Kerford UK Review (2026)

What is Kerford UK?

Kerford UK enables professional trading opportunities equipped with front-end features to enhance trading capabilities while all service established under laws of the UK operating though a financial hub – London.

Kerforf UK Broker designed a quite unique trading environment with access to trade Forex, Equities, Mutual Funds, Precious Metals and Bullion all offered through a choice between platforms and trading conditions.

Also while reviewing Kerford UK product offering it states an STP connection that brings light-speed execution through innovative technology while orders filled with no slippage, which is definitely a great advantage for whenever strategy you deploy.

Kerford UK Pros and Cons

Kerford UK is a reliable broker with digital account opening and various funding methods. There is STP connection on numerous instruments, education and platform selection.

For negative points, there is no specified spreads, 24/7 support and research is rather basic.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 📉 Instruments | Forex, Equities, Mutual Funds, Precious Metals and Bullion |

| 🖥 Platforms | Kerford UK Trader |

| 💰 EUR/USD Spread | 1 pip |

| 💰 Base currencies | EUR, GBP, USD |

| 💳 Minimum deposit | 1,000 US$ |

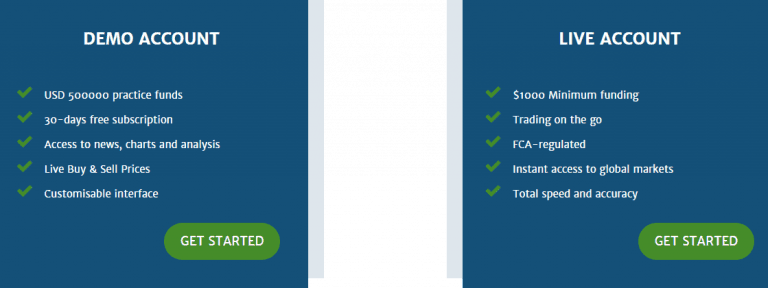

| 🎮 Demo Account | Provided |

| 📚 Education | Education provided with lessons, videos |

| ☎ Customer Support | 24/5 |

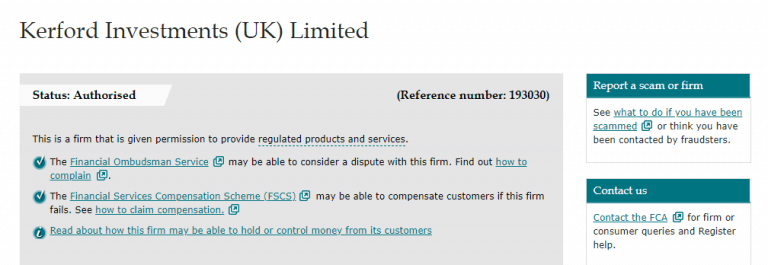

Is Kerford UK safe or a scam

No, Kerford UK is not a scam.

Keyford UK as an established investment firm in the UK obviously authorized by the Financial Conduct Authority, and this is the first thing to verify if the broker mentions its operation through the UK. Almost all financial firms should be authorized by the UK’s FCA, as authority strictly oversee the reputation and reliability of the finance industry.

Therefore, in our Kerford UK review, we cover license as the most important step to verify before you sign in to alluring trading opportunities. Kerford UK thus is a company which gained trust due to its license and a quite long history of operation.

In simple words it means, the broker is constantly overseen, reported and obliged to strict safety measures in reverse bringing you a clear state of mind. Money are always segregated in separate accounts, as well protected by FSCS in case of the company insolvency, as well you can always ask for support from FCA while trading with its licensed brokers.

What is Kerford UK Leverage?

Another important topic to cover in our Kerford UK review is offered leverage levels that may bring you bigger exposure to the markets and maximize your profits. Nevertheless, it is absolutely necessary to learn how to apply leverage smartly, as its potential increases risks of loosing as well.

Therefore, authorities recently restrict the use of high leverage for retail traders so by trading with a UK brokerage the leverage levels offer up to 1:30 for Forex instruments, 1:20 for minor currency pairs and even 1:10 for Commodities. Yet, professionals may apply for higher ratios up to 1:200 as broker mentions on its website.

Account types

Kerford UK mentions three account types that give an opportunity to trade through Mini, Standard and Pro account. However, there is no clear explanation of the differences between others. As we understood, accounts are designed according to the trading size you plan to operate, which with higher volume will bring you better costs and offered opportunities.

Fees

Kerford UK fees are built into a spread, however the specific quotes or Kerford UK spreads have no example on the website. Yet, Kerford UK mentions its spread as the lowest spread among industry offers. Along with that, Kerford UK offers a tailored solutions for traders through its STP connection and raw spreads. While trading costs suited to one own trading style, which you may directly check with the customer service. Also, compare fees to another popular broker BDSwiss.

Lastly, always consider rollover or overnight fee as a cost, which is about -2% for short positions held longer than a day.

| Kerford UK fees | AvaTrade Spread | eToro |

|---|---|---|

| No | No | No |

| No | No | Yes |

| Yes | Yes | Yes |

How to Deposit and Withdraw funds from Kerford UK?

The last point in our Kerford UK Review is to understand how to transfer money once you decide to open an account. So transfer options including various payment methods mainly Credit or Debit Cards, and Bank Wire Transfer.

Kerford UK minimum deposit

The minimum deposit amount starts at 1,000$, and higher for next grate types, which may be quite high for beginning traders, but a reasonable amount for professional ones. Actually, counting on other strong points of Kerford UK offering it might be an interesting opportunity for all.

Kerford UK minimum deposit vs other brokers

| Kerford UK | Most Other Brokers | |

| Minimum Deposit | $1,000 | $500 |

Withdrawal

Kerforf UK does not charge additional fees for deposits, however, the payment provider may treat the deposits with an additional processing fee hence will add extra fees, which you better check on. Kerford UK withdrawal options are similar to deposit.

Trading Platforms

So by bringing you an exposure to trade Forex, CFDs, metals and more Kerford UK propose to execute orders and use its own developed software Kerford UK Trader.

The platform was developed under strict and powerful goals in order to suit both a professional approach and offer ease for beginners. Software versions suit all types of devices, so you may download version for your PC or MAC, as well remain active on the go through its mobile applications.

Even though it might seem a loose that Kerford UK does not offer industry leading MT4, lets better see a good size of it, Kerford UK platform is indeed a very friendly and powerful tool. Its advanced trading implements featuring free products and training along with access to the Demo platform for your better familiarization.

In addition, the platform offers effortless ease through its intuitive design, yet packed with a powerful generation of analysis, great charting and modules that can be dynamically connected.

Education

Besides, Kerford UK maintains not only powerful trading conditions, but understanding the necessity of good customer care along with education provided.

Therefore, traders of any size, portfolio and experience may find a way to invest with Kerford UK as broker sets gainful learning materials with education covering Forex Lessons, CFD trading and Trading Metals Online.

Conclusion

Overall within Kerford UK review, we do like brokers offering in general, even though there are some points remain unclear as the company does not provide much information on its website. Kerford UK execution and trading technology is definitely a strong point, along with a range of accounts and great exposure to markets. Also, its long history of operation brings understanding the company manages to keep strong throughout various events and is a proved, reliable broker.