Kawase Exchange | Fondex Review (2026)

What is Fondex?

Fondex or previously known as Kawase Exchange is a European online trading broker based in Cyprus which operates inspired by Japanese concepts such as trust, power, determination, flexibility, and simplicity.

Fondex as a trading name of TopFX uses years of expertise and regulated license to provide high-performance trading experience combined with the latest technologies.

Generally, TopFX is an international brokerage firm specializing in liquidity provision and regulated institutional brokerage services that began its operation in 2010 (Check TopFX broker review). The retail operation started only 5 years later, while Kawase and than Fondex launched trading in key Asian markets.

Fondex Pros and Cons

Fondex has good reputation and reviews from traders and is European broker with Japanese technology. There are Powerful cTrader platform capabilities, Great copy trading options suitable for beginners, Low commission trading fees and a Single account with transparent conditions.

For the negative side, there is no comprehensive education, not MT4 offered as alternative and Conditions vary according to regulations.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC |

| 📉 Instruments | Fondex FX, Shares, iShares, Powershares ETFs, Indices, Metals and Commodities |

| 🖥 Platforms | cTrader |

| 💳 Minimum deposit | No deposit requirement |

| 💰 Base currencies | Several Currencies offered |

| 🎮 Demo Account | Available |

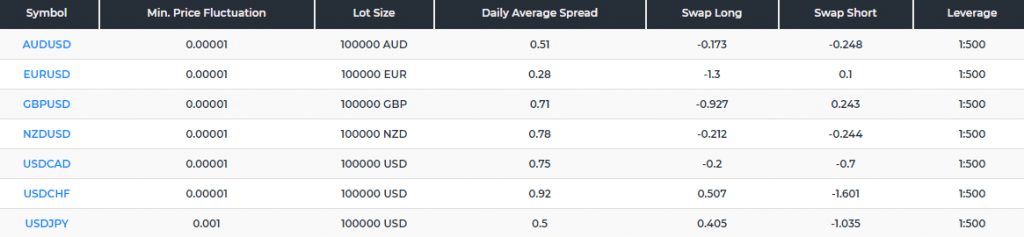

| 💰 EUR/USD Spread | 0.28 pips |

| 📚 Education | No comprehensive education |

| ☎ Customer Support | 24/5 |

Awards

Its successful model of operation and delivery of trading environment been recognized by numerous rewards and Awards fro popular exhibitors or publishers. Also, Fondex clients have voted the company as number one in customer service, value for money and overall client satisfaction that proves Fonex’s good position within the proposals.

Is Fondex safe or a scam

No, Fondex considered low-risk Forex trading broker since being headquartered in Cyprus, the company is registered under the name TopFX LTD and respectively conduct its business with imposed regulation by CySEC. Previously TopFX used trading name Kawase and recently was rebranded to Fondex, while still remaining the regulated company also cross border registered with 25 EU regulators to serve clients within the EEA zone.

How are you protected?

The CySEC multiple requirements, that have also complied with MiFID directive including capital adequacy, financial reporting to the regulators and undertake of a detailed audit, making control over Fondex activity constant and unparalleled.

The money protection and client safety provided in multiple ways also, the traders’ funds are kept in world leading banks and fully segregated, meaning are separated from the company’s actives along protected by negative balance protection.

In addition, Fondex is also a member of the ICF (Investor Compensation Fund) that resolves issues in the unlikely events and compensates investors. Read more about CySEC by the link.

Even though the additional entity is located in the offshore zone, recently offshores also creating more strict licensing rules, while in addition to ESMA regulations Fondex considered as a safe broker to invest and trade with.

Leverage

Leverage is the mechanism by which you may trade a large amount of money, due to leverage capability to magnify your initial trading size. For example, if your trading account has a 1:30 leverage, and assume that you have $1000 in your account, meaning 1:30 leverage allows you to trade a $30,000 position.

Leverage may magnify your exposure, yet the probability of profits or losses increases simultaneously, which makes it essential to learn how to use leverage smartly.

