Royal Financial Trading Review (2026)

Regulator

What is Royal Financial Trading?

Royal Financial Trading is a team of trading professionals that established the brokerage company in 2006 to offer optimal trading conditions, tailored services and support.

Originally, the broker headquarters in Lebanon, but due to the rapid spread in the world, the company established offices in leading financial world centers Cyprus and Australia, while fully complied with applicable regulations.

The broker will provide you with real market execution of trades based on NDD execution, while the client gains can be potentially multiplied with high leverage up to 1:500 on Forex financial instruments.

Furthermore, you may choose trading strategy either to day trader, perform auto trading, follow professional through Social Trading capabilities, or maybe to invest through MAM technology.

Royal Financial Trading Pros and Cons

Royal Financial Trading is among well regarded Brokers with easy digital account opening, good platform tools and education with research. Also, various options to deposit or withdraw funds.

On the flip side trading fees for Stock CFDs are higher, and there is no 24/7 support.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation and License | ASIC, CySEC, CMA, FSA, VFSC |

| 📉 Instruments | Spot FX and commodities, CFDs for Indices, Stocks and Bonds |

| 🖥 Platforms | MT4, MubasherTrade Pro, RJO, Trading Central |

| 💰 EUR/USD Spread | 1.4 pips |

| 💳 Minimum deposit | 50 US$ |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | USD, EUR, AUD, GBP, CAD, HKD, NZD, SGD, CHF, PLN, LBP |

| 📚 Education | Live News, Economic Calendar, Traders Dashboard, Market Levels and the Trading Central |

| ☎ Customer Support | 24/5 |

Awards

Overall, while we will see more details about the Royal group of companies within our Rotal Financial Trading Review. With its provided competitive trading conditions the company received a dozen awards from reputable financial expositions and continue growing.

Is Royal Financial Trading safe or scam

No, ROYAL is not a scam it is multiply licensed broker, including top tier ASIC and additional regulations by CySEC and CMA Lebanon. Royal Financial trading is considered low risk for Forex and CFDs.

Is Royal Financial Trading legit?

Royal Financial Trading is authorized by the Australian Securities and Investments Commission (ASIC), also by the Cyprus Securities and Exchange Commission (CYSEC) and the Lebanese Capital Markets Authority (CMA) and Central Bank of Lebanon.

In addition, there are international entities authorized by FSA and VFSC allowing traders from various countries to open accounts.

Are you protected?

In short, being regulated by the leading authorities, Royal perform its transparent operation while fully complies with established numerous rules. The regulations always in a position to offer clients the best capabilities under the full supervision of the regulations in their areas of operation.

While the transparency provided within the framework requirements dedicated to reduce systematic risks, protect investors from illegal practices and organizing professional activities or clearing settlement services with sharp detail. Also, all client’s funds are protected at all times, not only by segregation in world leading banks, but also by risk management systems, internal control functions and scheme compensation in case of insolvency.

Leverage

As for the Leverage ratios offered by Royal Financial Trading it does depend under which regulatory restrictions and rules your account is opened with. Therefore, Australian traders may enjoy high leverage levels up to 1:500 for Forex instruments, as ASIC authority allows so.

- In reverse, Cyprus regulatory restrictions along with European legislation mandates lower leverage of only 1:30 for major currency pairs and even 1:10 for Commodities.

While trading with Lebanese entity may entitle various leverage levels too, therefore, check carefully under which regulation you will fall and what levels are applicable to your residency status.

Accounts

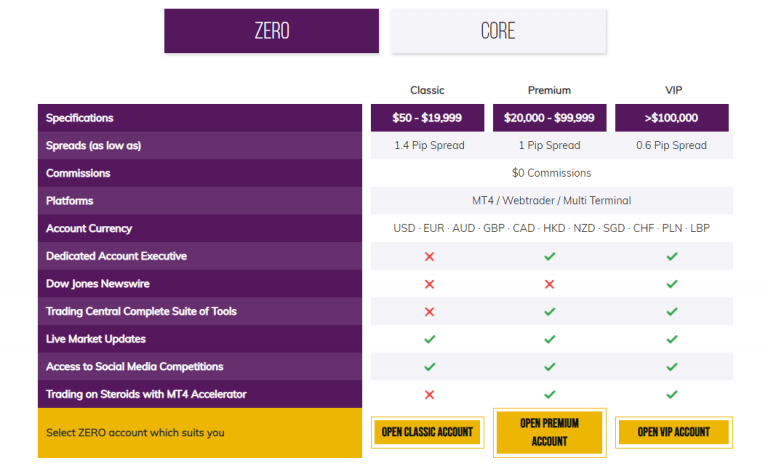

There is a choice between two main account types, first offered with spread only basis or on a commission basis, known as Zero and Core account. Further on, depending on your initial investment broker would offer you better trading conditions and lower costs.

