OANDA Review (2026)

Regulator

What is OANDA?

OANDA is a technology-driven financial services corporation founded back in 1996 in the United States, with a belief that the internet would open the markets with fair access to everyone for data and trading.

Indeed what we experience now shows that the approach was absolutely right, while OANDA stood as the first company with comprehensive currency exchange information presented online and the one supported the development of currency trading in 2001.

Recently, during the last years broker truly grown to a global corporation with offices in 8 financial centers (USA, Canada, UK, Japan, Singapore and Australia) , that serves clients from about 200 countries, maintained support in 9 languages and follows strict regulations of 6 major authorities.

Is Oanda a good broker?

Actually, OANDA reliability and trust are confirmed also by the leading global brands who choose OANDA as their partner and including the biggest world organizations Google, KPMG, TESLA, airbnb, FedEx, IATA, pwc, twitter, Expedia and more.

As a financial corporation with exchange and currencies background, OANDA performs additional apart from the trading solutions, that diverse the broker’s businesses and includes OANDA Money Transfer and OANDA’s Forex solutions for business.

OANDA Pros and Cons

Oanda is a reliable broker with among history of operation and strong establishment, excellent reputation and numerous regulations. There is no minimum deposit requirement and professional education section, making OANDA great for beginning traders. There is range of trading tools, proprietary software and industry leading tools provided with the low costs and spreads.

For the negative side, OANDA conditions are different depending on the entity and regulation rules and Some withdrawals add on fees.

10 Points Summary

| 🏢 Headquarters | USA with official entities in Canada, UK, Japan, Singapore and Australia |

| 🗺️ Regulation | CFTC, NFA, FCA, MAS, ASIC, IIROC |

| 📉 Instruments | Forex and CFD trading, over 100 instruments, including currency pairs, indices, commodities, bonds and metals, futures trading, commodities futures |

| 🖥 Platforms | Oanda trade, MT4 |

| 🎮 Demo Account | Included |

| 💰 Base currencies | EUR, USD, GBP, AUD, CAD, CHF, HKD, JPY, SGD |

| 💳 Minimum deposit | No minimum requirement |

| 💰 EUR/USD Spread | 1.2 pips |

| 📚 Education | Education materials designed by the level |

| ☎ Customer Support | 24/5 |

Awards

In addition, OANDA’s commitment to democratizing the global financial markets has been recognized throughout industry publications and organizations by its multiple awards within the industry. Oanda clients also have voted the company as number one in customer service, or value for money and overall client satisfaction on a yearly basis.

Is Oanda safe or a scam

OANDA as heavily regulated company is a potentially safe company to trade with, as its every step and actions are strictly overseen and complied with the operational guidelines. OANDA hold licenses from world recognized top-tier authorities and Established according to the United States CFTC and NFA regulation with additional regulation from FCA, ASIC, IIROC, MAS in Singapore, FFAJ Japan. Which makes OANDA low risk Forex and CFD broker.

Is Oanda legit?

OANDA Corporation is actually heavily regulated and authorized by various government agencies due to its global presence and coverage of various jurisdictions.

OANDA that is divided by the geographical regions and covering the US, Canadian, European, Asian and Australian markets are also respectively regulated and authorized by each of the necessary, particular agencies that oversee the trading business. Of course, regulatory regime and requirements in each jurisdiction are slightly different but all in all adhere to the same purpose customer protection and transparency within the market offering.

| OANDA entity | Regulation and License |

| OANDA Corporation | Is authorized by the CFTC (USA) and is a member of the NFA (USA) registration No: 0325821 |

| OANDA Europe Limited | Is authorized by Financial Conduct Authority FCA (UK) registration no. 542574 |

| OANDA Australia Pty Ltd | Is authorized by ASIC (Australia) registration no. ABN 26 152 088 349, AFSL No. 412981 |

| OANDA (Canada) Corporation ULC | Is authorized by IIROC (Canada) registration no.09-0280 |

| OANDA Asia Pacific Pte Ltd | Is authorized by Monetary Authority Singapore (Singapore) registration no. 200704926K |

| OANDA Japan Co., Ltd | Is authorized by FFAJ (Japan) |

How are you protected?

