Plus500 Review (2026)

What is Plus500?

Plus500 was founded in 2008 in Israel and now operates numerous entities around the world through Cyprus, UK, Australia, Singapore and more. Actually, Plus500 is a leading CFD provider that truly established a strong foundation for its professional trading environments and further growth.

Plus500 is also listed regulated financial CFD provider and the real size of the company is visible by the official number, as we found in Plus500 Review it serves over 304+ thousand active clients. Just for the last year over 39+ Million Positions were opened and traded value of over 1849$ billion was transacted.

Plus500 Pros and Cons

Plus500 is a reputable brand with numerous traders worldwide, it is trusted brokers with FCA, CySEC and other regulations also listed in Stock Exchange for extra transparency. Plus500 is one of the best brokers for CFD trading with easy to use trading platform and mobile app.

On the other hand, there is no proper education or good research tool, so proposal might not be suitable for beginners and the product offering is solely based on CFDs.

10 Points Summary

🏢 Headquarters

Israel.

🗺️ Regulation

CFD provider regulated in Cyprus, UK, Singapore, Australia, New Zealand and South Africa

🖥 Platforms

Plus500 Platform

📉 Instruments

Some of the greatest CFD product range including Cryptocurrency

💰 EUR/USD Spread

variable

🎮 Demo Account

Available

💳 Minimum deposit

100$

💰 Base currencies

10 base currencies offered

📚 Education

A rather limited range of educational materials and no trading course in general or live webinars.

☎ Customer Support

24/7

10 Points Summary

| 🏢 Headquarters | Israel. |

| 🗺️ Regulation | CFD provider regulated in Cyprus, UK, Singapore, Australia, New Zealand and South Africa |

| 🖥 Platforms | Plus500 Platform |

| 📉 Instruments | Some of the greatest CFD product range including Cryptocurrency |

| 💰 EUR/USD Spread | variable |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | 10 base currencies offered |

| 📚 Education | A rather limited range of educational materials and no trading course in general or live webinars. |

| ☎ Customer Support | 24/7 |

How does Plus500 trading work?

Plus500 enables retail and professional accounts to trade CFDs on a range of assets offering more than 50 countries with advanced support in 16 languages 24/7 and truly global coverage of the enabled operation. Eventually, Plus500 providing financial investment opportunity by giving world traders access to financial markets through its developed trading technology based on CFDs.

While also firm is a listed official CFD provider which gives an extra level of security and more benefits to its traders.

In addition, Plus500 shows an understanding of the importance of innovation thus constantly improves trading services, generously rewarding clients with fair trading conditions. As well as developing various trading programs or add-ons to enhance capabilities, which became award-winning programs suitable for large communities, affiliates and traders.

Awards

Apart from its comprehensive activity Plus500 it is a timely recognized worldwide CFD platform by various independent organizations and exhibitions. Plus500 also builds strategic points through numerous initiatives. Constantly increasing its trading volumes, expanding to new jurisdictions, continues leadership through development and supporting various social activities and sponsorships.

- Main Sponsor of Club Atletico de Madrid, 2016-2018 Champions League finalists and 2013-2014 “La Liga” champions

- Plus500 Group signed a major sponsorship deal with the “Plus500 Brumbies”, 2017 Super Rugby Australian Conference Champions

Is Plus500 safe or a scam

Plus500 considered secure not a scam due to its eligible status to offer Contracts for Difference CFD trading and various underlying products through the application of the strictest guidelines. Meaning trading experience and performance offered by Plus500 is fully legit and set according to safety rules applied by world known and respected regulatory bodies.

Eventually, registration within the world respected jurisdiction provides you with a state company is constantly overseen and established under high standards in reverse guarantees its sustainability.

The point why we always push on regulation is because the trading world is full of “alluring” trading brokers established only through offshore poorly regulated entities, which never may bring you a safe condition for trading due to lack of controls.

