Key to Markets Review (2026)

Regulator

What is Key to Markets?

Key to Markets is a brokerage firm that offers access to online financial trading and markets for Institutional, Corporate and Individual Clients. The company is headquartered in the UK under name Key to Markets Limited, which fully owns also a New Zealand company and is a part of a European group that has partners in the US, UK, Europe, Middle East and Asia.

Among its global coverage, the broker offers great markets range which includes Forex, Shares, Indices, Commodities and range of Cryptocurrencies with ECN connection that are available at 8$ commissions per round micro-lot and ultra-tight spreads from 0.1 pips.

Pros and Cons

Key to Markets account opening is fully digital and easy, there is good platform support and powerful ECN connectivity, withdrawal options are widely available.

The only gap might be missing educational support and lack of 24/7 customer support.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FSCL, FCA, DMCC |

| 📉 Instruments | Forex, Shares, Indices, Commodities and range of Cryptocurrencies |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 0.4 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, GBP |

| 💳 Minimum deposit | 100$ |

| 📚 Education | Learning materials, research |

| ☎ Customer Support | 24/5 |

Is Key to Markets safe or a scam

Since the Key to Markets brand is a UK based company it is an FCA regulated broker and authorized to provide financial services that comply with necessary and very strict laws and requirements, it is not a scam.

The New Zealand incorporated company is fully-owned and controlled by Key to Markets (UK) and is registered in New Zealand along with its membership in FSCL with approved External Disputes Resolution scheme. Lastly, the registered in Dubai (UAE) company – Key to Markets DMCC regulated by the DMCC with trading license and provision of legal financial services.

Therefore and due to its regulation, Key to Markets client funds is held in segregated accounts with custodian banks along with the advanced customer protection implemented procedures and operational standards. Which all in all makes it a trustable broker that complies to the best practices.

Leverage

As the majority of Forex brokers, Key to Markets also offers to use leverage, a powerful tool that increases the potential of gains through its possibility to multiple initial accounts balance. However, leverage should be used smartly as it increases the ratio of looses as well.

Key to Markets Leverage in particular, depending on the instrument you trade and defined by the regulatory restrictions together with your personal level of proficiency. Thus, European retail clients and eligible to use the leverage of 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities due to ESMA restrictions.

Yet, trading with Dubai Key to Markets branch you may access to higher leverage ratios that go to a maximum of 1:200 for some of the instruments, therefore better check with customer services on which levels you may count.

Account types

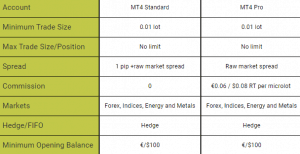

The account variety at Key to Markets enables two types designed for either Standard conditions trading or through the Professional environment.

PAMM accounts also known as a software application which allows traders to pool their funds and invest them under the management of an experienced trader are enabled at Key to Markets offering too. The PAMM system is located on a web-based platform where the investors or money managers can access the account from any device and have a great investment option.

Fees

Spreads will depend on the account type you trade, thus MT4 Standard account offers a simple feature where all costs included in the spread from 1 pip + raw market spread without any commissions. Means the company fee above is fixed on the total spread, while the raw spread provided by interbank liquidity pool.

MT4 Pro delivers raw market spreads for Forex, Indices, Energy and Metals with a commission of 8$ per round. This account usually preferred by scalpers and traders who require raw spreads for their strategies at all times, so it remains at your choice which account to choose and how to define the costs.

| Fees | Key to Markets Fees | Alvexo Fee | FXDD Fee |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spread

