Rubix FX Review (2026)

What is Rubix FX?

The parent company Gleneagle Securities which is known as Rubix FX is active since 2009 and headquartered in Australia, while the Rubix FX was established in 2014 with the mission to bring professional trading service to the customers.

The main proficiency of the company is the technological connectivity and strong relationships that aggregates the best available pricing through the multi-bank liquidity providers. The electronic price execution provides FIX API connectivity or white label solutions that are constantly monitored to bring the best prices with no rejections or slippage through the based in Equinix NY4 servers.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation and License | ASIC |

| 📉 Instruments | Forex, Commodity and CFD Index. |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 1.4 pips |

| 💳 Minimum deposit | 500$ |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | AUD, USD |

| 📚 Education | Research, analysis, social trading |

| ☎ Customer Support | 24/5 |

Trading Instruments

Rubix FX focused on the most effective tools and offers 70+ instruments via market leader MetaTrader4 or Rubix Prime platforms with access to trade Forex, Commodity and CFD Index.

Unlike the exchange-based markets, the deep liquidity and a large number of participants means there is no single entity which controls the price for a period, hence the transparency is guaranteed, while the retail trader can access the markets with a relatively low start since the broker provides high leverage.

Due to its tech-base the company also offers a vast of investment proposals to the institutional or corporate clients or traders can submit a MAM (Multi Account Manager) to trade across multiple accounts simultaneously.

Is Rubix FX safe or a scam?

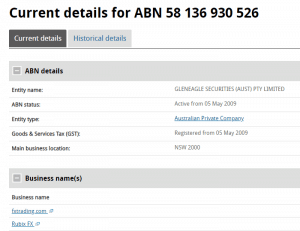

Rubix FX is a trading name of Gleneagle Securities (Aust) Pty Ltd, which is established Australian broker regulated by ASIC and licensed to carry on a financial services business under Australian Financial Services License. Actually, ASIC is among the most reputable authorities worldwide and trading with them enables you to be sure of the transparent operation broker deploy. Here you can learn more Why trade with ASIC brokers.

As a registered Australian company and as required by the law, the Rubix FX conducts activities with its full compliance while providing secure trading, investor’s protection and performs transparent trading at all times.

Along with that, to receive ASIC license, the broker should strictly comply to numerous restrictions that are designed to protect traders and is constantly overseen in terms of its compliance. And that is why we recommend trading only with well-regulated brokers and avoid offshore ones, as they simply comply to none of the rules.

Trading Platforms

The majority of the technological brokers always including in their offering the market leader MetaTrader4, and Rubix FX is not an exception. Yet, apart from MT4 that is known for its powerful charts and capabilities with any suitable style as well through access via any device (PC, iOS, Mobiles), there is a possibility to use core electronic offering through FIX API that allows connectivity to any platform.

Rubix Prime offers a TrueFX Partner program, which is direct trading with prices from market making banks or companies that are available to everyone. Rubix Prime is institutional GUI that is integrated with Integral FX Inside trading through the real-time currency rates are free with access to historical rates without charge.

Moreover, the broker allows using the Autotrade system through myFXbook extension, which is the leading mirroring or social trading platform that brings vast of opportunities from the world’s professionals through small volume-based charge only. This is the simplest strategy that is a perfect solution for novice traders, or for the investors who would like to run trading without interruption.

Account Types

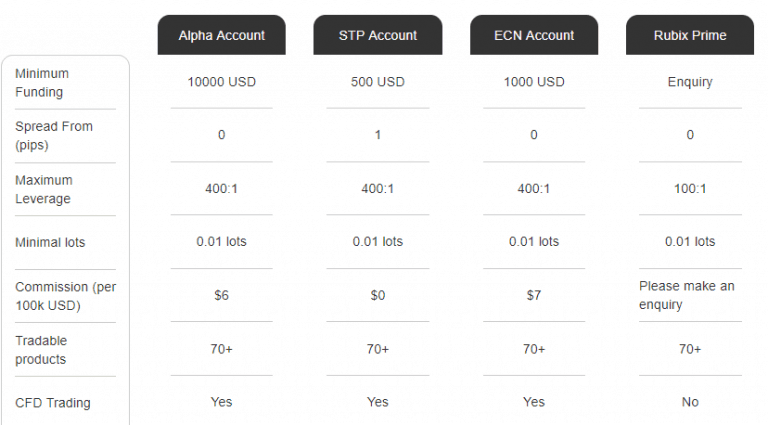

There are three Account types that are offered by the Rubix FX, plus a Rubix Prime account with an absolutely tailored trading solution. The main differences are based on a choice between STP execution with spreads only, or ECN connectivity with raw spread plus commission per trader.