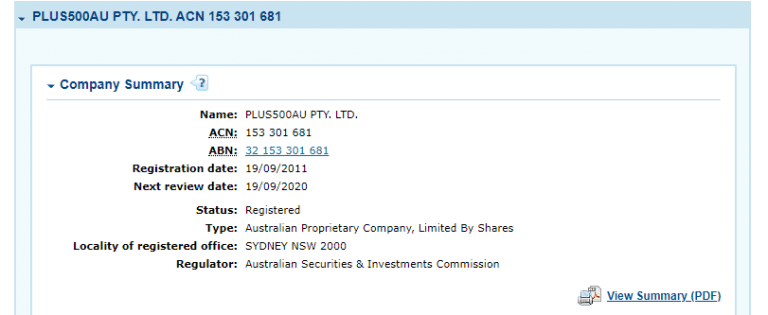

Is Plus500 authorized and regulated?

Plus500 is a trademark, operated as regulated CFD platform through Plus500 Ltd which is authorized by the financial authorities. These including United Kingdom authority, Cyprus Securities and Exchange Commission, Australian Securities Investment Commission ASIC CySEC FCA FSB and MAS in Singapore Monetary Authority of Singapore.

In addition, Plus500 Ltd is listed on the Main Market of the London Stock Exchange with a solid financial background bringing an additional level of trust toward them. See particular regulatory licenses and Plus500 entities names below.

| Legal entity | Investor Protection & Licenses |

| Plus500CY Ltd | Cyprus Securities and Exchange Commission registration no. 250/14 |

| Plus500UK Ltd | Regulated by FCA UK registration no. 509909 |

| Plus500AU Pty Ltd | ASIC Securities Investment Commission (Australia) registration no. AFSL 417727 |

| FMA in New Zealand, FSP 486026 | |

| Authorized South Africa FSP 47546 | |

| Plus500SG Pte Ltd | MAS Singapore registration no. CMS100648-1 |

| Plus500IL Ltd | Registered in Israel and licensed to operate a trading platform |

How are you protected?

While each jurisdiction and regulation will apply slightly different rules towards Plus500 operation, its main concerns are always diverted towards traders and investment safety all in all. Therefore, in accordance with the CySEC, FCA, Australian Securities and investment commission and other respected regulations, CFD provider strongly complies with numerous client protective tools.

Regulators oblige to afford maximum protection of funds under various rules, as well as to apply safety measures under any or various circumstances in order to guarantee daytraders safety. The clients’ funds are always paid into a segregated trust account, so the CFD provider uses its own funds for hedging or any other business purposes.

In addition, all clients’ accounts are protected with Negative balance protection, means customers cannot lose more than the funds they have on their account. More details you may verify through the regulators’ official website.

Leverage

As for the Plus500 risks which mainly considered what type of strategy you deploy as well as leverage you use, as while trading your capital is at risk and retail investor accounts lose money.

Yet, under the regulatory restrictions and impose of authorized operation, the residents of various countries fall under particular jurisdiction rules.

So before you get started you should verify and clear what level you entitled to use, as traders will face some differences between the leverage levels offered due to regulations. Also according to your level of experience, as professionals may access high leverage ones the status is proved.

- European CySEC, ASIC and FCA regulated traders will enjoy maximum leverage of 1:30

- MAS traders are allowed to get a multiplication of Plus500 leverage up to 1:50

- South African traders will be offered to use 1:20 for Shares, 1:300 for Forex and Indices, and 1:30 for Crypto assets.

What is required margin?

Each instrument defines its own margin to be traded, also is different according to the applicable leverage. This information you should check directly from the platform specifically for the instrument you’re going to trade.

