Pepperstone Review (2026)

Regulator

What is Pepperstone?

Pepperstone is a wholly-owned subsidiary of Pepperstone Group Limited, an Australian-based company established in 2010, which has quickly grown into one of the large forex and CFD worldwide providers.

Pepperstone Limited was launched in the UK in 2015 while expanded its services to cover the needs of UK and European clients through local access. Overall, the group serves offices in major financial destinations Melbourne, Dubai, Limassol, Nassau, Nairobi, Dusseldorf and London.

Pepperstone Pros and Cons

Pepperstone is a reliable broker with top-tier licensed FCA and ASIC, the account opening is fully digital and trading environment is one of the best Australian offering with NDD accounts, powerful research and trading tools. Education section is great quality and support is excellent.

For the Cons there is no 24/7 support and demo account available for 30 days only, also instruments are limited to Forex and CFDs.

10 Points Summary

🏢 Headquarters

Australia

🗺️ Regulation

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN

🖥 Platforms

MT4, MT5, cTrader, TradingView

📉 Instruments

CFD's on equties, indices, shares, commodities, energy, metal and cryptocurrency

💰 EUR/USD Spread

0.77 pips

🎮 Demo Account

Available

💳 Minimum deposit

200$

💰 Base currencies

AUS, USD, SGD, HKD, JPY, NZD, EUR, CHF and GBP

📚 Education

Provided, research tools included

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

| 🖥 Platforms | MT4, MT5, cTrader, TradingView |

| 📉 Instruments | CFD's on equties, indices, shares, commodities, energy, metal and cryptocurrency |

| 💰 EUR/USD Spread | 0.77 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | AUS, USD, SGD, HKD, JPY, NZD, EUR, CHF and GBP |

| 📚 Education | Provided, research tools included |

| ☎ Customer Support | 24/5 |

What type of broker is Pepperstone?

Pepperstone was originally founded as a specialist forex broker providing access to interbank execution and low spread pricing. However, further on Pepperstone established assistance service for both retail and institutional traders through low-cost pricing by the multiple direct destinations of liquidity, without a deal desk and became execution-only broker.

The Pepperstone quotes coming from as many as 22 Major Banks and Electronic Crossing Networks, therefore traders can place orders assured of the best possible market price.

Awards

Indeed, Pepperstone strives to propose the best options to traders community was recognized by numerous awards, which the broker received regularly along to the great reviews from traders themselves.

- Exporter of the Year | Digital Technologies | Governor of Victoria Export Awards 2017

- #1 Overall Client Satisfaction | #1 Value for Money | #1 Execution Speed | #1 Spreads | #1 Platform Reliability | #1 Platform Ease of Use | #1 Commissions | Investment Trends

Is Pepperstone safe or a scam

No, Pepperstone is not a scam, it is a reliable established Australian broker complied its operation according to the respected regulation by the Australian Securities and Investments Commission (ASIC), as well as the holder of an Australian Financial Services Licence proving low-risk Forex.

Is Pepperstone legit?

Yes, Pepperstone is legit and regulated broker. In addition, Pepperstone holds relevant authorization at every region it operates. Therefore, clients’ residents of the UK and EEA are processed by Pepperstone Limited that is a registered UK company and regulated by the Financial Conduct Authority.

In addition, Pepperstone recently as of November’20 acquire CySEC license as well, so that the EU clients are fully covered under its legislation. It also, add on BaFIN license at the end of the month securing German markets likewise. Read more on the News tag.

MENA region and clients from Dubai are also authorized to legit and regulated Forex trading opportunity since the broker is authorized by the DFSA. In addition, with continuous expand Pepperstone established an entity in Kenya while regulated by CMA so the African region is covered as well.

| Pepperstone entity | Regulation and License |

| Pepperstone Group Limited | ASIC (Australia) registration no. ACN 147 055 703, AFSL 414530 |

| Pepperstone Limited | FCA (UK) registration no. 684312 |

How are you protected?

The above regulators strictly oblige the broker to follow the required performance, hence Pepperstone has no doubts about their reliability. Both, ASIC and FCA demand financial services firms follow strict capital requirements, fully segregate traders’ accounts from the company funds, comply to internal risk management, training, accounting, audits and many more.

In addition, the company provides Negative Balance protection and an automated Risk Management System to secure clients’ safe trade.

Leverage

In regards to the traders from Europe or those which account are registered with Pepperstone UK, as the European ESMA regulation recently lowered the maximum allowed leverage with a security purpose the maximum leverage level is 1:30 on Forex instruments.

