Saxo Bank Review (2026)

Regulator

What is Saxo Bank?

The Saxo Group spans the globe with a strong unified network through both local sales and organizations allows serving clients in more than 180 countries.

The Saxo Group is a multi-asset trading and investment organization with over 25 years on Fintech innovation, a fully licensed regulated European bank under the supervision of Danish FSA. The headquarter is located in Copenhagen while an organization operating in financial centers around the world including London, Paris, Zurich, Dubai, Singapore, Shanghai, Sydney, Hong Kong and Tokyo.

Firstly Bank was introduced as Midas, and then officially became Saxo Bank A/S when the European Union Directive has been accepted (back in 1996). As well Saxo Bank became the first broker in Denmark that gained approval under this directive.

Is Saxo Bank a market maker?

Saxo facilities are developed for both private or institutional clients for various trading and investment solutions. Saxo bank is truly giant in its industry as managing more than 15 billion USD in AUM, over 1 million daily transactions and is a professional partner to 300+ banks, brokers and financial service providers with a broad range of classes and instruments. Being a Market Maker Saxo Bank establishes strong participation in the financial world, also acting as a liquidity provider.

Saxo Bank Pros and Cons

Saxo Bank is considered very reliable and solid firm due to its regulation, banking license in Europe and extra transparency. Trading conditions are good, the range of instruments is very wide including Options, Futures, Bond, Forex and CFD instruments, provided via Well developed trading software and platforms. The costs and spreads are good and low, and account opening is smooth supported by quality customer service.

On the flip side minimum deposit is high, might not be suitable for beginning traders, also deposit fees might be applicable based on your bank.

10 Points Summary

| 🏢 Headquarters | Copenhagen |

| 🗺️ Regulation | Danish FSA, ASIC, JFSA, MAS, FCA, FSC |

| 💳 Minimum deposit | 10,000$ |

| 🖥 Platforms | Proprietary Web trading platform SaxoTraderGO and desktop SaxoTraderPRO |

| 📉 Instruments | FX, CFDs, Stocks, ETFs, Futures, Options, Mutual funds and Bonds |

| 🎮 Demo Account | 20 Day Free Demo account |

| 💰 Base currencies | Various currencies supported |

| 💰 EUR/USD Spread | 0.8 pips |

| 📚 Education | No education courses |

| ☎ Customer Support | 24/5 |

Awards

Overall, the company profile shows positive feedback and operational scores, besides the numerous clients they serve and obtained reputation along the years. While the firm constantly shows some of the best results in its performance along with achievements in international recognition.

Is Saxo Bank safe or a scam

Yes, Saxo bank is safe. It is multiply regulated broker operating under banking license. It is considered low-risk trading Forex and CFDs with Saxo Bank.

Is Saxo Bank legit?

Saxo Bank A/S is definitely a trusted broker, as its incorporated in Denmark business and is fully licensed European bank (license no. 1149). Which also run its service under the supervision and regulation by the Danish Financial Supervisory Authority (FSA).

Therefore, Saxo Bank operations are conducted as an EU-regulated bank and investment firm that falls under the jurisdiction and has all necessary legal requirements, protocols and policies to ensure full compliance and customer protection.

Along with the major registration, Saxo bank is subject to operate under the various worldwide institutions, due to its global presence including Singapore, Dubai, Hong Kong and more.

How are you protected?

In addition, Saxo Bank A/S is subject to stringent financial reporting requirements under EU directives and specific regulations regarding client handling. As such, Saxo Bank is a respected member of the Danish Guarantee Fund for Depositors and Investors that guarantees clients’ deposits for up to EUR 100,000 for cash in the event of insolvency.

| Saxo Bank entity | Regulation and License |

| Saxo Bank A/S | Authorized by Danish FSA license no. 1149 |

| Saxo Capital Markets UK Limited | Authorized Financial Conduct Authority (United Kingdom) registration no. 551422 |

| Saxo Capital Markets Pte. Ltd. Singapore | Authorized by MAS (Singapore) registration no. 200601141M |

| Saxo Bank A/S – DIFC Representative Office | Authorized by the U.A.E. Central Bank registration no. 2017/995/13 |

| Authorized by DFSA (Dubai) registration no. CL2637 | |

| Saxo Bank FX K.K. | Authorized by FSA (Japan) registration no. 239 |

| Saxo Capital Markets Hong Kong Ltd | Authorized by the SFC (Hong Kong) registration no. 1395901 |

| Saxo Capital Markets (Australia) Pty. Ltd | Authorized by ASIC (Australia) registration no. 126 373 859 |

Leverage

Together with investment opportunities, there are some instruments that allowing leverage trading, while the maximum allowed leverage is determined by the regulators in each geographic region, as well according to the set levels defined by the trader himself.

