Interactive Brokers Review (2026)

Regulator

What is Interactive Brokers?

The company history started back in 1977 when Chairman Thomas Peterffy brought a seat on the American Stock Exchange (AMEX) and became a trading member as an individual market maker in equity options. Since then, through many years of development and integration, Interactive Brokers or IB conducts its broker or dealer business on over 120 world market destinations and is truly one of the biggest trading providers worldwide that adhere to the trading technology development.

So why the Interactive Brokers gained their highest rankings and a great reputation among traders community? Firstly, the general broker’s offerings directed to the competitive, client oriented proposals through a transparent policy, low commissions, financing rates and price executions that minimize the costs, but delivers the highest level of trading technology.

Interactive Brokers management office is headquartered in Greenwich, Connecticut and serves its additional entities in the USA, Switzerland, Canada, Hong Kong, UK, Australia, Hungary, Russia, Japan, India, China and Estonia.

InteractiveBrokers Pros and Cons

Interactive Brokers is one of the best and well-regulated brokers worldwide with excellent reputation, account opening is smooth, technological base, trading platform and range of available instruments are also one of the best available in industry in addition to some of lowest commissions and spreads. Education section, the range of available tools, customer support and funding methods are also on the highest level.

From the negative side, we would only admit the advanced level of all proposal overall, plus quite high deposit for some accounts that makes IB more suitable for seasoned or professional traders’, also institutions.

What type of broker is InteractiveBrokers?

In its broker dealer or agency business model, IB provides direct access trade execution and clearing services to institutional and retail traders for a wide variety of products including stocks, options, futures, forex, bonds, CFDs and funds worldwide. In fact, in 2017 IBKR was among the first brokers offering client access to Bitcoin futures trading on the Cboe Futures Exchange (CFE) and the CME.

Actually, apart from the retail client’s solution, the broker focuses on broad offering to connect and conduct trading business solutions through Investors’ Marketplace, an online service that comprises service providers, advisors, hedge funds, research analysts, business developers and administrators. As well as introduces a new Order Management System (OMS) for Institutional clients.

10 Points Summary

| 🏢 Headquarters | USA |

| 🗺️ Regulation and License | US SEC & CFTC, ASIC, FCA |

| 📉 Instruments | Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs , Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

| 🖥 Platforms | TWS, IB WebTrader |

| 💳 Minimum deposit | 2,000$ |

| 🎮 Demo Account | Available |

| 💰 Base currencies | Various currencies |

| 📚 Education | Professional Trading Acedemy |

| 💰 Costs | One of the lowest commissions |

| ☎ Customer Support | 24/7 |

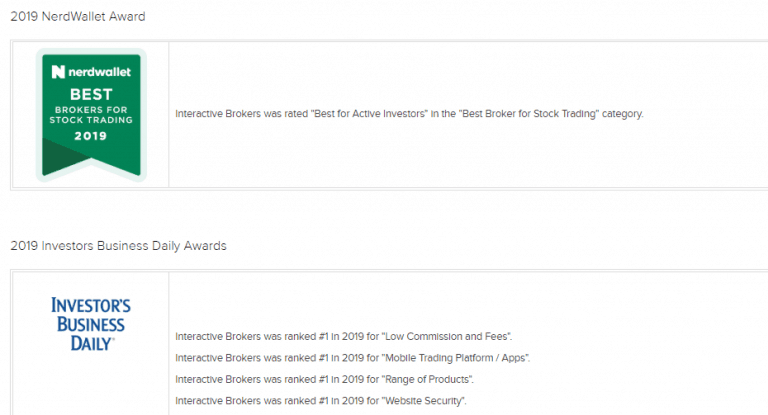

Awards

Throughout the long operation of the Interactive Brokers Group, its constant development and enlargement of the proposals affiliates execute over 800,000 trades per day. While broker serves as a trusted partner with numerous clients, or global companies the broker been recognized not only as an important player in the trading industry but been recognized timely by various awards and programs.