All customer funds, according to the regulations are kept in top tier bank accounts and are fully segregated, as well as protected by negative balance protection. Within the trading process, Oanda manages currency exposure and risk while use risk management technology, which net aggregate client positions automatically and anonymously, aggregates positions above predefined which are immediately hedged.

Leverage

The OANDA fxTrade platform supports margin trading, which means you can trade positions larger than your account balance. The advantage of margin-based trading is that you can leverage the funds in your account and potentially generate large profits relative to the amount invested, however, the downside is that you have an equal opportunity to incur losses in your account. Meaning leverage involves high risks.

So you should apply in good practice to utilize stop loss orders and limit high leverage on particular potential losses. However, in Oanda policy Stop Loss orders are not guaranteed, (check on the guaranteed stop loss brokers).

The maximum leverage allowed is determined by the regulators in each geographic region. You may always choose to be conservative and limit leverage utilized to lower levels than allowed by the regulators, for example

- US regulator requires 50:1 leverage on Forex instruments,

- the recent European ESMA regulation demand maximum of 30:1,

- Australian clients may still apply to a leverage 400:1.

Account types

At OANDA there is no difference between clients, that’s why the broker do not differ the types of account and features only one standard type of trading account. However, the client turns to the Premium client at $50K minimum deposit and gets tailoring requirements, custom pricing and tighter spreads.

The account management is well-organized as we found via our Oanda Review, where all transaction and activity is seen through online account area, while there is a good range of base account currencies allowing you to safe conversion fees.

How to open an account

Fees

Oanda trading proposals lead to trade over 100 instruments including currency pairs, commodities, indices, bonds and metals with no minimum deposit requirement or trade size, no added commissions, with the costs based only into the spread, which is by fact quite competitive. For full fee structure see the comparison table below and considere funding fees and other fees that may arise.

| Fees | Oanda Fees | FXCM Fees | XM Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