A perfect solution includes in total 6 Account Types to the traders from bigger to smaller size and features Classic, Premium, Vip for Zero and Core account type respectively.

Besides, there is a choice to open either Individual, Join, Corporate or Trust Account, as well as the MAM, to manage the multiple accounts from a single interface and Islamic account for Muslim traders, which includes no interest, swap or rollover commissions (Find out the best swap free forex broker).

Instruments

There are many investment opportunities available within the Royal, while trading access provided through an NDD execution model by the selection of financial products Spot FX and commodities, CFDs for Indices, Stocks and Bonds.

Fees

The diversity of account types caters to various investment strategies and activities while holding a Royal Financial Trading account allows you to benefit from the most demanding figures on tight spreads, low cost and quick execution.

| Fees | Royal Financial Trading Fees | AvaTrade Fees | BDSwiss Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Average |

Spreads

Royal Financial Trading spreads designed according to the account type, since as much higher account size you maintain the better spread offering is included.

So if you select a group of Zero account all costs are built into a variable spread, examples of which you may see in the table below. And if you prefer a commission basis Core account group is your selection, where spreads starting from 0 pips and add on 7$ commission for a classic account, 5$ for Premium and 3.5$ for VIP one.

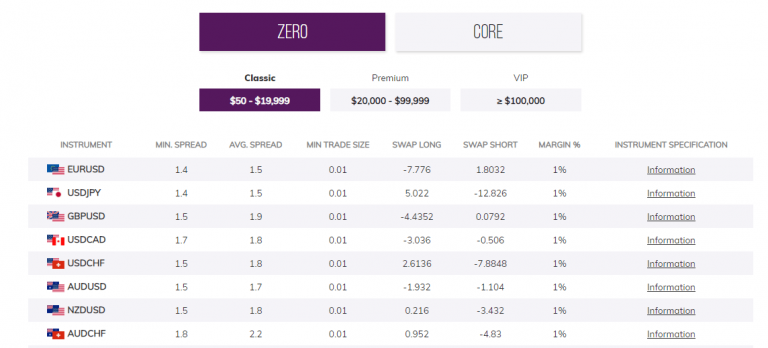

Also, see or Compare spreads of different accounts on the most popular pairs through the snapshot below. Also, always consider rollover or overnight fee as a cost, for the positions held longer than a day. As well you may check applicable fees to another popular broker Eightcap.

Asset/ Pair

Royal Financial Trading Fees

AvaTrade Fees

BDSwiss Fees

EUR USD

1.4 pips

1.3 pips

1.5 pips

Crude Oil WTI

4

3

6

Gold

17

40

25

BTC/USD

50.5

0.75%

2000

| Asset/ Pair | Royal Financial Trading Fees | AvaTrade Fees | BDSwiss Fees |

|---|---|---|---|

| EUR USD | 1.4 pips | 1.3 pips | 1.5 pips |

| Crude Oil WTI | 4 | 3 | 6 |

| Gold | 17 | 40 | 25 |

| BTC/USD | 50.5 | 0.75% | 2000 |

Snapshot of Royal Financial Trading spreads

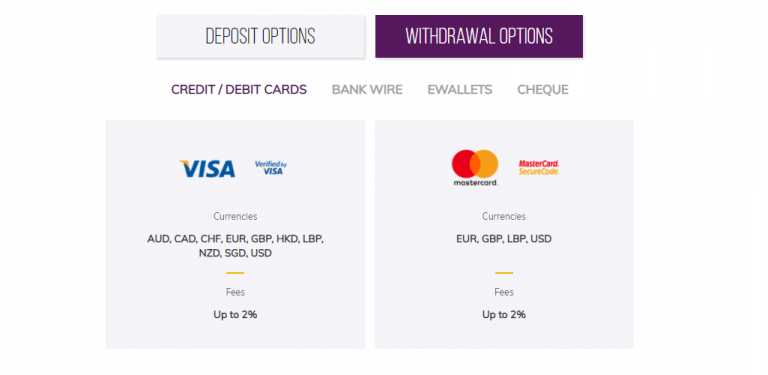

Deposits and Withdrawals

Money deposit and withdrawal is another crucial point within Royal Financail Trading Review, while we found that broker supports 13 payment methods and offering 11 account base currencies all in all supporting smooth money transfer.

Deposit methods

The methods including a wide range of payment options yet may vary according to the country regulations and your residence so always good to verify this information with the support center as well.