Pepperstone still offers leverage of 1:500 for the approved pro clients, which you can benefit from. Yet, make sure to learn deeply about leverage and how to use it smartly, as an increase of your trading size may play a significant role in your either potential income or looses as well.

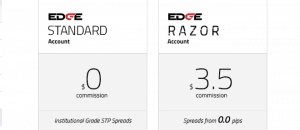

Account types

Pepperstone accounts offer the same quality performance, support and comprehensive platform’s features, beginning traders or non-professionals can sign for a Standard Account, a classical type on no commission basis and institutional grade STP spreads from 0.6 pips available in the MT4 platform.

A choice for professional traders who prefer to pay commission instead of spread consistent in Razor Account – commission from 3.5$ and spread from 0.0 pip, while leverage is flexible along with advanced algorithms for execution speed.

Active Trader

Active traders with high volume or institutional traders may access Active Trader Program specialized specifications with spreads from 0.0 pips, advanced reporting and dedicated manager, as well as VPS hosting service, custom solutions like API, FX GUI and leading third party providers.

Moreover, traders following Sharia rules may sign for a SWAP Free Account with STP spreads with 0 commission.

Fees

Pepperstone pricing are either built into a spread or a commission basis, provided by multiple liquidity providers, therefore you definitely get very competitive pricing, while spread considered to be among the industry lowest spreads. Full fees and pricing are in the table below, however Pepperstone overall fees are good.

| Fees | Pepperstone Fees | XM Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

spread on Standard or Razor accounts, where e.g. EUR/USD minimum spread starting from 0 pips and most often overages on 0.17-0.77 pips. Cryptocurrency costs are also good, where Bitcoin spreads are from $10, Ethereum $4 and Litecoin spread is $3.

For the most accurate data check the official Pepperstone website or platform also, check out and compare fees with another popular broker HotForex or see comparison table below.

Asset/ Pair

Pepperstone Spread

XM Spread

AvaTrade Spread

EUR USD Spread

0.77 pips

1.6 pips

1.3 pips

Crude Oil WTI Spread

2.3 pips

5 pips

3 pips

Gold Spread

0.13

35

40

BTC USD Spread

31.39

60

0.75%

| Asset/ Pair | Pepperstone Spread | XM Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.77 pips | 1.6 pips | 1.3 pips |

| Crude Oil WTI Spread | 2.3 pips | 5 pips | 3 pips |

| Gold Spread | 0.13 | 35 | 40 |

| BTC USD Spread | 31.39 | 60 | 0.75% |

What is Pepperstone commission?

The commission fee is added on Pepperstone Razor Accounts only, since you will be trading with interbank spread quotes starting from 0 pips and commission charges are added as a trading fee. Pepperstone applies transparent conditions and a quite competitive offering of $3.5 per lot per 100,000 USD traded.

Trading Instruments

The markets or instrument offering includes CFDs on 70+currency pairs, Cryptocurrencies (with access to trade Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin against the US Dollar), metals, commodities as well a range of major indices across the multiple broker’s platforms.

Note, that instruments may vary depending on jurisdiction (e.g. Crypto CFDs are not available under CMA).

Deposits and Withdrawals

Pepperstone’s enables clients to fund an account with ease throughout client area, as well to choose account currency that includes AUD, USD, EUR, CAD, GBP, CHF, JPY, NZD, CAD, SGD and HKD. Which is edefinitely great, in simple words means you can skip exchange fee and may benefit from trading in your local currency.

Deposit Options

In terms of funding methods, Pepperstone offers numerous payment methods, yet check according to its regulation whether the method is available or not.

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Local Bank Deposit,

- Neteller,

- Bpay,

- Union Pay

- PayPal

- MPESA

Pepperstone Minimum deposit

The Pepperstone minimum deposit amount is 200$ for any account type of your choice.

HYCM minimum deposit vs other brokers

| HYCM | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Pepperstone does not charge any internal fees for deposits or withdrawals, traders can use various withdrawal options including Cards, ewallets and Bank transfers, however international bank institutions may attract fees from either party which will be referred to the client.

