IC Markets Review (2026)

Regulator

What is IC Markets?

The company was incorporated in Sydney, Australia in 2007 by a team of financial professionals who aimed to bridge the gap between retail and institutional clients offering trading solutions. Recently, the broker grows to one of the leading trading providers in Australia and also expand beyond as serves international and European entity, also establish a Chinese Support centre and proposes truly competitive trading conditions.

IC Markets Pros and Cons

IC Markets is a broker with good reputation, great selection between platform including MT4, MT5 and cTrader platform, education provided for free and 24/7 customer support. There is a selection between spread basis and raw spread accounts also various instruments are available.

On the flip, proposal vary according to the entity and is larger via offshore entity, we found some spreads higher than average.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, CySEC |

| 🖥 Platforms | cTrader, MT4, MT5 |

| 📉 Instruments | FX, Equities, Commodities, Futures CFDS, Stocks and Bonds, Crypto trade |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 200 US$ |

| 💰 EUR/USD Spread | 1 pip |

| 💰 Base currencies | 10 currencies offered |

| 📚 Education | Included on a free basis |

| ☎ Customer Support | 24/7 |

What type of broker is IC Markets?

IC Markets is an ECN trading environment provider that brings true spreads from 0.0 pips from the liquidity suppliers from over 50 different banks and dark pool liquidity sources across 60 forex pairs. IC Markets is a choice for high volume traders, scalpers, EA traders and robots that can enjoy no dealing desk with no manipulation at the prices.

The execution brings speeds and low latency through fiber optic connects traders orders to the market by servers in the NY4 & LD5 IBX Equinix Data Center New York and London.

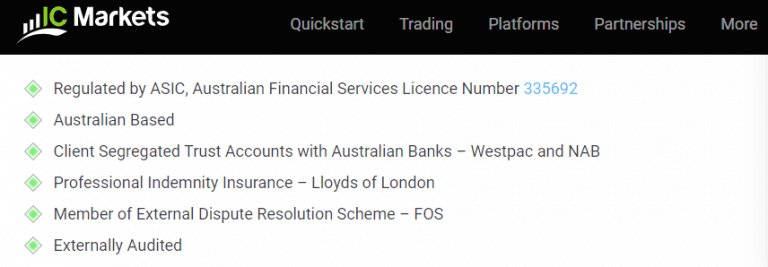

Is IC Markets safe or a scam

IC Markets considered being a safe broker, as the licensed and regulated trading companies are constantly overseen and audited by the external reputable authority.

Is IC Markets legal?

In the case of IC Markets, the broker is incorporated in Australia it does its service regarded by the Australian Securities and Investments Commission (ASIC) license (read more why trade with ASIC Brokers). In addition, IC Markets runs a regulated entity in Cyprus, therefore officially and legally operating trading service for European clients.

With a license and regulation from ASIC, which one of the strictest and most demanding financial regulators, IC Market traders can feel completely confident. The money protection provided through multiple regulated ways and includes the client money segregation while accounts accessed by the client only and used for the purpose of facilitating their own trading.

In addition, IC Markets is a member of the Financial Ombudsman Service (FOS), an approved Australian external dispute resolution scheme that fairly and independently resolves disputes between consumers and member financial services providers.

Leverage

IC Markets offering leverage up to 1:500 that opens the path to the forex market for Retail traders with a quite low or small initial deposit to cover margins. The use of leverage can magnify gains but you should always remember that losses can also exceed your initial deposit.

- Maximum of 1:500 available for Australian clients

- 1:30 allowed for European traders

- 1:500 for an international proposal

Leverage is known as a loan given by the broker to the trader to enable trading with a bigger capital and increase potential gains. However, we would recommend to any trader use tool smartly and read carefully how to set up correct leverage to a particular instrument or trading strategy, as also leverage defined by the IC Markets entity and particular jurisdiction regulations.

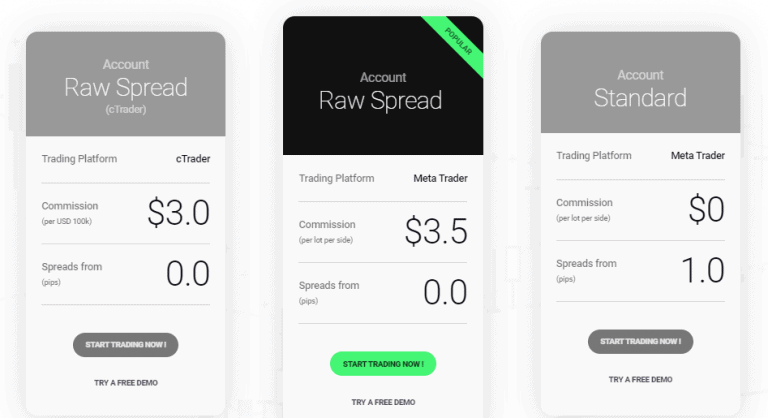

Account types

There are three main account types that are featuring the same compatibility and power provided by the company, yet are designed to meet the expectations and needs of different trading styles. Two first account offering raw spread condition and commission charge per trade also offering either MT4 platform of cTrader for your selection.