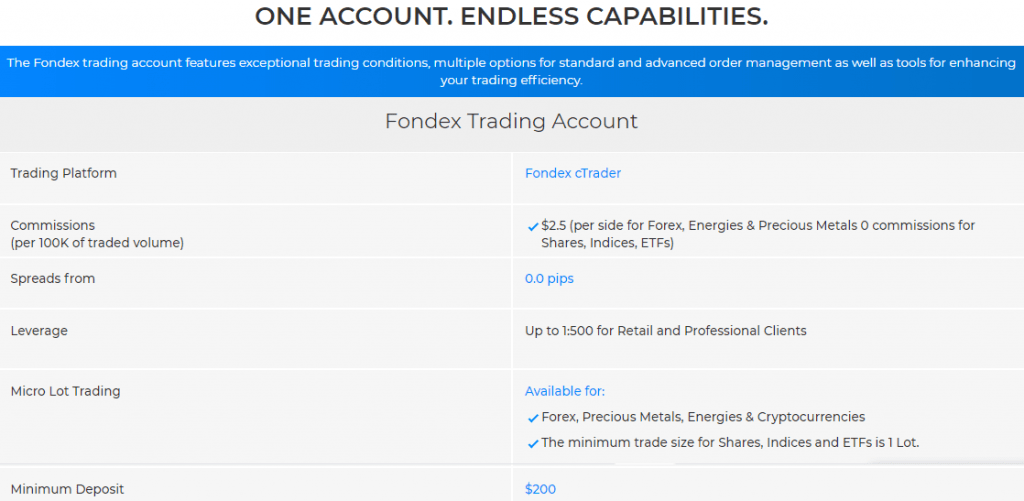

- Fondex enables you to trade with leverage up to 1:500 for Professional clients, and retailers may use lower levels due to regulatory restrictions by ESMA. Thus, retail trader leverage goes to 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

- International traders entitle for 1:500 for major currency pairs

Account types

Fondex does not offer different account types and built its proposal into Fondex singe account to suit different trading styles or volumes with spreads from 0 pips. Also for Muslim traders there is an option to trade via Swap-free account.

Fees

The proprietary price aggregation uses the unique identification of the price with an interval of more than 50 times per second to identify the lowest available quote for an instrument, thus Fondex spreads are raw with trading charges entirely commission based.

Spreads

Fondex spreads as mentioned are raw spreads with an additional commission charge of 2.5$ per side and 100k$ traded, which makes it a pretty good choice for active traders and beginners as well. For 100 Shares and ETFs there is a commission of 1$ per side, which is also very low compared to similar brokers and market proposals.

As an example, you may refer to the table below and see a typical Fondex spread as we found via fondex review, as well you may compare fees to another popular broker BlackBull Markets.

Fondex rollover

Also, always consider Fondex rollover or overnight fee as a cost, charged on the positions held longer than a day and determined by the direction you trade and is differential between bids. Holding costs are based on many factors and most often positive swap are paid on buy positions.

The Fondex Swap-free account also offers access to the traders of Islamic belief to enter the trading process with no swap charges or spread widening. In order to apply for this account, you should proceed with a form that requires a proof of faith to complete the process.

Instruments

Fondex delivers more than 1000 Markets to trade, so international traders gaining access to the world’s premier liquidity providers and global exchanges through sources proprietary aggregator engine with the best possible pricing from tier-1 grade banks. The range of trading markets including most traded instruments making Fondex FX, Shares, iShares, Powershares ETFs, Indices, Metals and Commodity Broker.