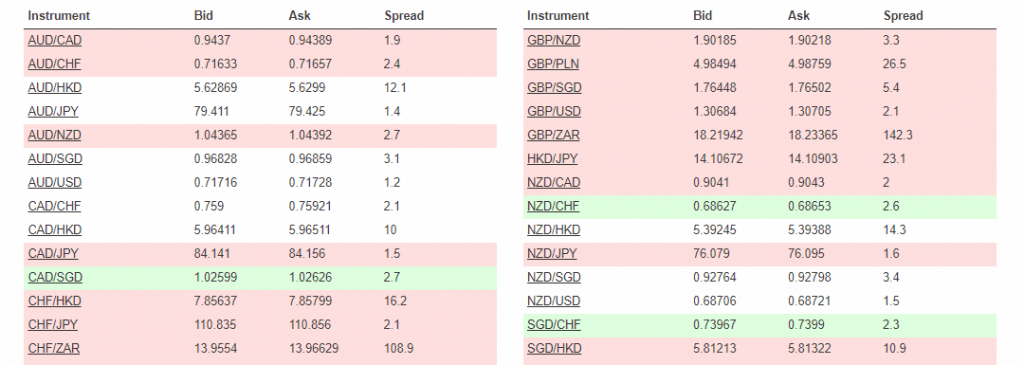

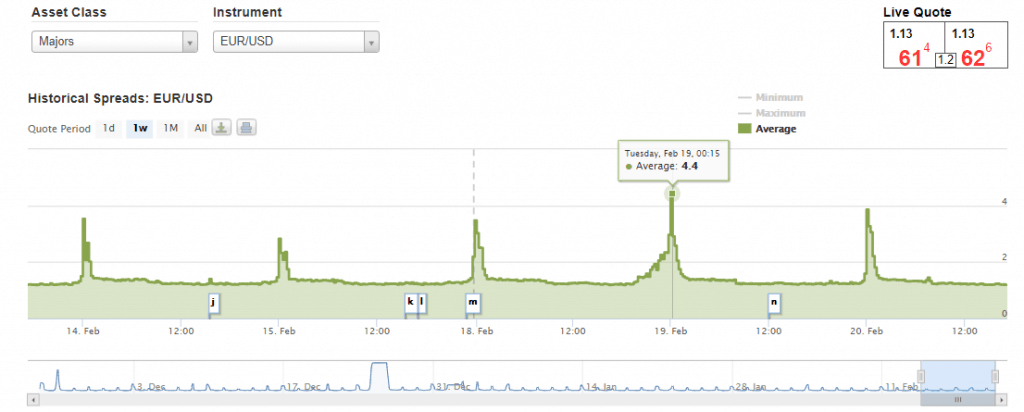

Oanda spread is calculated through an Oanda platform which is electronically connected to numerous global banks that access the most accurate foreign exchange and CFD rates in case you trade forex or CFD instruments. Below you may see an average spread on most traded instruments, as well as a snap from a live quotes.

Apart from live quotes you may find information about the historical spread on a particular asset or instrument, which can be very useful for you to understand the price policy of the Oanda and get knowledge on how the spread is influenced by the volatile market conditions.

Compare OANDA fees to another popular broker Eightcap.

| Asset/ Pair | Oanda Fees | FXCM Fees | XM Fees |

|---|---|---|---|

| EUR USD | 1.2 pips | 1.3 pips | 1.6 pips |

| Crude Oil WTI | 4 pips | 4 pips | 5 pips |

| Gold | 25.3 | 0.76 point | 35 |

Futures trading

Futures trading is available only in some regions so be sure to verify this info, while fee conditions are typically based on commission per trade. In addition, trading commodity futures or others will require to use a particular forward contract where the quotes are available, which information you can also find through research resources provided.

Instruments

In its offering, brokers OANDA is a leader in currency data, offering advanced range of instruments and including Forex and CFD trading, over 100 instruments, including currency pairs, indices, commodities, bonds and metals, futures trading, commodities futures. Also offering corporate fx payments and exchange rate services for a wide range of organizations and investors.

What OANDA offers for Deposits and Withdrawals ?

The important question about money transfers to and from the trading account features a slight difference according to the trader’s residence and under which OANDA entity you hold an account. It is a fact, various jurisdictions due to tax and laws allow some of the payment methods, while others may be prohibited to use.

Deposit options

There are vast of deposit methods available at Oanda, however be sure to verify compliant conditions to your residence and particular rules you will automatically fall according to regulations.

- USA clients (Check Forex Brokers Accepting US Clients) options offer Bank transfers and payment by Credit Cards, Checks and Automated Clearing House – with no fees, however, be ready that your bank may charge some performance services. Canada Clients: Bank wire transfer and PayPal (CAD only).

- European Clients may use Credit/ Debit Cards, SWIFT wire transfer, PayPal (GBP, USD and EUR), BACS and CHAPS (only GBP).

- Asia Pacific traders eligible to use DBS Pay Bills, Internet banking transfer, Bank wire transfer, PayPal (SGD only), Cheques (SGD only), China

- Australian Clients that allowed to use Credit/ Debit Cards, Internet banking transfer, Bank wire transfer, PayPal, Bpay, China UnionPay.

What is the minimum deposit for OANDA?

The Oanda applied no minimum deposit requirement rule, yet you should calculate needed amount to deposit in order to cover trading fees and margins, where each is defined by the instrument you trade.

