IFC Markets Review (2026)

Regulator

What is IFC Markets?

IFC Markets provides its trading services for more than a decade to over 165k+ clients through unlimited trading instruments and numerous opportunities. While IFC Markets is a part of IFCM group of companies that are involved in the development of the projects in the field of financial technologies with the requirements set by international legislation to provide financial services.

The trading proposal is mainly based on CFD trading also with a good range of trading instruments and platforms, which we will see further in detail in our IFC Markets Review.

Being, Cyprus established broker IFC Markets offering attractive and regulated proposal, yet international coverage is done through additional entities in BVI and Malaysia Labuan.

IFC Markets Pros and Cons

IFC Markets provides regulated CFDs trading, Great education through Academy, MT4 and MT5 platform and proprietary software, Fast account opening and free Demo account, Low costs and wide range of instruments.

For Cons, Support not available 24/7 Conditions may vary in particular entities and there is Deposit fee.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC, FSC |

| 🖥 Platforms | NetTradeX, MT4, MT5 |

| 📉 Instruments | 50 currency pairs, 400+ stocks CFDs, 19 commodity futures, 4 CFDs on ETF and Crypto Futures |

| 💰 EUR/USD Spread | 1.2 pips |

| 💰 Base currencies | Several currencies |

| 🎮 Demo Account | Included |

| 💳 Minimum deposit | 1$ |

| 📚 Education | Education Videos, Webinars and Analysis, Research tools |

| ☎ Customer Support | 24/5 |

Is IFC Markets safe or a scam

We consider IFC Markets as a safe broker with lower risk due to the regulation by the European authority CySEC which demands strict follow of rules as authorities enable and supervise the company to carry out investment business. However, the IFC Markets is a brand name used by the two established companies IFCMARKETS. CORP. incorporated in the British Virgin Islands under registration and license of the British Virgin Islands Financial Services Commission (BVI FSC).

Even though that the jurisdiction is offshore, which we always advise taking caution due to their lack of control over financial firms, IFC Markets incorporated additional entity the IFCM CYPRUS LIMITED a Cyprus Investment Firm registered under the regulation of the CySEC.

How are you protected

IFCM CYPRUS LIMITED as a CySEC broker is also a member of the ICF (Investor Compensation Fund) and complies with the European Commission’s MiFID, which authorized to provide investment services within EEA safely.

Generally, the customers’ safety enabled through various ways with funds segregation, participation in schemes, as well IFCMARKETS. CORP. holds Professional indemnity for Financial Institutions Insurance in AIG EUROPE LIMITED.

Leverage

Leverage is the tool by which you may trade a large amount of money, through its capability to magnify initial balance therefore money you operate. Yet the probability of profits or losses increases in parallel, which makes it important to learn how to use leverage smartly.

IFC leverage levels determined by the regulatory restrictions, as well as by your personal residence in the country or another. So be sure to verify applicable conditions according to your residence and other laws as well.

- Trading with European IFC Markets entity the maximum leverage level is set to 1:30 for Forex instruments,

- Trading with international branches may allow you to access to high leverage up to 1:300.

Account types

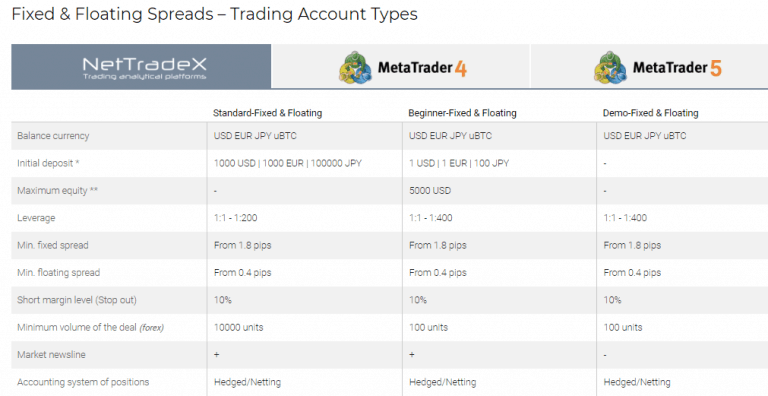

There are three account types Standard, Beginner and Demo account with balance currency USD, EUR, JPY and uBTC so easy transfers are available, either with fixed or floating spreads for each of the trading platforms. Higher grade account will bring better conditions as well as lowering maximum leverage to a 1:200 but requires deposits from 1,000$.

Besides to the real trading accounts, the IFCM allows free Demo account which operates with virtual funds and is intended for studying or the functional purpose to test strategies.

Also, you may get the VIP status and get flexible trading conditions, exclusive personal instruments, free access to a VPS, 0 commissions on deposits and withdrawals and much more.