Further on, as much trading size increasing you may gain even lower costs through Alpha Account or access tailored solution according to your investment needs.

Fees

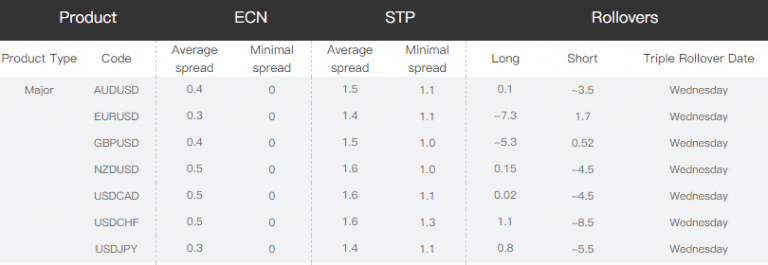

As for the trading costs, Rubix offers a range of various floating spreads depending on the technology you use and account type you use. See below comparison on some popular instruments and Rubix FX Spread, as well compare fees to another popular broker TMGM.

And of course, always consider rollover or overnight fee as a cost, which is about –7.3 for short positions on Eur/Usd and 1.7 on long ones, which are held longer than a day.

| Asset/ Pair | Rubix FX Spread |

| EUR/USD | 1.4 |

| Crude Oil WTI | 6.4 |

| Gold | 11 |

| BTC/USD | 75 |

Leverage

While trading with Rubix you are able to operate with floating leverage, while this powerful tool may increase your potential gains timely due to its possibility to multiple initial account balance. Yet remember that correct leverage should be set to various instruments, as it may increase your potential loses as well.

- Being an Australian broker you will operate with high leverage ratios like 1:200, 1:300 or even 1:400. Yet check about your level of trading, as various ratio may apply according to your own level of proficiency in trading.

Deposit and Withdrawal Methods

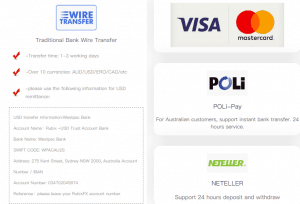

The deposit methods including a range of base currencies that are accepted by the broker, along with the conditions that provide funds security. As such, all clients’ funds are kept in segregated accounts at Westpac Banking Corporation, and there are no fees to deposit via Bank Wire Transfers.

Yet, the withdrawal to an overseas bank account may attract a bank transfer fee which will be deducted from the amount to be remitted. In addition, the money can be transferred via China Union Pay, POLi Pay and Neteller.

Minimum deposit

As for the minimum deposit amount, the first grade STP account at Rubix requires 500$ as a start, while other accounts deploy higher levels of first deposits.

Conclusion

As regulated by Australian ASIC authority, the Rubix FX shows a great technology solution and development within the Forex trading, which is also conducted in a safe way together with regulatory restrictions.

As the majority of the Australian brokers, Rubix chose the path based on the most important nowadays features, which includes technology base, fast connectivity, improved competitive pricing and leading software. The traders of any strategy are most welcome, even through the option of social trading via market leader software.

Yet, the only missing part is the education and analytical analysis, which company decided not to provide, however, there is plenty of information available so it may not be a big loss, as the most important – safe and comprehensive trading environment within the Rubix FX is on a high level.

Rubix FX Updates

Rubix FX is no longer active, the mother company operates FXTRADING.com however is not operating regulated Australia entity, the broker solely operates though offshore Vanuatu even though using its Australian regulated name. We recommend doing your own research about Rubix FX or FXTRADING and better do not trade with the ofhsore brokers due to lack of regulations.