Account Types

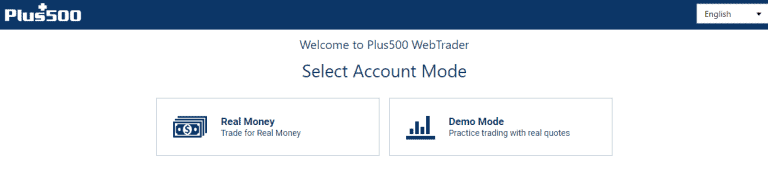

Plus500 offers a standard trading account to all clients, so you may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one, since you can choose a free unlimited Demo account, which is easily opened and further can be converted to the real trading.

Who can open a Plus500 account?

Due to international branches almost all over the major jurisdictions, Plus500 accepts clients from many countries around the world. However, some regions will fall under restrictions, thus US, Canada, Indonesia, Cuba and Iran. So you always better check whether you falling under these rules or not.

Can a Plus500 account be opened by South African residents?

Yes, if you are South African resident you may trade under Plus500AU Pty Ltd which is an authorized South Africa Financial provider.

So if you are eligible to use Plus500 trading service, there is offer of Islamic Accounts a specified feature for those traders who require special conditions due to the follow of Sharia rules. Therefore, Islamic traders are most welcomed as well.

What are the account types?

To maintain simplicity, Plus500 offers a standard trading account to all clients, so you may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one.

Once done despite trading size or level of your experience all clients use one account feature, while further, traders may get some extra benefits and discounts as long as the trading size increases.

How to open an account?

So step by step process of opening requires you to follow the Plus500 sign-in link where you will be guided through a quite simple process of opening step by step. The demo account will be opened within 5 minutes, while to start Live trading you should submit necessary proves and documentation.

According to the particular jurisdiction of the Plus500 you will be asked to provide the documentation to prove your identity or some additional information. Once done, you will then be able to transfer money to your live account and start trading instantly.

Opening an account step by step

1. Follow Plus500 Sign In or create an account link

2. Enter your personal data (Name, email, phone number, etc.)

3. Verify your account and identity by upload of confirmation documents – residential proof like a utility bill, copy of your ID, bank statement etc.

4. Complete online quiz form to confirm your trading experience

5. Once an account is activated and proved, which may take up to 2 business days follow with the money deposit and enjoy trading.

Trading Fees

Plus500 applies a transparent fee structure with no surprises, all costs are essentially built into the competitive spread. Yet, apart from that, you should know about some additional fees like non-trading charges alike inactivity fee which we will see in detail further.

Always note fees are always changing as Plus500 offering fixed and dynamic spreads. They are constantly adjusted to the market conditions, therefore here we provide spreads and rates for reference only that were actual at the time of the writing.

