LMAX Exchange Review (2026)

Regulator

What is LMAX?

LMAX Exchange group is the holding company of LMAX Limited and LMAX Broker Limited, which operated under the brand name LMAX Exchange and is a financial technology company incorporated in London.

What is interesting, LMAX is the first regulated MTF (Multilateral Trading Facility) that brought a possibility for Institutions and professional traders to operate on the central limit order book from top-tier banks and liquidity suppliers on a number of instruments including ETFs, Spot Commodities and Currencies.

Therefore, through the years of its operation LMAX is one of the fastest growing financial companies in the UK that delivers solid infrastructure to the global offering and consistent of largest transparent, fair and precise trading conditions.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA, CySEC |

| 📉 Instruments | ETFs, Spot Commodities and Currencies, Cryptocurrency |

| 🖥 Platforms | LMAX Exchange Proprietary |

| 💰 Costs | 0.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | GBP, USD, EUR |

| 💳 Minimum deposit | 10,000$ |

| 📚 Education | Education, research |

| ☎ Customer Support | 24/5 |

Awards

Over the last years, LMAX for its excellent trading services has been recognized as one of the fastest-growing technology firms in the UK with conduct businesses within Europe, North America and Asia-Pacific. For its achievements LMAX been also recognized by prestigious rankings that demonstrate the innovative achievements.

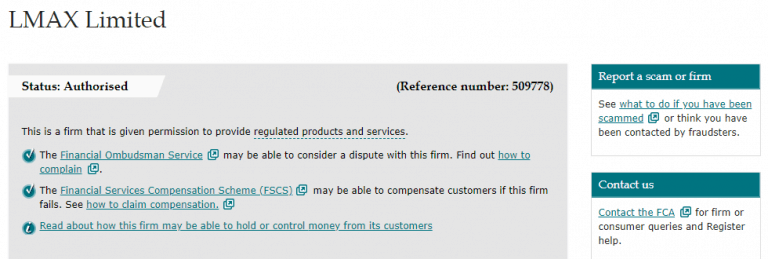

Is LMAX safe or a scam?

LMAX Exchange is a trading name of LMAX Limited and LMAX Global, while both companies operate as a trading facility authorized and licensed by the Financial Conduct Authority. Actually, there is a particular need to conduct a double regulation of each branch, as according to the European MiFID requirements, specified to the Broker’s offering and the way the business model is delivered.

Therefore, LMAX conducted a unique trading venue for institutional clients or with a purpose to use sophisticated algorithms, either deliver retail client options through centralized clearing across venues.

In a result, due to its regulations and complied requirements, LMAX provides an utmost level of security to its investors and clients, along with full compliance with applicable laws and best protective strategies. The following regulation adheres to the strict guidelines of operation, capital demands, client’s funds’ segregation and scheme participation, which overall ensures the protection of investments under any circumstances.

Trading Instruments

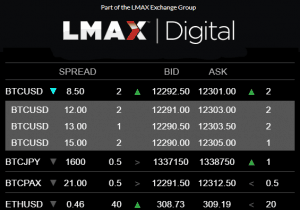

Moreover, Cryptocurrency institutional trading is enabled through separate brand within the group – LMAX Digital that enables to trade Bitcoin, Ethereum, Litecoin, Bitcoin Cash and Ripple among institutions admitted to trading. The trading technology is based on proprietary LMAX Exchange and is a custodian solution on a tiered system with increased security.

Account types

LMAX Exchange does not offer a range of account types, while the type will diverse only by the Investors profile. Due to the company establishment and the way they deliver trading opportunities, either Institutional or Professional clients are able to join, which also requires a strong financial background.

The reason for that is the superior technology that is core to traders of bigger size, as well as the quite high balance to maintain the account opening – 10,000$. Due to the clientele nature, the accounts will feature tailor-made offerings with variable spreads, typically 0.1 – 0.2 pips and a competitive commission rate structure dependant on the level of activity.

