ICM Capital Review (2026)

Regulator

What is ICM Capital?

ICM Capital Limited is a London based broker, operates as a wholly owned subsidiary of ICM Holding SARL (Luxembourg). Additionally, support and operation offices have been established in Dubai and Shanghai.

The key features of the broker consist of wide product variety – OTC Spot Foreign Exchange, OTC Precious Metals, OTC US Stocks, OTC Energy Futures, OTC Index Futures, Cash CFDs.

Markets are accessible through one account offering with tight spreads (ECN Spreads starting from 0 pips), deep liquidity provided by the Tier-1 Bank, speedy no-requotes market execution with live Trading Central reports, and more.

ICM Capital Pros and Cons

ICM Capital is a reliable broker with ECN trading technology and good technical solitons. Spreads are low and average and there is good education section.

For the negative side, instruments are limited to CFDs and OTC assets.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 🖥 Platforms | MT4 |

| 📉 Instruments | OTC Spot Foreign Exchange, OTC Precious Metals, OTC US Stocks, OTC Energy Futures, OTC Index Futures, Cash CFDs |

| 💰 EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | GBP, USD, EUR |

| 📚 Education | All-inclusive education center designed for traders at all levels. |

| ☎ Customer Support | 24/5 |

Awards

Various international awards, have recognized the ICM Capital as a leading institution within the UK, as well in MENA regions and others.

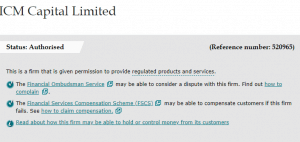

Is ICM Capital safe or a scam

No, ICM Capital is not a scam, it is a reliable regulated broker with top-tier license from FCA for low-risk Forex trading.

The ICM Capital is authorized and regulated by the Financial Conduct Authority (FCA), which regulates the financial services industry in the United Kingdom, with the aim to protect consumers and ensure the industry remains stable.

Being one of the most reputable and sharp authorities within the Financial industry, FCA status delivers security of funds provided to the clients under the Financial Services Compensation Scheme (FSCS) covering up to £50,000 in the event ICM Capital becomes insolvent. To go above, ICM enhanced this with additional protection up to £1,000,000 backed by substantial global capital and available to all live account clients with no additional cost.

Account types

ICM Capital release only one account type named – ICM Direct. The broker uses market execution while liquidity accumulated via major Tier 1 global banks. The broker also caters to those who want to practice their trading techniques, by providing an option of opening a risk free Demo Account.

In addition, ICM Capital offers Islamic accounts to clients following the Muslim faith. Forex Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against the Islamic faith.

Fees

ICM Capital fee structure is simple since based on a spread, also see below other fees to consider like funding or inactivity fee.

In a standard account feature, you should count on the rollover rates in case you hold a long position. For instance, the EURUSD long buying position will impose -7.86$ while selling will gain 2.68$ per lot.

| Fees | ICM Capital Spread | AxiTrader Spread | One Financial Markets Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

Spreads

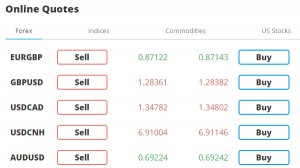

The Brokers keeps the spreads for all markets consistently lower among the offering, as historical data show that spread for EUR/USD during peak house averages at 1.3 pips. Comparison of typical spreads you can see below, as well see and compare ICM Capital fees with its peer Capital.com.

| Asset | ICM Capital Spread | AxiTrader Spread | One Financial Markets Spread |

|---|---|---|---|

| EUR USD Spread | 1.3 pip | 1.24 pip | 1 pip |

| Crude Oil WTI Spread | 4 | 5 | 3 |

| Gold Spread | 45 | 26.82 | 30 |

In addition, ICM Capital offers Islamic accounts to clients following the Muslim faith. Forex Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against the Islamic faith.

Therefore, in a standard account feature, you should count on the rollover rates in case you hold a long position. For instance, the EURUSD long buying position will impose -7.86$ while selling will gain 2.68$ per lot.

The broker also caters to those who want to practice their trading techniques, by providing an option of opening a risk free Demo Account.

Leverage

Being a UK based regulated broker ICM Capital follows strict guidelines set by the European authority ESMA. Eventually, a recent updates from the European regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

- clients of ICM Capital may use leverage up to 1:30 for Forex products, 1:5 for CFDs and 1:10 for Commodities.

Deposits and Withdrawals

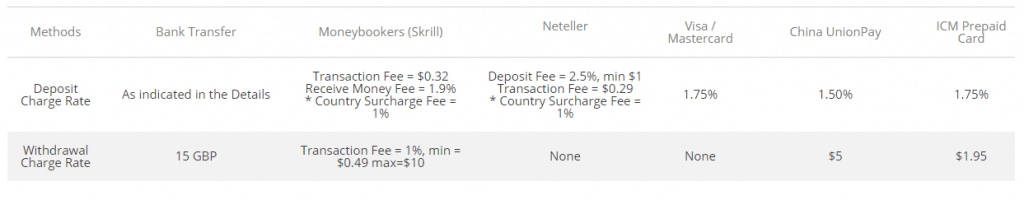

ICM Capital offers several ways to transfer funds for the clients’ convenience. The deposited money will be active in clients’ accounts within 24 hours, while traders can use bank transfer, card payments and range of e-wallets Neteller, Skrill, China UnionPay, etc.

