MEX Exchange Review (2026)

What is MEX Exchange?

MEX Exchange is an established firm in the field of online financial trading operating since 2012 throughout Australia and became one of the most regarded industry institutions. MEX Exchange offers its customers trading access through advanced trading platforms on a range of instruments including Forex, Metals, Stocks and CFDs.

Also, MEX Exchange is a part of a global group, a quite known company MultiBank with offices in Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus, MEXFintech in Hong Kong, along with additional branches MEX Group Worldwide offices in Hong Kong, MEX Asset Management (Austria) GmbH, Beijing, Tianjin, Hangzhou and Ho Chi Minh City, etc.

Overall, and as we will see further the details of MEX Exchange services provided, the broker became quite a big one as its services were delivered to over 280,000 retail and institutional customers throughout over 90 countries.

MEX Exchange Pros and Cons

MEX Exchange is a reliable broker with good education and trading proposals based on MT4 and a 0$ minimum deposit requirement.

On the MEX Cons the products are limited to Forex and CFDs, and there is no 24/7 support.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC |

| 🖥 Platforms | MT4 |

| 📉 Instruments | CFDs on Indices, Currencies, and commodities |

| 💰 EUR/USD Spread | 0.5 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0$ |

| 💰 Base currencies | Various currencies |

| 📚 Education | Provided Education through partnerships and tools |

| ☎ Customer Support | 24/5 |

Awards

So by providing its unparalleled expertise in technology, trading systems and professional approach toward FX and CFD traders, MEX exchange also delivers vast trading opportunities with tight pricing and powerful conditions. In addition, there is a variety of tools including education material performed by the partnership with LepusProprietaryTrading a famous Forex educator, all accompanied by support on whatever question you may have.

As well as additional developed opportunities for Money Managers through PAMM or MAM accounts and various institutional programs, which all in all recognized MEX Exchange as a great trading provider with numerous industry awards, recognitions and other gains. And that is despite a large number of happy traders they serve that recognizes its achievements as well.

Is MEX Exchange safe or a scam

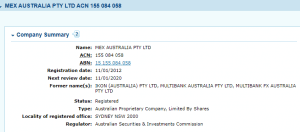

MEX Exchange is not a scam, it is an Australian financial service firm that obliges fully to its laws and regulations providing low-risk trading. Australia being a popular and reputable jurisdiction therefore, strictly regulates its financial firms and obliges to high capitalization along with a clients’ protection ensuring market integrity and healthy competition.

The task of control over financial firms performed by the authority ASIC, a world-leading regulator. Read more about ASIC regulations by the link.

Is MEX Exchange legit?

Yes, it is a legit broker due to its registrations and regulation in Australia. Also, it becomes obvious that MEX Exchange is a part of the MultiBank Exchange Group, which is a global financial investment group heavily regulated by world recognized authorities across reputable jurisdictions.

Traders protection

As for the ASIC regulations, MEX Exchange maintains the settled international rules for the money management and operation of the traders’ accounts with the highest protection level. That is involving segregation of the client accounts from the company funds, making it unreachable to the firm, also applying security of transactions.

All in all, the set of rules makes your investment secured by the country’s legislations, securing your interests and providing transparency overall trading process.

Leverage

Obviously being an Australian financial investment firm, MEX Exchange still permits high leverage ratios up to 1:500 available for retail traders. Obtained leverage also depends on the instrument you trade, as well as defined by the level of trader, thus professionals access higher levels once confirming their status.

- Retail traders leverage is maximum of 1:500 for major currency pairs, 1:100 for Commodities

Nevertheless, it is always necessary to learn how to use leverage smartly, as many from the world regulators already decreased dramatically allowed leverage levels with the purpose to protect clients. In addition, there are specified margins for the trading of particular instruments which you should check and verify too, as margin call occurs when there are no enough trading funds.

