MahiFX Review (2026)

Regulator

What is MahiFX?

MahiFX is an innovation driven company that pushes the industry to its limits through the FX industry at key global investment banks. MahiFX first product MFX Trade was formally launched back in 2012, while the company itself established in 2010 by collective interbank experience leaders combining technology, quantitative analytics and trading.

MahiFX broker operates through global financial centers and is formerly New Zealand broker with additional entities in Australia and London, UK brokerage. Overall, MahiFX offers access to online trading with exposure to over 100 FX pairs including precious metals by being e-FX Engine Room developed by a team of experts.

Is MahiFX safe or a scam?

Going to an important topic about company reliability, as we found MahiFX is regulated and authorized broker not only in its original New Zealand but also authorized in the UK and Australia. Therefore, MahiFX holds three licenses notably three world-respected licenses including FCA, ASIC and FMA.

While each jurisdiction mandates slightly different rules to follow and oblige to, all of them anyhow transmitted to customer protection and constant overseeing of the firm’s reliability. Which means, all the business and service MahiFX provide is strictly sharpen to transparent money operation, company operational funding itself, follow of protective measures and treatment of clients, lastly participation into compensation in case of insolvency.

So, while investing with MahiFX you can rest assured of the legal notes broker operate through, as well as count on the guarded investment by the world authorities in case anything goes wrong with your investment.

- MahiFX Limited – authorized by ASIC (Australia) registration no. AFSL 414198

- MahiFX Limited – authorized by FMA (New Zealand) registration no. FSP197465

- MahiFX (UK) Limited – authorized by FCA (UK) registration no. 08107062

MahiFX products

What is absolutely unique at MahiFX is its three products combining into e-FX Engine Room while each of them serves an important and professional approach to FX trading. These including MFX Compass, MFX Vector and MFX Echo.

Respectively, MFX Compass is a Pricing and risk management tool with a solution to sophisticated filtering and efficient management with ongoing consultancy.

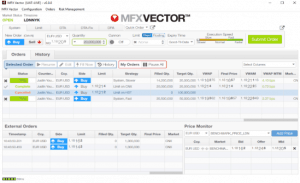

MFX Vector is an advanced trading center or better to say platform, which we will see in detail further.

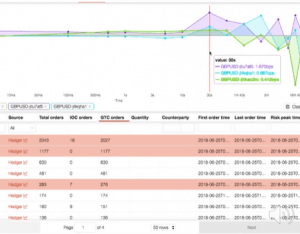

Lastly, MFX Echo is a professional approach to analytics with 3-dimensional analysis, liquidity visualization and price explanation.

Account types

MahiFX offers a single trading account for retail traders, therefore it does not make a difference on your trading experience or even the amount you invest. Simply this account has no minimum requirement and is commission-free, spread only account. Other accounts are designed for a particular need like Institutions or professionals.

Fees

As for the trading costs, MahiFX does not charge a commission per trade while all costs are built into a tight spread. The variable spread is set to an average of 1 pip for the EUR/USD pair, which is considered not very low but indeed competitive spread among the industry offers.

You may compare MahiFX fees to another popular broker FBS.

MahiFX rollover

Also, always consider MahiFX rollover or overnight fee as a cost, which is charged on the positions held longer than a day. Each instrument charges different quote for overnight positions, which may work in your favor as a refund or be deducted as a fee.

Leverage

MahiFX being an international broker do offer you an expand to trading size through powerful tool leverage, which may increase potential gains.

Leverage levels always depending on the instrument you trade, as well defined by the regulatory restrictions in the country or another. Therefore, trading with New Zealand MahiFX you may bring exposure to the markets through maximum leverage of 1:100, while trading with the FCA entity of MahiFX leverage is significantly lowered. The maximum leverage you may use as a retail trader being a European trader or the one from the UK is set to a 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

And of course, always learn how to use leverage correctly, as leverage may increase your potential loses as well and is a different feature in various instruments.

Funding Methods

MahiFX as the majority of brokers offers an easy and secure way to fund the live trading account, that includes options by Credit/ Debit Card or Bank Wire transfer.

Minimum deposit

MahiFX minimum deposit is 1$ for live account to start allowing even beginning traders to engage with ease. Nevertheless, as a transaction cost, there is a specified margin for each instrument which you should know about and verify before depositing money.

MahiFX minimum deposit vs other brokers

| MahiFX | Most Other Brokers | |

| Minimum Deposit | $1 | $500 |

Withdrawal

MahiFX does not charge withdrawal fees and withdrawal options are Credit Cards and Bank wire, most used methods. However, make sure to check on with the customer service and payment provider in case any fees are waived due to international transactions or other applications for money transfers.

Trading Platforms

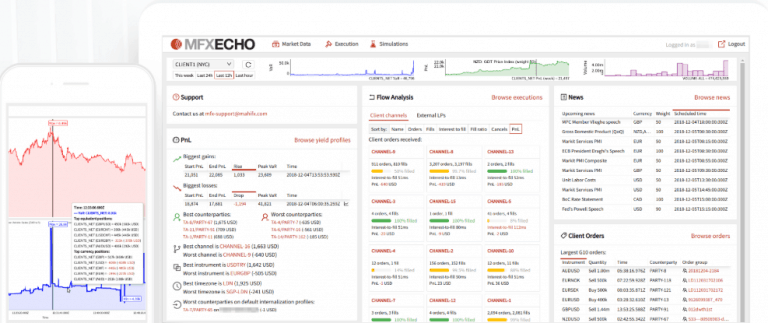

Another great advantage while trading with MahiFX is its unique combination between straightforward algorithms with a powerful engine and amazing flexibility of the platform. MahiFX designed its own complete command centre MFXVector that allows to trade like professional by posting to the top of the book and choose between passive or aggressive strategies.

Generally, we really like MahiFX platform with its Dynamic time and pricing and easy to understand interface with great Limit Orders and mode to choose while trading. Moreover, you will be using the same innovative technology Tier 1 banks use, so you may specify levels of aggression, executed amount and other flexibility while concluding an order.

And all that is enhanced by the conjunction with MFXEcho and MFXCompass products enabling you to the great advantage of powerful analytics and risk management. Agree, this mixture is indeed a progressive and promising opportunity for trading success, even though broker does offer a popular MT4 for your convenience too which is known to almost any trader own MahiFX platform brings truly competitive environment.

Conclusion

Being a New Zealand broker operating through multiple licenses including ASIC, FCA and FMA MahiFX indeed is a reliable company overseen by the leading world authorities. In terms of the trading offers itself, we do like MahiFX technology solutions and how they build trading conditions based on the unique products they develop. Even though, there is not too much diversification to markets as main mainstays on FX trading MahiFX has numerous advantages including good cost, access to high leverage and no initial deposit.

The broker’s licenses are not active, so trading may not be safe. We advise traders to be very careful before choosing to sign with the broker.