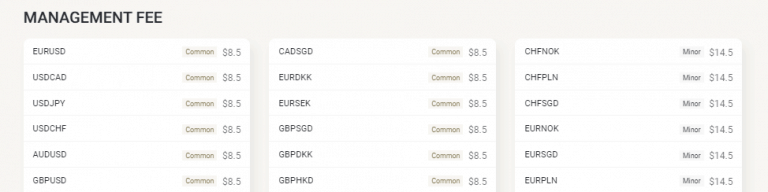

However, House of Borse offers interest-free accounts known as a Swap-free account where a fixed management fee is charged on the open position, see the example below.

Funding Methods

So once you decide already to open an account with House of Borse next step is to deposit money while you may send funds either through Bank Wire Transfer or by Credit Card.

House of Borse minimum deposit

House of Borse requires 5,000$ as minimum deposit. In respect that House of Borse designed its proposal for professional and corporate clients, the opportunity to trade through its robust technology seems to be a reasonable amount to start.

House of Borse minimum deposit vs other brokers

| House of Borse | Most Other Brokers | |

| Minimum Deposit | $5,000 | $500 |

Withdrawal fee

House of Borse does not charge any fees for deposits or withdrawals, however payment provider fees are passed to the client respectively. Withdrawal options are Bank Wire, Cards and e-wallets, depending on your Card Type and its issue country fees may vary which you may check through a member area. Likewise, incoming bank fees while sending or withdrawing money through Wire Transfer will be charged on you.

House of Borse Trading Platform

House of Borse together with its powerful trading technology decided to a mainstay on the proven industry standard MetaTrader4. The platform offers a customer-friendly interface that enables all range of instruments to be available from a single interface powered with comprehensive tools and analysis features.

Nevertheless, House of Borse constantly develops its programs and listens to the traders’ need, therefore added an option to trade through the next version MetaTrader5.

MT5 is also a highly customizable trading platform with improved trading performance and even better charting and analysis toolbar.

Desktop trading

What is truly great with MetaTrader is its possibility to manage positions quickly and efficiently, together with option use to Expert Advisors (EAs) with the automatic placement of orders. Together with other numerous advantages MT4 and MT5 are known for that made them as a proven professional software used by successful traders around the world.

MetaTrader also available on the iPhone, iPad and android devices with no charge, and of course suitable for all kinds of devices alike PC, MAC, etc. Moreover, the House of Borse supports PAMM systems, with a special set of trading performance specifically designed for professional needs.

Conclusion

So we conclude the House of Borse as an attractive opportunity for trading in case you are a professional or a corporate client. As beginning traders or those of smaller size may be stuck with a quite high minimum deposit and obviously general House of Borse proposal is designed with specified trading conditions suitable for bigger size traders. What is also important, House of Borse is a broker that you can trust due to its regulations from reputable FCA and reputation they gained.