| Fees | Plus500 Fees | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

An overview of the Non Trading Fees

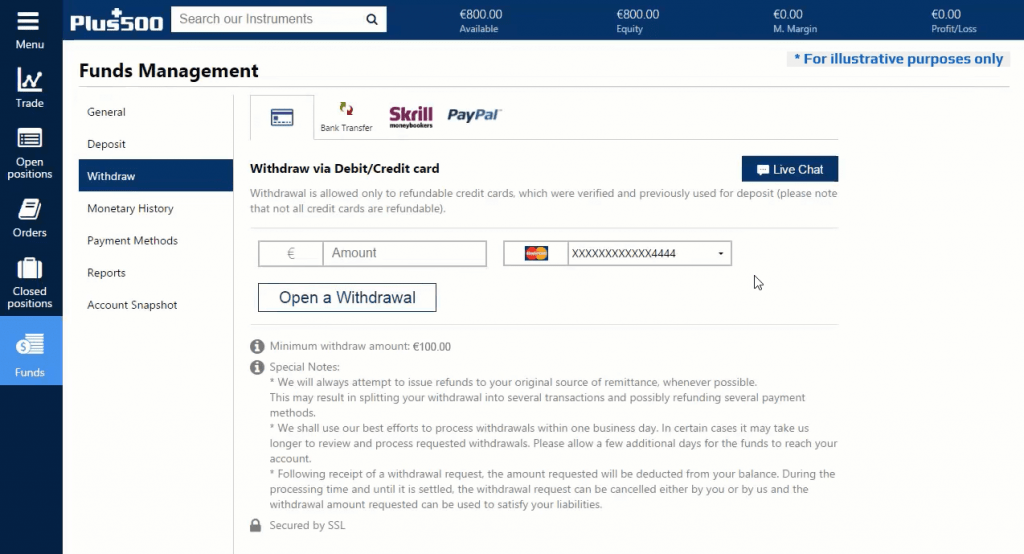

These fees should be considered while applying with as well, while Plus500 non trading fees considered quite favorable. There are no withdrawal fees, while the minimum withdrawal amount is 100$, see the next paragraph in our Review, or other charges so the only case is Plus500 Inactivity fee.

Means, in case your account remains inactive with no trades for the period of three months the fee of up to $10 is charged. This takes place in order to secure service availability and adapted to real accounts only, which is easily avoided by the minimum activity even.

A quick look at Plus500

Of course, you should never make your decision about a broker or another just based on a spread charge, or select only the only with lowest fees. You need to consider all points of the trading offering together with other fees, trading conditions, regulations and so.

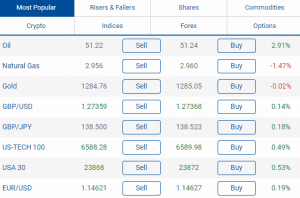

If we would quickly look at Plus500 offers, the first thing we would point is that they offer variable spreads along with an amazing variety of instruments. Yet, all asset classes offered only on CFD basis and the platform you may use is proprietary Plus500 software.

Fee conditions upon opening of trade

Spreads

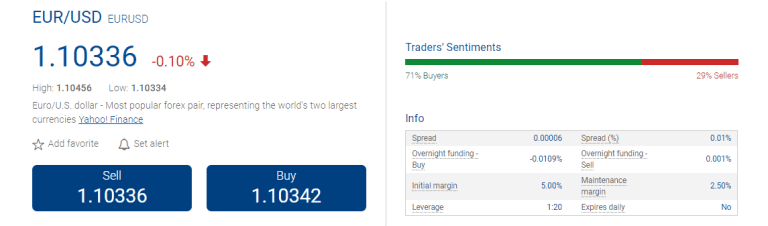

Plus500 charges are built into the spread basis, as the majority of CFD fees that broker offers, also with no additional charges or commissions. Forex fees based on spread only with no commission, as this type of fees allows simplicity of the calculation and is the best suitable option for many traders despite the strategy. We will see Plus500 spread breakdown below, while Forex fees considered to be average level.

An overview of the trading fees

In fact, Plus500 ranked fees through Plus500 Review as its spread appeared among the tightest spreads and average or actually competitive ones in the industry.

It is indeed sometimes hard to define whether the fees are good or not, for this reason we will see further as it is important to compare brokers and Plus500.

Our find on CFD fees

While spread initially means the difference between asking and bid price generated by the Plus500 which representing its trading cost. Eventually, Plus500 CFD fees and Stock CFDs are very pleasant. See comparison further.

Asset/ Pair

Plus500 Spread

AvaTrade Spread

eToro Spread

EUR USD Spread

0.6 pips

1.3 pips

3 pips

Crude Oil WTI Spread

2 pips

3 pips

5 pips

Gold Spread

29

40

45

BTC USD Spread

0.35%

0.75%

0.75%

| Asset/ Pair | Plus500 Spread | AvaTrade Spread | eToro Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 1.3 pips | 3 pips |

| Crude Oil WTI Spread | 2 pips | 3 pips | 5 pips |

| Gold Spread | 29 | 40 | 45 |

| BTC USD Spread | 0.35% | 0.75% | 0.75% |

Overnight fee

Plus500 Overnight fee or overnight funding is applicable to those positions that are referred to be a long position, which is held a certain time and longer than a day. The fee is subtracted from the account on a percentage basis and also defined by each instrument particularly.

