PhillipCapital UK Review (2026)

Regulator

What is Phillip Capital?

PhillipCapital UK as a part of the PhillipCapital Group of companies was founded 40 years ago in Singapore, with offices in 16 countries and over $1 billion in shareholder funds. The broker trading offering places focus on the CFD, FX, commodities markets throughout the MT4 platform with true believe that quality is more important than the quantity.

Further on, the PhillipCapital UK branch has been launched in 2015, with a purpose to achieve group expansion and target to spread the circle of Forex services. An overall trading process performed on a well-established financial service basis, while PhillipCapital operates in a close binding with liquidity providers and STP execution, hence they are able to obtain better rates than other industry competitors. And, what is the most interesting, company chooses to share those low rates with their clients, rather than keeping profit to themselves, so most probably the spreads are lower or commission is reversed.

Phillip Capital Pros and Cons

Oanda is a reliable broker with excellent regulation, STP execution, low spreads compared t industry peers, good range of trading instruments and a comprehensive education section.

The negative side, there is no 24/7 support and instruments are limited.

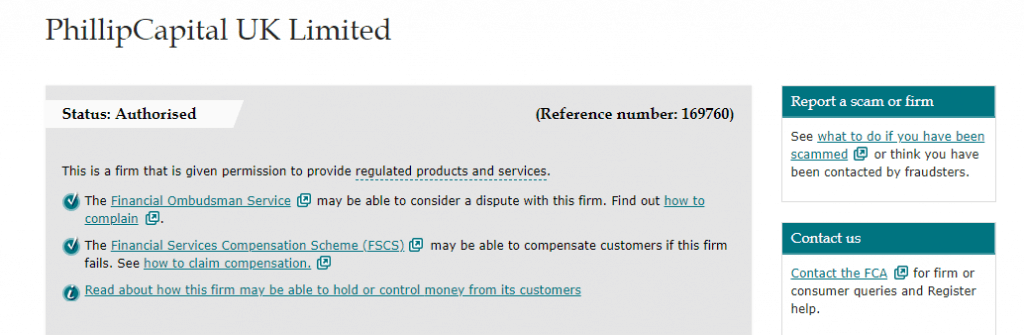

Is Phillip Capital safe or a scam

No, Phillip Capital is not a scam is a regulated by top-tier FCA broker for extra transparency and low risk Forex and CFDs.

PhillipCapital UK Limited operates through its registered office in London, UK and acts as a part of the PhillipCapital Group, which is authorized and regulated by the Financial Conduct Authority, UK.

In fact, FCA is one of the leading world authorities in terms of the regulatory requirements and set of the rules each licensed broker obliged to respect. Therefore, PhillipCapital UK follows strict standards of regulation, which claims clients money to be stored in segregated accounts in reputable Banks, while the money is held and reconciled daily.

All financial processes are fast and accurate, payments usually received by the client within 5 working days throughout sharp and strong strong procedures and operations regarding the management and safety.

Leverage

Leverage level or known as a loan taken by the trader from the broker is a great tool, which can significantly magnify your trading capabilities, yet you should be careful as the tool works in reverse as well. In simple words, it means that leverage allows multiplying your initial balance up to 1:30 for Forex major currencies, 1:20 for minor currencies and 1:10 for commodities.

These levers, which are also used by the PhillipCapitall UK are determined by the regulatory requirements, as recent updated from the regulatory body in Europe ESMA set levels to a lower number due to a recognition of risks on leverage positions.

Account types

PhillipCapital offers four different types of accounts allowing to tailor the trading experience, while the choice introduced a Phillip, Phillip Trader and two Premium accounts – a spread or commission account, as well as PhillipCapital Social Trading account. In addition, Premium account holders can benefit from the VPN/VPS subscription and monthly rebate program.

Fees

Phillip Capital markets are not that widely presented, however pricing is very competitive and fees either built inot s apred or commission charge based on the account type you select. Other fees like funding fees or non-trading fees are in the table below.