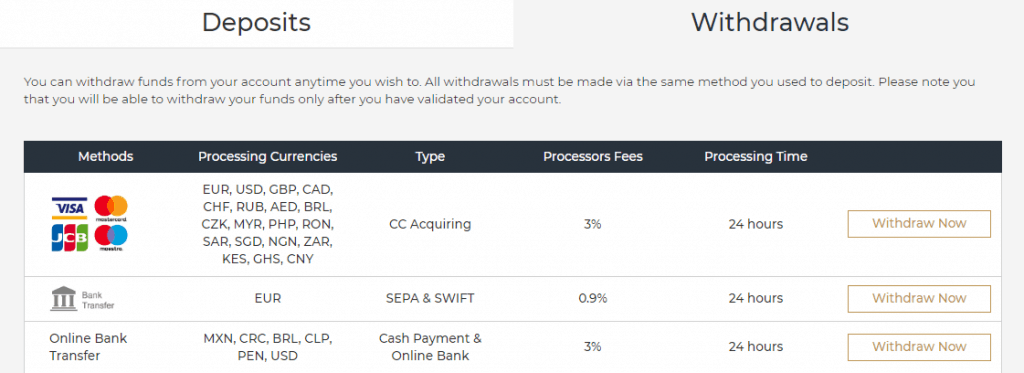

Deposit and Withdrawal Methods

Deposit or withdrawal of funds is directly available from Fondex cTrader that bypasses the client area making it a convenient process, while the transactions will be performed by the desired method.

Deposit methods

The available methods including

- Card Payments,

- Bank Transfers,

- UnionPay,

- Qiwi,

- WebMoney,

- Skrill,

- Neteller,

- Yandex money.

However, some payment methods are available only in specific countries and will only appear if the deposit window launched from the specific region.

What is the minimum deposit for Fondex?

Fondex minimum deposit is 0$, however the recommended amount that allows you to engage in live trading at the beginning is set to 200 units of your chosen currency USD200, GBP200 etc. Which is a reasonable amount for any size of the trader, along with Fondex one account offering with no differences on the account you trade.

Fondex minimum deposit vs other brokers

| Fondex | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Fondex does not charge deposit fees, yet check carefully with your payment provider in case any fees will be waived from their side. However, the withdrawals will incur an additional processing fee that is divided by the payment method, Fondex withdrawal options Cards and Online Transfers will add-on 3% fee, and Bank Wire Transfer costs 0.9% for transfers in Euro.

Trading Platforms

An Award-winning Fondex trading platform offering truly bank-grade trading conditions along with fast execution through a depth of market and direct connection to banks with its NDD model.

The proprietary platform is actually one of the greatest advantages from Fondex, its previously known Kawase cTrader Broker and now Fondex cTrader was built as a DMA platform with execution always defined by speed and high characteristics directly connected to the market with no bridge technology. Thus you are gaining access to trade on the same level as the institutional clients do, which is of course a fantastic opportunity.

| Pros | Cons |

|---|---|

| Mainstay on multiply awarded cTrader Light fast NDD execution Powerful trading capabilities with free tools | No MT4 |

| Clean view and good charting | |

| Comprehensive analysis | |

| Copy trading and auto trading |

Web Platform

The platform delivers extreme unparalleled transparency with a detailed order, deal and position timeline, live order book values and 50 fields of position details.

Desktop platform

Fondex cTrader scales to various devices through Desktop, Web and Mobile versions making the performance accessible to almost everything with Live market sentiment, Charting tools, trading history and session info and on-server trailing stops.

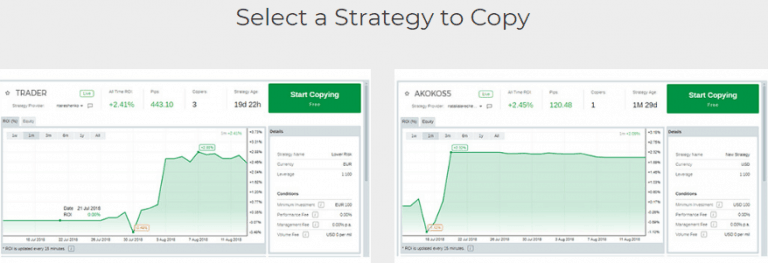

Mirror trading

Furthermore, the cTrader enhances the offering with mirror trading and algorithmic trading through cMirror and cAlgo. Alongside the cMirror was developed to allow mirroring of 1000+ strategies from top traders that increases significantly the possibilities to trade with ease and convenience.