What is more great, Plus500 Guaranteed Stop Order is a specific feature that guarantees your requested rate, yet subject to a slightly wider spread. This is a very useful tool during high volatility conditions, which remains at your disposal but definitely worth considering to manage your risks better.

For the Currency Conversion Fee broker charges this fee for all trades on instruments denominated in a currency different to the currency of your account.

For instance, you may also check out and compare fees to another popular social trading broker Capital.com.

Deposits and Withdrawals

Plus500 subsidiaries are authorized and regulated in the jurisdictions in which they operate, therefore with its compliance with client money rules and high level of protection you may transfer funds to or from trading account conveniently.

Below we compare Plus500 to other CFD broker which offer both retail investor accounts and Professional account with a similar proposal and financial instruments.

Plus500 deposit options compared to similar brokers

| Plus500 | eToro | AvaTrade | |

| Bank Transfer | V | V | V |

| Credit Debit Card | V | V | V |

| Electronic Wallets | V | V | V |

| Base Currencies | 10 | 1 | 5 |

Why is it important to compare the base currencies of Plus500 with other similar brokers?

Because it simply means you avoid conversion fees and may transfer funds more easily in the currency you denominate your account. See the comparison to other CFD brokers and their account based currencies.

Deposit fees and options

At this point, Plus500 maintains a great customer oriented policy, which makes funds transaction smooth process with free of charge deposits while none of the charges are passed to the client. However, if you made a deposit in a different currency to that which account is denominated in, the company may pass on commissions for conversion.

There is offers a great range of base currency as well, meaning if you allocate your account in particular currency there is no conversion fee paid for your bank account in case you make the transaction at a defined rate.

Plus500 supports several ways of money transfers to trading accounts including

- Credit Debit card (only Visa or MasterCard debit/credit card are acceptable)

- E-wallets including PayPal or Skrill

- Bank transfer with the direct bank to bank funds transfer

What is the minimum deposit for Plus500?

Plus500 minimum deposit is 100$ but varies according to the jurisdiction under which the trading account is opened. Important to note, each method has its own minimum deposit requirement too.

Plus500 minimum deposit vs other brokers

| Plus500 | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Plus500 withdrawal

Plus500 withdrawal fee is $0, yet you should set request to withdraw more than a set minimum amount of 100$ and up to five per month times. Withdrawal methods including Bank Wire Transfer, Credit Cards and electronic wallets have a minimum amount of thresholds, which can be found on the withdrawal screen on the trading platform and varies from one jurisdiction to another.

How long does withdrawing money from your account take?

So once you follow the steps and submit your withdrawal inquiry, Bank Transfer or other methods typically processed and confirmed by the Plus500 accounting team within 1-3 business days.

Yet, you should always give some days for your payment provider to process the transaction which depends on the jurisdiction and provider rules.

How to withdraw money from Plus500?

So in order to withdraw money from your trading account you should follow the next steps

- Login to your account select Withdraw Funds’ at the menu

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the withdrawal request along with necessary requirements

- Confirm withdrawal and Submit

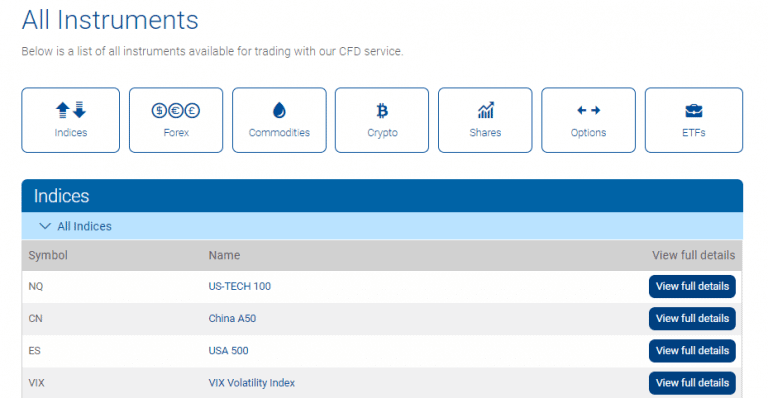

Market Instruments

As for the product range, as fast-growing is definitely one of the leading CFD providers offers a truly great portfolio with over 2800 instruments offered so you surely will find the right portfolio to trade. The CFD provider enables you to trade and speculate on movements in the price alongside innovative trading technology.