Instruments

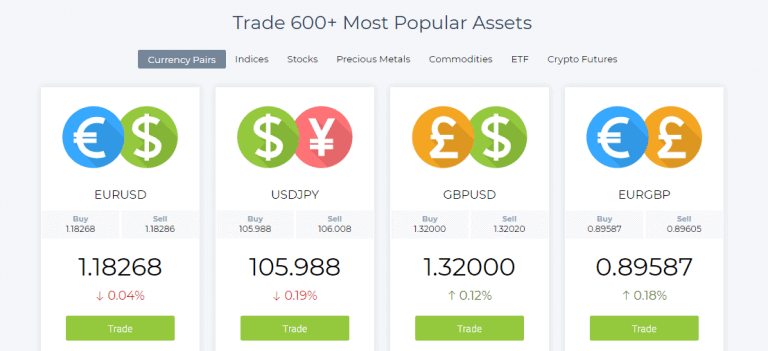

IFCM is an international Forex and CFD Broker giving an opportunity to trade 50 currency pairs with instant order execution, 400+ stocks CFDs with 100% dividend adjustment and up to 1:30 leverage, 19 commodity futures with no expiration, 4 CFDs on ETF Traded in NYSE and CFDs on Crypto Futures.

Fees

IFC Markets offers a pricing model and quotes themselves are provided from bank-liquidity providers that automatically transfer of clients’ orders to the interbank market.

| Fees | IFC Markets Fees | Fortrade Fees | FXPrimus Fees |

|---|---|---|---|

| Deposit Fee | Yes | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | High | Average |

Spreads

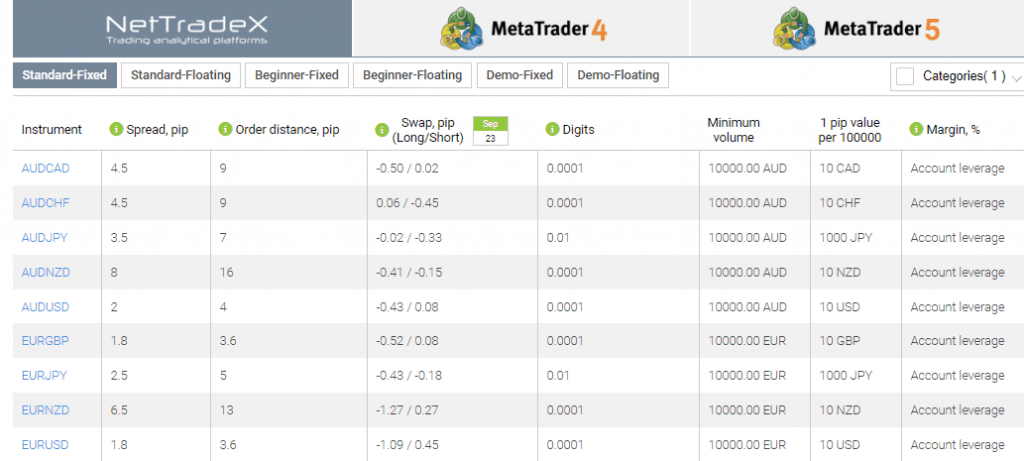

While all trading styles are welcomed at IFC Markets, the broker also offers a competitive trading strategy and spreads while you are able to choose either fixed and floating spread for CFD trading according to your need.

Therefore, the spread offering is depending on the account type you choose, as well as vary on each platform, refer to the table below and see fixed IFC Markets spread compared to other trading brokers, as well you may compare fees to another popular broker HotForex.

Trading Fees of IFC Markets vs Similar Trading Brokers

| Asset/ Pair | IFC Markets Spread | Fortrade Spread | FXPrimus Spread |

|---|---|---|---|

| EUR USD Spread | 1.2 pips | 2 pips | 1.7 pips |

| Crude Oil WTI Spread | 6 pips | 7 pips | 5 pips |

| Gold Spread | 80 pips | 45 | 26 |

Additional fees

Also, always consider rollover or overnight fee as a cost, charged on the positions held longer than a day and determined either you are selling or buying instruments. Quotes are charged or refunded by the specific measure defined on each instrument, as an example also refer to the table above.

In addition, clients belonging to the Islamic religion can open an Islamic Trading Account where Swaps are not calculated (Find swap free brokers by link).

Payment Methods

Deposit Options

The payment methods include a range of world leading payment providers, thus the IFCM supports Wire Transfers, Bank Cards, WebMoney, Skrill, Neteller, OKPAY, Unistream and transfers between own trading accounts.

What is the minimum deposit for IFC Markets?

The minimum IFC Markets account opening requirement is 1$ as a start for Beginning account based either on floating or fixed spread (Find the best fixed spread forex broker by the link) demand only. The deposit minimums are diversified by the funding option along with applicable commissions or without them.

IFC Markets minimum deposit vs other brokers

| IFC Markets | Most Other Brokers | |

| Minimum Deposit | $1 | $500 |

Withdrawals

IFC Markets made a promotion to cover fees for deposits or withdrawals. Yet, this is applicable to some IFC Markets withdrawal methods, which you should check with customer service as there are some differences between the countries of origin. Some deposits will also add on processing fees and other are offered for free for example Credit Card payment.

For the withdrawals, you can use the same methods along with applicable to the option commissions and minimum amounts that are allowed for transfer, which is defined by every provider. E.g. Card transfers minimum is 10$ with 2% + 7.50$ commission above, while CashU charges no fees.