Fees

Phillip Capital Fee

Swissquote Fee

FP markets Fee

Deposit Fee

No

No

No

Withdrawal Fee

No

No

No

Inactivity Fee

Yes

Yes

Yes

Fee ranking

Low

Average

Low

Spreads

| Fees | Phillip Capital Fee | Swissquote Fee | FP markets Fee |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Low |

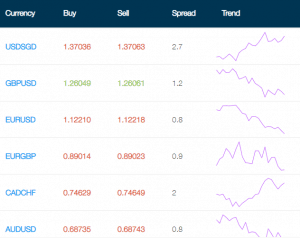

PhilipCapital spreads are truly one the most competitively presented among the competition. General offer includes 15 long or short global indices, 45 currency pairs available to both hedge and speculation on currency movements, along with commodity trading from more than 20 liquidity providers. See comparison on Standard account typical spreads below, remembering that the more attractive costs applied to other higher ranked accounts. As well compare to another UK popular broker BDSwiss.

| Asset | Phillip Capital Spread | Swissquote Spread | FP markets Spread |

|---|---|---|---|

| EUR USD Spread | 0.7 pips | 1.7 pips | 0.7 pips |

| Crude Oil WTI Spread | 4.1 | 5 | 3 pip |

| Gold Spread | 3.8 | 28.6 | 16 cents |

Deposits and Withdrawals

Phillip Capital offers various payment methods once the account is open, however, the most common ones only, excluding e-wallets. The broker supports payments via Debit card (Visa, MasterCard, Maestro) / Bank Transfer / check (UK Only), yet the company does not accept credit card payments.

Minimum deposit

Philip Capital minimum deposit amount is 200$, Euro or GBP, as this will allow you to subscribe for the first category of the offered Phillip Capital accounts.

Philip Capital minimum deposit vs other brokers

| Philip Capital | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawal

There are no applicable withdrawal fees or deposit for Philip Capital funding, while base account currencies including GBP / EUR / USD.

Though you have to note, the company holds £15 /month inactive fee, for accounts that are inactive for 6 months until the account balance is 0.

Trading Platforms

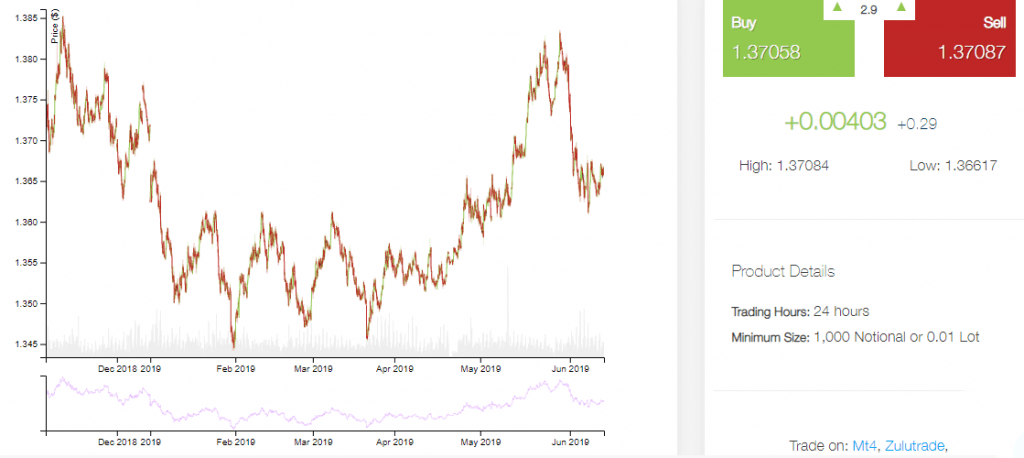

Trading with Phillip Capital you can choose between the industry standard MT4, which is known among the majority of traders and allows immediate start without prior education from the scratch due to its customer-friendly features.

The MT4 is available in formats suitable for desktop, mobile or tablet trades while offering mobility and ease of use to the trader of any style. Along with that PhillipCapital wants to be certain of efficient and fair trading, hence improved the platform by powerful insights, access to investment research information provided by Trading Central, real time news from Market News International, access to MT4 Expert Advisors and FxWirePro™.

Social Trading

Moreover, you can also use an automated trading platform a world trusted and first Social Trading Platform – ZuluTrade. While ZuluTrade enables you to locate successful traders ranked by ZuluRank and evaluate the algorithm, you can also translate all trades to your own PhillipCapitall account. Therefore, you always have an option to execute your trading orders either through the MetaTrader4 or ZuluTrades platforms.

Education

What’s else putting PhillipCapital from the mainstream, is their customer-oriented and supportive business model, which is obvious from their generous offering and provided operation. The Beginning traders may enjoy also the comprehensive learning materials, or of course, it is always recommended to enhance your capabilities and strive to be better day by day.

All in all, PhillipCapital offering definitely worth consideration, as their business model is very attractive, which has been also proved by received recognition from the clients and numerous awards.

Conclusion

Since the PhillipCapital UK relies on its established through years reputation of the mother company, through its focus on a range of trading opportunities, that makes trading powerful. Apart from the strong regulations and implemented procedures, another pleasant offer from the company is a variety of trading accounts, which featuring two Premiums with different basis on spread or commission. Also, PhillipCapital offering competitive prices.