The accounts are available in multiple currencies, up to 10, are fully segregated from the company’s funds and supported by multi-lingual customer team. Additionally, traders that follow Sharia rules can sign for Swap free or Islamic account as an option at IC Markets too, along with risk-free demo account on both MT4 and cTrader that allows the practice of the trading strategy.

Fees

IC Markets offers different pricing defining trading fees on applicable accounts, as the fees slightly diverse based on the account type and platform you choose. Also, beware that various IC Markets entities in different jurisdictions may apply its own trading conditions, so be sure to check it out as well.

| Fees | IC Markets Fees | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

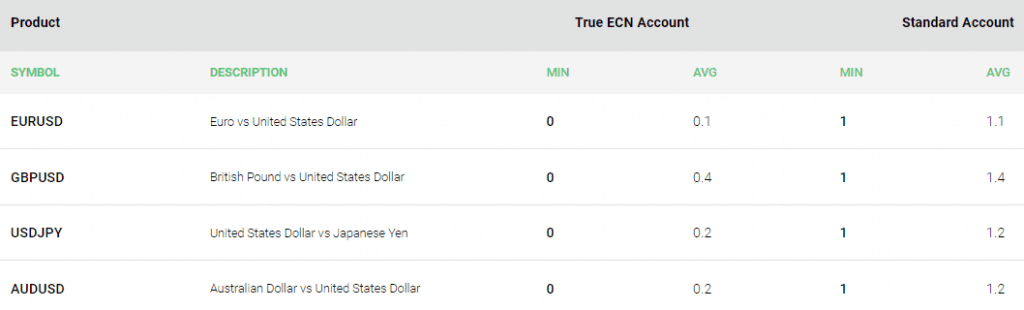

The Standard Account enabled through MetaTrader4 with CNS VPS Cross-Connect and spread only basis from 1.0 pips. While the True ECN account or Raw Account allows micro lot trading from 0.01 size, deep institutional grade liquidity, ECN spreads from 0 pips and commission of 3.50$ per 100k traded available at MT4 also.

Spreads on EURUSD averages at about 0.1 pips 24/5, which is as per the IC Markets expert advisors is currently the tightest average EURUSD spread globally.

cTrader ECN account offering approximately the same feature as MT4, but with the difference of the platform that is used by mainly professional traders of a bigger size. The applicable spread also starts at 0.0 pips and commission of 3.00$ per 100k traded that serves execution through Equinix LD5.

Trading Fees of IC Markets

Asset/ Pair

IC Markets Spread

AvaTrade Spread

eToro Spread

EUR USD Spread

1 pip

1.3 pip

3 pip

Crude Oil WTI Spread

5 pip

3 pip

5 pip

Gold Spread

1 point

40

45

Trading Fees of IC Markets

| Asset/ Pair | IC Markets Spread | AvaTrade Spread | eToro Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.3 pip | 3 pip |

| Crude Oil WTI Spread | 5 pip | 3 pip | 5 pip |

| Gold Spread | 1 point | 40 | 45 |

Overnight Fee

IC Markets overnight fee or a swap rate determined by the overnight interest rate differential between the two currencies involved in the pair and whether the position is a buy ‘long’ or sell ‘short’. The fee originally varies from the currency to another, but you should always bear in mind its existence that may bring you either negative or a plus to your account.

Here is a snapshot of IC Markets fees

Trading Instruments

The markets offer includes a range that suite demands of any trader and include the major instruments to trade, along with new additions alike Cryptocurrencies. The asset classes consist of FX, Equities, Commodities, Futures CFDS, Stocks and Bonds. The IC Markets Crypto trade offers trading pairs with Bitcoin, Ethereum, Dash, Litecoin, Bitcoin Cash and Ripple, and allows go long or short with leverage 1:5 margin of 20% and the minimum lot of 0.01.

