JFD Brokers Review (2026)

Regulator

What is JFD Brokers?

Previously known as JFD Brokers now broker is renamed to JFB Bank.

JFD Group, founded in 2011 by professional traders that adhere to transparent trading and fairness as one of the core values. The company’s main office located in Cyprus and additional offices served in Bulgaria, along with a subsidiary in Germany. To support their client the customer local lines available in the range of world countries that includes also Russia, UK, Switzerland, Czech Republic and more.

Until not JFD became as a progressive and very respected company among the trading industry, as the broker uses a pure agency model with Direct Market Access, hence execute orders straight with client-centric trading without any misunderstanding.

JFD Brokers Pros and Cons

JFD is good broker with regulation and Direct access to markets for a quality trading solution, range of trading platforms and easy account opening. There are many funding methods supported and traders can find education.

For negative points, there is no 24/7 support and conditions vary according to the entity rules, so might be more competitive for some regions.

10 Points Summary

| 🏢 Headquarters | Cyprus |

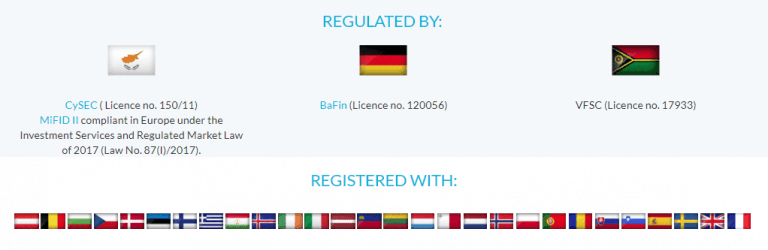

| 🗺️ Regulation | CySec, BaFIN, VFSC |

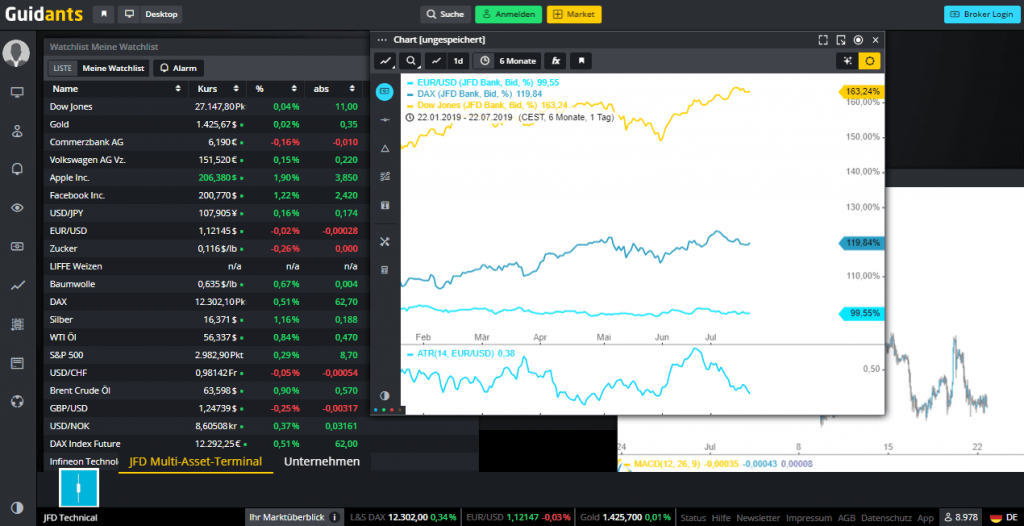

| 🖥 Platforms | MT4, MT5, Guidance |

| 📉 Instruments | Forex, CFDs on Index, shares, commodities, bonds, ETF and ETN, Cryptocurrency |

| 💰 EUR/USD Spread | 0.01 + comission of 0.03$ |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 500$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Education tools and daily analysis |

| ☎ Customer Support | 24/5 |

Is JFD Brokers safe or a scam

JFD is a registered and licensed broker so is not a scam, it operates as a JFD group under strict European regulations, by CySEC and the MiFID along with numerous registrations in EEA zone like FCA, CONSOB, BaFIN and ACPR. Together with its CySEC license, JFD is sharply authorized by German BaFIN known for their strict regulations and control over the brokerage. Even though, JFD also serves an offshore entity in Vanuatu its parallel regulations from ESMA does not leave questions towards their reliability and transparency.

