Ikon Finance Review (2026)

What is Ikon Finance?

Ikon Finance is a brokerage firm that operates within the online trading industry while giving access to speculate on the FX and Futures space. At the beginning of its operation, the company delivered access in New York as a Futures Commission Merchant, while further based its office in the UK, as one of the firm’s that offers online trading solutions to institutional clients.

Even though Ikon Finance is not a giant company or trading provider, the broker constantly develops its strategies and the products offering through market-leading vendors and develops its in-house technologies and launches liquidity to institutional clients.

Of course in parallel, there is a very attractive offering to the retail clients too through its subsidiary Ikon Finance Limited operating in line with changing regulatory guidelines.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | Forex, Futures |

| 🖥 Platforms | MT4, Ikon Prodigy |

| 💰 Costs | 1.3 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, USD, EUR |

| 💳 Minimum deposit | 100$ |

| 📚 Education | Education and learning materials |

| ☎ Customer Support | 24/5 |

Is Ikon Finance safe or a scam?

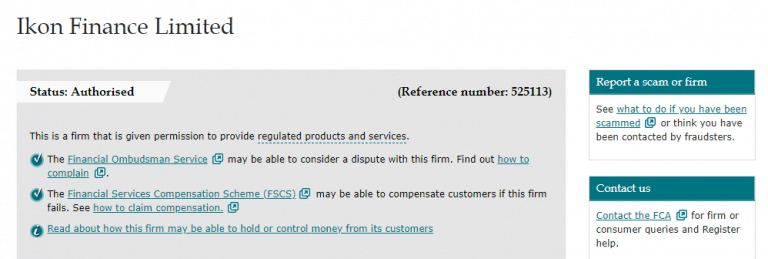

Ikon Finance Limited is authorized and regulated by the Financial Conduct Authority since the company is based in London, UK and according to the law requires a full licensing from FCA to operate legally.

Therefore, the broker fully complies with numerous FCA regulations, which is indeed one of the strictest operational guidelines along with its various cross-registrations and regulations across the EEA zone. So why the regulation is so important, because the client always treated fairly while trader’s funds are always segregated, means an account in which the trader’s assets kept is separate from the broker’s assets at all times.

Along with that rule, which enables security and money protection, every Ikon Finance client is covered by the Investor Compensation Fund in the unlikely event.

Furthermore, Ikon Finance continuously monitors its operations and provide comprehensive security for all online transactions or manipulations through the range of the provided platforms.

Leverage

The marginal trading as a known Forex attractive opportunity allows retail traders to operate through a multiplied amount of the initial deposit and operate larger positions. This tool gives a great advantage as it increases your potential gains, however, you should learn how to use leverage smartly and obtain a good knowledge of its risks to lose as well.

However, leverage was recognized by the world authorities as a potentially risky tool, therefore the UK and European regulatory bodies lowered allowed levels of leverage.

- In particular, you may use the only level of1:30 applied to Major Currency pairs, and even lower 1:20 for Minor ones, which is applicable to all UK regulated brokers and respectively Ikon Finance as well.

Account types

Ikon proposes four account types that include Ikon Classic MT4 Account, Icon Plus MT4, Prodigy Classic and Ikon Pro Accounts.

Every account type delivers a tailored solution to the traders either one who prefers lower costs, a specific strategy, platform or the necessity to trade through spread only either on a commission basis.

As for the trading costs, the standard offering includes all costs into the Ikon Finance Spread, while other higher grade accounts will feature better pricing alike spread from 0.3 pips and range of trading lot requirements depending on the type of account.

Moreover, the traders that require a swap-free or Islamic account with specified conditions are welcomed to open the account at Ikon Finance too.

Fees

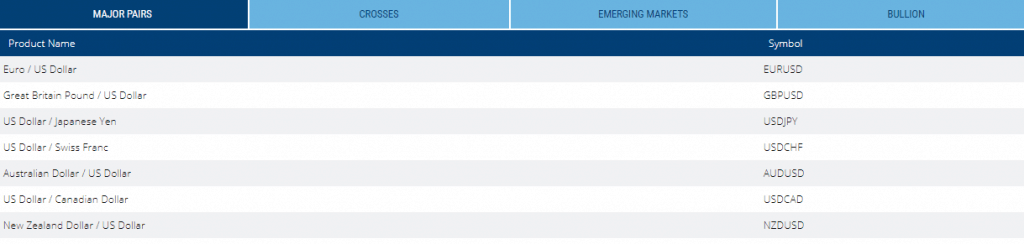

See below Standard account Spread, as well you can check and compare Ikon Finance fees to another popular brokerage HotForex.

| Asset/ Pair | Ikon Finance Spread |

| EUR/USD | 1.3 |

| Crude Oil WTI | 4 |

| Gold | 30 cents |

Deposits and Withdrawals

The client payments as well as the transactions to and from the trading accounts can be performed in various ways and includes the most efficient and reliable options alike Card Payments, Bank Transfers and usage of the e-platform Skrill.

Minimum deposit

Ikon Finance minimum balance is 200$. It is considered a good and attractive offering, as the requirement is affordable for the traders of different level.

Ikon Finance minimum deposit vs other brokers

| Ikon Finance | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawals

Withdrawal options are widely available at Ikon Finance including Bank Transfers, Cards and e-wallets. For the transaction costs, there are some additional fees may be applicable and which are always trader’s responsibility since the payment provider charges the fee for the performance of the transaction. However, refer to the Broker Ikon Finance in order to recheck if there are any fees that may occur while transacting the funds to or from the trading account, as some of the options are performed with 0$ fee.

Trading Platforms

The Ikon Finance mainstays at the industry leader MetaTrader4 platform that supports the use of Expert Advisors (EAs) and enables users to integrate trade algorithms or signals into the trading platform, execute trades via multiple features including robots or manual trading.

Desktop platform

Yet, there is an option to use the developed Ikon Prodigy platform that takes account into the countless inputs from a multitude of institutional and retail customers worldwide with advanced trading features and instruments that allow high speed and stability.

So the choice is solely yours, either to use the MT4 that contains more than 50 built-in indicators and tools that not only help predict trends, but also define the appropriate entry and exit points, or to try out the Ikon Prodigy.

Mobile trading

Ikon also supporting multiple mobile devices so the trader can stay updated with the convenient market information and manage the trades with no matter of location.

A concise summary of the solutions is available to all demo and live account users so that you’ll be able to see the slight differences between the software and choose the most appropriate one according to your trading needs and requirements toward the strategy you use.

Education

However, Ikon Finance professional basis should not be scary for new traders, as newbies are able to familiarize themselves with critical trading elements and re-test practice on a risk-free Demo account along with the education and learning materials from the company. The support remains on hand at all times through various options and services that are available to the client at any time.

Conclusion

Overall, Ikon Finance is a reliable FCA regulated company based in the UK, which offers different portfolio and allows various type investors or traders engage in trading across the range of multiple markets and platforms. Broker’s delivered trading conditions along with the STP execution model performs advanced feature trading that is suited to the traders of different styles and strategies. The beginning traders can also enjoy the educational materials and the provided support, while seasoned clients will find powerful trading tools to enhance their trading capabilities.

Ikon Finance Updates

Ikon Finance is no longer active, its FCA license is not confirmed too. We recommend stay allerted and do your own research.