Therefore, you may become either a signal provider and earn a commission or to automate your trading positions through a follow of a strategy and all that is available through one account feature.

Mobile platform

Customer Support

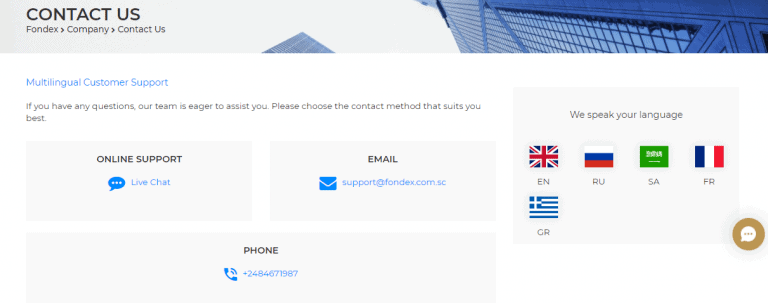

What is more, Fondex customer support service proved its proficiency and is among the leading positions, providing multilingual support and fast response with Live chat option. Along with its competitive trading conditions Fondex support team can guide you through the account opening, trading process and at any stage.

There is an international phone line and email support, so overall Fondex traders are covered with professional service any trader may need, which is definitely a big plus.

Education

So the last point in our Fondex Review is education materials, and here we saw that broker provides education articles for numerous topics along with Forex News and recent market updates. However, that’s is all what education is limited for, so if you are very beginner you better sign in for a good education course with webinars and seminars through a third party provider is you still wish to trade with Fondex.

Research tools, yet, are very advanced and at the professional level since Fondex cTrader supports various tools and enlarging capabilities with god analysis features.

Conclusion

The Fondex review presents a company brokerage, previously known as Kawase Exchange which relied on its liquidity provision and institution brokerage expertise to deliver competitive offering to the retail clients. The direct access to the market based on exceptional technology solutions while the proprietary platform connected directly to the Banks generates consistency for active traders with various benefits upon the trading size reach and comprehensive trading tools.

Reviews

Like many others I’ve started trading with a dream of making millions overnight. And like many others the dream did not come true. it took time to understand that my discrete trading is more of a gambling approach to markets. It took over a year to come to this conclusion. Fortunately Fondex has got copy-trading solution. I withdrew half of my deposit and left the remaining half to try out the copy trading. I don’t suggest investing in top of the top performers here, as high returns often have some underlying issues like large expected drawdowns. At the moment I’m investing in 3 different strategies with moderate risks and am totally happy with moderate 50-70% yearly returns.

mind sharing this strategies? would really appreciate

Is there copy-trading? If yes, what are the advantages?

Yeap, copy-trading is available at the platform. Actually this is one of the biggest advantages of a cTrader. Folowing the master account of a chosen trader is a way to diversify owns strategies portfolio or simply one of the passive investments methods.

Guys, does copy-trading feature really works there? And what the conditions?

This is an excellent format for those who do not have the opportunity to deal with the market and trade on their own.

There you can choose from more than 400 different approaches with one click, you can choose your own strategies and stop this format at any time.

You can choose how you want to allocate funds for each trade – increase or decrease.

You also have a stop-loss under your control and you can change it for each specific strategy.

Some of the strategies are free, while others will require a certain commission from you – it all depends on your provider. But you will immediately see this information, so there are no unpleasant surprises.

What are the conditions to participate in the rankings for copy-trading?

Oh, it’s no big deal, you’ll figure it out quickly.

You just choose in the rating those traders who make large and regular profits and subscribe to them.

When they execute orders, they are copied to your account.

This is the best solution if you do not have the opportunity or time to analyze the market yourself.

It is very convenient.