All clients funds are kept separately from the company funds while kept in licensed financial institutions and guaranteeing their security. Since JFD is a member of the Investor Compensation Fund (ICF), all clients run with its protection in case of insolvency. Furthermore, the broker implements negative balance protection.

Instruments

The market offering of JFD is a wide range over 1,000 trading instruments through 8 asset classes that include Forex, CFDs on Index, shares, commodities, bonds, ETF and ETN, Cryptocurrency and likewise the JFD is the first broker which launched Physical Stocks on MT5 platform.

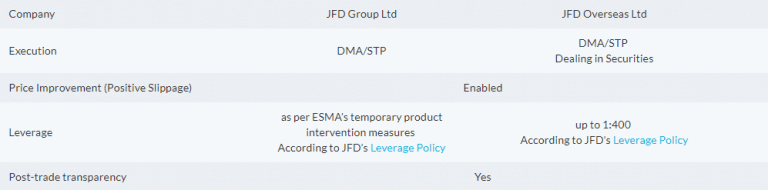

Leverage

Under the regulatory restrictions, JFD falls with specific requirements on each jurisdiction it run a business. Generally, JFD uses lower leverage to reduce the risk of money lost. Moreover, the European resident traders are allowed to use a maximum leverage 1:30, while another trader operating through JFD oversees may apply for leverage up to 1:400 on Forex instruments.

Account types

JFD Bank offers only one account type which offered with tight spreads and fast direct execution into the market.

Fees

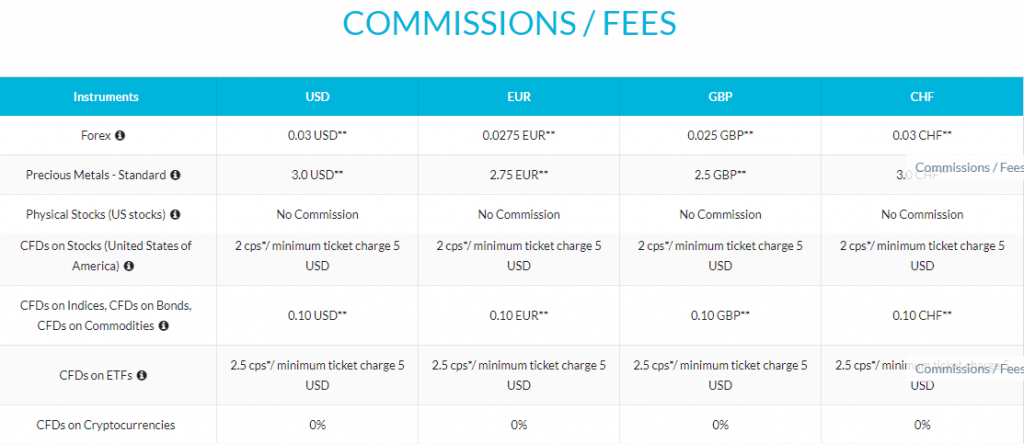

JFD Brokers fees are good, mainly built into a commission charge, but good to check funding fees, non activity fees and other conditions too. The Agency Model brings an absolutely 0 rejection rate and no requotes, with the addition of unconditional and anonymous access to the interbank market based on a “Fill or Fill” model with negative and positive slippage enabled.

| Fees | JFD Brokers Fees | AETOS Fees | ATC Brokers Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Average |

Spreads

JFD spread offers the interbank spreads are averaged at 0.1 for EUR/USD pair, and starting from 0 pip for all clients. Trading on DAX and DOW offered through reduced commissions on CFDs (0.1 per lot per side), while risks are controlled with mini lots on CFD trading and the right money management.

As well, to enjoy these great quotes the only requirement to pay for a broker is a very small commission defined by the instrument you trader, but actually is very and very low comparing to the market offering.