Account types

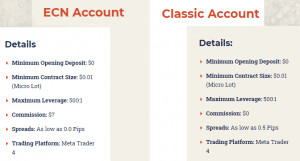

MEX Exchange offers two account types designed to suit your style of trading. This proposal includes a Standard account with a spread-only basis, and an ECN Account with a commission charge per trade, while both operate powerful execution based on STP bridges MEX Exchange group develops.

Actually, the stability of the performance is one of the main priorities in MEX Exchange thus you’ll probably enjoy its conditions along with the price models it offers, also getting quotes from numerous liquidity providers.

How to open an Account

Digital account opening is a quite simple process, where you should submit necessary information and documentation or order to set it all fine. You can follow an open account link and walk through the next steps.

- Follow Open Account link

- Provide personal data and trading experience to confirm your Live account

- Verify account through the link on your email and get access to your account area and Demo trading

- Make the first deposit

- Access trading and markets

What are MEX Exchange Fees?

The important point any trader would consider f course about fees, or what you have to pay to the broker for its trading service provided. Despite typical charge spread, or difference between the sell and buy prices, there are other payments to be considered including non trading fees and inactivity fees, see fee ranking table below.

Additional fees

Additional costs that may be added over your positions are MEX Exchange swaps or overnight fees that are charged in case a position is held longer than a day. Swaps are calculated by each instrument, since each currency pair has its own swap charge individually and may be checked directly from the platform.

Also, other costs may involve inactivity fee or fees that might be waived for withdrawals or deposits, so better to consider all packages all together as we do in our MEX Exchange Review.

| Fees | MEX Exchange Fees | OctaFX Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | High |

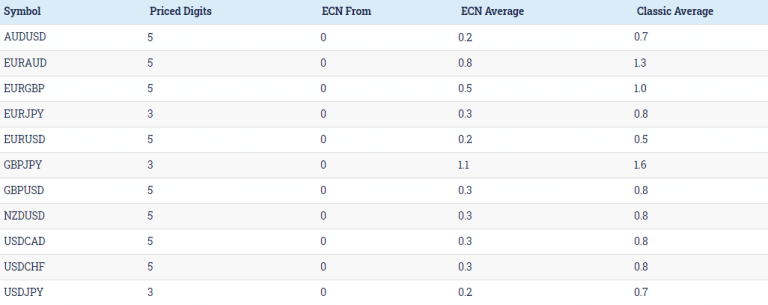

Spreads

MEX Exchange spread as usually it happens defined by the account type you operate. Therefore, the Standard account with all costs included into spread features spreads from 0.5 pips with no other costs, which is a good option for easy calculation over the take positions.

In case you prefer to use MEX ECN, you will get raw spreads starting from 0.0 pips but with a commission charge of $7. You may see some examples of Forex spreads below for the Classic account, while we found MEX fees are quite competitive, as well you can compare fees to BlackBull Markets.

Asset/ Pair

MEX Exchange Spread

OctaFX Spread

AvaTrade Spread

EUR USD Spread

0.5 pips

0.5 pips

1.3 pips

Crude Oil WTI Spread

2 pips

2 pips

3 pips

Gold Spread

15

20

40

| Asset/ Pair | MEX Exchange Spread | OctaFX Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.5 pips | 0.5 pips | 1.3 pips |

| Crude Oil WTI Spread | 2 pips | 2 pips | 3 pips |

| Gold Spread | 15 | 20 | 40 |

Snapshot of MEX Exchange fees

Trading Instruments

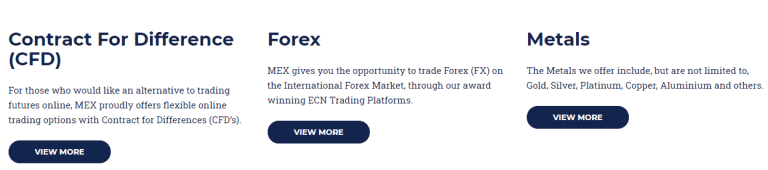

MEX Exchange builds its portfolio with the most traded instruments and offering to trade of Forex, Metals and CFDs. Through CFDs trading you will get access to Cash Index trading, yet with no exchange fees that are typically charged if your trade Indexes directly.