The proposal itself offers indices, shares, commodities, currency pairs, ETFs and options on CFD instruments basis. In addition, Plus500 also offering the quite advanced capability of crypto trading while adding more and more instruments to its list.

CFDs and Forex via CFDs trading offers a great advantage to you as a trader, as it means you’re not buying or selling the underlying instrument but speculate on its movement. Also, CFDs are traded as leveraged products with the possibility to access higher options if you’re a professional trader which magnifies your possibilities as well as your losses when using leverage. Therefore, you need to use them smartly.

Can I trade Cryptocurrency on Plus500?

Since the CFD platform constantly introducing new products and services to meet their clients’ trading needs, while all are still based on CFDs. So, yes you can trade Cryptocurrency on Plus500. Since the Crypto trading is now market “boom”, Plus500 included this opportunity too.

The range of instruments is also quite comprehensive one, as you are able to trade Bitcoin, Ethereum / Bitcoin, Bitcoin Cash, Ethereum, Litecoin, NEO, Ripple, IOTA, Monero based on CFDs. Which is very convenient as, with all the complications of the cryptoassets you don’t need to own crypro wallet or asset itself, you may simply speculate on the price movement with a defined amount.

Another great cryptocurrency specification is that the market works around the clock even on weekends (Except for one hour on Sundays), while the rest of the markets are closed which brings you an extra benefit.

Hence, advanced Plus500 risk management tools are very useful here for measure controls, since crypts are extremely volatile instruments. The Cryptocurrencies are traded as CFDs on cryptocurrencies, which means you do not purchase cryptocurrency itself but speculating on its price fluctuation making the process accessible to almost any trader.

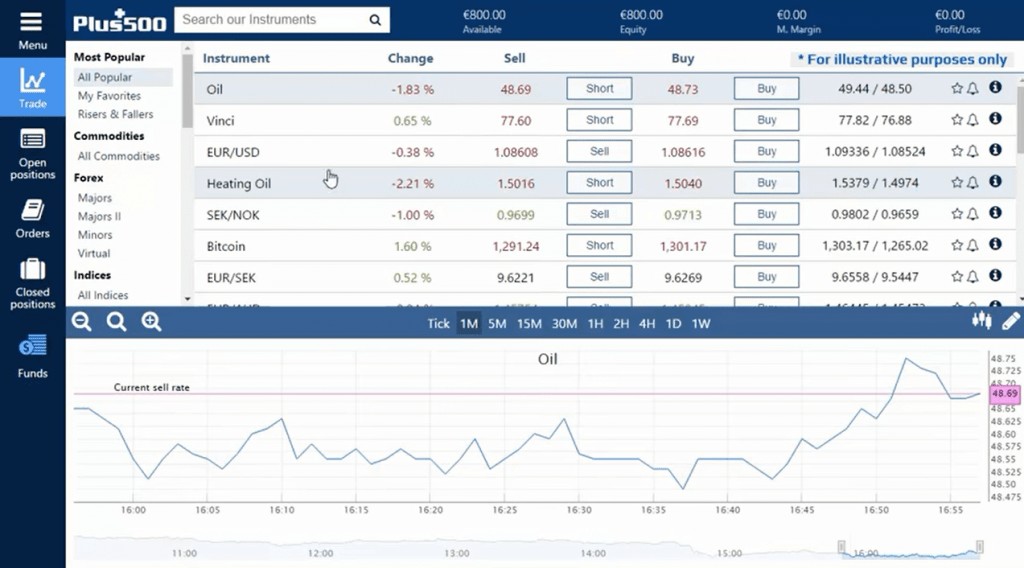

Trading Platforms Plus500

Plus500 has a simple, intuitive and easy to use platform interface for CFDs that is a Plus500 proprietary trading platform that is also solely based online.