Deposits and Withdrawals

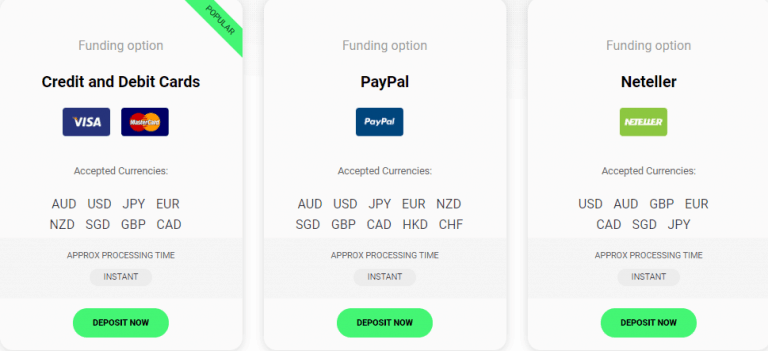

IC Markets offers 10 flexible funding options in 10 major base currencies AUD, GBP, JPY, HKD, SGD, NZD, CHF, CAD, EUR, USD. Which is great, since you may choose the suitable one for you and avoid extra conversion fees.

Deposit Options

From the client secure area, there is an ability to deposit or withdraw funds throughout

- Cards,

- PayPal,

- Bank Transfer including local ones,

- Neteller, Skrill, WebMoney, Qiwi,

- China UnionPay, FasaPay and more.

IC Markets minimum deposit

Minimum deposit for IC Markets is 200$ for Standard Account on MetaTrader4, along with other two account types available at IC Markets.

IC Markets minimum deposit vs other brokers

| IC Markets | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

IC Markets withdrawals allowing to use popular Bank Transfer, WebMoney, Cards and e-wallets, IC markets does not charge additional fees for deposits and apply 0$ fee for withdrawals. Yet, for International Bank Wire withdrawals, IC Markets pass the transfer fees charged by the company banking institution, which is approximately AUD20 that is deducted from the amount of your withdrawal.

How long does it take to withdraw money from IC Markets?

Various payment methods will process withdraw money in its defined time, while IC Markets accounting team confirms transactions quite quickly within 1-2 business days.

Trading Platforms

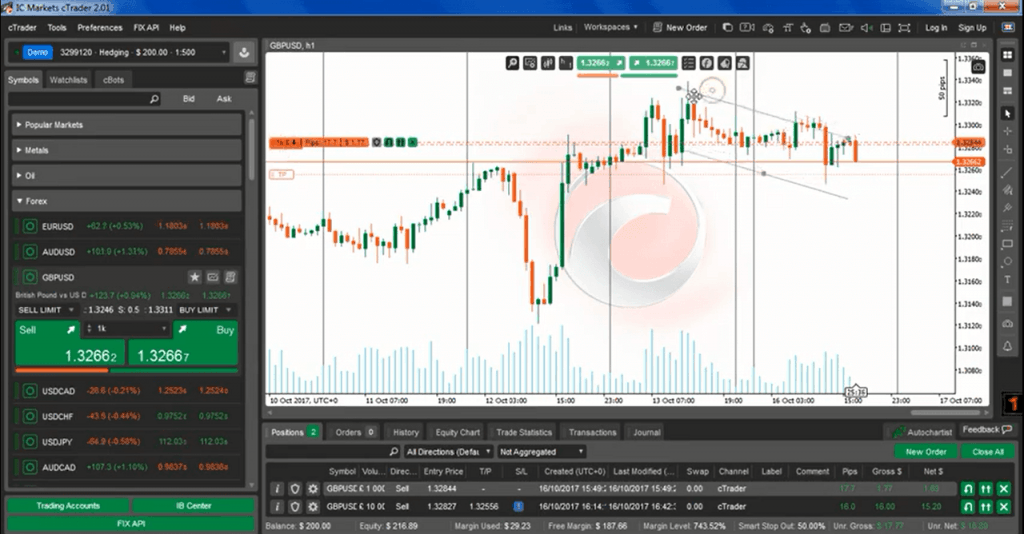

Apart from the sophisticated technical optimization of the execution provided by leading technologies, the IC Markets offers advanced software proposals too. MetaTrader 4 and cTrader are two of the best trading platforms available in the market today, hence IC Markets have both options in their direct access to provided ECN trading environment.

