KVB Kunlun Review (2026)

Regulator

What is KVB Kunlun?

KVB Kunlun Financial Group serves multiple financial business functions including global foreign exchange and securities brokering, systems and liquidity providing, corporate treasury management platforms and hedge, wealth management, financial IT solutions and many more.

Incorporated companies or representative offices are established in various global jurisdictions including Sydney and Melbourne in Australia, Auckland in New Zealand, Toronto in Canada, Beijing, Hong Kong and Taipei in China and many other international cities.

KVB Kunlun provides liquidity solutions and a series of technology consulting services for traders involving forex and derivatives, precious metals, bulk commodities trading – including MT4 bridging, risk monitoring, transaction monitoring, price engines, price integration, backstage, reporting tools and much more.

This enables risk hedging directly connected to the international market and enables institutional clients to gain a competitive advantage in the global capital market.

10 Points Summary

| 🏢 Headquarters | Hong Kong, New Zealand |

| 🗺️ Regulation and License | FSC, ASIC, FMA, MSB |

| 📉 Instruments | Forex and derivatives, precious metals, bulk commodities |

| 🖥 Platforms | MT4, ForexStar, KVB EFX Platform |

| 💰 Costs | 0.4 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, GBP, AUD, CAD |

| 💳 Minimum deposit | 1,000$ |

| 📚 Education | Research, trading tools |

| ☎ Customer Support | 24/5 |

Is KVB a good broker?

In addition, the core mission of the company is to provide safe hedging and value-adding services for the wealth of their customers. With many years of relevant experiences and resources that are deeply rooted in the overseas cities with large Chinese populations, KVB Kunlun provides customized wealth management and planning programs to meet respective financial needs of enterprises and individual clients at different stages.

Awards

The company professional qualification was recognized timely by many jurisdictions and financial regulatory authorities, while the multinational business conducted according to the respective regulation.

The investments and provided services are professionally committed to providing high-end solutions and technologies with constant research and development of the latest transaction tools that help with increasingly complex businesses and risk control systems. The business of KVB Kunlun foreign exchange was listed on the Stock Exchange of Hong Kong.

Is KVB Kunlun safe or a scam?

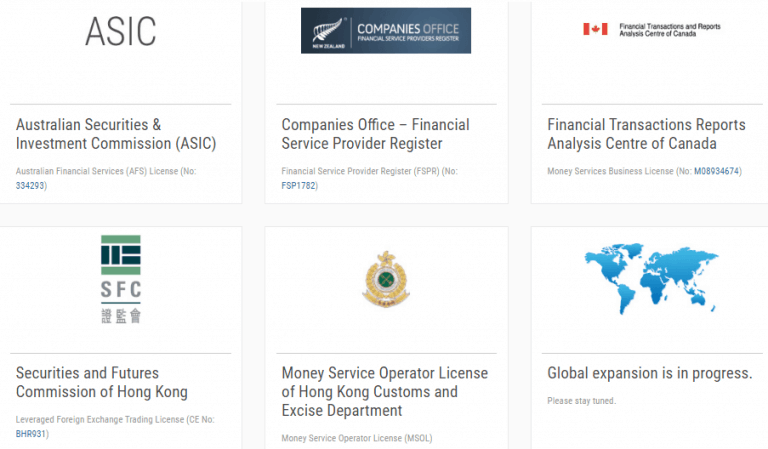

Due to its international presence, the KVB Kunlun established many subsidiaries that are respectfully licensed and supervised by the local governmental authorities in regard to financial services.

KVB Kunlun Financial Group of Companies including KVB Kunlun Pty Limited, KVB Asset Management Limited, KVB Kunlun New Zealand Limited, KVB Kunlun International (HK) Limited, KVB Kunlun Securities (HK) Limited, KVB Kunlun Asset Management (HK) Limited, KVB Kunlun Canada Inc, KVB Global Markets Limited, KVB Global Markets Pty Limited.

According to its heavy regulation by many entities, the registration provides a clear state of operation along with funds security and customer protection. The procedures involving proper control systems, adequate accounting and capital maintenance as well as the transparency of offered services.

Regulatory licenses

International entities operating under the KVB Kunlun brand holding world recognized and respected licenses, ensuring you invest with safe broker that includes ASIC (Australia), FSC (Hong Kong),

FMA (New Zealand), MSB (Canada), also operating under China Banking Regulatory Commission and Money Service Operator License of Hong Kong Customs and Excise Department (MSOL). The company is primarily a Hong-Kong based firm, while the foreign exchange and acts as a derivatives issuer through the New Zealand branch.