The difference between Plus500 WebTrader & Windows trader

There are several versions suitable for any device generally maintained by the Plus500 WebTrader platform is a desktop based platform via a web browser. This means you don’t have to download or install specific software onto a PC, you just need an internet connection. So the WebTrader & Windows trader eventually is the same feature available through your browser at Plus500.

- Plus500 does not offer desktop platform Windows

Login and Security

So in order to get started, you should login with security settings to your account and may use either your existing Google or Facebook account.

Web Trading platform

Pros

Cons

Great proprietary Web trading platform

No MetaTrader4 offered

Customer and User friendly

Limited range of tools and technical analysis

Web and Mobile App for iOS and Android

Only Web Version available

Easy to navigate and simple to use

Comprehensive search between portfolios

Fee Report

Supporting many languages

| Pros | Cons |

|---|---|

| Great proprietary Web trading platform | No MetaTrader4 offered |

| Customer and User friendly | Limited range of tools and technical analysis |

| Web and Mobile App for iOS and Android | Only Web Version available |

| Easy to navigate and simple to use | |

| Comprehensive search between portfolios | |

| Fee Report | |

| Supporting many languages |

Look and feel

A trading software is simple to use and understand, while everything happens right through the website. Once you login, you’ll see a clean and understandable interface with watchlist and full control over your account, with search, Portfolio settings and Fee reports along with statistics.

Both web and mobile platforms are easy to navigate and use, with nice and clean design and great charts, also with well-defined product search functions. Even seeing the platform for the first time you get around quickly, as simple to navigate and analyze interface will definitely compliment your strategy.

The placing of orders

Apart from main features, the Plus500 trading platform enables to control account with risk management tools, such as Stop Limit or Stop Loss.

The Order Types

Also, a Trailing Stop, which is automatically Limit a Position’s Losses While Locking In Profits, Guaranteed Stop and FREE notifications.

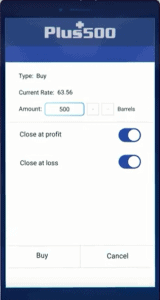

Mobile Trading Platform

Along with WebTrader you may use great mobile trading especially well designed suitable for Android iPhone or iPad. Actually it gained one of the highest ratings – best mobile platform as CFD trading mobile app on Apple’s App Store and Google Play. Plus500 mobile trading platform is also packed with necessary tools and full control over your account or positions, which brings you great accessibility on the go.

Pros

Cons

Customer friendly

None

Intuitive navigation

Good search between indices commodities and other instruments

| Pros | Cons |

|---|---|

| Customer friendly | None |

| Intuitive navigation | |

| Good search between indices commodities and other instruments |

How do I Sell/Buy on Plus500?

In order to place an order you should access your account and click on the desired instrument sell/buy order while configuring settings, as well as defining risk levels. Further, you may manage your position either by adjusting figures or closing it manually.

Search functions

One of the great features at the platform is its search function, which offers easy navigation between the instruments, products with advanced search or a simple one. So you easily may find category just by a simple typing of the name in a search line.