Moreover, the ICM has launched a solution for easy funding – the own ICM Capital Mastercard (the card issued by Wirecard Card Solutions Ltd), that enables to transfer of funds of any trading profits from the client’s trading account easily. Clients can submit an online application for card issuance with one-time payment fee of 40$.

Minimum deposit

ICM Capital minimum deposit is 200$, which is an additional pleasant feature for various traders, which allows to start from an initially small amount.

ICM Capital minimum deposit vs other brokers

| ICM Capital | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawal

The withdrawal or deposit fee varies according to the payment method you choose. Yet, broker covers the transfer fees for deposits above 500$ in case of Bank transfers, while other methods fees vary, see the specification table below. Visa or Mastercard (will include a fee of 1.75% above), which are taxable by fees also. However, for the withdrawals company covers fee expenses for Visa and Neteller options.

Trading Platforms

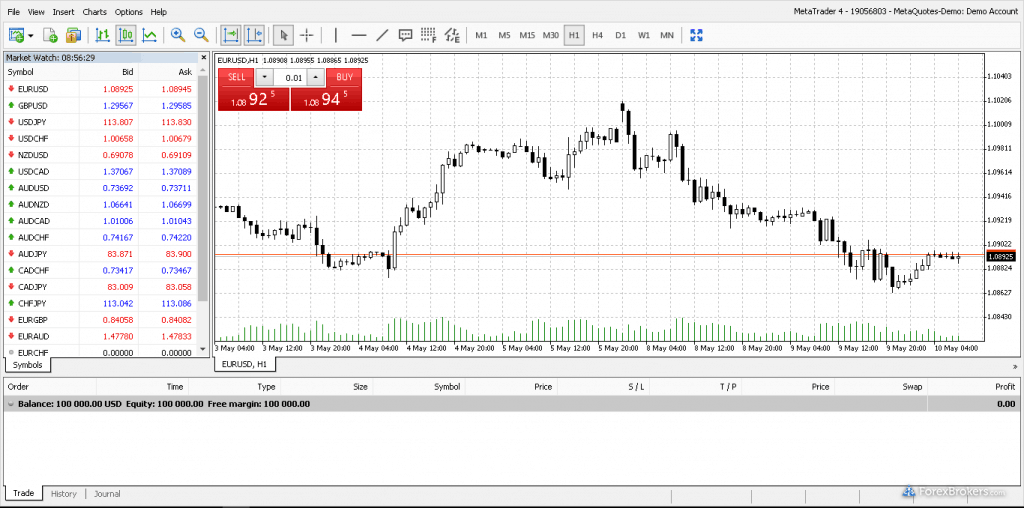

ICM Capital’s trading platforms have been selected according to importance within the industry offering and the most balanced trading parameters like speed, reliability and security. For that reason, clients of ICM Capital mainstays at popular MetaTrader4.

Desktop trading

It is a fact that MetaTrader 4 is a highly professional platform that not only allows you to actively trade, it also has powerful technical analysis, charting and modeling tools. Also, all clients can benefit from auto trading by the use of Expert advisor in the terminal.

Those programs are written in MetaQuotes Language 4 and allowing to analyze and trade in the automatic mode. MT4 is suited for all devices, the trader can access the trading environment by PC, Mac, mobile or tablet.

Withal, ICM Capital has chosen Trading Central’s technical analysis package for their product offering and provided free of charge for live account holders. Trading Central is a global benchmark provides daily market reports and covering technical analysis for Forex, Precious Metals and Oil.

Support

The support is provided by the company in multiple languages, via telephone, email and live chat is suitable for the beginner and the advanced traders and is an award-winning Customer Support service as well highly regarded by the clients. Furthermore, to assist in the fast growing retail Forex market, an all-inclusive education center designed for traders at all levels.

- Besides, the broker performs various contests and championships to let their traders improve skills and win valuable prizes.

- ICM Capital Limited, the British Forex, Commodities and CFD’s trading firm is an Official Sponsor of the England Polo Team at Chestertons Polo.

Conclusion

Overall, the major point is the company’s reliability and trustworthiness. As regulated by FCA, the broker maintains secure trading as well upholds additional insurance of $1 million coverage. Lastly, the account with the quite small deposit requirement of 200$ must be considered by the beginning traders, as well platform’s extended features support in the beginning too, ICM trading technology demonstrates great trade execution and allow all trading styles. For the Clients benefit, the company offers smart spreads calculation through ECN deep liquidity providers starting from 0 pips.