Overall, Saxo Bank leverage comes up to 1:100 on Forex instruments at various regions, since the bank does not support the high risk trade strategies for the traders good. It is true that high leverage increases the risks, thus levels are set to reasonable levels.

However, the main headquarter of Saxo Bank which deploys regulated brokerage activity recently updated limitations to leverage, so be sure to verify conditions according to the entity and your residence respectively.

- European clients may use 30:1 leverage on Forex instruments,

- Dubai and UAE traders entitle for a maximum of 1:200 (Check for forex brokers in Dubai)

- Australian clients under ASIC regulation may still apply to a leverage 400:1.

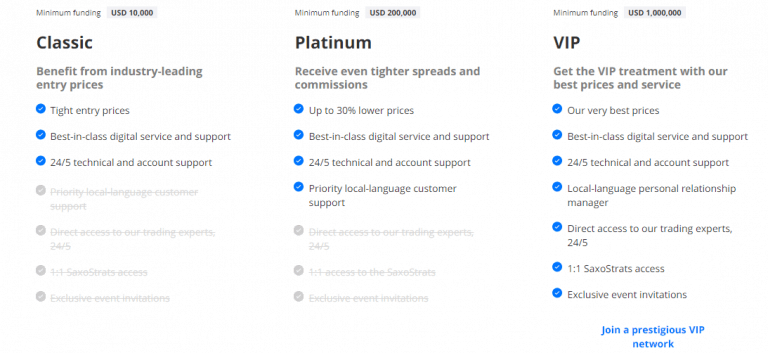

Account types

Saxo Bank offers three accounts with no matter how much client trade, all featuring the same technical capabilities, along with company support.

The difference between them vary the price offerings as well as the depth of support from the company, like extended news and research capabilities and preferred customer services. In addition, the bonus offered by the bank is built into the interests, which is the part of the service provided to the Premium clients and above.

The new traders can benefit from the Saxo Bank offer to try out market strategies and familiarise yourself with their platforms before the real trade practice. While the 20-day free demonstration of their platforms with a simulated 100,000$ account to practice with is available to all.

How to open your account

Instruments

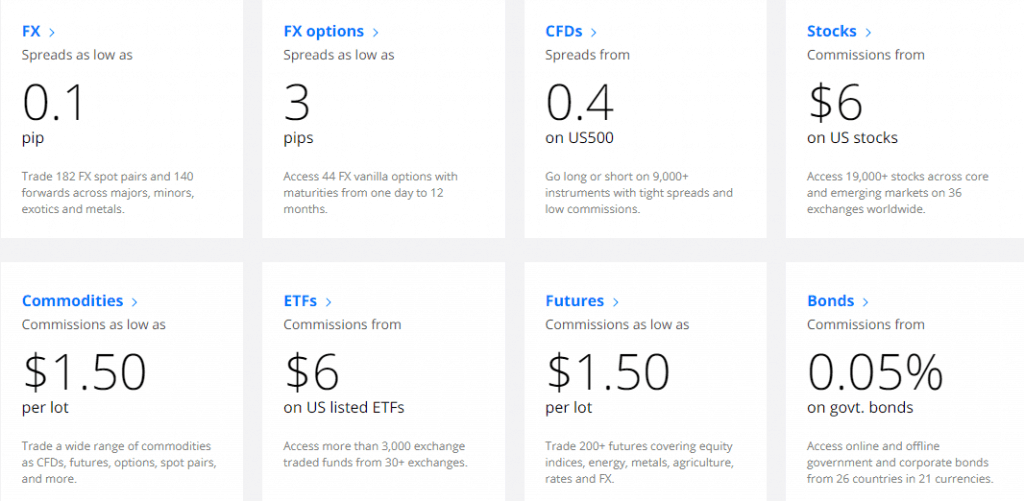

The product choices of the Saxo Bank include a truly wide selection of markets to trade offering to trade of FX, CFDs, Stocks, ETFs, Futures, Options, Mutual funds and Bonds. It is indeed a great and large proposal suitable for any size of the trader where you can get an instrument you wish to trade, also provided with competitive pricing.