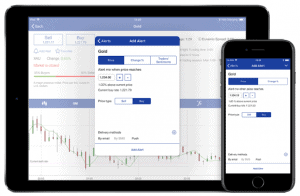

Notifications & Alerts

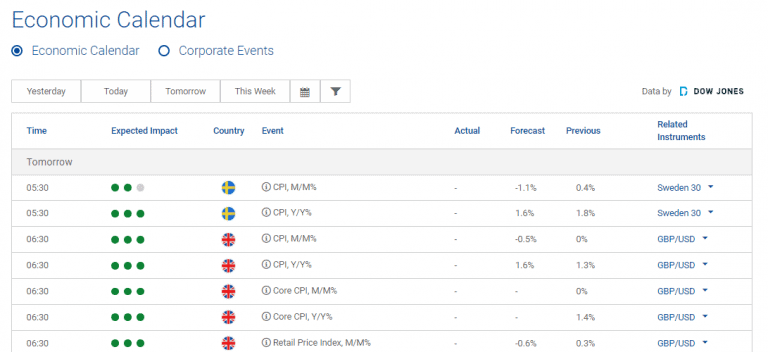

Yet, together with platform simple design it still powered with advanced technical indicators, charts and real-time price alerts with notifications which you may receive to your email. Also, you will find an economic calendar and news feeds, which allows deeper analysis of the price movements.

How to make money from Plus500?

First of all, you should consider all the risks involved as trading always carries a risk and should not be defined as a source of income.

Besides, to get the potential trading success you should maintain a powerful strategy that will work the best for you, as well as will bring an ability to enhance your performance which happens through scrupulous learning and polish of the strategy.

Is Plus500 any good?

Actually, Plus500 gives you all the opportunity to succeed in trading including a great range of markets to trade all accompanied with quite good costs, so all the possibilities remaining in your hands.

Customer Service

Another great point at Plus500 is its customer support service available 24/7 offering WhatsApp support, live chat through chat support, email support. So when ether question or inquiry you may have you should contact the support team as its service is good and professional.

Plus500 gladly assist traders in various ways and truly relevant answers, with reliable and quick guidelines or help you should request, which is fantastic and important for you as a client. Also considering a grate range of languages they support and availability 24/7 with live chat rewards them even more, as this level of support is quite rare among other brokers.

Education

As for the educational materials that are necessary for beginning traders and alongside your trading journey at all times, this is not what you can find in Plus500.

It provides a rather limited range of educational materials and no trading course in general or live webinars. There are some course videos known as Plus500 Trade’s Guide which is just a guide on how to use a proprietary trading platform.

The platform itself offers great charting tools alongside with economic calendar, built in news feed and alert systems which are useful. But there is no provided technical analysis or other materials with research purposes to support your everyday trading.

Research

Research also very helpful with educational and research purposes as allowing you to be a better trader and stay aware of market conditions. However, there is no fundamental analysis or trading ideas also news are rather general, also with no social trading functions.

Therefore, trading with Plus500 you should perform your own research before making trading decisions, which is more suitable for experienced traders. In case you are very beginner maybe it is best to consider other brokers or to find a good educational course in order to become successful in what you do.

Conclusion

Overall, Plus500 having operated over 10 years obtained a name of a trusted CFD broker with an extensive variety of instruments, provided by OTC operation. For the quality of service, we witness good ability to cover various trading demands, easy to use a simple trading environment, good apps with great spread offering and a balance between trading conditions. However, Plus500 working with CFDs model of operation only, while products usually leveraged with may involve high risk for real money.

Is Plus500 good for beginners?

Actually, one of the limitations of the company is that there is no comprehensive educational support, as well as analyst recommendations or fundamental data, which is not so good for beginning traders suitable fr retail investor accounts.

Plus500 platform is suitable for experienced traders only, though Plus500 is a very user-friendly platform, yet CFDs are complex financial products, thus the platform is not suitable for beginners or un-experienced traders.

Yet this is not a very negative aspect since the major features to potential success conditions of Plus500 are at a very sustainable level. Besides, always consider whether you can afford trading with real money as risks while trading includes a possibility that accounts lose money.

Also, you may see our Plus500 video review for better visual understanding and of course, we will be glad to know your own thoughts about Plus500 which you may share in the comment area below.