SVSFX Review (2026)

Regulator

We recommend reading full SVSFX review and check on latest updates about SVSFX.

What is SVSFX?

SVSFX is an online financial trading provider, specializing on FX and CFDs trading for retail and institutional clients. The company was founded back in 2003 while owned as well operated by SVS Securities PLC located in London (UK).

In fact, at SVSFX one of the main company leads and proficiencies belongs to institutional clients. A regulated trading specialist SVSFX proposes a variety of products to all financial world parties while bringing a multiplicity of solutions to their offerings. Services and product suite are tailor made proposal, along with their top liquidity, strong support and execution policy for Hedge Funds, Money Managers, Partners and of course retail clients while all dual branded.

Another powerful feature is their well and highly demanded SVSFX electronic trading or API, which uses integration based upon FIX 4.4 protocol and is super comprehensive. Therefore, at the first look the SVSFX offering seems like a very attractive opportunity for the traders of bigger size or professionals, nevertheless see more details to find the benefits that may suit your needs too.

Is SVSFX safe or a scam?

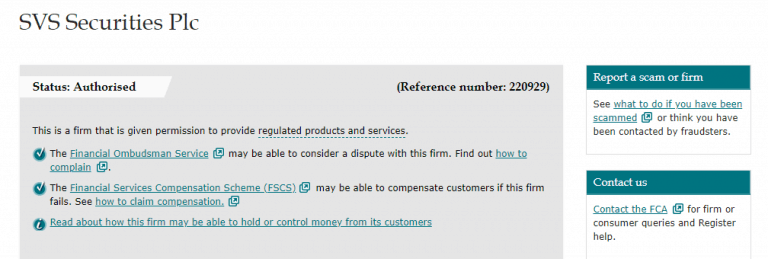

SVSFX as a trade name of SVS Securities Plc is respectively authorized and regulated by the Financial Conduct Authority (FCA, UK) with registration number 220929. Also, SVS Securities Pl acts as a member of the London Stock Exchange.

Therefore, the company regulatory status means that all procedures are in strict concordance with the rules, as maintained by regulatory authorities’ requirement, while the organization’s activities fully comply to provide protection and reliability.

In addition, the regulation requires safety guarding, which involves that clients’ funds are kept in the segregated account and supervised internally as well externally and ensuring maximum protection of account holders. Also, probably the most important in funds safety is the Financial Services Compensation Scheme (FSCS) coverage, which will act in your interest in case of company insolvency.

Trading Platforms

Currently, the broker uses only one, but yet the world’s most popular trading platform – MT4, available through desktop, web and mobile apps. There is no need actually to explain a lot about MT4, since it’s leading platform among the traders for many years, as well broker choice is obvious due to its performance characteristics and vast of available tools that increase execution success. At SVSFX MT4 you can benefit from the advanced charting toolbox with comprehensive technical analysis or to run personalized Expert Advisors (EAs) with no restrictions.

For the offered tools, the broker decided not to offer a wide range, yet select only several quite typical tools available to uncover trading opportunities. In the lists is Margin Calculator (calculates how much exactly required to make the trade), Historical Exchange Rate tool (comparing rates taken globally from the history for the most traded currencies), Pip Calculator (allows better risk management and measuring the value per pip as per account currency) and Profit Calculator (helps to figure potential profit or loss).

Trading Products

SVSFX acts as a market maker and deals with clients as principal in relation to Margin Trading, all transactions are undertaken on an execution only basis and such transactions are on performed OTC, or Over-The-counter not on a regulated exchange.

The general trading instrument range comes to more than 50 Foreign Exchange (FX) instruments, which been recently improved and completed the full suite of products. Another pillar is Contracts for Difference (CFD) trading, which contains all the popular global indices, commodities, energy products and precious metals.

The company does not swank with a huge range of trading instruments since they chose the path of the most commonly traded assets to offer. Depending upon clients account balance at SVSFX and its proficiency level, spreads may vary as well you can choose from fixed or floating spreads. See comparison on a first grade spreads offered by SVSFX, as well you can compare spread to another broker City Index.

| Asset/ Pair | SVSFX Fee Terms |

| EUR/USD | 1.9 pips |

| Crude Oil WTI | 4.5 |

| Gold | 41 cent |

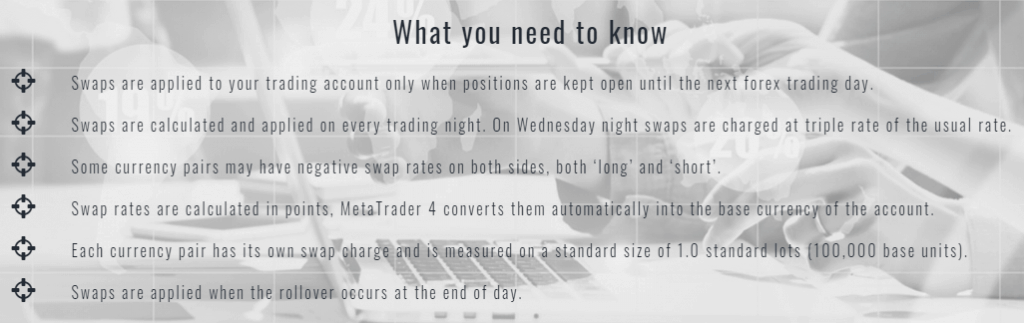

Additionally, you should always consider swap fee or overnight funding which is charged in case you holding positions overnight. Nevertheless, the SVSFX offers also Islamic Account which features swap-free option available to those traders who follow Sharia laws.