OANDA minimum deposit vs other brokers

| OANDA | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawal

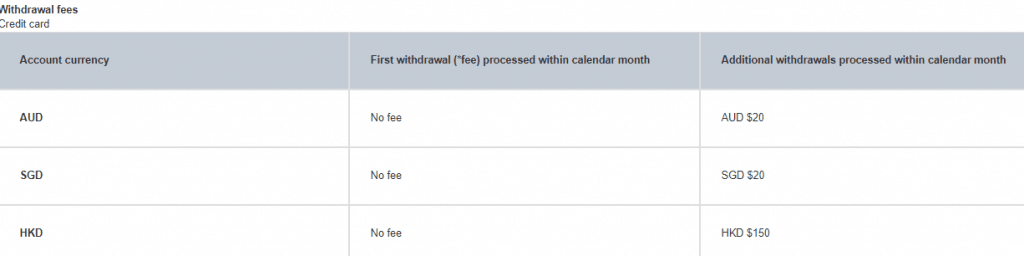

Same as with deposits, withdrawal options vary based on the company division. Most often transactions performed via Bank Transfer or Wire Transfer, or Credit cards with 0$ withdrawal fee for the first request within a month. Yet, if you wish to withdraw more funds, it may incur additionally applicable to various jurisdictions’ fee. See example on fees for Australian clients below.

How do I withdraw money from Oanda?

All money management is done via account online area, where you can submit a withdrawal request through a guided follow of steps, also see fee reports and account history.

Trading Platforms

Generally speaking, Oanda technology and software offering aiming to build itself around the right approach to protect the client and his trades, therefore adheres to tighter spreads and custom platforms across premium offering and automation of trading strategies.

No one would debate that execution means a lot in trading, and at Oanda you can enjoy a new proprietary v20 execution engine that executes trades in just milliseconds.

| Pros | Cons |

|---|---|

| Good selection between platform suitable for beginners and professionals | No alerts |

| Mainstay on multiply awarded proprietary Oanda Trade | |

| Powerful trading capabilities with free range of tools | |

| Clean view and good charting | |

| MT4 still available as additional platform option |

Web Trading

As a mainstay OANDA using a proprietary platform Oanda Trade, which can be classified as ‘easy to use trading functionality’ and has won many awards along with numerous highest traders’ regards.

OANDA’s platform supporting Web Trading, Desktop Trading and Mobile Trading Apps, while Web Trading allowing easy access via any browser.

Desktop Trading platform

Full suit and powerful capabilities, of course, are available via the desktop platform where Oanda Trade Web providing access across trading functionality, including advanced charting tools, chart pattern recognition, institutional quality backtesting, and a stream of financial news from leading providers.

Overall, the platform indeed can be classified as best in its class and definitely will be enjoyed by various level traders.

However, if you prefer MetaTrader4 it’s still an option with OANDA too, furthermore platform including all favors of exceptional execution, competitive spreads, full support of EAs including hedging scopes and the possibility to install pattern MT4 plugin for technical analysis.

Another designed by OANDA feature is OANDA Forex Labs, which is an absolutely unique institution performing the latest developments and featuring Forex Analysis, Signals & FX Tools in the continuous improvement process, as well there is an ability to try the beta version on the new ones.

Placing order

Mobile Trading platform

Oanda Trade Mobile is also awarded application which is easy to use and features good search functions, there are various languages supported by the specifications and of course available on iOS and Android.

Customer Support

Another good point to admit is customer service and support Oanda provides, through Oanda’s help portal you will find not only relative answers to common questions but is multilingual supported by Live chat, email and international lines available almost at every country worldwide.

The only gap could be the availability of customer support 24/5, yet you can leave your concern and the support team will contact you once available.

Education

If you are new to trading you might be interested in Oanda as well, since the broker provides education materials and webinars designed by the level of experience ranging from basic to expert levels.

Full range of trading tools including analysis reports and advanced charts powered by Trading View, also you can count on the economic overlay and other essential research tools very useful to your successful trading experience.

Conclusion

Overall, Oanda has very attractive features such as no minimum deposit, pricing transparency, technical optimization and a variety of tools, it is becoming clear why the broker gained high trust and popularity among the traders’ community. The fact that the company stands and operates on a strong background of reliable and successful cooperation with “global business giants” it definitely adds another advantage towards Oanda. What we like is number of developments and patterns being done by the OANDA in technical instruments and their impact on a trading process.

Reviews

Can I open the account from Kenya?

Dear David,

Yes, you can open OANDA account from Kenya. You just need to go to its website and click “open a trading account”, choose your country and proceed with the application.

Please, is it possible to access the demo online? If yes, send me one.

Does Oanda accept clients from Nigeria?