Price Markets Review (2026)

What is Price Markets?

Price Markets broker matches the order through their established ECN system on more than 50 FX, Indices and Commodities on the array of trading platforms, gateways in client’s location of choice. Price Markets is a UK established provider of FX Prime Brokerage and Infrastructure services to the trading community which operates since 2013.

The main idea of a brokerage is developing a vast array of technological solutions and create a competitive offering to the global traders, through established high-tech on a higher level. In fact, Price Markets succeed in their strives and received numerous awards and recognitions for achievements, along with good references from the traders community.

Price Markets Pros and Cons

Price Markets is a reputable legit Broker with good trading conditions for trading technology. The account opening is smooth, trading instruments are widely available and trading costs are built into commission charge.

On the negative side Price markets might more suit advanced traders, there is no 24/7 support, also education are rather basic.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 🖥 Platforms | MT4 ECN, WebTrader, Currenex, liquidX, integral |

| 📉 Instruments | FX, Indices and Commodities |

| 💰 EUR/USD Spread | 0 pip +3.5$ comission |

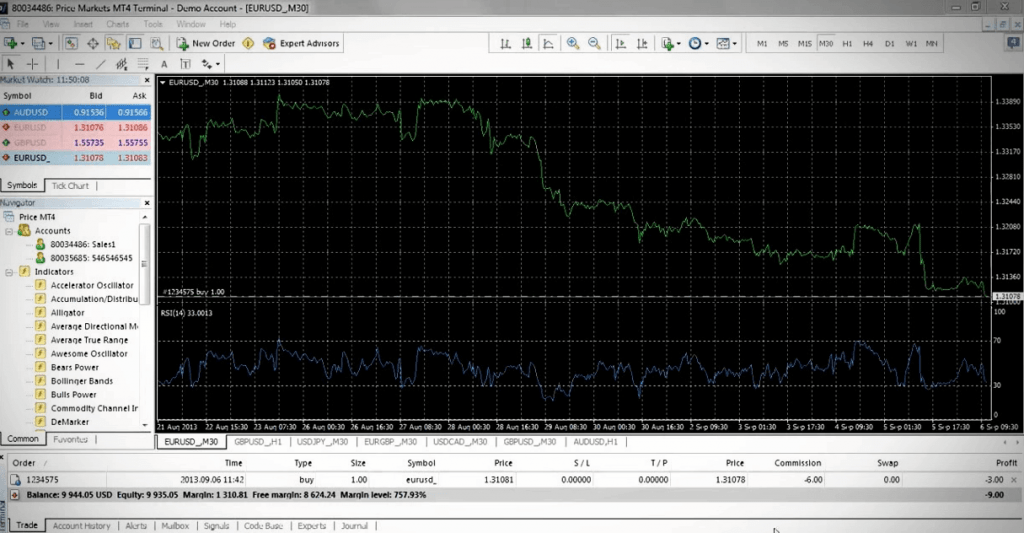

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 500 US$ |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Limited education provided |

| ☎ Customer Support | 24/5 |

Is Price Markets safe or a scam?

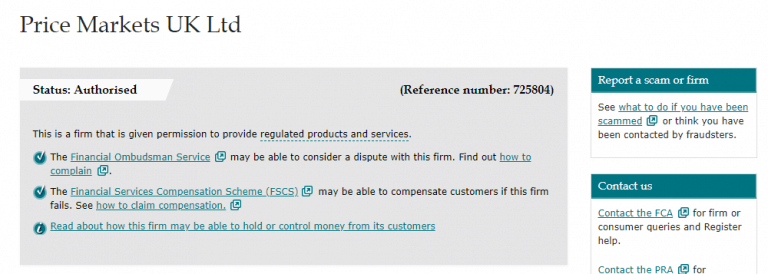

No price Markets is not a scam. Price Markets UK Ltd is a company incorporated by the UK and therefore respectively authorized by FCA (Financial Conduct Authority) to operate within a strong regulatory framework considered low risk trading broker. Actually, regulation is the most important part since reputable license ensures measures, controls and reporting of the market and counterparty risks to authority.

For you, as a trader, it means that Price Markets keeps client’s money in segregated accounts with major UK institutions that ensure funds protection. Along with up to 50,000 GBP FSCS Protection per Retail Client in the unlikely event that Price Markets is no longer able to meet its financial obligations.

Leverage

Price Markets offering leverage up to 1:30 for major currency pairs that open the way to use bigger trading size comparing to the initial balance you maintain thus maximizes capabilities. Yet, the leverage is also may work in reverse too, therefore you should learn how to use it smartly.

Actually, the lower level is defined by the FCA regulatory requirements, since Price Markets is respectively authorized in the UK, and that is done with a purpose to protect retail traders from unpractical use of high leverage ratios.