Trading Platforms

There are few options of the trading platform offered by the KVB Kunlun, which are also depending on the kind of investment or trading you do with the broker. The proprietary platform – ForexStar including PC and mobile versions that enables access to trading anywhere in the world, through the developed platform based on MT4 technology.

Also, you may choose Online Electronic FX Trading Platform eFX 2.0 that combined real time trading with flow management capacity.

The platforms enable to place orders with real-time technical analysis, charts features and expert reviews with immediate confirmation. The software was designed as a bilingual platform in Chinese and English with user-friendly interface and comprehensive capabilities.

In addition, the platform enhanced with strong risk management functions that include pending orders, regular records and capabilities to always grasp market conditions. What is more KVB is licensed to make a market giving a unique opportunity for rates through Cross-platform Data feed.

Supplementary, the financial website providing comprehensive market information and free online courses to enhance traders’ skills, as well as multiple channels with daily professional visions and comments.

Accounts

KVB Kunlun provides a variety of financial investment products that are designed to each own needs and requirements along with investment and fund management. The trading instruments diversify over 30 kinds of currency pairs, 6 major global indices, 5 major commodity futures and multiple types of popular Chinese stock index products.

As for the accounts, KVB Kunlun divides accounts by the type of investment and presenting either Forex Trading to trade foreign currency pairs, precious metals, China and global stock indexes and commodities. Another account developed for Global Settlement and corporate Forex management with enterprise foreign exchange management solutions.

And the last, but not the list is an account to conduct stock trading in Hong Kong and internationally, due to the company’s position in the Hong Kong Stock Exchange.

Fees

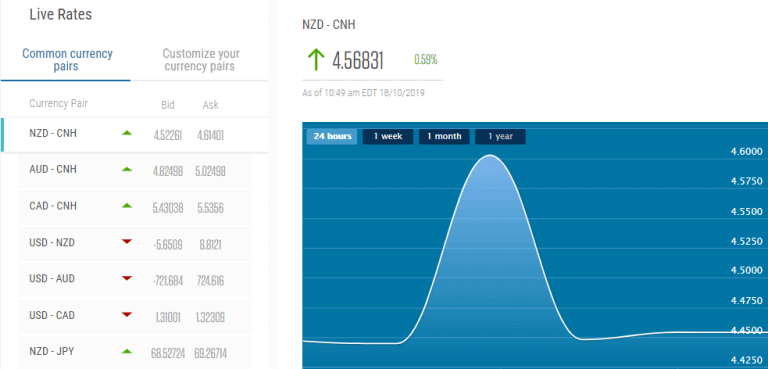

The trading conditions offering quite low spreads, typically 0.4 for EUR/USD, high rebates and 0 commissions. The quotes are provided by international banks that precise 5-digit quotes and customized multi-window observation which is indeed very powerful capability for any strategy. Also, you may compare KVB Kunlun fees to another broker BDSwiss.

Leverage

As usual, offered leverage depending on the jurisdiction you are trading with, due to the KVB Kunlun particular regulatory obligations and restrictions authority impose. Usually, the standard level of leverage set to a ratio up to 200:1, which may be lower in some countries again due to legislation.

Payment Methods

The clients of KVB Kunlun are offered by the modest range of payment options, which are the most common to use and include Card payments and Bank Wire transfers.

KVB Minimum deposit

The minimum deposit requirement is 1,000$ for the trading account, while the corporate or institutional account features are tailor-made offerings designed to suit particular and necessary client’s need where minimum amounts vary.

KVB Withdrawal fees

Typically there are no charges for withdrawals waved by the KVB Kunlun, however, check on with the customer service in case any fees are applicable due to regulatory restrictions in each jurisdiction.

Conclusion

Overall, KVB Kunlun review shows a company with a global presence and strong positions within the financial industry due to its advanced proposals in terms of solutions and investment services themselves. Numerous regulations and compliances with the local laws of each KVB Kunlun entity confirming its reliable status and bringing a clear state of mind which is very important.

Furthermore, the company provides not only competitive brokerage services but a vast range of financial technologies to choose from. Even though the deposit requirement might be quite high for the average trader, the KVB Kunlun’s expertise might be an attractive feature to active traders or the institutional investments.

Yet, we would be glad to know your personal opinion about KVB Kunlun, you may your experience in the comment area below, or ask us for some additional information.