- Credit cards

- bank transfers

- Money Transfer, Pape Cheque

- E-payments Skrill, Neteller, iDEal, giropay and many more

However note, there are maybe differences between the payment options and applicable commissions according to the Royal Financial Trading entity you trading with, as various jurisdictions implement different rules.

Minimum deposit

Royal Financial Trading minimum deposit amount requires 50$ to open a Classic live trading account, while higher types mandates higher deposits, check in the section above.

Royal Financial Trading minimum deposit vs other brokers

| Royal Financial Trading | Most Other Brokers | |

| Minimum Deposit | $50 | $500 |

How to withdraw money?

Royal Financial Trading withdrawal fees may vary again according to the jurisdiction and the payment method you choose. Yet, there are fees on withdrawal options card payments or bank wire transfers up to 2%.

Trading Platforms

The trading technology of Royal arms the traders with the trading platform that brings quick access into the market and full of rich information. The MetaTrader4 is one of the most popular online trading worldwide platforms that combines interface simplicity and powerful tools and is also Royal Financial mainstay.

| Pros | Cons |

|---|---|

| Mainstay on MT4 | None |

| Web trading platform | |

| User friendly design and login | |

| Price alerts | |

| Professional platform MetaFX | |

| Supporting many languages |

Web Trading

There are several versions of the platform to suit the demands including the Desktop, WebTrader and Mobile application, as well as a solution with simultaneous trading possibility through MT4 MultiTerminal and MAM accounts for Money managers.

Desktop Platform

All the platform versions featuring almost the same functionality with the difference what you as a trader particularly may need. As desktop versions are usually full feature with all the functions available and included, so you can deploy the strategy of your preference.

In addition, there are available MetaFX platform allowing to manage multiple accounts or suitable for professionals as well.

Mobile Platform

The mobile platform is also in the package allowing to stay updated under any conditions right from your mobile device iOS or Android, and develop the trading offering and perform an accurate breakdown of technical analysis.

What is Social trading?

Royal Financial Trading provides daily reports with the latest trends and numerous tools that enhance trading. These including MT4 Accelerator, VPS Hosting options, Trading Central analysis and Social Trading capabilities.

Social trading is a great feature which enables trading through the leading platforms myFXbook and ForexSignals.com and ZuluTrade. Currently, social trading is a leading analytical network that provides a base to compare and copy trades from the professionals and is great for beginners or experienced traders.

Customer Support

One of the important parts of the Royal Financial Trading review a proposal with a good level of customer service and support that covers the need of the traders with the option to contact the broker either via email, phone lines, also with call back options, live chat, WhatsApp and Messenger support as well.

Education

Along with that, an experienced team of relationship managers and specialists always remaining on hand to assist its clients. In addition, daily reports and analysis tools along with educational materials will make sure the trader is on the right path together with established resources alike Live News, Economic Calendar, Traders Dashboard, Market Levels and the Trading Central.

Conclusion

Our final thought on Royal Financial Trading cleared a reliable, globally presented brokerage company, with a competitive trading solution and number of opportunities. An established direct connection, seamless trading process and numerous technologies with low trading prices definitely create a winning combination. Traders of different sizes or various strategies, even including social trading, are able to connect and choose the best option along with good range of trading platform and service to choose from.

Reviews

My name is Aziz Hachem from Lebanon I m trading from 3 month in this broker royal financial , they did delwte all my openning position without any explanation . I need my money back they are scam they still your money do not invest with them .just a scam company.

Hello Aziz,

We searched our database for your name and we couldn’t find it. For us to take a look at your complaint, please reach out to us on any of the communication channels listed on our website oneroyal.com

Best Regards,

I openned an account in 1000 $ andI win 200 $ I went to withdraw and I could not I called them and they reject my withdrawwww … They are thiefs and scam …. You cannot withdraw avoid them

Hi Aysa,

We searched our database for your name and we couldn’t find it. For us to take a look at your complaint, please reach out to us on any of the communication channels listed on our website oneroyal.com

Best Regards,

Go away from this company they are not a company they are thiefs .commission + spread and swap. They are not on islamic rules they are thiefs and not 7allal .

Don t invest with them . thiefs.

Hello Anas,

We searched our database for your name and we couldn’t find it. For us to take a look at your complaint, please reach out to us on any of the communication channels listed on our website oneroyal.com

Best Regards,

don’t take royal a trader, I had a trade in profit and they deleted from my history and my broker pretended like nothing happend, i have complain but they dont give me my money back. they are manipilators

Hello Jamil,

We searched our database for your name and we couldn’t find it. For us to take a look at your complaint, please reach out to us on any of the communication channels listed on our website oneroyal.com

Best Regards,