Is Interactive Brokers safe or a scam

No, is not a scam in fact Interactive Brokers is highly and very heavily regulated by the international regulatory bodies around the world, due to its global presence and adhere to deliver truly safe trading environment.

Is IB legit?

The Interactive brokers’ group of companies serves not only numerous entities around the word, but design and operate vast of trademarks that are all regulated and are part of the InteractiveBrokers LLC: Interactive Brokers ®, IBSM, InteractiveBrokers.com ®, IB Universal Account ®, Interactive Analytics ®, IB Options AnalyticsSM, IB SmartRoutingSM, PortfolioAnalyst ®, IB Trader WorkstationSM and One World, One AccountSMare.

The IB holds several operation licenses from the respected authorities that keep broker to operate in full compliance with SEC, FINRA, NYSE, FCA, ASIC, IIROC and other regulatory agency standards or the set of rules that protect traders and presence in the trading industry itself.

| Interactive Brokers entity | Regulation and License |

| INTERACTIVE BROKERS LLC | A member NYSE – FINRA – SIPC and regulated by the US Securities and Exchange Commission and the Commodity Futures Trading Commission. |

| INTERACTIVE BROKERS CANADA INC. | Is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and Member – Canadian Investor Protection Fund. |

| INTERACTIVE BROKERS AUSTRALIA PTY LTD | ABN 98 166 929 568 is licensed and regulated by the Australian Securities and Investments Commission (AFSL: 245574) and is a participant of ASX, ASX 24 and Chi-X Australia. |

| INTERACTIVE BROKERS (U.K.) LIMITED | Is authorized and regulated by the Financial Conduct Authority entry number 208159. |

| INTERACTIVE BROKERS (INDIA) PVT. LTD. | Is a member of NSE, BSE. Regn. No. SEBI Registration No. INZ000217730; NSDL: IN-DP-NSDL-301-2008. CIN-U67120MH2007FTC170004. |

| INTERACTIVE BROKERS SECURITIES JAPAN INC | Financial instruments broker: Kanto Finance Bureau Director (Kimyo) No. 187. Membership Association: Japan Securities Dealers Association General Financial Futures Trading Association. |

| INTERACTIVE BROKERS HONG KONG LIMITED | Is regulated by the Hong Kong Securities and Futures Commission, and is a member of the SEHK and the HKFE. |

How are you protected?

Actually, the compliance to regulation means that every step of the operation, client’s fund management, participation into the compensation scheme, negative balance protection, procedure execution or general trading delivery has no questions, as they are taken strictly on how it has to be for the best possible performance.

So you can trade with the courage and peace of mind that your funds are safe and well protected. Notwithstanding the long company history that built a reputation of the reputed and trusted financial service provider brings a stable base to trade.

Leverage

The Interactive Brokers offers margin rates generally apply to all customers, while in various jurisdictions, local regulators require different or higher margin rates. If the local margin rates are higher than the IB margin rates, then the margin rates required by local regulators will apply.

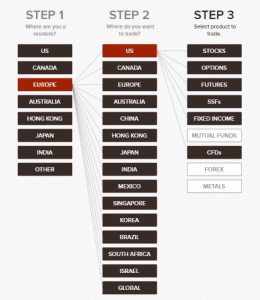

In addition, leverage depending on the trading instrument, the country of your residence since regulation restricts high risks involved in leverage. For this reason for you easier understanding, IB provides an online tool to check on all applicable margins at your glance so you can choose trading best conditions.

Generally speaking, the leverage may vary according to the region from 1:5 on Cryptocurrency CFDs and up to a maximum of 1:400 available on Forex but for those clients that falls under Australian ASIC regulation.

Account types

The range of account designed specifically to meet each one’s need, while every specification is taken into consideration for both parties good and includes Individual, Joint, Trust, IRA and UGMA/UTMA Accounts.