Account types

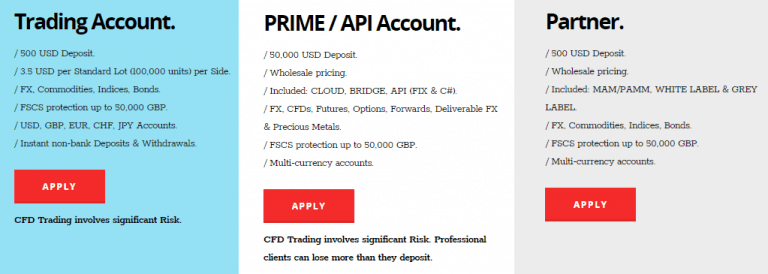

Price Markets offers accounts with various requirements designed to suit particular trading needs while the minimum deal size may vary between markets and can be as low as 1,000 USD or 1 micro-lot. Actually, retail account type is only one at the first stage, yet once the client passes the questioner different conditions may be offered according to the trader’s size, experience and type.

Fees

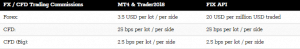

Price Markets transaction costs and pricing includes, the commission, spread and Swap charge or credit on each rollover based on the interest rates of the two traded currencies with a mark-up/mark-down from 1.5%.

| Fees | Price Markets Fees | Core Spreads Fees | InterTrader Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

Spreads

Typically Price Markets Forex spreads starting from 0.0 pips, Gold from 12 cents, UK100 – 0.7 pts and GER30 0.3 pts, while costs are built into a commission charge 3.5$ for Standard account. See below Price markets spreads, also you may check spreads of another popular broker BlackBull Markets.

| Spread | Price Markets Spread | Core Spreads Fees | InterTrader Fees |

|---|---|---|---|

| EUR USD Spread | 0.3 pips | 0.6 pips | 0.6 pips |

| Crude Oil WTI Spread | 1 pips | 3 pips | 3 pips |

| Gold Spread | 1 | 4 | 1 |

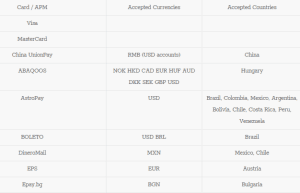

Methods of Payment

Deposits and Withdrawals to and from the live account can be processed through truly vast and multiple options, allowing you to choose the best suitable option according to your region or country of residence. The array of methods including Bank, Credit Card, Debit Card, local payment options, as well as numerous web payments like Giropay, Skrill, POLi, Sofort etc.

Minimum deposit

The minimum deposit for Price Markets is 500$, which will allow you to subscribe either for Trading Account or Partner account including MAM or PAMM options.

Price Markets minimum deposit vs other brokers

| Price Markets | Most Other Brokers | |

| Minimum Deposit | $500 | $500 |

Withdrawal

What is more great, Price Markets does not charge any Fees to process withdrawal or deposits, while accounts available at USD, EUR, GBP, JPY, CHF currencies and is definitely a great feature.

Trading Platforms

Price Markets uses a wide array of platform solutions that provide the best in class trading experience, as well as the choice to choose from. All platforms run on low-latency proprietary cloud network in LD and NY.

In addition, traders can choose from the variety of trading solutions that includes co-location, algorithmic trading, aggregator or bridge, deliverable FX, PAMM for money managers, IBs and White Labels. At an extra cost variety of machines proposing VPS from 50$ a month, Custom cloud, Research and Enterprise (Bare Metal Service), etc.

The Price Markets platform mainstay is the MetaTrader4 Terminal that is the desktop version of the popular platform also enhanced by priceCLOUD. Another offered platforms including Currenex that brings seamless and anonymous pricing, along with liquidX, integral featuring DMA execution.

Also, there are numerous solutions for APIs and technical trading varying on specific conditions and the orders of strategies you use across multiple venues.

Apart from the powerful features that the platform provides, additional trading apps allow a review of the real-time performance of hundreds of trading signal providers or community, which all in all indeed very comprehensive choice to choose from.

Customer Support

The customer support is also organized by the broker on a high level that brings exceptional attention to the clients. Whatever the nature of the client is, either retail or corporate trader, Price Markets supports by information in any way, even though educational materials are slightly presented. Customer service available in multiple languages and can be accessed via online chat, email, phones, etc.

Conclusion

The Price Markets review made it clear that broker treating Customers Fairly, as a Matched Principal Broker, since Price Markets UK performs technology solution for trading that uses ECN connection. All ranges of markets are traded as a CFD contract (Contract For Difference), that are hedged exposure in the relevant market for the instrument you trade. The traders of any size will find a way to start trading with the Price Markets since there are many options to engage in trading, however very new to the trading won’t find a vast of educational materials.