Leverage

The SVSFX, as the majority of Forex brokers offering a margin trading, which allows you to trade positions larger than your account balance. The advantage of margin-based trading is obvious, as you can potentially generate larger profits however, the downside is that you have an equal opportunity to incur losses in your account as well. Therefore, recognizing this higher risk the recent regulatory requirements from the UK’s FCA applied limited leverage to their licensed brokers. So, the maximum leverage you may use is only 1:30 for major currency pairs, 1:20 for minor pairs and even lower for other instruments.

SVSFX Payment Methods

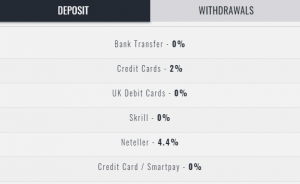

Actually, for the payment methods, the SVSFX covers the most used money transfer tools and ways to fund the account. Requests are processed quickly, through the secured website area of account funding, while payment methods enclose Credit/ Debit Cards payments (MasterCard, Visa, Maestro, Visa Electron), as well popular e-wallets Skrill, Neteller and of course bank transfers are the option too.

The minimum deposit requirement for the Standard Account is set to a 500$, which is a quite affordable minimum by various trading size traders, which will allow you to access competitive conditions.

Since SCSFX aims for complete transparency and trying to keep clients’ costs as low as possible, depositing and withdrawing fees of various payment methods are mainly covered by the broker. However, there are a few ones that imply additional fees. For instance, deposit by Credit Card will add 2% above or by Neteller – 4.4%. For the withdrawing way through Neteller will require an additional 2 % and 20% through Credit Card.

Conclusion on SVSFX

The SVSFX is a reliable broker with 15 years of experience offering trading in various FX currency pairs and range of CFDs. Even though, the mainstream of the company is on institutional clients, and the offerings to them range a comprehensive variety of solutions, the retail clients will find their benefits too. One of the advantages is a mainstay platform MT4, which enable traders of every strategy and style to find a way to potential success. In addition, low initial deposit, fast executions with competitive pricing as well transparent and easy fund methods are definitely gaining a broker’s advantages.

And of course, we would be glad to know your personal opinion about SVSFX, share your experience, read some of the recent news by the tad and refer to us for some additional information.

Important Update on SVSFX

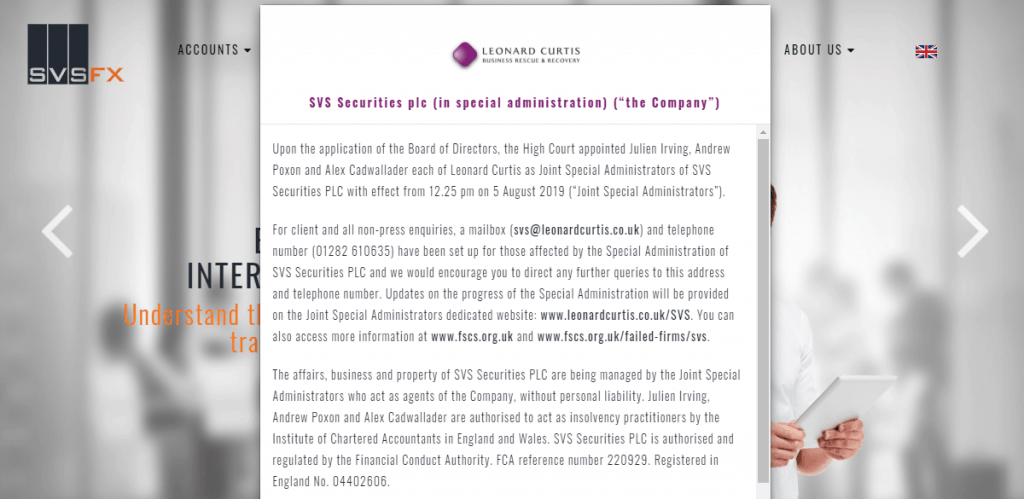

Recently and since August 2019 trading broker SVSFX upon the application of the Board of Directors entered into the Special Administration of SVS Securities PLC.

Therefore and in case you are holding an account with SVSFX you will be contacted for further clarification or updates on the process.

Reviews

Hi sir i wand star trading my contact number +966576473214 iam indian

Dear Manoj,

Since the SVSFX has been in administration for half a year already, you won’t be able to open an account with this broker. We recommend you to check the list of other Regulated brokers and choose a different regulated broket to start trading with.