Trading Platforms

The trading platforms range includes the popular choice of MetaTrader4 and MetaTrader5, as well as IFCM is the licensee for the usage of the new generation trading station NetTradeX.

| Pros | Cons |

|---|---|

| User friendly software | None |

| Available platforms MetaTrade 4 and 5 also proprietary NetTradeX | |

| Versions suitable for Web, Mobile and Desktop trading | |

| Fee Report | |

| Supporting numerous languages |

Desktop Platform

As most probably, market leaders MT4 or advanced MT5 does not require too much introduction, as platforms delivering a comprehensive feature to trade with numerous possibilities, automation of trading, and a MultiTerminal available too.

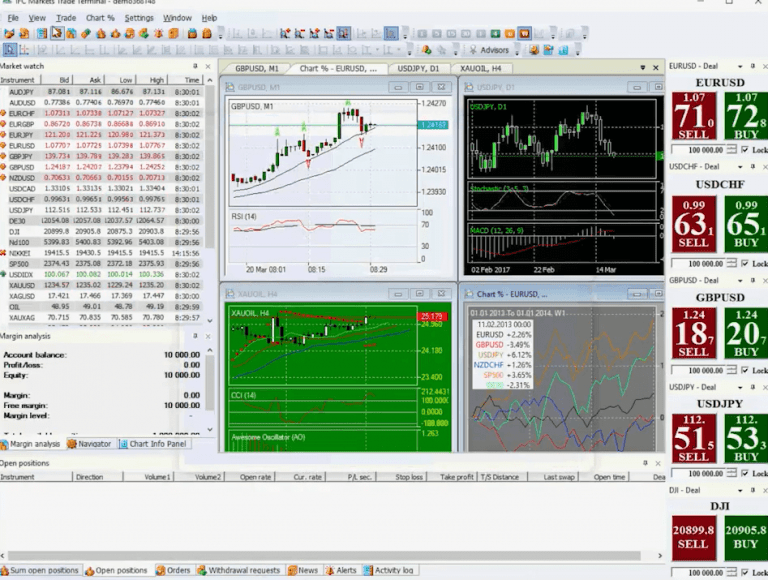

So other option is to use a NeTradeX that is advanced software which perfectly fits professional traders giving a possibility to trade with unique features of the GeWorko Method with the creation of own instruments, Portfolio Trading, etc. The instruments range including the standard ones along with synthetic instruments created by experts and availability to create own one.

The trading terminal apart from the common functions provides automated trading with Advisors and graphical interface for managing positions and orders, custom indicators and service utilities.

So you can operate either on the NetTradeX Advisors or simultaneously in both terminals as a primary and secondary one. The integrated language of NetTradeX Advisors complements the functionality of the main terminal, thus you can use manual mode or set up the algorithms with the specified code, which is indeed a fantastic opportunity to be considered.

Web Platform

Platforms available on Web version as well, yet feature less functionality and comprehensive tool rather than desktop does. Meanwhile, it is good for monitoring and basic trading strategies and definitely worth consideration as well.

Mobile trading Platform

Also, there is an option to use the platforms on various devices including mobile applications, iOS Android which is a great feature.

Customer Support

While the customer support offers 18 languages by the constant availability and multiple contact ways that are available through IFC Markets established entities.

Education

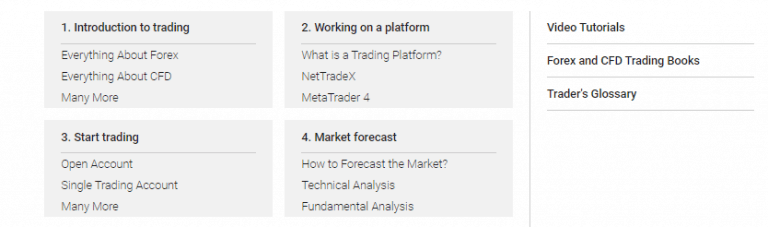

Since the trading environment is not the only important part of successful trading, the broker recognizes the need to support and educate their clients in various ways. The education materials organized through Online Trading Academy, Video tutorials, books and glossaries along with daily technical analysis and analytical videos that are prepared by the experts.

Conclusion

Overall, the IFC Markets is developed group of companies that provides access to trade on a comprehensive range of Trading instruments Forex and CFDs, along with the newly presented markets and comprehensive portfolio. The business model is based on transparent and trustful relations with the clients through established STP execution with a range of platforms, including the proprietary platform with powerful features. Besides, the broker supports you with education and customer service in multiple languages along with accounts to choose from.

Reviews

Can I really trade here? I need an honest broker?

I can say based on my own experience. I trade with ifc almost 2 years and i can surely recommend this broker. Never had any problems with withdrawal they don’t speculate trades

How can I start trading as a beginner without any experience?

I have been scammed by three different platforms already, someone should please advice me on how to start thanks.

Dear Kelvin,

If you are interested in trading specifically with IFC Markets, you can check their Education section . If you want to get more Forex trading knowledge in general, visit our webinars and seminars sections