Is there an automated trading ? Is it allowed?

Yeah, it’s not only allowed, but companu actively promote it. There’s cTrader automated trading platform and it’s good, even taking in account the fact that I don’t like automated trading, I prefer manual trading.

What is automated trading and how profitable it can be?

This is a copy of other traders’ trades.

Here, as well as active trading, you need capital and proper risk management.

But it can be convenient, if you can not deal with the market yourself for some reason.

How effective is Fondex automated trading?

It’s quite effective, with typical limitations of automated trading system. It is more effective than manual trading of a non-professional trader, but certainly not more effective than trading of a professional trader. I see automated trading as a way to diversify risks. I invest part of my money in manual trading, part of my money in automated trading.

If I have any problems, can someone help me here? Support service?

I’d suggest using a live chat. I’m not a big fan of phone conversations, moreover that you’ll need to spend time on identification before they can help you anyhow with your account by phone. So the live chat is the fastest and the most convenient method. To tell the truth I’ve never used mail with them apart for sending the docs, but I guess that can work fine either. At least the verification process was very fast in my case too (by e-mail)

I have already tried to use automated trading strategies here. Everything works fine.

There is a question about trading signals. Are those posted every day?

Yes, signals are usually provided within a day. And as I have noticed, usually the least signals are provided on Monday – well, this is understandable, because on this day the market only “recovers” after the weekend. On the other weekdays, however, there are a lot of them.

What kind of platform is cTrader? I’ve never heard of it before, and I think it’s weird. But I’d be happy to be informed a bit about it, thank you in advance 😉

Just an MT4/MT5 analogue. I think the platform to trade with depends only on your mindset, so I can’t suggest nothing in this regard. By the way, there is one strong advantage that allows cTrader to overcome MT4/MT5. You can use C## to create scripts (cBots) for further trading. So creating code is easier for cTrader, compared to Metatrader and its MQL

What are trading conditions for Cryptocurrencies in Fondex?

Trading conditions in this company are quite specific. First, one should say that it’s a cTrader-oriented broker. So, you will not find any other trading platforms, including classical and widespread ones, such as Metatraders. Here you are expected to use only cTrader. However, it can be a problem only for true fans of Metatraders. Many people, especially freshers like cTrader for its catchy and intuitive design and decent functionality.

Another thing that may surprise you is that Fondex offers only one account, but it’s pretty universal and boasts a slew of attractive features. For example, you can enjoy very low spreads (from o pips). It’s possible to trade digital coins as well as indices without commission. As for other assets, get ready to pay $1 per side for 100 shares and ETFs and also $2.5 per side per $100k traded volume for energies, precious metals, and currency pairs.

There’s no minimum deposit here. The maximum leverage is 1:500.

There are no commissions on crypto currencies.

But there is a variable spread – about 10 dollars.

There is not only the usual bitcoin, but also other crypto currency options.

Money for bitcoin wallets are withdrawn without commission.

I was looking for cTrader brokerage and Fondex was one of the most obvious choices, so I just chose it to trade with. I was choosing brokers only by the spread size, nice that on Fondex you can check them on the website even without signing up, so that’s as fast as possible. Spreads for major Forex pairs are even lower than 1 pips, that’s the most tasty offering among cTrader brokers. I’m trading a year already, everything is nice, I have nothing to complain about. But I can’t find info about scalping there, is it allowed? I’ve seen info that there’s 60 seconds time requirement, is that true?

Of course, you can scalp with this broker. As for the 60-second time limit, I guess that you are confusing Fondex with another broker. They don’t have any restrictions regarding the time that a trade must last. So it suits perfectly for scalping. I know that from my own experience.

What’s your trading commission?

About $2.50 on currency pairs, and $1 on stocks.

Are there many assets here? Which are the most diverse?

There are a lot of assets, primarily Forex currency pairs and stocks. I can’t say anything about other assets, because I simply don’t trade them. All in all, if you are not looking for something very specific, I don’t think you will have any issues and you would diversify your portfolio.