See reference fees and spreads below, also check out the spread of FP Markets.

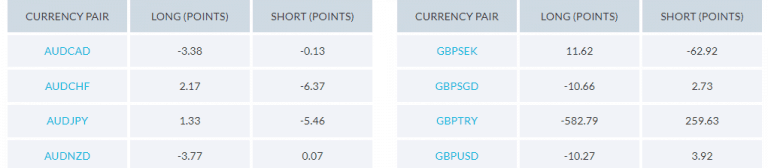

In addition, overnight financing costs are calculated for CFDs on Stocks & Cash Indices are 3.25% +/- Libor.

Deposits and Withdrawals

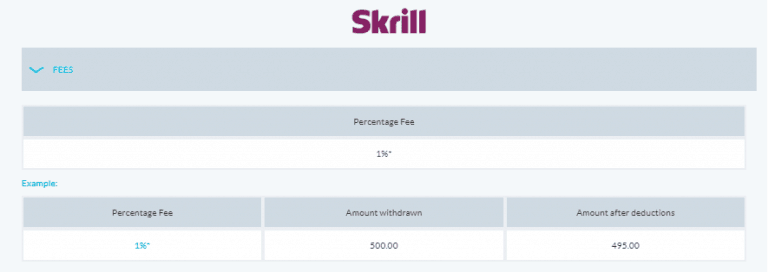

In order to start live trading, you may choose an applicable payment method to fund the account or transfer money. The options including bank transfers, bank transfer with Sofort, which will include 1.8% deposit fee, and online payments like Skrill with 2.9% fee, Safecharge with 1.95% fee and UnionPay with no charges. Therefore, you should carefully check which payment method to choose along to consult applicable fees to perform fund transfers.

Withdrawal

To withdraw the funds’ you can use the same methods, which are eligible for fees also. Thus, Skrill and Safecharge will require 1% fee for the transaction process.

Minimum deposit

JFD Bank minimum deposit amount is 500$ regardless of the platform or a trading account you choose to trade.

JFD Bank minimum deposit vs other brokers

| JFD Bank | Most Other Brokers | |

| Minimum Deposit | $500 | $500 |

Trading Platforms

So there we going for details of technical optimization and software provided by JFD. Rest assured that the broker designed the best server infrastructure for the trading success, their servers hosted in Equinix data centers in London and New Yor, that are connected directly to Liquidity Providers.

The technology brings straight-through processing high capacity aggregation, smart order routing and bridging to a new level. Moreover, traders stay connected under any condtions with VPS (Virtual Private Server) for advanced trading strategies and continuous EA monitoring. The VPS is offered through two providers with a discount charge as a JFD client, Fozzy offers 50% discount and MyTradeHost took 10% discount per month.

As for the trading platforms, JFD chose the industry-proven platforms for their proven performance and capacities. The award-winning platforms MT4 and MT5 are available at the traders’ toolbar to access markets through flexible, yet comprehensive trading along with a powerful Guidance platform available with its JFD unique offering in German.

Social Trading

Overall, all platforms bringing the utmost level of trading capabilities with slightly different features that support various trading stiles, which are remaining as an option to choose from for a particular trader. Platforms available through desktop, web and mobile application versions, as well as including options to automate, perform technical trading or use social trading capabilities.

Education

Overall, JFD brought a quality offering to the traders of different experience and size, which does not diverse clients for their style or invested amount. Thus award-winning research team provides daily market analysis along with advanced educational tools with state of art learning materials and data.

Even so, the company is a quite new player, their grown and trust ability has been recognized by industry publications and clients timely.

Conclusion

Overall, the JFD Bank shows one of the shortlisted features that brings to all retail clients the same features of trading. It truly doesn’t make any difference between the customers or confusing, as all markets are available under multiple platforms with just one pricing, one execution and one account type model. Broker’s technical optimization and servers are on a top of technology, which all bring a truly powerful combination to trade for both beginning or even very advanced traders with various styles, which is great option to consider.