Even though IB has a huge selection of the account types, which vary according to the client’s own preference and type, yet the account is not just a simple account available via client portal, as it includes integrated investment management that allows borrowing, earn, spend and invest funds worldwide.

Also, there are option trading for IBKR lite and IBKR pro conditions which is designed either for experienced traders and day trading with selected order types, or allowing commission free trading that is considered one of the best online trading opportunities.

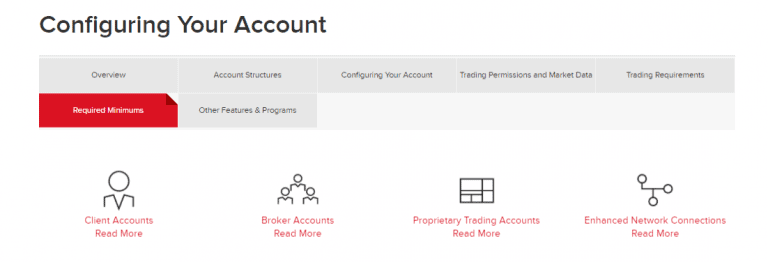

How to configure your account

Trader Account

Let us have a look closer what the personal group means, while the first group is the Trader & Investor Accounts, which is suitable for individual investors or traders, family office, small business or friends and family advisor.

The second group is the Institutional Accounts, which are designed for registered investment advisors, hedge or mutual funds, money managers, proprietary trading group, introducing broker, incentive plan admin, SIPP administrator. And the third group developed for Other Services Accounts – compliance officers, administrators, educators, referrers.

Instruments

Another fantastic thing at IB as we see within InteractiveBrokers Review is an advanced product range. Eventually, you will be able to trade almost everything what is available for trading through IB platforms. These markets range includes Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads.

Of course, conditions and applicable laws in some jurisdictions may impose variations between proposals but all in all you will definitely find what you want to trade.

Fees

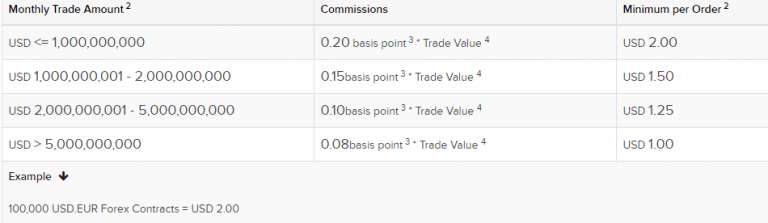

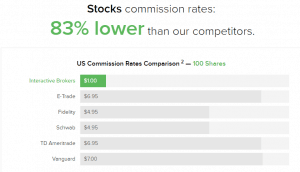

Now let us see InteractiveBrokers Review on brokers’ model of trading fee, which is based on charge of the commission per trade also ranging on a product you trade, hence the prices are quite competitive since does not include spreads and allows you easy calculation.

Considering full fee structure including commission, funding fees, inactivity fee, platform fees or other we found Interactive Broker fees as low and very competitive among the similar proposal.

| Fees | Interactive Brokers Fees | Trading Station Fees | Forex.com |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

Spreads

Our find on Trading Comission

As a result of its global expand and transparency, you will get a tight spread, defined of substantial liquidity and the charge on commission which you have to pay on every opened position.

Moreover, the commission is based on trading volumes, as well on the size of an order. The active traders’ program allows to get discount according to the account type and trading volumes trader performs, thus will result in a better price model.

Interactive Brokers pricing is among the most competitive ones, even though the commissions or various additional fees system seem to be quite complicated with its possible fees in changing positions or so. The general outcome is still pleasant especially while trading Stocks, Futures or EFPs.

The pricing on them are either Fixed or Tiered commission with a choice remained to you, either to stick to the fixed price with all regulatory fees or low broker commission depending on traded volume through tiered rates as a rebate.

For instance, check out and compare fees with another popular broker BDSwiss.