I’ve been trading at Fondex not so long. I came here on the recommendation of my friend. He discovered this broker less than a year ago. At that time, not much was known about this company yet. But my friend managed to discern the company’s potential and says that he has never regretted his choice.

I’m also pleased with the trading conditions at Fondex. I trade in the comfortable cTrader platform with the possibility of copying trades.

But I have one question. I recently opened a Bitcoin chart and wanted to open a trade. But I was confused by the very tight spread. It was several times smaller than in other companies. Is this really so? Or do I have to pay some extra costs besides a small spread and commission?

No, the company really doesn’t have any hidden fees. Everything rather transparent and clear with Fondex. Spreads and commissions are lower than the average on the market. And you’re right. It’s especially noticeable on the Bitcoin chart.

What if I burn my depo completely on my live account. Will it be closed by the broker?

No, your account will not be closed by the broker. It only remains to deposit money and you can get back to trading.

I’m pleased with spreads and commissions at Fondex. Usually brokers give either account without commissions or without spreads. In both first and in the second case, the costs are quite substantial. If you miscalculate the volume of the trade, you can get a significant loss. And to cover it, you will need a large profit.

Fondex has a different model, which I like the most on the market so far. So, at Fondex, the spread is 0.2-0.5 pips on EUR/USD, and the commission is only 5 dollars per lot. These are minimum values.

But I got so caught up in my story that I completely forgot to ask: did anyone use the Autochartist in cTrader from Fondex? let me know how do you do that?

I will tell you more about using Autochartist in Fondex.

So, Autochartist contains a window of signals for each asset. The signals are in a time sequence. The most recent ones are always on the top.

So you open the Autochartist window in the Fondex platform. Then you look at the pattern, how long it lasted (how many candles), and the signal’s Significance. The last parameter is represented as a scale. This is the value I usually use. If the Significance is high, then I open a trade in the direction shown. If it is small, then I skip it and wait for the next signal.

Can I trade microlots on any asset supported by Fondex?

Yes, you can trade mini and micro-lots in Forex, energy, metals and indices. For Stocks and ETFs, the minimum trade size is 1 lot.

Recently I started to study trading and all its subtleties. I like watching the news on economic topics and watching Forex. It fascinates me.

I have been at Fondex for over a month. It seems to me that this is a good enough broker with acceptable trading conditions. During the month of my activity, I have never been delayed in payment or frozen my account, as other unfair brokers do!

I like the platform of this broker. cTrader is practical and convenient for both beginners and pro traders. The broker clearly worked through the instructions and training on the platform, where he gave answers to all the necessary questions. However, I still want to clarify from those who know. How to choose the right master trader? Thanks in advance!

I think you need to look at the popularity of a trader and his strategy. And you also need to pay attention to what percentage of the profit to the deposit this strategy brings. You can easily see this on the Fondex website. There is also a rating of master traders.

I want to say that the services of this broker are impressive.

How can I customize my leverage?

Setting up leverage with Fondex broker is when you open your trading account. But if you change your mind and understand that you need a higher or lower leverage, you can change it in the Fondex trading account settings!

Fondex provides good trading conditions and leverage up to 1: 500. You can change the settings in your account. I don’t know any other way. You can also contact the Fondex support service and they will help you.

This broker was recommended as reliable and having good trading conditions as well as protection against negative balance. I am confused by the absence of such familiar trading platforms as MT4 and MT5.

I would like to hear feedback from those who used the trading platform cTrader.

Indeed, it is difficult to move on to something new than you’re used to. I would like to hear about the advantages and disadvantages of this trading platform, whether its functionality is similar to MT4 and MT5.

In general, is the broker planning to add new trading platforms?

I have no idea whether the broker intends to add new platforms or not. As for me, I’m quite satisfied with cTrader. Its layout is completely different from Metatraders. It’s more user-friendly. So, I think that you’ll easily get used to it.