Spreads

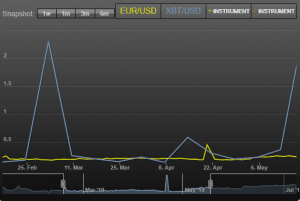

For a better understanding of the trading costs, LMAX made it open to check historical spread on a number of offered instruments, while the costs are truly very competitive and are a great advance for professional trading.

For instance, see below comparison on some popular instruments, as well compare fees to another popular broker BlackBull Markets.

| Asset/ Pair | LMAX Spread |

| EUR/USD | 0.2 |

| Crude Oil WTI | 4 |

| Gold | 25 cents |

| BTC/USD | 15 |

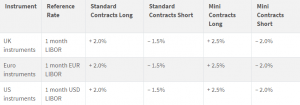

Another cost, which you should take into consideration is an overnight fee or swap rate which is paid in case the position is held longer than a day.

Deposit and Withdrawal

LMAX Global currently offers accounts denominated in GBP, EUR, USD, AUD, CHF, JPY, PLN, SEK, SGD, HKD and HUF, while there are only two most convenient and reliable payment methods accepted to fund the account. Therefore, you may use either bank transfer and debit/credit card.

Minimum deposit

LMAX minimum deposit is 10,000$ or establishment amount, which will allow you to engage into trading with LMAX .

LMAX minimum deposit vs other brokers

| LMAX Exchange | Most Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Withdrawals

LMAX does not wave additional fees for the money transfers to or from the account, traders can use Bank Wire and Credit cards as withdrawal options. However, you should always consult with your bank in terms if there any charges places by the payment provider himself.

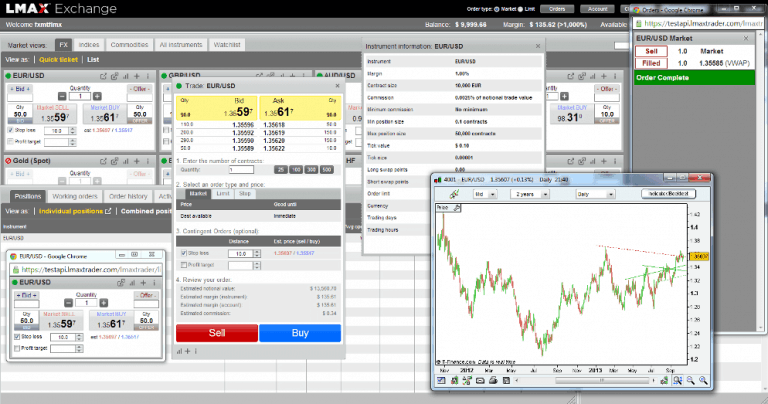

Trading Platforms

Based on the scalable technology of LMAX Exchange the continuous focus on expertise and improvements throughout low latency engines, there are also number of ways to access LMAX Global either via FIX 4.4, API (Java, .NET), Web GUI, Mobile Application (LMAX Global Trading, LMAX Exchange News, LMAX Exchange VWAP) and MT4/5 Bridges (for Brokers).

Generally speaking, LMAX Exchange technology is truly comprehensive, which is recognized by multiple industry awards, delivers superior connectivity, ultra-low latency execution and real-time streaming market and trade data available to all participants – regardless of status, size or activity levels

All bring real-time updates, quality execution speed, capabilities to use various strategies, also by PAMM and MAM features, and an ultimate level analysis tools with full market depth.

Customer Support

LMAX takes an active part within the global FX market in the measures and survey findings conducted to assess the sentiments and recommendations on the changes.

The customer support service is another strong pro of the LMAX that provides various functions, either online, or by phone, email support, along with trading education through the huge video library.

Conclusion

Overall, LMAX Exchange review presents a company with comprehensive solution to the individual traders of bigger size and institutional clients. Even though the novice traders may not be the company clientele, due to the technological offering, high financial demands and overall implementation, LMAX offering is among the most competitive and powerful for its solutions as well as the conditions. There is not much detailed information about the Broker’s accounts and platforms, yet the general proposal is deeply comprehensive for institutions as much as it has to be tailored and enhanced by each own need.