Along with state of art ECN technology MEX Exchange developed transforming it to an unparalleled stability platform suitable for professionals and beginners, which is a good advantage even though that instrument range is rather basic.

Deposits and Withdrawals

MEX Exchange offers a selection of instant, simple and secure payment option for deposits and withdrawals while all manipulations are done through a Client Portal. Besides, you may choose desired base currency so money transfers will not incur additional conversion fees.

Deposit fees and Options

Generally, you may select a payment provider among

- e-wallet Neteller, Skrill, China UnionPay,

- Wire or Bank transfer,

- Card payment

What is the minimum deposit for MEX Exchange

MEX Exchange has no deposit requirement. This means, trader can define the amount to start with, as a minimum is 0$ for Standard or ECN Accounts, but check on all the necessary margins for the instrument you will be trading.

MEX Exchange minimum deposit vs other brokers

| MEX Exchange | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawal

MEX Exchange withdrawal charges no any internal fees. Yet, depending on the payment provider as well as international laws some fees may be applicable, so you always better check them with the payment provider directly as they are falling on your side.

How long does it take to withdraw money from MEX Exchange?

Typically broker confirms your withdrawal request within 1-2 business days, however always add extra days as payment providers may take its time to process the transaction, which always depends on your country of origin.

Trading Platforms

Mex Exchange offers you trading capability through a popular choice of MT4 technology platform that is also enabled through a partial fill with bridge technology. Even though MetaTrader4 is a quite known platform among world traders, MEX Exchange enhanced software with an additional add-on and numerous features maximizing its capabilities for successful trading.

Pros

Cons

Quality customer support

No 24/7 support

Live chat, Phone lines

Quick response within working hours

| Pros | Cons |

|---|---|

| Quality customer support | No 24/7 support |

| Live chat, Phone lines | |

| Quick response within working hours |

Web Trading

Initially, Web Trading allows you to access the trading room without any specified software, by a simple load of page through the browser you can get to your account and trade. This is indeed very useful under any circumstances, yet note more comprehensive tools and some add-ons or features are available only through the desktop version, so for advanced trading, you better install one.

Desktop platform

There are few versions of the software suitable for various devices, as well as constantly undergo development. The platform itself is known under name MEX NexGen MT4 which is an online-based platform with all instruments and comprehensive analysis MT4 famous for.

Also, the platform fully supports APIs, Algos, non restricted Expert Advisors and access through PAMM accounts available for managers, so all the comprehensive features along with thousands of research and analysis tools are here.

Mobile Trading Platform

The mobile app is also included into the package, while app is simple to use and packed with a wide range of tools at the same time. MT4 mobile offers various charting capabilities also customization which is fantastic for mobile trading along with full management of your account.

Customer Support

With its global reach, the diversity of the companies provides customers with multiple support in any case or questioning. The 24h customer service available on 10+ languages with the service desk, on-boarding, configuration and cash management are also accessible via chat, email, phone lines etc.

Education

Beginners may count on educational support through learning materials, videos, tutorials and seminars designed according to the level of experience and suitable for your demand. Indeed, education and good knowledge is a key to success in trading so here MEX Exchange is your good partner too, as long as the broker partnered with LepusProprietaryTrading some of well-recognized trading veteran company providing quality knowledge.

Further in the trading process broker also provides up-to-date online financial news in multiple languages that were timely recognized too, where MEX Exchange runs its own Blog.

Research materials and analytical tools available through the platform, also offering Autochartist and a great option to benefit from DupliTrade advanced auto-execution mirror system, recognized as a leading signal provider for Forex, Indices and Commodities trading.

Conclusion

Overall, MEX Exchange might be a good option to consider for both beginning and professional traders. MEX Exchange has strong background and years of proven trading service success, also developed powerful technology base to provide trading, also enhanced offer with numerous assets to trade, availability of account types to choose from and education materials. So, MEX Exchange might be a good option to consider for both beginning and professional traders.