It’s more convenient to view news on this platform. Besides this, it’s much easier to access assets here – they are all in the list to the left.

To trade successfully, I often need to go back and look at the history of transactions. I want to know if there is access to the user’s complete history of transactions?

Access to the complete history of your trades can be viewed in the History tab.

I have been trading with a broker for the third month. So far, it goes so-so, with a variable success. Someone can tell you which indicators bring you the most profit when trading with Fondex?

I often use MACD and RSI. When these two indicators work together, they almost always give the correct signal to trade.

I have been trading forex for about 8 years now. During this time I have worked with different brokers. Frankly speaking, I have never heard anything about Fondex 2.5 months ago. I got to know it purely by chance and opened a demo account. I will tell you right away that there is no difference between demo and real account. I am very glad to advise that there is no spread, no limits on pipsing and hedging. I was surprised by the great access to the trading tools.

For those who are new to currency trading, the company’s analytics and tutorials section will be of great help. It is possible to receive information directly in the browser of the trading platform, without applications and any routine.

The broker also offers advanced fundamental analysis with FXStreet. As a user of the cTrader trading platform, you will be able to generate a detailed report on your trading activity.

Anyone who knows how to make money will do so at any broker, but if you want more quality, then try working with these guys.

A decent broker, without the hype of scandals. I am always pleased with the accurate execution.

I have only used the Metatrader4 platform before, but I have no experience with cTrader. Can you advise how easy it will be for me to learn this new program?

I also recently started using the cTrader trading platform and I want to say that this software is much easier than Metatrader 4.

I like to use this.

What is the commission for trading cryptocurrency with Fondex?

Broker Fondex tries to offer the best trading conditions and therefore there are 0 commissions for cryptocurrency trading.

I am working with Fondex recently. I can’t specifically say anything good or bad about this broker. It seems to be an ordinary forex broker, with its pros and cons. I have not noticed anything super, and I have no problems either. I like the customer service, the support team is very responsive, they work well, they help if necessary, and they do not annoy me unnecessarily. I have already withdrawn money a couple of times, so this point has already been checked. The broker offers more than 1000 assets for trading, among them are more than 900 stocks such as Apple, Amazon, BMW; 15 indices such as NASDAQ, DAX, FTSE; precious metals. There is a free demo version and protection against negative balance, copy trading – copying proven strategies of other traders is allowed. Automated trading is allowed. I am 100% happy with my broker at the moment. Over time, I will see how things go, and if anything changes, I will write a second review. The cTrader trading platform is suitable for professionals and novice traders.

Is it advantageous to trade cryptos here?

Yes, you can save money on each trading position because the broker doesn’t charge fees on cryptos.

There are lots of reasons why I chose this broker. For example, I liked floating spread, starting from 0 pips, or quite medium leverage 1:500 which allows traders not to forget about risk management practices and make deals wisely. Moreover, I would note the presence of both manual and automatic trading here. As for automatic, then you can choose either between a provided trading bot or you can write the code for your own in a special platform. By the way, anyone knows something about deposits and withdrawing conditions?

The only thing that you should keep in mind regarding deposits and withdrawals is that you should use the same payment methods for both types of operations. The rest is completely free as Fondex does not charge any commissions for deposits and withdrawals, while processing takes very short time. So once you make good profits and request a withdrawal, don;t be surprised to see your funds in your account in a blink of an eye 😉

I read different Forex brokers for several days, looked for a broker and decided to try trading here. I liked Fondex with its low spreads and a small deposit to start trading. But of course I will start trading with a demo account. Everybody does it. It is necessary to study and there is such an opportunity, but something worries me. I know that there is a special trading platform cTrader that a small number of brokers have. I don’t worry much. Is this software not complicated? Is it ok to trade here ??

I want to convince you that cTrader will not be more difficult than the rest of the trading software.

Besides, cTrader has more options for quality analysis. This is very important for profit.