Comparison InteractiveBrokers fees and other brokers

Additional charges

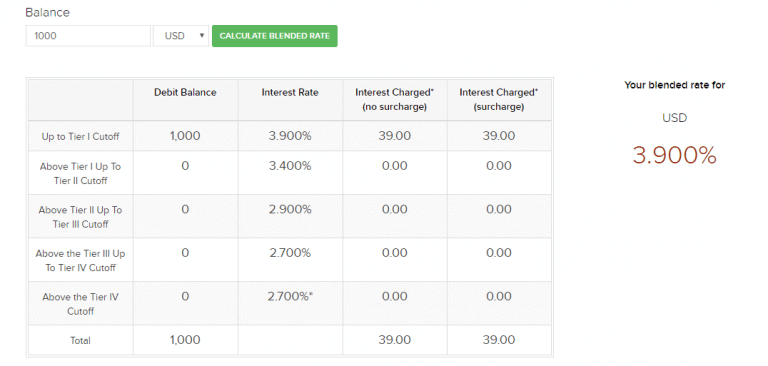

In addition, Interactive Brokers calculates an internal funding rate based on a combination of internationally recognized benchmarks on overnight deposits and real time market rates as traded, measured. So then the IBKR’s interest model will start with the fixing rates and incorporates the dynamic market pricing to produce a midpoint or “Benchmark”.

IBKR accrues interest charge on margin loans on a daily basis and posts actual interest monthly on the third business day of the following month.

Deposits and Withdrawals

The payment methods accepted by broker covering the most common options, however you should check what is applicable according to your particular residence, as the methods may vary.

Deposit Options

The major options are available, so you can perform deposits or withdraw funds through bank wire transfers, ACH Initiated, US Automated Clearing House (ACH) transfer Initiated, by Check or online bill payment, BPAY, Canadian Bill, EFT, Direct Rollover (IRA only) and more. As well, IB allows transfer of funds between the internal accounts.

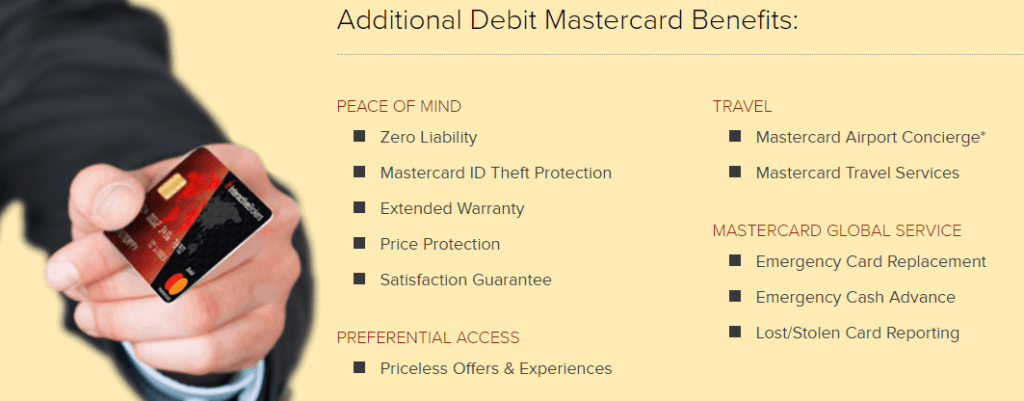

In addition, to make the funding process easier, IB introduced the Interactive Brokers Debit Mastercard, which allows cardholders to spend and borrow directly against their Interactive Brokers account.

What is the minimum deposit requirement for InteractiveBrokers?

The minimum deposit requirement varies by the account type, also since IB announces enlarging programs and opportunities for low cost trading it lowers deposit requirements. A typical individual account requires a 2,000$ deposit, while the Friends and Family Advisor only 200$. As well the requirement may vary according to the region, e.g. Indian residents submitted to 500$ deposit to start.