Fees

A closer look on the Saxo Bank pricing on its numerous over 40’000+ instruments in its portfolio that are all available from the multi-currency account of a single cross-margin depending on the instrument you trade. We consider Saxo fees as low and average, also consider below full fees including funding and other fees compared to competitors.

| Fees | Saxo Bank Fees | BDSwiss Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | Yes | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

Spreads

Saxo Bank traders can benefit from the tight-spreads and low commissions through real time quotes for currency pairs and other instruments, e.g. EUR/USD at 0.1 pips, US 500 at 0.4 pts and US Stocks from 6$.

Along with very competitive pricing, which we found via our Saxo Bank Review since the broker is one of the large liquidity providers thus getting exclusively fast and low quotes, the bigger account shows spreads from 0 pips.

You can also compare Saxo Bank trading fees to another popular broker FBS and see below broker comparison.

Commission

Of course, it is defined by the instrument which pricing model is applicable, alike trading of Commodities, Options, Mutual Funds, ETFs, Futures and Bonds are charging a commission. So for detailed conditions, you better check the official website, where full pricing is available and defined also by the account type you would sign in. Yet commissions are quite pleasant at Saxo Bank as well, alike listed US ETFs are 3$, Futures 1.25$ per lot and Bonds are applicable for 0.05% govt.

Trading Fees of Saxo Bank vs Similar Brokers

| Asset/ Pair | Saxo Bank Spread | BDSwiss Spread | AvaTrade Spread |

|---|---|---|---|

| EURUSD Spread | 0.8 pips | 1.5 pips | 1.3 pips |

| Crude Oil WTI Spread | 5 | 6 | 3 |

| Gold Spread | 27 | 25 | 40 |

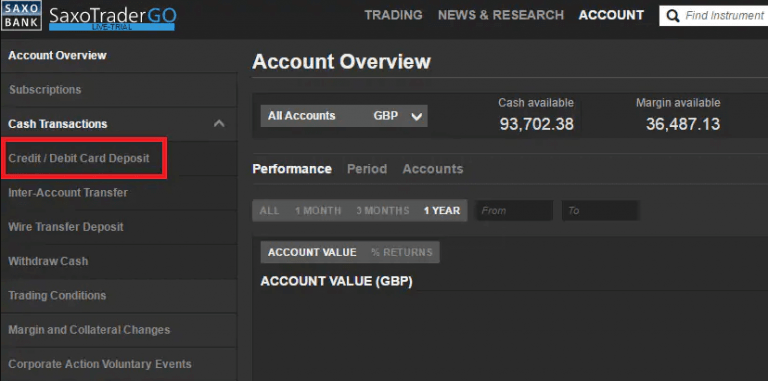

Deposits and Withdrawals

The deposits or withdrawals at Saxo Bank only accept funds originating from a bank account or an account held at a licensed financial institution. Saxo Bank does not accept Third Party Payments, Bankers Drafts, Check, Cash deposits and remittances from Exchange houses.

Deposits

In addition, Debit & Credit card payments are subject to the deposit fee charged by the card operator (Visa / MasterCard), which ranges from 0.50% to 2.83%, depending on the transaction currency.

What is the minimum deposit for Saxo Bank?

Saxo Bank minimum deposits and the lowest requirement is 10,000$ for Classic Account, apart from that, there are other limitations on funds transactions which may be imposed due to the payment providers conditions.

Higher account types will require more money at the start, 200,000$ for Platinum and 1M$ for VIP account, which concludes Saxo Bank as truly broker more suitable for professionals and bigger size traders.

Saxo Bank minimum deposit vs other brokers

| Saxo Bank | Most Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Withdrawal

Saxo bank withdrawl options are well organized, by far most used Bank Wire is available, also Card payments. For the transaction of withdrawals there are no fees charged for any withdrawals submitted via the Online Cash Withdrawal Module.