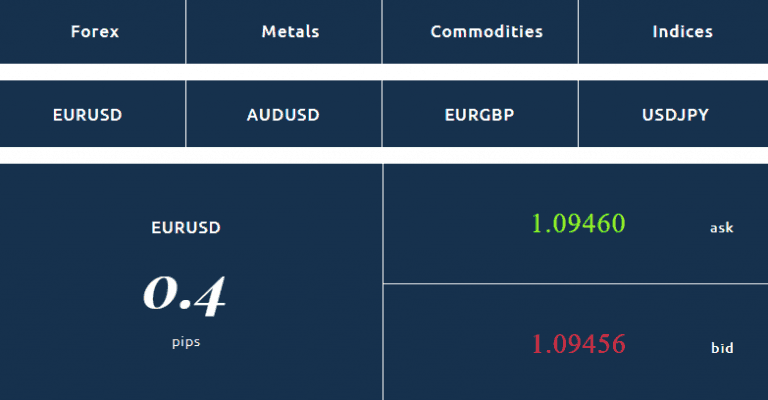

Key to markets Spread is for reference in the table below, also You may refer to the current sample of spread which is starting from 0 pips, as well compare spreads to another popular broker HotForex.

| Asset | Key to Markets Spread | Alvexo Spread | FXDD Spread |

|---|---|---|---|

| EUR USD Spread | 0.4 pips | 1.4 pips | 1.9 pips |

| WTI Crude Oil Spread | 3 | 4 | 5 |

| Gold Spread | 28 | 35 | 40 |

Key to Markets rollover

Also, you should consider Key to Markets rollover or overnight fee as a cost, charged on the positions held longer than a day and defined by each instrument separately. However, in case you are a trader who follows Muslim belief, Key to Markets specifically designed Islamic account which features no swaps with no possibility to held positions overnight.

Payment Methods

So once you ready to fund your account and start live trading, there are payment options including the most used methods Bank Transfers, Credit Cards, Skrill, Neteller and Sticpay, postepay, SEPA, etc.

Minimum deposit

Key to Markets live trading minimum deposit is 100$ for both Standard account and the Professional one, which is indeed a fantastic opportunity for all the traders or investors.

Key to Markets minimum deposit vs other brokers

| Key to Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Key to Markets withdrawal fee

Key to Markets does charge a deposit fee, for all Key to Markets withdrawal methods transaction costs apply a 2.5%, except the bank wire transfer which has no fee and 1% for withdrawal that is why make sure to count on that too.

Trading Platforms

Key to Markets brings ECN MetaTrader4 as a trading operating system that is available in a various versions compatible with all devices, mobiles and tablets. The MT4 platform is well-known for its advanced trading capabilities, powerful level of analytical and technical tools and additional features that enables vast of trading possibilities.

Yet, the MT4 tools enhancing trading even further, while MQL Suite improves the skills of discretionary traders with the new generation tools and available to all the clients with a live account an initial deposit of at least 2,500$. FIX APIs provides the possibility of trading to advanced developers using their proprietary algorithms and black boxes through robust integration and the light protocol.

In addition, you may Auto-trade your account powered by Myfxbook that offers to run Auto system and link it to the MT4 trading account. The experienced traders can create own portfolio to follow their success, while the novices may copy and learn from the professional for free without paying any performance fees, the cost will be the only small percentage from the successful trade.

Nevertheless, another reward from the company is a free VPS service that enables constant connection to the servers without interruptions, which allows using EAs without special hardware systems.

Customer service

The broker provides all-around customer service that brings an opportunity to enjoy the trading experience fully. Generally, a transparent and effective approach of the Key to Markets teams makes a broker a reliable partner for any type of the investors.

Moreover, Key to Markets is a partner with Forex Nations CIC, which is legally committed to donating at least 65% of their company profit to underserved entrepreneurs around the world through a Microcredit System.

Conclusion

Key to Markets reviews broker with ECN connection with the raw, interbank spreads. The company is fully regulated by the reputable world authorities, which means the necessary protection level is provided. The range of account types allows choosing the best option according to the trading style while PAMM, Islamic, Auto trading accounts are available. In addition, the minimum deposit requirement it relatively low only 100$ that open access to all ranges of trading instruments.