KAB Review (2026)

Regulator

What is KAB?

KAB as a trading broker was founded in 2002, while today operating international services through integrated multinational financial group KAB International Holdings Ltd., which is located in Hong Kong and China. As well operates Online Trading through a subsidiary Cyprus Investment Firm – KAB Strategy Ltd.

Generally speaking, KAB group offers its services through the Middle East, Europe and Asia while including various firms to provide its financial investment solutions and vast trading solutions.

The Kuwait branch was established simultaneously with China office and operates under the brand name KAB Kuwait Group regulated by the local authority CMA.

KAB Pros and Cons

KAB is a reliable broker with top-tier regulation and very good technology for trading, including Futures, Portfolios and other popular assets trading suitable for advanced or professional traders.

For the negative side, beginners might not choose KAB since the technology is rather good for experienced traders, there is no spread basis accounts and proper education.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC, CMA |

| 📉 Instruments | Stocks, IPOs and ETFs, Rolling Futures/CFDs, Spot Metals and Currencies and Portfolio Management Services |

| 🖥 Platforms | MT4, KAB HK/China Securities Trading Platform |

| 💰 Costs | Futures commission is 40$ per open side |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, GBP, USD, |

| 💳 Minimum deposit | 100 US$ |

| 📚 Education | Research tools |

| ☎ Customer Support | 24/5 |

Is KAB safe or a scam

No, KAB is not a scam.

KAB STRATEGY LIMITED or better known as a KAB is a licensed and regulated Cypriot Investment Firm, which also authorized under the Cyprus Securities and Exchange Commission to operate within all member states of the EU according to the MiFID regulations.

In addition to that, and due to the established operation of KAB in the MENA region, the broker is also authorized in Kuwait to offer trading service.

The above regulation provides a safe state to global traders, restricts and requires a licensed company to provide a sufficient level of security to the clients, as well as operating a reliable financial service. Client investments and funds are kept separately from the company’s own accounts, ensuring better protection for the client.

Finally, being a member of the Investor Compensation Fund set up by the Central Bank of Cyprus and the Cyprus Securities and Exchange Commission, KAB provides another layer of protection for eligible clients in case of the broker’s insolvency or unlikely events.

Leverage

At KAB, you’ll have the flexibility to choose suitable leverage to your trading needs, starting from 1:20 and up to 1:500 for some Forex instruments and according to your residence, but generally KAB considered high leverage broker.

Leverage tool indeed is a powerful feature, yet you should learn deeply how to use it the best way, as leverage may work in reverse to your gains too.

Instruments

The broker offers a wide range of financial products and services through one multi-purpose account tailored to investors’ individual needs, whilst fulfilling the requirements of various EU regulatory bodies.

The product offering includes Hong Kong Stock Exchange-traded securities, such as Stocks, IPOs and ETFs, Rolling Futures/CFDs, Spot Metals and Currencies and Portfolio Management Services, provided at reasonable, competitive tight spreads and commissions.

Yet, it seems like KAB is more convenient choice for professional traders and active ones due to their high possibilities and technological proposals through advanced features.

Account types

The account types at KAB are designed by the trading markets as well as by the execution model according to the instrument you will trade.

– KAB MT4 Account allows trading CFDs on presenting instruments on a popular MT4 platform with flexible leverage up to 1:500 and availability to trade mini or standard lots upon trader’s choice.

– ECN Forex Account brings direct option to real-time pricing provided by the 60 world banks with a raw spread offering and commission per trade negotiable according to your trading size.

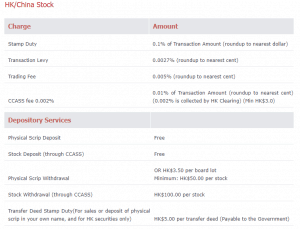

– HK/China Stocks Account brings access to trade one of the biggest world markets and invest directly in Hong Kong securities. The account is self managed via an online platform with instant execution of trades and no minimum deposit requirements bringing a fantastic option for China Stocks trading.

– Portfolio Management account offers IPO (Initial Public Offering) market on a click with an evaluation of investment need using proven strategies. The company’s goal is to achieve long-term appreciation by investing in the Asia region, while the minimum initial subscription is HKF 1,000,000.

In addition, since the broker KAB branch is located in Kuwait it also offers Islamic or Swap-free accounts that are suitable for Muslim customers.

Fees

KAB fees are mainly a commission charge, while the account offerings along with the commissions and general trading conditions may be slightly different from the proposal to the European or any other residence clients. So for the best-updated information, you should refer to the customer support stating the country of origin and get the most recent and correct offering before you sing-up an account with KAB.

| Fees | KAB | Dukascopy | Interactive Brokers |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

Spreads

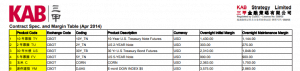

KAB charges are typically built into commission that is divided and calculated according to the trading instrument, but also mainstay on fixed spread (find the best forex broker with lowest fixed spread) option while as an example, Futures commission is 40$ per open side, Gold spread is 0.50$ with 40$ commission fee, and ECN accounts commissions are negotiable with raw spread offerings for Forex instruments.

Payment Methods

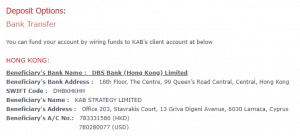

To make the deposit and start live trading you should process the request from “My Account” area and proceed with payment either via

- Bank Transfer

- or by online payment using UnionPay Card.

Even though payment options look limited, these are actually the most convenient ones, while the KAB broker does not charge any fees or commissions for depositing funds, however, some payment providers may charge additional fees and are solely your responsibility.

Minimum Deposit

Minimum deposit amount for KAB defines 5 main types of investment types, while each consist of more than 40 types of products with specifically defined minimum investment amount. For example, for precious metals the initial margin for one lot of standard contract is US$ 1,000, but you may access it through 0.1 lot of mini-contract that requires US$ 100. For more details, you better contact customer service and check on of necessary instrument.

KAB minimum deposit vs other brokers

| KAB | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Deposit

MT4 trading account is based on USD, thus funding with other currencies will apply the prevailing market rate. KAB withdrawal are the same simultaneously connected to the Bank or Credit Card holder designates.

Trading Platforms

Fast, stable and reliable online trading platforms enable you to access to Precious Metals, Equities, Indices, Commodities and Forex just with the click of a button, around the clock, anywhere in the world the trader might be.

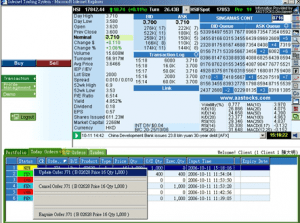

The KAB’s choice stands on popular and known MT4 platform with real-time pricing, interactive charts, market news, analysis tools and HK or China Securities Trading Platform a designed by KAB software that enables access to manage the account and execute the order in Hong Kong Exchange Securities online or with standing orders.

MT4 does not require too much wording, as this software is the most widely used platform worldwide brings easy connectivity to the trading community, seamless integration, powerful graphs, intelligent multi-trading functions on a range of lots.

KAB also provides well-rounded support for the financial trading moves and enhanced the platform by their develops through two versions either for the PC or by Mobile application.

Conclusion

For our final thoughts, KAB is a company with reliable operations in the industry of financial trading and stock exchanges, as well as with unique opportunity to trade through HK/ China Stock trade. Being a part of the larger global group, KAB is a well-regulated broker that provides a safe trading environment. As for the investment offering, it is mainly focused on the stock trading and CFDs on Indices, Commodities and more. Yet, the traders or investors of preferably professional level or active traders may find useful benefits that are comfortable with personal demands.