Pacific Financial Derivatives Review (2026)

What is Pacific Financial Derivatives?

Pacific Financial Derivatives is a New Zealand brokerage company, which was established with Japanese technology and experience. Firstly, the company was an authorized IB (Introducing Broker) while further enhanced its offering to act as an Authorized Futures Dealer and registered Financial Service Provider.

10 Points Summary

| 🏢 Headquarters | New Zealand |

| 🗺️ Regulation and License | FMA |

| 📉 Instruments | FX, Spot Metals, Commodities, CFDs, Indices, Futures and Contracts |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 0.5 pips |

| 💳 Minimum deposit | 5$ |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | AUD, USD |

| 📚 Education | Extensive educational support and customer service |

| ☎ Customer Support | 24/5 |

Is Pacific Financial Derivatives safe or a scam?

It is essential to carefully select a broker, while the regulated companies are required to minimize risk management, strictly follow of laws and maintenance of particular capital. Therefore, it is crucial to perform trading with a clear state company that complies with relevant registrations.

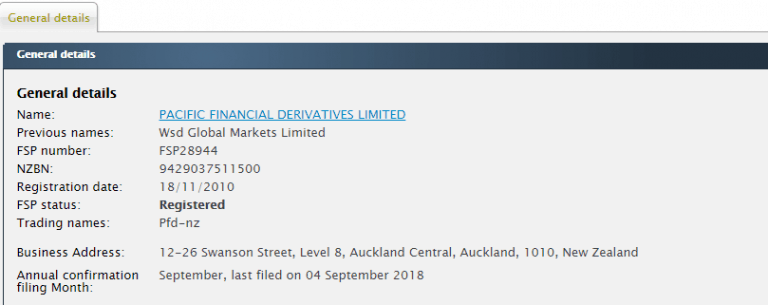

At the beginning of the PFD history, the company was authorized by the Securities Commission as an Authorised IB with the NZ Futures and Options Exchange. Then the firm spreads its services and gained a license to behave as NZX Futures and Options Participant Firm.

Since 2011 the company was accredited by the New Zealand authority FMA (Financial Markets Authority) to deal with Futures, and 4 years later obtained the license as a Derivatives Issuer.

Therefore, there are no doubts about PFD operational standards and compliance, since supervision by FMA provides a safe trading environment to investors. The basic requirements adhere to key legislations along with anti-money laundering and the fair dealing provisions.

Generally, the FMA as an agency with the role to regulate capital markets and financial services within the NZ providing efficiency and transparency.

Instruments

Currently, PFD provides brokerage services through NDD, straight to process model to trade in FX, Spot Metals, Commodities, CFDs, Indices, Futures and Contracts for the investor of any size and across the globe.

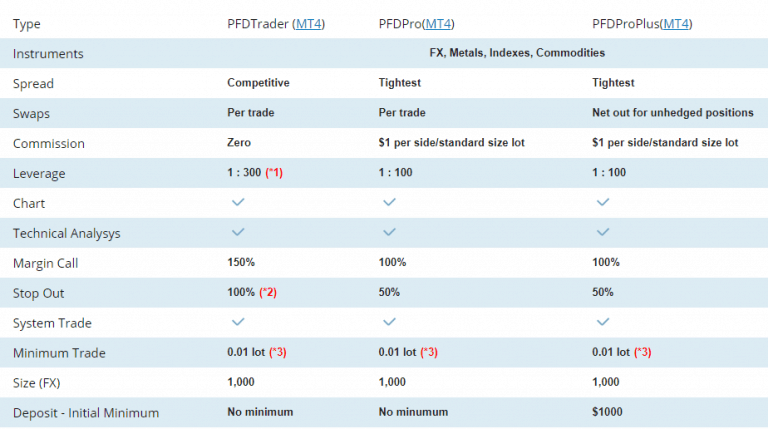

Leverage

At PFD, you’ll have the flexibility to choose suitable leverage to your trading needs, starting from 1:20 and up to 1:300, which is considered high leverage. Leverage tool indeed is a powerful feature, yet you should learn deeply how to use it the best way, as leverage may work in reverse to your gains too.

Nevertheless, being a New Zealand broker PFD still allows the highest leverage for retails traders, which brings alluring opportunity to magnify potential gains.

Account types

PFD Broker has designed three account types offering access to all available trading instruments through a range of suited trading conditions. And of course, trading terminals providing daily and monthly statements, risk management through profit and loss positions and unparalleled support.