I’m looking forward to trading with you because I find your trading conditions very attractive. I have recently found out that you abolished fees on all assets. I welcome this decision of yours. I have nearly decided to open a real account with your company. I intend to trade very actively throughout the day and I want to make one thing clear. What assets do you recommend me to trade to quickly increase my depo?

Of course, there is no ideal asset for quickly increasing your deposit. Among traders the most profitable are usually the most volatile currency pairs, pairs that are considered to be majors.

This can be a dangerous misconception, because trading on these currency pairs allows you not only to quickly increase your deposit, but also quickly lose it.

More experienced traders are inclined to believe that trading in stocks is ideal for increasing the deposit. Perhaps, the increase in the deposit will not be as fast as it is possible on the major currency pairs. But I increased my Fondex deposit by closely following the news of major companies and trading stocks.

Actually, I have tried so many brokers in my life and this one is the last, mainly because it suited my trading needs. There are pretty low spreads and that was the main thing which gained my attention once. Nevertheless, I have some questions. Is it worth exp[loring the copy trading platform further, what’s your experience with it?

It seems to me that using a copy of the trading platform should be an additional tool.

The trader must learn to trade, forecast and open orders by himself. But, this is just my opinion.

I decided to start working with this broker because Fondex is a broker with good trading conditions.

I should confess that I thought that the cTrader trading platform was very difficult and I could not cope with it.

Nothing is impossible!

Fortunately, I was able to use a demo account for a long time, which I need to study trading instruments and create my own trading strategy.

I am sure that the trade will be successful!

It is good to hear that. I mean that it is never too late to acquire new skills and habits and the very fact of coming to fondex because of good trading conditions speaks volumes. Anyway, good luck with mastering ctrader and conquering the market 😎

I have never imagined that I once I would join the community of a broker on a cTrader platform. Nevertheless it has hapenned and now I’m here. It’s pretty difficult to answer what exactly keep me with this broker, but I can allege that the abundance of technical indicators is the main feature for me. I’m fond of technical analysis, so that’s why I remain here. Moreover, zero commissions on depositing/withdrawals help me a lot. However, my question is there negative balance protection?

This broker offers negative balance protection, so you shouldn’t bother about it.

If I had to choose my top three favorite brokers, one of the brokers would be Fondex broker.

Here the most modern cTrader trading platform is available for trading, very low spreads and no commissions for trading currency pairs and many other assets.

At least I can say that for EUR/USD the average spread is about 0.4 pips. For metals, the spreads are also very low.

CTrader is an awesome product, much better than MTs. I joined the broker exactly because of cTrader. As for EUR/USD I hate it. It’s very cunning. I have recently shifted to cross pairs and that’s a completely different experience – far more pleasant.

Zero commission on indices and cryptocurrencies were something that I missed a lot, since I left my previous broker… I had to seek for a new one for a very long time and I was really delighted when I finally met this one. It seemed to me that this broker is pretty reliable and it turned out to be the real truth. No doubts, that one can state that there is something that he/she don’t like, but for me, everything turned out to be suitable.

Of course, some people might not like it…

These are all just opinions.

As for me… the situation is the same. I like everything)

I occasionally discovered this broker. Should confess that the thing that attracted me was cTrader. Earlier I had an opportunity to work on this platform, so I’m aware of its advantages. Then, what I also briefly noticed is that they offer 1:500 leverage. That’s an optimal leverage size for me. I don’t need higher or smaller leverage. I want to ask one question before I open a real account. Can I trade without commission here?

suree!! i know here is an opportunity to trade without commissions, as I know it works for all assets

I enjoy using fondex cTrader trading platform. It is different from what I used before. Featuring risk management, fast execution and market analysis tools, it is the optimal platform for both beginners and professional traders.

By this moment I have a question concerned to automatization. Is there any roboservices here?

I do enjoy ctrader trading platform also. Sure, there is roboservices. Advanced technical features is what you need. Check automate section for optimisation of automative processes. There are four types of cbots availabe for your goal.