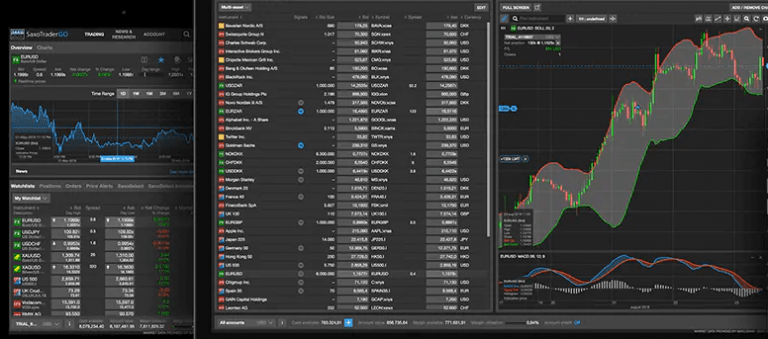

Trading Platforms

The Saxo Bank trading platforms designed specifically, with a deep understanding of the importance in a combination of easy interface and powerful capabilities.

Whether the client is a demanding trader who’s looking for the performance and flexibility or an investor who requires an easy platform on the go the Saxo Bank offers that solution by two types of the platform SaxoTraderGo and SaxoTraderPRO.

| Pros | Cons |

|---|---|

| Proprietary Web trading platform SaxoTraderGO and desktop SaxoTraderPRO | No MT4 or other industry popular software |

| User friendly design and login | |

| Price alerts | |

| Advanced range of tools and trading strategies | |

| Supporting many languages |

Web Platform

SaxoTraderGO – is the choice of the most traders and investors, an easy-going yet powerful platform that gain awards for its productivity. Fast, reliable and available across multiple devices, SaxoTraderGO is a web-based application that supports all products and asset classes. A wide range of risk management tools and features allows executing trades quickly and intuitively.

Desktop Platform

SaxoTraderPRO is the professional’s choice of a downloadable, fully customized, professional-grade platform for advanced traders. SaxoTraderPRO brings an intuitive, multi-screen platform to Windows and Mac, also can still have access with mobile and tablet apps.

The platform features configurable workstations and workflows, tailored trade settings, as well series of advanced functions: enhanced trade ticket, depth trader, time and sales, algorithmic orders, charting package and option chain for vanilla and touch options.

Mobile App

Lastly, there is a designed mobile app that allows to you keep track of the trading developments, markets and updates right from your mobile.

Customer Support

Being also a reputable European Bank there is well established support in more than 180 countries from offices in major financial hubs. Customer service available through Europe, Asia Pacific and Middle East regions also in various languages, so customers are well covered with necessary service.

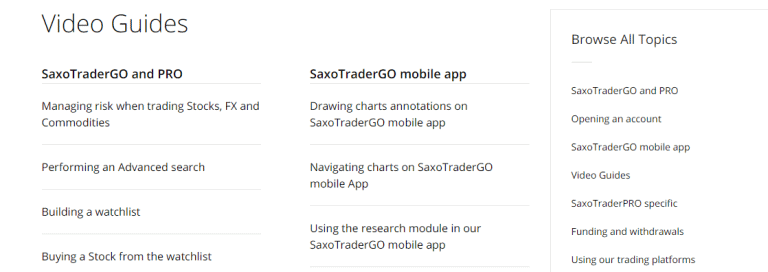

Education

Since Saxo Bank offering mainly proposals for traders with experience and bigger size, Saxo Bank might be not good option for the very beginners also due to lack of education courses some other brokers’ offerings as well. You will get technical analysis, News feed and Video guides to support the learning of the proprietary platform but that is all.

However, professionals and traders who choose Saxo will definitely enjoy amazing research tools and strategy builders available directly through the platform.

Conclusion

For final thoughts Saxo Bank is a reliable broker, tntering the market in 1992, Saxo was a fintech company a long before the term was even created and has proceeded to become one of the most trusted names in online trading and investing. As a licensed and regulated Danish bank, the Saxo Bank Group brings a trusted offering to trade any cycle in the economy, while covering risks by hedges. If you are retail trader, Saxo Bank will be a solution to have the same access and features as an institution or organization. So, overall Saxo Bank is a good choice for the traders of bigger size, since the first deposit is higher.