Withdraw money step by step

- Login to your account

- Select on Withdraw Funds’ at the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

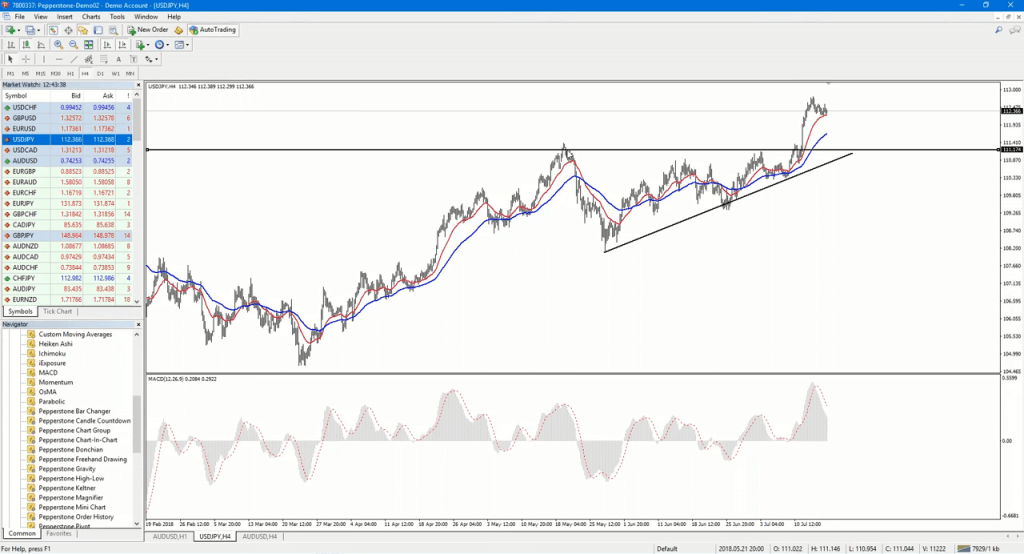

Trading Platforms

The Pepperstone’s trading technology and software mainstays the importance of performance and then an additional included parameters. With 11 Pepperstone trading platforms offering MT4 or its new version MT5, TradingView and cTrader on various versions so you truly gain a powerful trading solution with your own way of strategy or output since all trading styles are supported.

| Pros | Cons |

|---|---|

| User friendly software | None |

| Available MT4 and MT5, cTrader, TradingView platforms | |

| 11 platforms suitable for Web, Mobile and Desktop trading | |

| Mobile App for iOS and Android | |

| Fee Report | |

| Supporting numerous languages |

Web Trading Platform

The popular choice of MetaTrader4 supports various devices from the web, desktop or mobile applications all at your choice. As well the platform offers a rich, user-friendly interface and hosts order management tools, indicators, expert advisors, DDE protocols and many more.

In addition, Pepperstone enhanced platform with Smart Trader Tools, a package with over 10 smart apps that makes trading more efficient.

Desktop Platform

The fans of cTrader Platform are welcomed also, as software believed to be one the most innovative and revolutionary trading platforms available through the Desktop version. As the platform based on an algorithmic logic it shows great performance and allows efficient position management in fast moving markets.

Where a combination of Pepperstone’s liquidity and robust infrastructure provides great productivity.

Besides, Pepperstone enhances trading options with social trading capabilities so you will be able to use industry popular ZuluTrade and its copy trading performance.

Mobile Platform

The platform is also available on Web version as well through the mobile application. Yet, a key cTrader’s component is cAlgo, which designed to be a powerful tool with robots and indicators developed on C# for intuitive functionality.

- Pepperstone also is an active partner of Equinix that creates a state of art Forex trading infrastructure that directly exchange data with strategic partners and customers in close proximity.

Customer Support

Another point to admit is awarded support provided by the Pepperstone. Their commitment to the client’s satisfaction includes 24 hour live chat facility and support, full self-service Secure Client Area for account management, as well as real time news feeds with education resources and market commentary.

Education

As for the education and traders resources, you would find an Education and Analysis center developed by Pepperstone, where trading videos, Webinars and numerous research tools available for all. What is also great there are trading ideas and social trading capabilities, also analysis and fundamental data powered by leading providers like Trading Central.

Together with advanced trading platform capabilities there are additional research included too like Autochartist, and regularly updated from the broker’s in-house analyst.

Conclusion

Out final thoughts about Pepperstone are very positive, as a regulated broker Pepperstone delivers a reliable trading solution. What we liked the most is the broker’s trade execution that starts from 50ms of latency, settled immediately, with no delays, rejects, or requotes, and of course fantastic, very competitive pricing model throughout powerful trading software.

Reviews

Hello,

How safe is my money incase I deposit?

Which countries in Africa is funds accepted, is nigeria ancluded? I am from Nigeria

I have been a client for 04 years and I no longer recommend Peperstone. I had unresolved issues, and support emails do not respond.

What issue can u explain for my information,I’m using since 3 month now