Nevertheless, you can still trade through MetaTrader5 an updated and improved version that is packed with brand new features if you prefer so.

| Pros | Cons |

|---|---|

| Mainstays on an industry known MT4 and MT5 | No proprietary platform |

| cTrader offered with raw spreads | |

| Customer friendly design | |

| Advanced range of tools | |

| Automated trading and PAMM capabilities | |

| No restrictions on strategies |

Desktop Platform

There is no need to talk long about the platform’s features, as all and each of them delivers powerful trading features. Each of the platforms available in different versions suitable for use either via Web Platform or directly from your browser or you can install Desktop version and enjoy full customization MetaTrader or cTrader offers.

Overall, IC Markets truly brings trading into the next level by comprehensive tools, additions and extensions to the platforms such as a one click trade module, market depth, spread monitor, trade risk calculator and advanced order types previously not available on MetaTrader 4.

Mobile Platform

Mobile Apps are also available and are very useful for modern traders stay updated with market conditions on the go. Likewise, MT4, MT5 and cTrader are available via Android or iOS devices, also permitting account management and control over the positions.

Auto Trading

In addition, Auto trading compatible with all broker’s platforms, EAs at MT4 or MT5 myfxbook at cTrader platform and as an addition, ZuluTrade is available too. ZuluTrade is one of the best social trading platforms that allow to choose among thousands of talented traders and to follow their trading signals for free.

Moreover, if you are willing to go into the partnership with the broker there is an offer by MAM and PAMM multi-account management systems that are flexible and easy to use tools. FIX API delivers a great opportunity for high volume traders, while VPS (Virtual Private Server) allows running a variety of automated trading strategies with a possibility to get free VPS use (if a required minimum volume of 15 round turn (FX) lots per calendar month is reached).

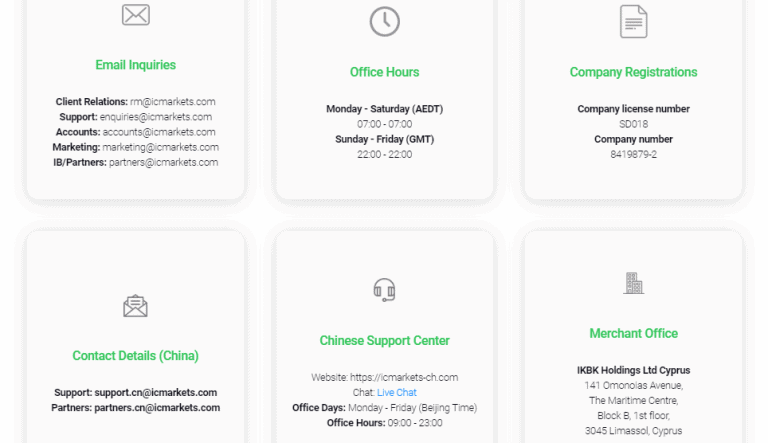

Customer Support

IC Markets strives to offer not only the best technological solutions but understanding the necessity of good quality customer service and support. The broker support available 24/7 and runs customer offices in various regions, so that all global is covered with IC Markets available to answer or assist teams.

Education

Eventually, IC Markets team has a significant amount of experience within the forex industry, hence understands what traders want and need exactly. Educational materials provided on a free basis and allows to obtain a clear vision of the topic through regular technical analysis reports, video tutorials, informational tools, webinars and more.

Research tools are available as well, including inbuilt numerous analysis tools inside platforms, as well as offering IC Markets designed Market Analysis Blog, Economic Calendar and trading ideas available through platforms.

Conclusion

In conclusion, the IC Markets brought a truly advanced trading offering, while you are able to choose from a wide range to tailor solutions to almost any trading parameter, which instrument to trade, a platform to use, account to open, to use auto trading or social trading, or even become a partner. Indeed, IC Markets technical optimization is among the strongest in terms of execution, platform optimization, the range of tools and provided support.

Reviews

Hi there I would like to open a real account with ic

Markets

They are a scam house. Close my position when I am winning more than 500k usd and took away all the money in my account.

Then you woke up right……..

Do you offer 1:500 leverage on retail accounts? I am experienced investor and a HNWI. I would open the account with €50000 in January rising to €100000 in February. I live in Spain and have professional advisers

Yes, IC Markets offers leverage up to 1:500 for Retail traders, BUT for the EU tarders the max leverage is only up to 1:30. You may check our list of the High Leverage Forex Brokers and maybe choose the one who would fit you.

Don’t create a account with this broker it’s really market maker and stolen only your money because hi trade against you really

They are a scam. They had an IT glitch took all my 12k gpb and refused to reimburse it stating it’s a risk you take in trading. AVOID ICMARKETS AT ALL COSTS!!!!