Interactive Brokers minimum deposit vs other brokers

| Interactive Brokers | Most Other Brokers | |

| Minimum Deposit | $2,000 | $500 |

Withdrawals

The withdrawal of funds performed via a withdrawal request on the Fund Transfers page which you should complete in Account Management. The pleasant thing is that IB allows one free withdrawal every month with no need to pay a withdrawal fee, also withdrawal options are widely available and depsnding on the region.

Further on, if you wish to withdraw funds again within a current month, IB will charge fees for any subsequent withdrawal.

Trading Platforms

The range of IB Platforms comes with various software which is applicable to any of your devices and ranges according to own preferences. Overall, the technology solution of Interactive Brokers definitely on the highest level features great powerful capabilities and flexibility at the same time.

Apart from the choice of the platform, each of them supports various trading products with advanced analysis tools and more additions exclusively available only at Interactive Brokers.

| Pros | Cons |

|---|---|

| Great platform suitable for all size traders and professionals | Platform might be complicated to learn for very beginners |

| Mainstay on multiply awarded proprietary trader workstation TWS | |

| Powerful trading capabilities with free range of tools | |

| Clean view and good charting | |

| Real time view with performance metrics, reports and more | |

| IBot, APIs |

Desktop Platform

Desktop TWS, the platform which won a huge number of awards. Flagship platform for active traders of high volume and multiple product trades. TWS features power and flexibility at the same time, with most advanced algos and tools.

Research

Enhancement provided by real-time comprehensive news, researchers and market data. As well as the most recent monitoring at any time and risk management tools. In addition, the software always on development, hence you can load different versions even the one under the tests.

Mobile Trading Platform

IBKR Mobile app brings easy trading under any conditions on your mobile Android or iOS. The platform might be close to the desktop one, since including a range of advanced quotes and researchers, as well full ability to manage the account.

The high security of trading provided by several ways, also the platform offers a pre-authorization that informs the company about a purchase of 1.000$ or more.

Trading tools

SO together with great technology and software, there are an advanced range that enhances capabilities even further. Some of them includes the following as we find via our InteractiveBrokers Review.

* IBot is a chat/voice based trading interface for traders on the go that understands native languages and available on TWS Desktop and Mobile.

*IB APIs features easy-to-use tools for those who want to write their own trading software or automated trading programs. An application can be built either through IB API programming languages or as a choice by FIX CTCI.

*QuickTrade brings access to the IB account with a simplified trading interface, where you can quickly place orders for a variety of asset types from within Account Management and works the same way as the Order Management Panel in WebTrader.

Web Platform

Lastly, you can use IB WebTrader a web-based trading interface with similar functionality as the desktop version. Over 120 worldwide markets available from a single account and with a great performance with no matter of the connectivity.

Customer Support

InteractiveBrokers global presence delivers also multiple support to the traders benefit provided by professional and well established centers. Also, customer support is defined by the type of investor either individuals and a separate ones for institutions.

Regular traders also will get easy access to phone support, Live chat room, contact search, also availability to report a problem, send general feedback and access feature poll for a request of new features. Eventually, this kind of professionalism you won’t find in many brokers best and we should remark again great offering of InteractiveBrokers in general and in particular as well.

Education

The range of learning materials, insight and technology solutions for better trading, like numerous Apps, widgets or progressive software is available too. Besides, IB being one of the biggest world tradings provides support with good quality education materials through its established Traders Academy.

There you can access Trading tools, Investment products Courses, Courses for risk analysis, together with Videos, Webinars, Traders’ insights, News and recent updates.

Conclusion

Overall, regulated globally in numerous financial centers Interactive Brokers is known for its competitive commission rates, a very advanced range of markets and technology to trade, also its nonstop development and availability of the newest products alike Bitcoin trade through the CFD. What we should strongly admit is the IB great offering of the broker is their technical development. Variety of platforms and tools are covering most demanding needs while bringing both performance and ease of use. The comprehensive proposals to the traders of every type, including various level traders or diverse institutions that bring the best possible technologies to the potential benefit of both parties.