Furthermore, there is an opportunity to open an Islamic account for the client who follows Sharia rules, which features account with no rollover interest on overnight positions.

Fees

These three accounts are designed for either beginning traders who are more recommended to trade with all costs built into a spread with PFDTrader account, while becoming more professional may switch to PFDPro with tightest spread and 1$ commission per side. What is more great there is no minimum deposit requirement for both account, so you may engage with any amount.

Spreads

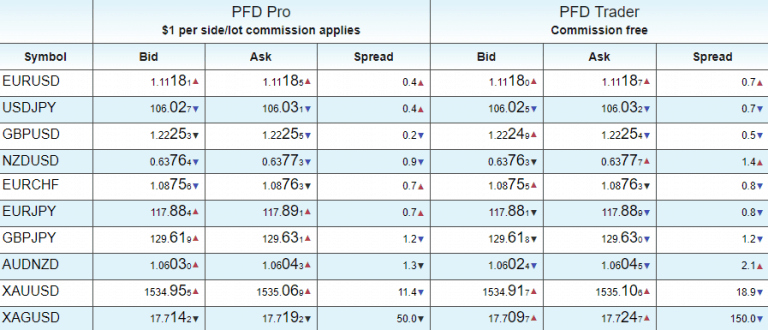

Pacific Financial Derivatives spreads presented by the account type you trade with, as an example refer to the table below for averaged spread offering, which may reach even 0 pips by trading through the PFDProPlus account. Also, always consider rollover or overnight fee as a cost, which is charged on the opened positions overnight alike 1% for short position. As well you may compare fees to another popular broker TMGM.

| Asset/ Pair | PFDTrader Spread |

| EUR/USD | 0.5 |

| Crude Oil WTI | 17 |

| Gold | 20 |

Funding Methods

In order to start live trading, of course, you should top-up the account and several options to transfer or deposit funds are at your option. Yet, you should note that payment providers may charge fees that are applicable in particular payment conditions.

Deposit Options

Methods including most popular Cards payments, Bank Transfers and e-wallets Neteller, Skrill, iDEAL, SoFort, etc or via POLi online banking.

Minimum Deposit

Pacific Financial Derivatives minimum funding is only 5$.

Pacific Financial Derivatives minimum deposit vs other brokers

| PFD | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

The funding fees or withdrawal fees range among the providers, but averaged between 1.5-2.9%. Nevertheless, there are also free of charge withdrawal payments through Neteller, or you will be entitled to 1.0% in case you prefer Card payment.

Trading Platforms

As the majority of brokers, PFD provides MT4 Trading platform which is the most commonly used global platform with friendly interface and powerful characteristics. The company is a licensed MetaQuotes partner to provide cutting-edge software for trading service and allowing to trade Forex, CFD and Futures Markets.

The platform is offered via web-based software, which simplifies the process of trading, as the environment is reachable from any device and via any browser while the only requirement is the internet connection. The downloadable version and Mobile Application however available too, so all set enables to stay connected and monitor positions with full management, comfort and ease.

Moreover, PFD’s MT4 enhanced with MetaTrader Market, a third party robot and technical indicator supplier, as well as a provider of numerous trading signals and a range of different level tools. Through MultiTerminal traders will be able to trade with the single interface a number of accounts simultaneously, so Money Managers are most welcomed too, with the possibility to obtain a MAM account.

Customer Support

Apart from the convenient methods and competitive pricing strategy, the broker provides traders with extensive educational support and customer service.

Customer support consists of the traders’ professionals that are able to assist in any possible way, including analysis advisory, technical support and in regards to operational matters, apart from the regular questioning.

The customer base of the company combines retail traders from the beginning ones to the most professional veterans, as well as corporate managers or institutional clients, while the overall PFD company ranking constantly receives highest rewards from the clients.

Conclusion

The Pacific Financial Derivatives review shows a New Zealand established brokerage company, which performs operations and relies on the experience of Japanese technology. The established STP processing provides direct access through competitive spreads and powerful capabilities. Overall, the trading conditions are suitable for the traders or investors of any size, since there is no deposit requirements and vast possibilities to engage, plus educational materials and wide support from the company.

Reviews

I want to registered . please how do I start?

How do I register?

Dear Sylvia,

Please, follow this link to register with Pacific Financial Derivatives.